As typhoon Tino (Kalmaegi, internationally) left over 200 Filipinos dead while affecting nearly 2 million people, President Marcos Jr declared “a state of national calamity.”

After the super typhoon Uwan (Fung-Wong) will add to the devastation, mass protests against huge flood control corruption are expected in the country.

In 2022, the Marcos Jr government pledged it would build on the legacy of the Duterte years and make Filipinos more prosperous and more secure. Critics claim both objectives have failed.

Billions of dollars lost to corruption

On July 27, Senator Panfilo Lacson warned that half of the 2 trillion pesos ($17 billion) allocated to the Department of Public Works and Highways (DPWH) for flood control projects may have been lost to corruption in the past 15 years.

And yet, almost in parallel, President Marcos Jr stated his administration had implemented over 5,500 flood control projects and announced new plans amounting to more than $10 billion over the next 13 years.

Ever since then, Manila’s political class has been swept by allegations on corruption, mismanagement, and irregularities in government-funded flood management projects. In August, the Senate Blue Ribbon Committee launched a high-profile investigation into the irregularities, focusing on the “ghost” projects, license renting schemes and contractor monopolies.

Corruption has long been pervasive in Philippine politics, economy and society. In the Corruption Perception Index, the country has consistently scored among the worst in the region. Even in peacetime, it is at par with the civil war-torn Sierra Leone and oil-cursed Angola.

In the era of former President Duterte, corruption fight was spotlighted. Now it thrives again. According to surveys, 81% of Filipinos believe corruption has worsened since martial law was declared 53 years ago. It is compounding misguided economic policies.

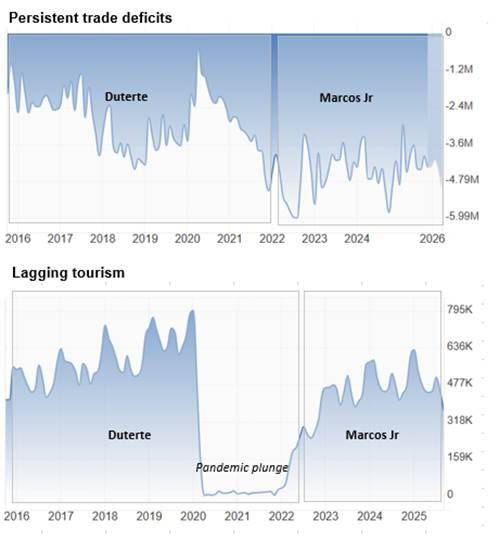

Rising trade deficits, slowing investment

In the Duterte era, exports were led by electronics, with significant growth in tourism and business process outsourcing. Those times are now gone.

In the Duterte era, the effort was to attract multinationals, particularly Chinese firms, to serve as anchor companies that would foster Philippine suppliers. But due to the government’s geopolitics, Chinese – and increasingly Western – multinationals see too much economic and geopolitical risk in the country. And so, the investments that could have come to the Philippines have gone to Vietnam, Malaysia and Thailand in the region.

Recently, even US Investment Climate Statement for the Philippines highlighted persistent corruption, a slow and opaque bureaucracy, and poor infrastructure as major disincentives to investors.

Lagging tourism

In Southeast Asia, Chinese tourism has played a vital role in the post-pandemic recovery. Before the pandemic, Chinese tourists accounted for 40-60% of the regional total.

Subsequently, regional recovery was fueled by Chinese tourism. The only exception? The Philippines.

In 2019, Chinese tourist arrivals in the country soared to over 1.7 million. As of September 2025, the Philippines has reported less than 204,000 Chinese arrivals for the year, a figure that is far, far below the government target. The country was banking on a 2-million visitors from China.

The sharp decline is attributed to geopolitical tensions, the suspension of the e-visa program, even safety concerns.

Even if the 2025 total would climb closer to 300,000, that would be just 15-20% of the 2019 level. It’s a catastrophic missed opportunity.

Sources: Trade deficits: Author, Philippine Statistics Authority; Tourism: Author, National Statistical Coordination Board Philippines; Exchange rate: Bangko Sentral ng Pilipinas

BPO outsourcing at risk

Digital economy is a major component of the GDP. But in the absence of domestic ICT anchor firms, the sector is at the mercy of Western offshoring. And that spells huge trouble at a time, when the West prioritizes trade wars, as evidenced by Manila’s costly losses in US tariff wars.

Meanwhile, geopolitics has alienated investments by Chinese ICT giants, which could have catalyzed ICT ecosystems in the country.

And there’s worse ahead. The Philippine outsourcing sector is a $30 billion industry that accounts for 7% of the Philippines’ GDP and commands 15% of the global market. Yet, one-third of its jobs in the Philippines are at risk from artificial intelligence (AI), with those in the BPO sector most vulnerable. Sadly, college-educated, young, urban, female, and well-paid workers in the services sector will be most exposed.

In addition to AI, US protectionist initiatives could perfect the jobs devastation in the Philippine outsourcing industry. Introduced in July, the bipartisan “Keep Call Centers in America Act” proposes to penalize US companies that offshore a significant portion of their call center jobs. The recent Halting International Relocation of Employment Act (HIRE Act) aims to curb outsourcing by imposing a 25% excise tax on payments to foreign workers.

If these realities kick in, US vulture capitalists can be expected to target and short the Philippines, which could compound challenges, as in the past.

Economic growth, missed opportunities

In early 2024, US news agency Bloomberg asked President Marcos Jr whether the Philippines could achieve an 8% growth rate. “Why not?” the president replied. “Yes, I think it is, I think it is doable.”

Yet, at the time, GDP year-on-year growth decelerated to barely 5.2%.

Have things got better? No.

In 2025, the government’s target was reduced to 5.5-6.5%. Just weeks ago, the International Monetary Fund (IMF) downgraded the Philippine growth projection to 5.4% this year. More recently, economic growth slowed to just 4.0% in the third quarter – the slowest since early 2021, when the COVID-19 pandemic caused a contraction.

Unsurprisingly, critics claim the incumbent economic policies have failed. Here’s a thought experiment about the extent of that failure. During the Duterte era, Philippine GDP increased from $329 billion to $404 billion, despite the pandemic plunge. On the back of that performance, IMF expected Philippine GDP to climb close to $640 billion by 2028.

Current IMF estimates suggest that by 2028, Philippine GDP would be less than $560 billion. So, the government is set to underperform by $80 billion.

That’s the cost of missed opportunities – although the final cost could prove higher.

Source: Author, data from IMF