Advertising on streaming services is a big new growth business for marketing and media companies, but consumers are increasingly frustrated by what they see and hear on their screens.

Ads might be too loud, of poor quality or irrelevant, and repeat too often. Sometimes, there’s an ad in a foreign language or a blank screen. As more streaming services launch ad-supported plans, viewers are experiencing these issues in greater numbers, which could come at a cost to the media companies.

“It can lead to them losing subscribers,” said Ruben Schreurs, chief executive officer of Ebiquity Plc, a London-based consultancy that says 75 of the world’s top 100 advertisers are clients.

Better, more-relevant advertising has been one of the recurring mantras of the connected-TV world. As online platforms gathered more data on their users, they were supposed to provide sponsors with targeted opportunities. Consumers would see spots for products they were more likely to want. Instead, those advances have become the source of viewer frustration.

National ad spending on streaming is expected to climb 13% to $12.3 billion this year, while such spots on traditional TV networks fall 4.9% to $33.8 billion, researcher Magna Global estimated in June. Streaming now reaches 96% of U.S. households, according to another researcher, Kantar Group & Affiliates, making the services a big opportunity for advertisers.

“We’ve seen more budget and spend move over,” said Joe Nowak, senior vice president of growth and strategy at Kantar.

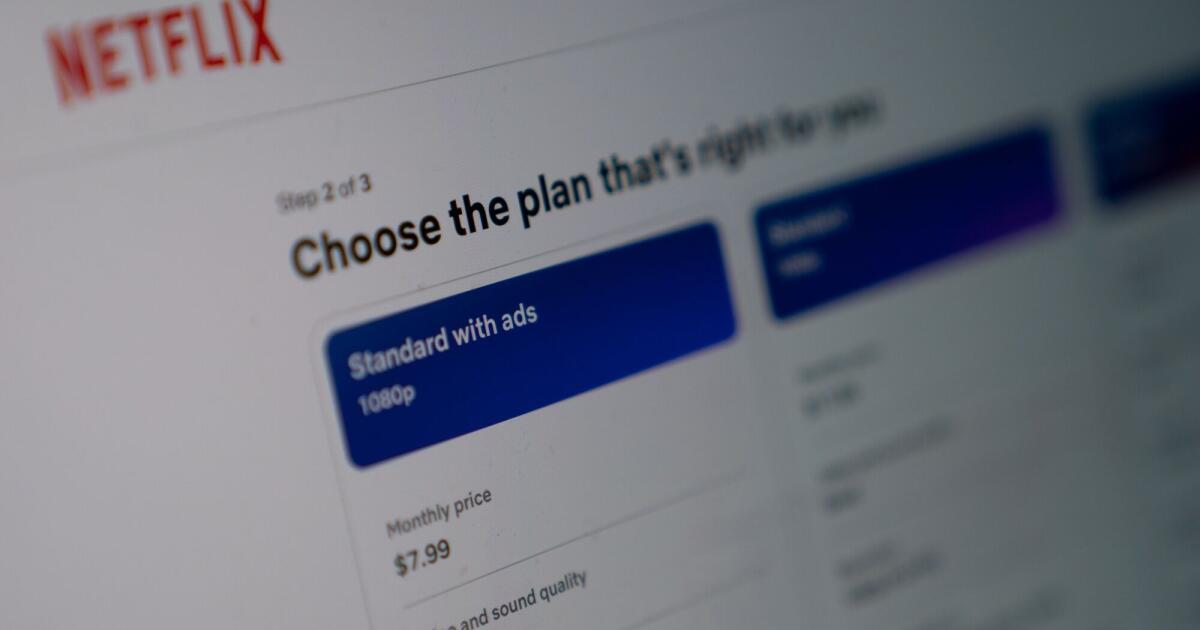

Walt Disney Co. and Netflix Inc. have launched advertising-supported plans for their streaming services. At Netflix, ad-supported plans account for more than half of new subscriptions in markets where those plans are offered. They are usually offered at a discount. Disney+ with commercials is $12 a month, for example, while the ad-free version is $19.

Streaming offers advertisers distinct advantages over other media, according to Nowak, including interactive capabilities. On Amazon.com Inc.’s Prime Video service viewers can click into ads to buy the products shown.

In theory, advertisers can also target consumers more closely on streaming services. In traditional TV, all viewers typically see the same ads during a given broadcast. With streaming, commercials can become more personalized through a process called “dynamic ad insertion.” Audiences see commercials tailored to attributes like their location or viewing history.

It’s also easier and cheaper for advertisers, including smaller ones, to purchase streaming spots than it is on broadcast or cable.

Streaming ads are typically sold in online auctions, where spots for shows, sporting events and movies go to the highest bidder. That’s led to “democratization of access,” according to Ebiquity’s Schreurs.

“Instead of actual salespeople from the network negotiating directly with media agencies for big activations, big deals for well-known brands where they can vet the creatives, the process has become real-time,” he said.

Without that vetting, streaming platforms have less control over the ads that appear on their platforms. The smaller brands winning auctions may not have the same resources to produce high-quality commercials, according to Sean Muller, chief executive officer of the ad measurement platform iSpotTV Inc. These businesses sometimes rely on artificial intelligence to produce their ads, he said.

“You absolutely get a lot of that, and they do tend to be lower-quality,” Muller said.

Another common issue centers on ad frequency. With brands able to snap up ad blocks at auction, they sometimes get overzealous, feeding viewers the same spot over and over in a single show.

That’s particularly frustrating for streaming viewers, who are “more of a captive audience” than traditional TV audiences, who can easily change channels.

“Switching apps is a little bit of a pain in the butt,” Muller said.

And unlike the old days when consumers recorded programs to watch later, in the streaming era you can’t skip the commercials.

While streaming ads can pinpoint audiences based on their ZIP code, they sometimes miss wildly. For instance, viewers in a neighborhood with a large Latino audience may get an ad in Spanish even while watching a show in English.

“If it was done the right way, it would be running in Spanish-language content,” said Jim Wilson, CEO of Madhive, an ad platform designed for local advertisers.

There are other problems with streaming ads that seldom pop up on regular TV. For example, a blank screen sometimes appears during commercial breaks.

“They’re either not sold out on their inventory or there’s some sort of technical issue,” Wilson said.

But perhaps the biggest annoyance for streaming viewers happens when ads are ear-splittingly loud — a problem that used to crop up on conventional TV. That happens when streaming services fail to “normalize” the volume on ads before they are inserted.

In October, California passed a law requiring the services to keep the sound level of ads the same as the programming they accompany. It was inspired, according to state Sen. Tom Umberg (D-Orange), by one of his staffers whose sleeping baby was awakened by a loud streaming ad.

“This is a quality-of-life issue,” he said in an interview.

The legislation, which takes effect on July 1, 2026, could inspire changes on a national level and is one of the most well-known bills he’s worked on.

“This struck a chord with anyone who watches any entertainment on a streaming service,” Umberg said.

Miller and Palmeri write for Bloomberg.