Incredible road trip across 6 European countries that everyone ‘must do once’

Want to see the most beautiful scenes in one trip? A must-do country European road trip will take you to six countries, where you will see the sea, mountains, castles and breath-taking views

Hopping on a plane and getting to your holiday destination in hours is a luxury, but one thing that everyone should do at least once in their lives is a road trip.

TikTok account Living Our Memories shared the perfect itinerary, where the key stops included France, Switzerland, Liechtenstein, Germany, Luxembourg and Belgium. The total route is 23 hours and 49 minutes, non-stop.

Gathering over a million views, the couple, who shared their travels with their 5K followers, captioned the video: “An epic road trip across 6 countries you must have to do at least once in your life.”

Champagne, France

First stop, the French region of Champagne, known for its scenic vineyards. Located in the northeast of France, their sparkling white wine is what makes them so well-known. Visitors can see the cities of Reims and Épernay, as well as the villages like Hautvillers and Méry-sur-Ay.

Wine lovers can make a pit stop and tour the famous Champagne houses such as Moet & Chandon, Veuve Clicquot, and Taittinger. Those who prefer adrenaline can do some outdoor activities such as biking through the Côte des Blancs and Montagne de Reims.

Stausee Steg, Liechtenstein

Liechtenstein’s turquoise waters in the middle of the most gorgeous greenery scenes, facing the mountains. It’s the perfect place for a swim in the lake or a picnic with your loved ones.

If you’re feeling sporty or want to capture the perfect shot, you can hike the mountains and get the perfect scene. According to AllTrails, it’s best to bring water shoes for those who plan to swim or walk near the rocky edges.

Lake Eibsee, Germany

Nature lovers will love Lake Eibsee in Germany. The waters are crystal clear with views of the Zugspitze mountains.

Some of the activities for visitors are hiking the 7.5 km (4.6 miles) walk around the lake, as it provides stunning views. You can also rent a boat or a canoe to explore the lake and the surrounding islands. If you’re brave enough, you can also swim in the waters – but it’s super cold.

Neuschwanstein Castle, Germany

Located in Bavaria, Germany, in the foothills of the Alps, Neuschwanstein Castle is just the exact layout as the ones in the Disney movies. In fact, it’s best known for the inspiration behind Disneyland’s Sleeping Beauty Castle.

The 19th-century historic castle overlooks the narrow Pollat gorge, and it’s close to the Alpsee and Schwansee lakes. Therefore, it makes it an ideal place to visit on the way to the upcoming location of the road trip.

Tickets cost 20 euros (£17.36), but children under the age of 18 can access the castle completely free of charge.

For more stories like this subscribe to our weekly newsletter, The Weekly Gulp, for a curated roundup of trending stories, poignant interviews, and viral lifestyle picks from The Mirror’s Audience U35 team delivered straight to your inbox.

Luxembourg City, Luxembourg

Luxembourg’s tourism has increased over the years, making it the perfect place for a city break or a day trip. The city has a unique blend of history and culture, with a lot to offer to visitors and locals alike.

Its historical sites include UNESCO World Heritage sites and famous landmarks such as the Grand Ducal Palace and the Cathédrale Notre-Dame. The best thing about Luxembourg is that you can enjoy it all year round, and the public transportation is free.

Dinant, Belgium

To conclude the road trip, what better way to do it than in Belgium? A more tranquil side of the country, with beautiful scenery and history. Its most popular tourist attraction is the Maison Leffe. The town’s location is also ideal along the River Meuse, as it overlooks the water and the pastel-coloured houses.

Visitors can walk through the cobbled streets, take a boat tour and even participate in water activities such as kayaking on the nearby Lesse River.

Bruges, Belgium

Perfect for a city break, a small yet fulfilling town with a lot to offer. If you’re a fan of medieval settings, this is the place for you. However, its popularity comes with big crowds and higher costs.

Bruges is also famous for its Belgian waffles, fries, chocolate and beer – so, come with an empty stomach to indulge the best sweet and savoury flavours.

Help us improve our content by completing the survey below. We’d love to hear from you!

How manager Dave Roberts helped Dodgers dig deep to win World Series

TORONTO — It was a game that started on Saturday and ended on Sunday, a World Series contest so packed with the rare, the historic and the dramatic that it couldn’t possibly be confined to one day.

At 11 innings, it was the longest Game 7 this century, and it equaled the longest in more than a century. It was the first Game 7 that had a ninth-inning home run to tie the score and the first to feature two video reviews that prevented the go-ahead run from scoring.

“It’s one of the greatest games I’ve ever been a part of,” Dodgers manager Dave Roberts said after his team outlasted the Toronto Blue Jays 5-4 to win its second straight World Series and end the longest season in franchise history, one that began in Japan and ended in Canada.

The victory made the Dodgers the first team to win back-to-back titles in 25 years and with that championship, Roberts’ third, he passed Hall of Famer Tommy Lasorda to become the second-most-decorated Dodger manager ever. He now trails only Walter Alston, another Hall of Famer, who won four World Series with the team.

Roberts, however, won his three titles over six seasons, something no Dodger skipper has ever done.

“It’s hard to reconcile that one,” said Roberts, whose jersey from Saturday’s game is on its way to Cooperstown, joining the cap the Hall of Fame requested after last year’s World Series win.

“I’m just really elated and really proud of our team, our guys, the way we fought. We’ve done something that hasn’t been done in decades. There was so many pressure points and how that game could have flipped, and we just kept fighting, and guys stepped up big.”

So did the manager.

Every move Roberts made worked, every button he pushed was the right one. Miguel Rojas, starting for the second time in nearly a month, saved the season with a game-tying home run in the top of the ninth while Andy Pages, inserted for defensive purposes during the bottom of the inning, ran down Ernie Clements’ drive at the wall with the bases loaded to end the threat.

In the 11th he had Yoshinobu Yamamoto pitch around Addison Barger, putting the winning run on base. But that set up the game-ending double play three pitches later.

“Credit to him, man. Every single move he did this postseason was incredible,” said Tyler Glasnow, one of four starting pitchers Roberts used in relief Saturday. And he had a fifth, Clayton Kershaw, warming up when the game ended.

Added Dodgers co-owner Magic Johnson: “He did some coaching tonight. This was a great manager’s game from him. He’s proven how great a manager he is. He’s a Hall of Famer.”

Roberts asked Yamamoto, who pitched six innings Friday to win Game 6, to throw another 2 2/3 innings in Game 7. It worked; Yamamoto won that game too.

“What Yoshi did tonight is unprecedented in modern-day baseball,” said Roberts, who came into the postgame interview room wearing ski goggles and dripping of champagne. “It just goes down to just trusting your players. It’s nice when you can look down the roster and have 26 guys that you believe in and know that at some point in time their number’s going to be called.”

And Roberts needed all 26 guys. Although the Dodgers players wore t-shirts with the slogan “We Rule October” when they mounted a makeshift stage in the center of the Rogers Centre field to celebrate their victory early Sunday, October was only part of it. Their year started in Tokyo in March and ended in Toronto in November, making it the first major league season to begin and end outside the U.S.

“We really extended the season,” Max Muncy, whose eighth-inning homer started the Dodgers’ comeback, said with a grin after the team’s 179th game in 226 days.

“Look back at the miles that we’ve logged this year,” Roberts said. “We never wavered. It’s a long season and we persevered, and we’re the last team standing.”

That, too, is a credit to Roberts, who has made the playoffs in each of his 10 seasons and went to the World Series five times, trailing only Alston among Dodger managers. His .621 regular-season winning percentage is best in franchise history among managers who worked more than three seasons. And he figures to keep padding those records.

“We’ve put together something pretty special,” said Roberts, who celebrated with his family on the field afterward. “I’m proud of the players for the fans, scouting, player development, all the stuff. To do what we’ve done in this span of time is pretty remarkable.

“I guess I’ll let the pundits and all the fans talk about if it’s a dynasty or not. But I’m pretty happy with where we’re at.”

On Sunday morning Glasnow, who missed the playoffs last season with an elbow injury, was pretty happy with where he was at as well.

“To be a part of the World Series is crazy,” he said, standing just off the infield as blue and gold confetti rained down. “You dream about it as a kid. To live it out, I feel so lucky. This group of guys, I’m so close to everyone. So many good people on this team. It’s just the perfect group of guys.”

The perfect manager, too.

Live: Hamas continues search for captives’ remains as Israel blocks aid | Israel-Palestine conflict News

Gaza residents say they fear a return to Israel’s full-scale bombing as they struggle to find food, water and medicine.

Published On 2 Nov 2025

Russia-Ukraine war: List of key events, day 1,347 | Russia-Ukraine war News

The battle over Ukraine’s Pokrovsk rages as both Russia and Ukraine continue to hit each other’s energy infrastructure.

Published On 2 Nov 2025

Here is how things stand on Sunday, November 2, 2025:

Fighting

- At least four civilians have been killed and 51 injured across Ukraine by Russian attacks, according to local officials.

- A strike blamed on Russia hit a shop in the Samariivskyi district of Dnipropetrovsk Oblast, killing two and injuring multiple people, regional military chief Vladyslav Haivanenko said.

- The Ukrainian military has said Russian forces launched four missiles and dropped 139 guided bombs over the past day, as well as thousands of shells and drones.

- Russia’s Ministry of Defence said its air defences intercepted 164 Ukrainian drones, including 39 over the Black Sea and 26 over Crimea, overnight.

- Fighting continues to intensify near the Ukrainian city of Pokrovsk, with the Russian army saying its forces destroyed Ukrainian military formations near the railway station.

- Oleksandr Syrskii, Ukraine’s top military commander, said Ukrainian troops were facing a “multi-thousand enemy” force in Pokrovsk, but rejected Russian claims that they were surrounded or blocked.

- Ukraine confirmed that its special forces had been deployed to protect key supply lines in Pokrovsk, while Russia claimed Ukrainian troops were surrendering and some of the special forces were killed while landing in a helicopter.

- Ukraine’s military intelligence announced a strike on the Koltsevoy fuel pipeline near Moscow, claiming all three lines were destroyed.

- A drone attack by Ukraine reportedly hit an oil terminal pier and a tanker in Tuapse town, located on the northeast shore of the Black Sea, setting fire to port infrastructure.

Politics

- Ukraine condemned Russia’s attacks on key energy infrastructure. Its Foreign Ministry accused Moscow of carrying out strikes on a power substation feeding nuclear power plants in “nuclear terrorism”.

- The International Atomic Energy Agency (IAEA) confirmed that its inspectors visited a substation critical to nuclear safety and security in Ukraine, and reported damage “as a result of recent military activities”.

- In a statement on Friday, G7 energy ministers condemned Russian attacks on Ukrainian energy infrastructure, saying they are affecting civilians.

- Ukraine’s President Volodymyr Zelenskyy claimed on Friday that his foreign intelligence service has identified 339 Ukrainian children who have been allegedly abducted by Russia.

Regional security

- Germany’s Defence Minister Boris Pistorius told the Reuters news agency he is confident that the country’s governing coalition can agree on a new model of military service for implementation next year as planned.

- An unidentified drone was spotted over the Kleine Brogel Air Base in Belgium on Saturday, the second such sighting over the previous 24 hours.

Inside The Wanted’s bitter feud as stars cut ties after secret divide, doomed reality show & wedding snub

THE once chart-topping boyband is said to have cut all final ties following a long-running secret divide, years of silence and bitter behind-the-scenes fallouts.

The British boy band – made up of Max George, Siva Kaneswaran, Jay McGuiness, Nathan Sykes and the late Tom Parker – have been at loggerheads since their split in 2014.

The platinum-selling group were behind hit songs such as “Glad You Came”, “All Time Low” and “Chasing the Sun” before they disbanded.

They briefly reunited in 2021 for a charity concert in Tom’s honour, but old wounds have reopened – and some members are said to no longer be on speaking terms.

Insiders claimed friendships “never fully healed” after the band’s initial breakup, with egos, solo projects and clashing personalities driving a deeper wedge between the lads.

The break up

The Wanted announced they were to split in January 2014 to “pursue personal endeavours” after completing their upcoming ‘Word of Mouth Tour’.

In a statement posted on their website, the band said: “The Wanted are pleased to announce the release of their new video and single ‘Glow In The Dark’ taken from their November release ‘Word of Mouth’.

“They are very excited to perform ‘Glow In The Dark’ along with their smash singles ‘I Found You’, ‘Chasing The Sun’, and ‘Glad You Came’, amongst others for their fans on their upcoming ‘Word of Mouth Tour’.

“This tour will be their last for a while as Tom, Max, Jay, Siva and Nathan have collectively decided to take time to pursue personal endeavours following the tour’s conclusion.

“The band wants to stress to their fans that they will continue on as The Wanted and look forward to many successful projects together in the future.

“They thank their fans for their continued love and support and look forward to seeing them on tour.”

‘Very difficult conversations’

Although their official statement claimed they’d “continue on as The Wanted,” Max later revealed that simmering tensions and clashing ambitions had secretly driven the group apart.

Max admitted: “Over the past year, there has been a lot of tension. Our personal lives drove us apart – things started to happen and we were drifting. We used to be such a brotherly pact, but it started to feel like it wasn’t The Wanted anymore.”

He went on to confess that he and bandmate Nathan were the ones who pushed for the split – despite protests from the others.

“We had a very difficult conversation,” Max said. “Our manager Scooter Braun asked us who would want to take a step out after and try to do their own thing. Me and Nathan both said we have other ambitions.”

Both singers went on to be represented by Braun – with Nathan briefly finding solo success (and headlines) thanks to a short-lived PR romance with Ariana Grande, while Max landed a role on Glee.

But behind the scenes, the duo’s diverging paths reportedly caused even more tension within the group.

Siva hits out at Max

Siva hit back at bandmate Max after The Wanted split, slamming his comments about “personal relationships causing issues” as “untrue and very unfair.”

Speaking out in an interview, Siva instead blamed their E! reality show The Wanted Life for sparking tension within the group.

He said: “I think from doing the TV show we all kind of knew where we stood and from that I felt like there was some sense of… I felt like it was every man for himself looking back on when the show aired.

“I’ve never been that way and I’d never actually seen it before until I looked back at the show. I think that is where we lost the team element and from there it kind of just went.”

Despite the rift, Siva said he wanted to find common ground with Max, adding: “Aside from the drama with Max, I’m going to talk to him to find a way forward and be adults about it.

“All of us boys are like brothers, it’s all I’ve ever known and we’re going on tour together.

“I think we’re just going to be professional with each other and give the fans a good show – because it’s all about the fans at the end of the day.”

Nathan cutting ties

In 2016, Nathan admitted he wasn’t talking to Siva or Max anymore.

Nathan told Yahoo: “I still class Jay [McGuiness] as a really good friend. He’s a really nice person. And Tom [Parker], I’m not so sure about where the others are at but I’m sure they are very busy and very happy.”

However, Nathan admitted that if everyone was on board with a reunion, he would be happy to have a “conversation” about it.

He said: “Obviously, I am very focused on my solo career at the moment, so I haven’t thought about the band ever getting back together, but you never know what is going to happen in the future.

“If there was an opportunity and everyone wanted to, it’s a conversation, but if everyone is still happy doing their own thing, then I think everyone will just be happy to continue as they are.”

Meanwhile, Siva was living in Los Angeles, attempting to crack Hollywood.

Tom’s cancer diagnosis

The band eventually put their differences aside when tragedy struck, after Tom was diagnosed with stage four brain cancer in 2021.

His illness brought the group back together, reuniting them publicly in October that year.

Reflecting on the reunion, Max said: “I think I speak on behalf of everyone, in the time away from it, it gave me time to reflect and appreciate what we’d achieved and how good our music actually was.

“Because at the time we were doing it, it was so packed in that we didn’t get to really appreciate how much we enjoyed each other’s company or how good our music was because… like, every day, it was all a bit mad.”

Jay added: “Even when we were under so much pressure and we’d be squabbling and whatever was going on, we always had fun, we were always very down to earth. But really,” he continued on a more serious note, “time helps a lot. And all of our perspective has changed.

“We are grateful, we’re the boy band that walk into the room and are, like, ‘I’m just happy to be here.’ Back in the day, Max has said this a few times, we wanted a number-one after number-one because we’d had that, and we felt terrible when we didn’t get that. And when five young men have that sort of ambition, it can get really tense.”

Jay said he believes the group reunion proved they could finally let bygones be bygones and simply enjoy being together again.

The Wanted made an emotional return to the stage at the Stand Up To Cancer concert organised by Tom at London’s Royal Albert Hall, an event later featured in the Channel 4 documentary Inside My Head.

“There was a moment where I thought I was going to break down and have a meltdown,” Tom admitted.

“But the boys just comforted me… It was just an emotional night all around, even for the whole day and stuff. And just walking into the venue – we had never played the Royal Albert Hall before, when we played all around the world.”

He added: “There’s just something beautifully special about it.”

Max and Siva tour

The Wanted fans were left baffled in May 2024 after Max announced he was heading on tour with just one of his bandmates.

The Strictly Come Dancing star revealed he would be touring alongside Siva – but without Jay or Nathan.

The duo performed in America for a number of dates and finished up in India.

Before the tour, Max told fans: “Myself and Siva can’t wait for this! Our first time in India… dream come true!”

Fans were quick to question the absence of Jay and Nathan – sparking fears the original line-up had officially fallen apart.

It later emerged that Jay would be performing in 2:22 A Ghost Story in Dublin, while Nathan is thought to be focusing on new music.

The shows marked the first time members of the group have performed since the tragic death of bandmate Tom.

The divide

The band have openly admitted there was a clear divide during their heyday – with Max and Tom on one side, and the others forming their own group.

Max and Siva even confessed they never imagined they’d end up touring as a duo when The Wanted went on hiatus in 2014, admitting they “weren’t the closest” and barely spent time together off stage.

Max said: “I’m not going to lie, if you’d said to us 10 years ago that it’d be me and Siva doing this together we’d be like no, never.

Siva agreed: “Max was with Tom, I was with Nathan and Jay.”

Max continued: “Apart from working, we didn’t spend any time together, so I feel like I’ve got to know Siva more in the last year than in the whole 10 before it.

Reflecting on Jay and Nathan’s decision not to rejoin the group, Max added: “We had lots of conversations with the other boys and each other.

“The other boys are so happy doing what they’re doing and they’re really focused on their lives and their careers.

Siva added: “We missed being in the band… we really wanted to get back on stage.”

Future reunion?

Earlier this year, Nathan told The Sun they would never get back together – as the band “will only ever be a five-piece.”

Nathan, Tom, Max, Siva and Jay reunited for a greatest hits album and one-off show in 2021, which was followed by a tour in early 2022, ending just two weeks before Tom’s passing.

Speaking about the emotional concerts, Nathan said: “Obviously, you’d give anything for it not to have happened.

“But, equally, I’m so grateful that we were able to have that time, given that it did happen.

“It was just such a special time and the reception that he got every night, he really felt it. And it meant so much to him that he could do that.

“He was desperate to do that tour. There were tough moments, but we were having some of our fondest memories with Tom over that time.

While Max and Siva toured as The Wanted 2.0 – a four-piece reunion with Nathan and Jay seems out of the question.

Nathan said: “I’m really happy for them. They get a lot of enjoyment in performing the music and they see it as a tribute to Tom.

“Whereas Jay and I’s approach to it is that there’s a lot of emotion attached to that still. And I think we would find that really difficult.

“It’s just two different approaches and neither one is wrong. I think it’s really difficult imagining The Wanted as a four-piece because The Wanted has been and will only ever be a five-piece.

“It’s difficult imagining not performing with Tom.”

Nathan’s wedding

Nathan tied the knot with his girlfriend of six years Charlotte Burke in October 2025.

Nathan opted for an intimate celebration, inviting just 61 of their closest friends and family, among them was his bandmate Jay.

But Max and Siva were noticeably absent from Nathan’s wedding.

Speaking to OK! Nathan said: “We haven’t touched base recently, so I’m not sure they would have known the wedding date.

“With them being out in America at the time, we’ve not had the chance to [catch up], but I’m sure we will soon.”

He added: “We had a room full of people we’re comfortable with, so it was a really safe space and allowed us to relax.”

However, it now seems that Max and Nathan might not be talking at all.

Unfollow

Fans on Reddit noticed that the pair unfollowed each other on Instagram, cutting off social media communication.

One said: “Couldn’t help but notice Max and Nathan unfollowed each other? I wonder if there’s any beef between them lol.”

Another added: “I’ve always suspected Max and Nathan had a falling out before they broke up the first time.”

A third penned: “It’s a real shame because teenage me loved Nathan and Max’s interactions.

“I remember when Nathan used to comment on Max’s ig posts around 2 years ago.

“They haven’t followed each other in a very long time.”

‘I tried the famous ‘airport theory’ but there’s one thing you should know’

As a former airport employee, I attempted the viral travel hack that allows passengers to successfully get on the plane by showing up 35 minutes before boarding starts

Everyone loves a holiday, but going two to three hours early to the airport can lead to you waiting for hours until the departure time – and that’s not fun.

According to Hoppa, airlines advise passengers to show up at the airport at least three hours before their departing time for international flights or two hours before any domestic flights, to ensure a smooth check-in process, such as dropping off your luggage, and avoiding any potential queues in security.

Working at the airport made me realise that there’s no need to show up hours earlier at the airport. As excited as one can get to begin their holidays, the airport isn’t a place to hang out. If I can give you a tip now, it’s to make sure your electronics and liquids are packed accordingly.

But there’s a trick for those who want to skip the long waiting hours, and it’s called the ‘airport theory’ – but there’s a catch.

READ MORE: Air passengers warned packing viral flight snack in hand luggage could risk £5,000 fineREAD MORE: ‘I was a check-in agent at Heathrow – this trick guarantees a seat change free of charge’

What is the ‘airport theory’?

Earlier this year, a so-called ‘airport theory’ went viral on social media, where passengers showed up to the airport 35 minutes (or even 15 minutes on some occasions) before their flight started boarding. Yes, it works, but there’s a catch that a lot of people miss.

During my holidays in Spain, I showed up at the airport less than an hour before the flight departed. No bags to check in and a digital boarding pass, I went through security in under five minutes. Lucky me, I was familiar with the layout of the airport, and I had minutes to spare to grab a coffee before heading to the departure gate.

The catch is that this only works for those travellers who don’t have to check in any luggage. If you have a big-sized bag to send off, you must show up at the check-in counters before they close, which is usually an hour before the flight departure time.

READ MORE: Get airport luggage off the plane first thanks to worker’s ‘little-know’ technique

For more stories like this subscribe to our weekly newsletter, The Weekly Gulp, for a curated roundup of trending stories, poignant interviews, and viral lifestyle picks from The Mirror’s Audience U35 team delivered straight to your inbox.

It’s also important to note that the waiting times at the airport can vary depending on the time of year. Therefore, it’s worth double-checking the status of your flight, as well as the distance between the security checkpoint and the gate.

Another secret from me is that if you ever show up late to the check-in counter and have a bag to drop, speak to an airline agent. In the majority of cases, the check-in agent will charge you a late drop-off fee to take your bag, which is better than leaving it behind!

Help us improve our content by completing the survey below. We’d love to hear from you!

Kane Williamson: Ex-New Zealand captain retires from T20 international cricket

“There’s so much T20 talent there and the next period will be important to get cricket into these guys and get them ready for the World Cup.

“Mitch [Santner] is a brilliant captain and leader – he has really come into his own with this team.

“It’s now their time to push the Black Caps forward in this format and I’ll be supporting from afar.”

The T20 World Cup in India and Sri Lanka starts in February.

Williamson made his T20 debut for New Zealand in 2011 but had not featured since June 2024.

Regarded by many as the best batter in New Zealand history, he is their leading Test run-scorer of all time and fourth on the ODI list.

New Zealand Cricket chief executive Scott Weenink said Williamson had earned the right to decide how he finished his ODI and Test careers.

“We’ve made it clear to Kane he has our full support as he reaches the back end of his illustrious career,” he said.

“We would, of course, love to see him play for as long as possible, but there’s no doubt whenever he does decide to finally call time, he will go down as a legend of New Zealand cricket.”

New Zealand completed a 3-0 clean sweep in the one-day series against England on Saturday, having lost a rain-affected T20 series 1-0 beforehand.

U.S. turns back clock at 2 a.m. Sunday as daylight savings time ends

Nov. 1 (UPI) — As daylight saving time ends overnight Saturday, a large majority of Americans will turn their clocks back and gain an extra hour of sleep early Sunday morning.

Many clocks will self-adjust at the appropriate time, such as the clocks on computers and cell phones, but others still must be changed manually.

The official time to turn the clocks back is 2 a.m. in states that participate in daylight saving time, which many view as an opportunity to get in an extra hour of celebration in states and locales that require bars to close at 2 a.m. or later.

Most of Canada and northern Mexico also will change their clocks as daylight saving time ends for them.

The purpose is to add an hour of daylight during the morning hours during the winter months and an extra hour of daylight during the evening hours during the summer months, according to USA Today.

Most of Arizona and all of Hawaii do not follow daylight saving time, though, which means clocks will remain the same as the rest of the nation joins them on standard time.

Arizona, with the exception of the Navajo Nation, forgoes daylight saving time due to the summers there being so hot.

Hawaii does not participate in daylight saving time due to its close proximity to the Equator and relatively consistent daylight hours throughout the year.

The U.S. territories of American Samoa, Guam, Puerto Rico, the Northern Mariana Islands, U.S. Minor Outlying Islands and the U.S. Virgin Islands likewise do not participate in daylight savings time due to their relatively stable hours of sunlight.

Daylight saving time started this year on March 9, and Sunday marks its earliest end since the Energy Policy Act of 2005 changed the end date from the last Sunday in October to the first Sunday in November, starting in 2007.

The act also changed its start date to the second Sunday in March, which extended daylight saving time by about four weeks per year.

Daylight saving time returns at 2 a.m. on March 8, 2026.

Germany was the first nation to adjust its clocks in 1916 during World War I, with the goal of reducing its energy usage.

Other nations, including the United States, soon followed.

Daylight saving time became a requirement in the United States upon the adoption of the Uniform Time Act of 1966, but states have the ability to opt out.

No state, however, has the option of permanently setting their clocks on daylight saving time.

Acceptance of the annual fall and spring time changes is not universal.

A CBS/YouGov poll in 2022 showed 80% of respondents favored keeping daylight saving time in effect all year, and the Senate that year passed the Sunshine Protection Act.

The measure died in the House of Representatives, however, as it chose not to bring it up for a vote.

Nineteen states, though, are prepared to eliminate the time change if Congress passes enabling legislation to do so.

A measure that would do so has been introduced in the Senate, but it has not been put up for a vote.

LIVE: India vs South Africa – ICC Women’s World Cup final 2025 | Cricket News

Follow our live build-up, team news, score and text commentary stream from the final in Navi Mumbai at 09:30 GMT.

Published On 2 Nov 2025

‘SNL’ recap: Miles Teller plays Property Brothers in White House skit

As we mentioned last time when Sabrina Carpenter hosted “Saturday Night Live,” there’s no substitute for a host who fully throws themselves into “SNL.”

He may not have done double duty as host and musical guest the way Carpenter did, but Miles Teller appeared to fully embrace the challenge of returning to host for a second time (the first was in 2022). The “Top Gun 2: Maverick” star, who’ll next be appearing in the movie “Eternity,” gave a solid performance, appearing in nearly every sketch, including the cold open and two pre-recorded videos.

He first appeared as former Gov. Andrew Cuomo, a candidate for New York mayor, in the cold open with help from Ramy Youssef and Shane Gillis as opponents Zohran Mamdani and Curtis Sliwa.

After that, Teller played a hungover game show contestant recovering from Halloween, a hockey player shooting a public service announcement for the unfortunately named Nashville Predators and both twin Property Brothers in a video sketch about the current White House renovation.

Teller was also in a sketch about a TV newsroom that decides to show viewers what its background employees are doing, a Netflix promo for a true crime story about husbands who don’t know where their wives went, one about a police press conference that takes a turn and a show closer about a silly Italian restaurant in Nebraska.

Teller handled it all well; he’s good with accents and earned strong laughs, especially playing two characters at the same time in the “Property Brothers” sketch and as Cuomo in the cold open.

Musical guest Brandi Carlile performed “Church & State” and “Human.”

This week’s cold open was one of the stronger (or at least funnier) political sketches of the season so far, tackling the New York mayoral race. As hosted by Errol Louis (Kenan Thompson), “the least famous person to be impersonated on ‘SNL,’ ” the debate sketch portrayed Cuomo (Teller) as a sexually harassing (“Yadda yadda yadda, honk honk, squeeze squeeze) panderer to Jewish voters; Mamdani (Youssef) as a force-smiling, TikTok-flirting candidate who’s pretty sure he won’t be able to implement his promises; and long-shot candidate Sliwa (Gillis) as an “old-fashioned New York nut” with one traumatic story after another to recount. The biggest surprise may have been Gillis, who as Sliwa recounted stories about being hung by his testicles and getting assaulted by a Times Square Spider-Man. Where was this energy when Gillis hosted “SNL”? As has been the habit on many a cold open, President Trump (James Austin Johnson) interrupts the proceedings to mock the candidates and insert his own commentary. This time, that included singing a song from “Phantom of the Opera” to conclude the sketch.

Teller’s monologue was short and simple, relaying how as a kid who moved around most of his childhood, “SNL” was a constant. He shared a photo of himself and his sisters dressed up as the “Night at the Roxbury” characters from the show and then made up a list of memories from the show, like having his first beer in the audience and falling over after having a few beers. Teller mentioned that he and his wife lost their Palisades home in January’s Los Angeles fires. As such, he made sure to point out the fire exits for the audience.

Best sketch of the night: An extreme White House makeover

The Property Brothers Jonathan and Drew Scott (Teller times two) meet their toughest clients yet: Trump and First Lady Melania Trump (Chloe Fineman) who need help with their current renovation of the White House to make room for a new ballroom. Melania shared her skeleton and withered tree decorations (“They are for Christmas,” she said), and the couple complained that 55,000 square feet and 132 rooms just isn’t enough space. With a budget of “$350 million to infinity” the brothers get to work with the help of park rangers and astronauts working through the government shutdown. But when it comes to getting paid for their work, there’s a problem. “Aren’t you guys from Canada?” the president asks. Then he calls ICE on them.

Also good: Nobody asked for this much transparency in news

On a show called Newspoint, the host (Fineman) and her guest (Thompson) are trying to have a serious news discussion, but because the show has opened up its full newsroom to viewers, all the workers in the background draw attention. Among them are Mikey Day, who awkwardly notices the cameras are on him before spilling a carrier of drinks, Bowen Yang as a worker who gets electrocuted by a copy machine and Teller, who has manga erotica up on his work screen. It’s nice to see some physical comedy from Day in particular and the sketch’s visual gags work nicely.

‘Weekend Update’ winner: George Santos is back, untruthful as ever!

Andrew Dismukes and Ashley Padilla (who should be a full cast member at this point instead of a featured player) played a couple who just made out but are trying to discuss the government shutdown. But it was Yang as chronic liar George Santos who stole “Update” (and some jewels) after Yang missed an opportunity on the last “SNL” episode to play the former representative, whose prison term was commuted by Trump. Santos claimed he finished the New York marathon, which hadn’t happened yet, and kept interrupting his chat with “Update” co-host Colin Jost to take calls with prisoners with a jail window and phone he brought with him. He purported to speak with Ghislaine Maxwell, Luigi Mangione and Sean “Diddy” Combs before revealing that the key to making prison rice pudding is preheating the toilet to 350 degrees. Santos ended the segment by revealing the necklace he stole from the Louvre and insisting that he’d just won the World Series.

Sleigh rides, spas and snowshoeing: 10 of the best winter holidays in Europe | Europe holidays

Sleigh rides in Zakopane, Poland

Saddle up for sleigh rides, strap in for a 220-metre illuminated toboggan run, and prepare to get lost in an ice-carved maze at the Snowland theme park in Zakopane, as Poland’s winter capital sparkles up for the season. Pair a snowy walk through the Chochołowska valley with a visit to the Chochołowskie thermal baths, with outdoor pools, sauna, balneotherapy and massage treatments. Stay at the Hotel Aries, which mixes classic Alpine design with Zakopane touches (local wine and traditional dishes in the Halka restaurant, furniture and rugs by local craftspeople), and don’t miss the world’s largest snow maze and the Palace of the Snow Queen in the Snowlandia theme park, which has individual chambers sculpted from snow and ice by local artists.

Doubles at Hotel Aries from £165 B&B. Zakopane is around two hours from Krakow by bus; the hotel is a 1km taxi ride from the station

Snowmobiling in Montenegro

A winter adventure doesn’t have to mean hurtling downhill at breakneck speed. Montenegro’s Durmitor national park offers snowmobiling through the Sinjajevina and Bjelasica mountains, white-water rafting and snowshoeing trails. Žabljak makes an ideal base. The highest small town in the Balkans, it is surrounded by glacial lakes that freeze in winter, and Black Lake (3km away) is a famous viewing point for the park’s spectacular night sky. Cosy Hotel Soa has a wellness centre with a hammam and Finnish sauna, and a fire-lit lounge with dramatic mountain views.

Doubles at Hotel Soa (hotelsoa.com) from €98 B&B. Žabljak is two and a half hours from the capital, Podgorica, by bus

Lakes and valleys in Slovenia

Discover a different side of the Alps on a four-night break to Slovenia, which combines one night in the buzzy capital, Ljubljana, with time exploring the forested landscapes and snowy peaks of the Triglav national park, Lake Bled and the Logar Valley. The scenic train ride through the Julian Alps from Bohinj to Most na Soči, on a rocky crest overlooking the Soča and Idrica rivers, is a highlight, as is a visit to Kranjska Gora, where the fairy-lit chalets and snow-capped pines feel straight out of the Austrian Tirol. After exploring, there are two nights in the peaceful Logar Valley, latticed with hiking trails, with thermal spa treatments on offer at the Hotel Plesik.

Four-night break from Untravelled Paths £974pp, B&B, including all transfers and excursions.

Trains and trekking in St Moritz, Switzerland

It’s all glitz in St Moritz, right? Well, no: perhaps surprisingly, it is possible to enjoy the glorious landscapes of the Upper Engadine without spending a fortune. Randolins, set above the resort on the Suvretta hillside, is one of Switzerland’s snow sports hotels, offering everything from cross-country skiing and horse-drawn carriage rides to snowy hikes from the door, along with an expansive wellness centre (including an 80C Finnish sauna) and two restaurants. It’s also the perfect base for exploring the region’s spectacular mountain railways; both the Glacier and the Bernina Express – which climbs to 2,250 metres – stop at St Moritz station. Booking in advance is essential for both.

Doubles at Randolins from £174 B&B. There are direct trains from Zurich to St Moritz (four hours)

Snowshoeing in the Lechtal, Austria

Few places can beat Austria for snowy landscapes, and there is plenty of Tirolean countryside to explore away from the busy ski resorts. This week of guided walking is tailored to take advantage of the trails that provide the best conditions on any given day, with snowshoes offering opportunities to access pristine sections unreachable in normal walking boots. Lunches are in traditional mountain Hütten (perhaps a cheesy Käsespätzle with crispy onions, or a bowl of Gulasch) and base is the charming Hotel Grüner Baum, in the high Alpine village of Bach im Lechtal. The highlight is a torchlit evening walk, with plenty of warming Glühwein.

A week’s guided walking from Ramble Worldwide, departing in January 2026, from £1,189pp half-board, including transfers, equipment and a tour leader

Cheese caves and chateaux in Annecy, France

Surrounded by dramatic peaks, and with a direct train connection from Paris (four hours), Annecy is that rare thing – a lake town that offers as much in winter as in summer. Boat trips run all year, while the voie verte greenway offers easy cycling and walking along the western lakeshore. Catch the bus to the Aravis mountains, where reblochon cheese is made and matured in cheese caves at the village of Manigod (guided tours available). The nearby Château de Menthon-Saint-Bernard is spectacular; 1,000-year-old turrets soaring up out of the forest. Stay at newly opened La Cour du 6 in the old town, with a sleek, art deco feel to the elegant rooms.

Doubles at La Cour du 6 from €100

A farmstay in the Trentino, Italy

There are just three bedrooms at Pimont Alpine Chalet, a gloriously tranquil esercizio rurale, a traditional farmstead surrounded by the rough-hewn peaks of the Adamello Brenta nature park. Days begin with an organic, locally sourced breakfast – including homemade bread, cakes and jam – in the cosy stube, which becomes a firelit lounge in the evening. The emphasis at Pimont is on slow-paced exploration. The owners are mountain guides who can accompany guests on hikes or advise on the best trails for independent walking. The nearby ski resort of Madonna di Campiglio offers ice-skating on the frozen Conca Verde lake, with dog-sledding through the surrounding forest.

Doubles at Pimont Alpine Chalet from €180 B&B. The nearest station is Trento, an hour and a half away by car

Sleigh rides in Sweden

Snow White herself wouldn’t have turned her nose up at Gammelgården; a picture-perfect cluster of restored log buildings, some dating back to the 1600s. Perched high up in the Sälen mountains, in the unspoilt Dalarna region 250 miles (400km) north-west of Stockholm, it’s the kind of place where it’s easy to settle in front of the fire and not move for days. There’s also plenty to do, with reindeer walks, dog-sledding, sleigh rides and snowmobile excursions, while back at base, a visit to the 400-year-old waffle cabin is not to be missed. Carnivores will love the evening menu, with a focus on local game (reindeer tataki or venison sirloin), but there are fish dishes and a veggie option too.

Doubles at Gammelgården from £110 B&B. The nearest train station is Mora, with direct bus connections to Sälen (two hours)

Hiking and hearty mountain food in Germany

Sandstone cliffs, dramatic gorges, flat-topped mesas – it’s a mystery as to why the spectacular landscapes of the Elbe Sandstone Mountains in eastern Germany remain so under the radar. This self-guided walking tour through “Saxon Switzerland”, as it’s called, takes in quiet villages of timber-framed cottages and dense pine forest, cloaking the peaks that sweep up to the sandstone spires. The trip begins in the spa town of Bad Schandau, home to the spectacular, 11-metre-high Kuhstall rock gate and the beautiful Lichtenhain waterfall. En route, expect hearty lunches of Spätzle (noodles), sausage and lentil soup, and marzipan cakes, at traditional Berggasthofs (mountain inns).

Five-night breaks from Walks Worldwide (walksworldwide.com) from £619 half-board, including luggage transfers, GPX and walking maps. Departures between November and March

Culinary Vercors in France

Active breaks are all very well, but sometimes a winter holiday needs nothing more than good food, great views and an indulgently comfortable place to stay. Opening for its winter season on 12 December, the lovely Hotel du Golf – a converted farmhouse in the village of Correncon, tucked away in the Vercors national park, ticks all the boxes. Its restaurant, Asterales, won a Michelin star this year, the wood-panelled bedrooms are chic and unfussy, and the hot tub, pool and sauna are a cocoon of warmth after a foray outdoors. Foodies should book a table at Palégrié, where everything is cooked over an open fire, and Le Clariant, an isolated, self-sufficient restaurant, buried deep in the Vercors forest.

Doubles at Hotel du Golf (hotel-du-golf-vercors.fr) from €156 B&B. Correncon is 40 minutes’ drive south of Grenoble

High school girls’ volleyball: Southern Section playoff results

SOUTHERN SECTION PLAYOFFS

SATURDAY’S RESULTS

Semifinals

DIVISION 1

Sierra Canyon d. Marymount. 25-13-26-28, 24-26, 25-22, 15-9

Mater Dei d. San Juan Hills, 25-15, 25-1, 25-15

DIVISION 2

Santa Margarita d. Long Beach Poly, 25-13, 25-18, 25-14

West Ranch d. JSerra, 25-21, 25-14, 25-19

DIVISION 3

Foothill d. Flintridge Prep, 25-21, 25-22, 23-25, 25-21

Cypress d. St. Margaret’s, 21-25, 25-21, 22-25, 25-23, 15-9

DIVISION 4

La Canada d. Dana Hills, 25-13, 25-20, 19-25, 25-18

Ventura d. Oak Park, 25-20, 23-25, 25-18, 25-14

DIVISION 5

Ontario Christian d. Santa Barbara, 25-18, 25-15, 25-18

Chadwick d. Royal, 25-16, 25-21, 25-27, 26-24

DIVISION 6

Arrowhead Christian d. Garden Grove Pacifica, 3-0

Wiseburn Da Vinci d. Capistrano Valley Christian, 25-23, 25-21, 25-17

DIVISION 7

West Valley d. Elsinore, 25-22, 25-14, 25-17

Cate d. CAMS, 3-1

DIVISION 8

Schurr d. Foothill Tech, 22-25, 21-25, 25-20, 25-19, 15-6

Artesia d. Loma Linda Academy, 25-7, 25-15, 25-23

DIVISION 9

Nogales d. Westminster La Quinta, 3-0

South El Monte d. Nordhoff, 3-1

DIVISION 10

Anaheim d. Thacher, 3-2

Moreno Valley d. San Luis Obispo Classical, 3-1

Note: Division 1 Finals Nov. 8 at 6 p.m. at Cerritos College; Finals (Divisions 2-10) Nov. 6-8 (sites & times TBA).

Grand Egyptian Museum opens after decades of delays

An image created by drones depicting the funerary mask of Tutankhamun lights up the sky above the Grand Egyptian Museum during the opening ceremony in Giza, Egypt, on Saturday. Photo by Mohamed Hossam/EPA

Nov. 1 (UPI) — The Grand Egyptian Museum in Giza, Egypt, is one of the world’s largest and opened on Saturday after decades of delays and a cost of more than $1 billion.

The 5 million-square-foot museum features exhibits and artifacts ranging across 7,000 years, from prehistory to about 400 A.D., according to CBS News.

It also is the world’s only museum that is dedicated to one culture, which is ancient Egypt.

“It’s a great day for Egypt and for humanity,” Nevine El-Aref told CBS News. “This is Egypt’s gift to the world.”

El-Aref is the media advisor to Egypt’s Tourism and Antiquities Minister Sherif Fathy.

“It’s a dream come true,” El-Aref added. “After all these years, the GEM is finally and officially open,” he said.

The triangular structure is located about a mile from the pyramids of Giza, which makes it a can’t miss for those who want to experience Egyptian antiquities up close with tours of the pyramids and a visit to the museum.

The GEM’s construction initially was budgeted for $500 million, but that price more than doubled over the past three decades amid delays and cost overruns.

Egyptian sources and international contributions covered the building cost.

The museum first was proposed in 1992, but significant events occurred between then and now, including the 2011 “Arab Spring” revolution in Egypt, a military coup d’etat in 2013 and the COVID-19 pandemic of 2020, delaying its completion, CNN reported.

The GEM’s main entrance features a 53-foot-tall obelisk suspended overhead and is viewable from below via a glass floor.

A grand staircase containing 108 steps enables visitors to access the museum’s main galleries and view large statues from top to bottom.

The GEM has 12 main halls for exhibits and encompasses a combined 194,000 square feet that can hold up to 100,000 items, according to the museum.

The museum also two galleries that are dedicated to the pharaoh Tutankhamun and contain 5,300 pieces from his tomb, NBC News reported.

Those galleries and others will exhibit items that never have been made available for public viewing.

It’s also the first time that all of the young pharaoh’s items have been exhibited under the same roof since British archaeologist Howard Carter discovered King Tut‘s tomb in the Valley of the Kings in 1922.

The museum’s walls and slanted ceilings mimic the lines of the nearby pyramids, but the structure does not exceed them in height.

The museum’s opening prompted the Egyptian government to declare a national holiday on Saturday.

How it ranks with the world’s other iconic museums remains to be seen, but it likely will rank favorably with its unique collection of ancient Egyptian artifacts and other attractions.

Britons evacuated from Jamaica as UK sends aid

A chartered flight from the UK government evacuating British nationals from Jamaica in the wake of Hurricane Melissa is due to land at London’s Gatwick Airport on Sunday.

The flight, which left Kingston’s Norman Manley International Airport, comes after the UK flew aid in earlier in the day as part of a £7.5m regional emergency package.

Some of the funding will be used to match public donations up to £1m to the International Red Cross and Red Crescent – with King Charles and Queen Camilla among those who have donated.

Despite aid arriving in Jamaica in recent days, blocked roads have complicated distribution after Hurricane Melissa devastated parts of the island, killing at least 19 people.

The hurricane made landfall in Jamaica on Tuesday as a category five storm and was one of the most powerful hurricanes ever measured in the Caribbean.

Melissa swept across the region over a number of days and left behind a trail of destruction and dozens of people dead. In Haiti, at least 30 people were killed, while Cuba also saw flooding and landslides.

Jamaica’s Information Minister Dana Morris Dixon said on Friday “there are entire communities that seem to be marooned and areas that seem to be flattened”.

Around 8,000 British nationals were thought to have been on the island when the hurricane hit.

The UK foreign office has asked citizens there to register their presence and also advises travellers to contact their airline to check whether commercial options are available.

The UK initially set aside a £2.5m immediate financial support package for the region, with an additional £5m announced by Foreign Secretary Yvette Cooper on Friday.

Cooper said the announcement came as “more information is now coming through on the scale of devastation caused by Hurricane Melissa, with homes damaged, roads blocks and lives lost”.

The British Red Cross said the King and Queen’s donation would help the International Federation of Red Cross and Red Crescent (IFRC) “continue its lifesaving work” – which includes search and rescue efforts in Jamaica as well as ensuring access to healthcare, safe shelter and clean water.

The Red Cross said that 72% of people across Jamaica still do not have electricity and around 6,000 are in emergency shelters.

Until the Jamaican government can get the broken electricity grid back up and running, any generators aid agencies can distribute will be vital.

So too will tarpaulins, given the extent of the housing crisis.

Meanwhile, with so many in need of clean drinking water and basic food, patience is wearing thin and there are more reports of desperate people entering supermarkets to gather and give out whatever food they can find.

The BBC has seen queues for petrol pumps, with people waiting for hours to then be told there is no fuel left when they reach the front of the queue.

Some people are seeking fuel for generators, others for a car to reach an area in which they can contact people, with the power down across most of the island.

The country’s health minister, Dr Christopher Tufton, on Saturday described “significant damage” across a number of hospitals – with the Black River Hospital in St Elizabeth being the most severely affected.

“That facility will have to be for now totally relocated in terms of services,” he said.

“The immediate challenge of the impacted hospitals is to preserve accident and emergency services,” Dr Tufton added. “What we’re seeing is that a lot of people are coming in now to these facilities with trauma-related [injuries] from falls from the roof, to ladders, to nails penetrating their feet”.

The minister said arrangements had been made for the ongoing supply of fuel to the facilities as well as a “daily supply of water”.

Although aid is entering the country, landslides, downed power lines and fallen trees have made certain roads impassable.

However, some of the worst affected areas of Jamaica should finally receive some relief in the coming hours.

At least one aid organisation, Global Empowerment Mission, rolled out this morning from Kingston with a seven-truck convoy to Black River, the badly damaged town of western Jamaica, carrying packs of humanitarian assistance put together by volunteers from the Jamaican diaspora community in Florida.

Help is also coming in from other aid groups and foreign governments via helicopter.

It remains only a small part of what the affected communities need but authorities insist more is coming soon.

Soap star who become country singer hints at huge comeback after 10 years

EXCLUSIVE: Twinne-Lee Moore played Porsche McQueen in Hollyoaks over a decade ago and the actress turned singer has hinted at a potential return for a reunion with her on-screen family

Hollyoaks could set to welcome back a familar face to the fictional village.

Twinnie-Lee Moore played Porsche McQueen from Novemebr 2014 until December 2015.

The character highlighted the issues of sexual abuse in children and other storylines included a failed marriage when her husband had various affairs.

During her time on the Channel 4 soap, Twinnie-Lee was nominated for the British Soap Award for Best Newcomer and an Inside Soap Award in 2015 for her powerful portrayal.

Since leaving Hollyoaks, Twinnie-Lee has swapped Yorkshire for Nashville to embark a career as a country pop singer-songwriter.

However, the TV star has hinted that a return to Hollyoaks could be on the cards after catching up with her on-screen family at the soap’s 30th anniversary celebration last month.

Speaking to Reach PLC, Twinnie-Lee said: “It’s been a whole decade and it’s so lovely to see everybody.

“The McQueens are obviously my favourite family and I was very honoured to be part of it and it brings back a lot of memories.”

When asked about a potential Porsche McQueen comeback, she added: “You’ll have to ask the writers about that.

“I’m currently in Nashville doing my music. I did pitch to them if they did want to come and do a Nashville series. She [Porsche] did leave on a cruise so you never know.”

Porsche was last seen on screen on Christmas Eve 2015 and Twinnie-Lee revealed that fans still message her a decade later about her character.

She explained: “It’s so wild because people even now still message me about Porsche. I posted something and everyone was like ‘omg come back’, ‘when you coming back’.

“She was such a great character to play, made a real impact and very relatable.”

Last year, Twinnie-Lee returned to the small screen in Emmerdale as Jade Garrick, an illegal gambling and underground fighting manager who Ross Barton (Michael Parr) and Billy Fletcher (Jay Kontzle) worked for for a small number of episodes.

Speaking about her new role at the time, the soap star said: “My life has been a bit crazy recently juggling music and acting with lots of back and forth between Nashville and Yorkshire but I’ve been loving it!!

“I’ve loved being back on screen, especially as the show is shot in Yorkshire, being able to be home with family and go to work on such an iconic show has been nothing short of amazing! The whole team has been so welcoming and really supportive.”

Hollyoaks airs Monday to Wednesday on E4 at 7pm and first look episodes can be streamed Channel 4 from 7am

British tourist dies on dream holiday after horror poisoning while backpacking

Bethany Clarke and her best friend Simone White were backpacking together around Southeast Asia when they drank bootleg shots laced with methanol – and it proved tragically fatal for Simone

A woman has died after unknowingly drinking shots laced with methanol.

Bethany Clarke, 28, from Orpington, southeast London, went backpacking around Southeast Asia with her best friend, Simone White, 28, last year.

Both the women drank the bootleg alcohol, and tragically it proved fatal for Simone.

Bethany and Simone started their backpacking in Cambodia and went from there to Laos. They had spent the day tubing down the river – a popular tourist activity – before returning to their hostel for a night of drinking.

Bethany said: “We had methanol-laced shots. We had five or six each, just mixing them with Sprite.

READ MORE: Man collapsed and died within three minutes after texting ‘it’s my lucky day’READ MORE: ‘I went to a bar to celebrate after work – then I woke up completely blind’

“The next morning, we didn’t feel right, but we just assumed it was a hangover. It was strange though – unlike any hangover I’d had before.

“It felt like being drunk but in a way where you couldn’t enjoy it. Something was just off.”

Despite their condition, they continued on with their plans, heading to the Blue Lagoon and kayaking down the river again.

Bethany added: “We were just lying on the backs of the kayaks, too weak to paddle. Simone was being sick off one of them. Neither of us wanted to swim or eat – which, we later learned, are early signs of methanol poisoning.”

It wasn’t until hours later, after they’d boarded a bus to their next destination, that things worsened, with Bethany fainting and Simone continuing to vomit.

Eventually, they were taken to a local hospital – one that Bethany described as “very poor”.

She said: “They had no idea what was wrong, they talked about food poisoning, but we hadn’t eaten the same things. It didn’t make sense.”

Still confused and deteriorating, the women made it to a private hospital. But by then it was too late.

READ MORE: Pensioners snorting cocaine skyrockets as UK hospitals in crisis

Bethany said: “They told me they’d do all they could to save her. She was having seizures during dialysis.”

When Simone’s condition worsened, her mother, Sue White, flew out to Laos, arriving just as her daughter was being wheeled into emergency brain surgery.

Bethany said: “Her brain had started to swell, and they had to shave her head. The surgery relieved the pressure but caused bleeding and the other side started swelling.”

The results confirming methanol poisoning wouldn’t arrive until two weeks later. By then, Simone had died.

Bethany said: “On an emotional level, it’s been a lot to process. Sometimes I still think, ‘Why don’t you reach out to Simone for that?’ and then I remember I can’t.”

Bethany has channeled her grief into campaigning for change and awareness. She said: “People still aren’t aware and don’t know the signs to look for.

READ MORE: Fake vodka poisoning kills 19 people with one fighting for life as nursery teacher arrested

“The government aren’t doing enough to educate British citizens about the signs of methanol poisoning.

“In Australia, where I live now, they have a big TikTok campaign and signs in all the airports.

“There’s a lot more work to be done in the UK – we’re behind. Anywhere there is organised crime, the opportunity exists – even in the UK.

Bethany also reckons there will be more deaths until people become more aware.”It’s highly likely we’ll see more deaths unless the UK government acts in a more radical way,” she said.

“It has to be in people’s heads – stick to canned drinks. But bottles can be more risky because the cap could have been replaced.

“Any spirits can be a risk. I say ‘steer clear, drink beer’ which rolls off the tongue.”

READ MORE: Limoncello poisoning victims’ parents reveal they bought booze that killed couple

Just recently, the Foreign Office added eight further countries to the risk list for methanol poisoning due to risks associated with counterfeit or tainted alcoholic drinks.

The list already covered Thailand, Laos and Vietnam, Cambodia, Indonesia, Turkey, Costa Rica and Fiji.

Ecuador, Japan, Kenya, Mexico, Nigeria, Peru, Russia and Uganda were now included in the list following incidents.

Methanol poisoning results from methanol being added to drinks such as cocktails and spirits to up the volume and cut costs.

Signs of the poisoning include nausea, vomiting, dizziness and confusion – and more distinctive symptoms, such as vision issues, can develop between 12 and 48 hours after consumption.

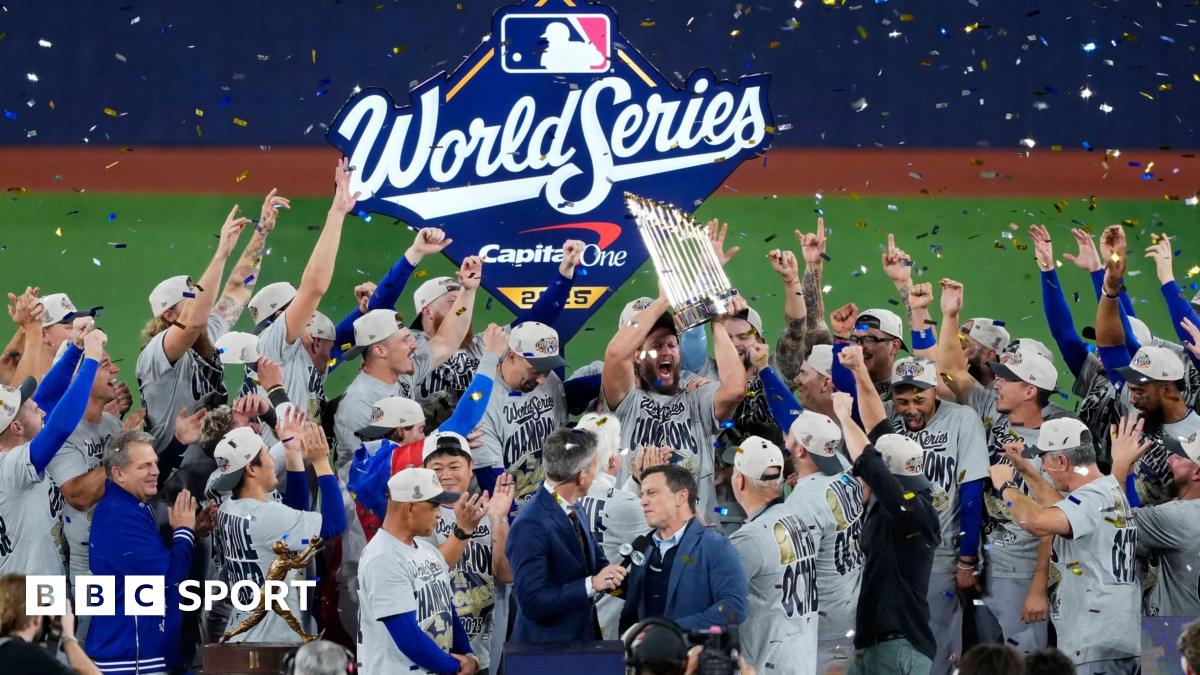

MLB World Series: LA Dodgers beat Toronto Blue Jays for back-to-back titles

Toronto’s veteran starter Max Scherzer came out of the game with the lead still 3-1 in the fifth inning, and the Dodgers rallied in the sixth when Tommy Edman’s sacrifice fly scored Mookie Betts to reduce the deficit to one run.

Back came the Blue Jays, when Ernie Clement’s stolen base put him in position for Gimenez to drive him in with a right-field double.

As is common in a World Series game seven, both sides made frequent pitching changes, even turning to starting pitchers from earlier in the series.

Trey Yesavage, who had started games one and five for Toronto, gave up Muncy’s solo shot in the eighth, before Rojas’ last-gasp effort off Jeff Hoffman levelled the scores.

Toronto loaded the bases in the bottom of the ninth but failed to conjure a run, and the Dodgers did the same in the 10th as expectation mounted, but both sides fluffed their lines.

It was only the sixth time in history that a World Series game seven had gone to extra innings, and Smith’s homer put the Dodgers within sight of the title.

The Blue Jays were tantalisingly close to taking it to a 12th inning or even winning it with a walk-off, but Yoshinobu Yamamoto, the Dodgers’ winning pitcher from games two and six, picked up another win in relief and was named as the series’ Most Valuable Player.

Dodgers win World Series 2025 after Smith homer against Blue Jays | Baseball News

Will Smith’s 11th-inning home run allows LA Dodgers to win Game 7 against Toronto Blue Jays and record seventh World Series title in franchise history.

Published On 2 Nov 2025

Will Smith homered in the 11th inning after Miguel Rojas connected for a tying drive in the ninth, and the Los Angeles Dodgers beat the Toronto Blue Jays 5-4 in Game 7 on Saturday night to become the first team in a quarter century to win consecutive Major League Baseball (MLB) World Series titles.

Los Angeles overcame 3-0 and 4-2 deficits and escaped a bases-loaded jam in the ninth to become the first repeat champion since the 1998-2000 New York Yankees, and the first from the National League since the 1975 and ’76 Cincinnati Reds.

Recommended Stories

list of 4 itemsend of list

Smith hit a 2-0 slider off Shane Bieber into the Blue Jays’ bullpen, giving the Dodgers their first lead of the night.

Yoshinobu Yamamoto, who threw 96 pitches in the Dodgers’ win on Friday, escaped a bases-loaded jam in the ninth and pitched 2 2/3 innings for his third win of the Series.

He gave up a leadoff double in the 11th to Vladimir Guerrero Jr, who was sacrificed to third. Addison Barger walked, and Alejandro Kirk grounded to shortstop Mookie Betts, who started a title-winning 6-4-3 double play.

Dodgers rally to win Game 7

With their ninth title and third in six years, the Dodgers made an argument for their 2020s teams to be considered a dynasty. Dave Roberts, their manager since 2016, boosted the probability that he will gain induction to the Hall of Fame.

Bo Bichette put Toronto ahead in the third with a three-run homer off two-way star Shohei Ohtani, who was pitching on three days’ rest after taking the loss in Game 3.

Los Angeles closed to 3-2 on sacrifice flies from Teoscar Hernandez in the fourth off Max Scherzer and Tommy Edman in the sixth against Chris Bassitt.

Andres Gimenez restored Toronto’s two-run lead with an RBI double in the sixth off Tyler Glasnow, who relieved after getting the final three outs on three pitches to save Game 6 on Friday.

Max Muncy’s eighth-inning homer off star rookie Trey Yesavage cut the Dodgers’ deficit to one run, and Rojas, inserted into the lineup in Game 6 to provide some energy, homered on a full-count slider from Jeff Hoffman.

Toronto put two on with one out in the bottom half against Blake Snell, and Los Angeles turned to Yamamoto.

He hit Alejandro Kirk on a hand with a pitch, loading the bases and prompting the Dodgers to play the infield in and the outfield shallow. Daulton Varsho grounded to second, where Rojas stumbled but managed to throw home for a force-out as catcher Smith kept his foot on the plate.

Ernie Clement then flied out to Andy Pages, who made a jumping, backhand catch on the centre-field warning track as he crashed into left fielder Kike Hernandez.

Seranthony Dominguez walked Mookie Betts with one out in the 10th, and Muncy singled for his third hit. Hernandez walked, loading the bases. Pages grounded to shortstop, where Gimenez threw home for a force-out. First baseman Guerrero then threw to pitcher Seranthony Dominguez covering first, just beating Hernandez in a call upheld in a video review.

The epic night matched the Marlins’ 3-2 win over Cleveland in 1997 as the second-longest Series Game 7, behind only the Washington Senators’ 4-3 victory against the New York Giants in 1924.

X-59 Supersonic Test Jet Takes To The Air (Updated)

Perhaps the most extraordinary-looking aircraft to have taken to the air in many years, the X-59 Quiet Supersonic Technology experimental test aircraft, or QueSST, has made its first flight. Much is resting on the test program that has now been kicked off, with the future of supersonic passenger flight arguably dependent on its successful outcome.

The first flight took place at the U.S. Air Force’s Plant 42 in Palmdale, California. Photographer Matt Hartman has shared pictures with us of the X-59 after its departure from Plant 42, as seen at the top of this story and below.

It has been planned that after the X-59’s first flight, it will be moved to NASA’s Armstrong Flight Research Center, which is collocated with Edwards Air Force Base in California, for further test flights.

Ahead of the first flight, NASA had outlined its plans for the milestone sortie. This would be a lower-altitude loop at about 240 miles per hour to check system integration. It will be followed by the first phase of flight testing, focused on verifying the X-59’s airworthiness and safety. During subsequent test flights, the X-59 will go higher and faster, eventually exceeding the speed of sound.

Although there were no public announcements, the first flight had been expected earlier this month but was scrubbed for unknown reasons. TWZ has reached out to NASA for more information in relation to today’s flight.

A product of Lockheed Martin’s famed Skunk Works advanced projects division, the X-59 was rolled out at the Skunk Works facility within Palmdale in January 2024.

“In just a few short years, we’ve gone from an ambitious concept to reality,” NASA Deputy Administrator Pam Melroy said at the time. “NASA’s X-59 will help change the way we travel, bringing us closer together in much less time.”

The first flight was preceded by integrated systems testing, engine runs, and taxi testing.

Taxi tests began at Palmdale this summer, marking the first time that the X-59 had moved under its own power. NASA test pilot Nils Larson was at the controls for the aircraft’s first low-speed taxi test on July 10, 2025.

The X-59 project was kicked off back in 2016, and NASA had originally hoped that the aircraft would take to the air for the first time in 2020. The targeted first flight then slipped successively to 2023, to 2024, and then to this year.

Among other issues, NASA blamed the schedule slip on “several technical challenges identified over the course of 2023,” which the QueSST team then had to work through.

Once at Armstrong, the X-59 will be put through its paces as the centerpiece of NASA’s Quiet Supersonic Technology mission. This is an exciting project that TWZ has covered in detail over the years.

The main goal of QueSST is to prove that careful design considerations can reduce the noise of a traditional sonic boom to a “quieter sonic thump.” If that can then be ported over to future commercial designs, it could solve the longstanding problem of regulations that prohibit supersonic flight over land.

The only genuinely successful supersonic airliner was the Anglo-French Concorde. Even that aircraft had an abbreviated career, during which it struggled with enormously high operating costs and an ever-shrinking market.

Even before Concorde entered service, however, commercial supersonic flight over the United States had been prohibited, under legislation introduced in 1973. Even the U.S. military faces heavy restrictions on where and when it can operate aircraft above the speed of sound within national airspace. Similar prohibitions on supersonic flight exist in many other countries, too.

NASA’s test program aims to push the X-59 to a speed of Mach 1.4, equivalent to around 925 miles per hour, over land. At that point, it’s hoped that its unique design, shaping, and technologies will result in a much quieter noise signature.

The second phase of the QueSST program will be about ensuring that the core design works as designed and will include multiple sorties over the supersonic test range at Edwards Air Force Base.

The third and final phase will be the Community Response Study, in which the X-59 will be flown over different locations in the United States. Individuals in those different communities will provide feedback on the noise signature via push notifications to cell phones.

At one time, the third phase was planned to take place between 2025 and 2026, but, as previously outlined, the program as a whole has now been delayed.

In the past, we have looked at some of the remarkable features that make the X-59 a test jet like no other.

Most obviously, there is its incredibly long nose, which accounts for around a third of its overall length of 99.7 feet. Meanwhile, its wingspan measures just under 30 feet. The idea behind the thin, tapering nose, which you can read about in detail here, is that the shock waves that are created in and around the supersonic regime will be dissipated. It is these shock waves that would otherwise produce a very audible sonic boom on the ground.

The X-59’s nose also dictates its unusual cockpit arrangement, with the pilot being located almost halfway down the length of the aircraft, with no forward-facing window at all. The pilot instead relies on the eXternal Vision System (XVS), which was specially developed for the aircraft, to see the outside world. This makes use of a series of high-resolution cameras that feed into a 4K monitor in the cockpit, something that we have also discussed in depth in the past.

Another noteworthy feature is the location of the X-59’s powerplant, on top of the rear of the fuselage, which ensures a smooth underside. This is another part of the jet that has been tailored to address supersonic shockwaves, helping prevent them from merging behind the aircraft and causing a sonic boom. The powerplant itself is a single F414-GE-100 turbofan, a variant of the same engine found on the F/A-18E/F Super Hornet.

Meanwhile, various items found on the X-59 are more familiar. For example, the canopy and elements of the pilot’s seat are taken from the T-38 Talon, the landing gear is borrowed from an F-16, and the life-support system is adapted from that used in the F-15 Eagle.

If all proceeds as planned with the QueSST program, NASA should be able to demonstrate that the rules that currently prohibit commercial supersonic flight over land, both in the United States and elsewhere, can be adjusted.

However, whether that potential regulatory change is enough to spur the successful development of future commercial high-speed aircraft designs remains a big question.

After all, aside from Concorde, the quest to successfully introduce a supersonic passenger transport is one that has otherwise been littered with failures. Many will now be pinning their hopes on the X-59 helping to reverse that trend.

Update: 4:20 PM Eastern –

Lockheed Martin has now put out a press release about the X-59’s first flight. As planned, the aircraft has now arrived at NASA’s Armstrong Flight Research Center.

“The X-59 performed exactly as planned, verifying initial flying qualities and air data performance on the way to a safe landing at its new home,” according to the release. “Skunk Works will continue to lead the aircraft’s initial flight test campaign, working closely with NASA to expand the X-59’s flight envelope over the coming months. Part of this test journey will include the X-59’s first supersonic flights, where the aircraft will achieve the optimal speed and altitude for a quiet boom. This will enable NASA to operate the X-59 to measure its sound signature and conduct community acceptance testing.”

“We are thrilled to achieve the first flight of the X-59,” O.J. Sanchez, Vice President and General Manager of Lockheed Martin’s Skunk Works, said in a statement. “This aircraft is a testament to the innovation and expertise of our joint team, and we are proud to be at the forefront of quiet supersonic technology development.”

“X-59 is a symbol of American ingenuity. The American spirit knows no bounds. It’s part of our DNA – the desire to go farther, faster, and even quieter than anyone has ever gone before,” Sean Duffy, Secretary of Transportation and acting NASA Administrator, also said in a statement. “This work sustains America’s place as the leader in aviation and has the potential to change the way the public flies.”

Contact the author: [email protected]

I don’t care if Dax cheats – we’re both attracted to other people… we’re married, not dead, admits Kristen Bell

SHE is one half of TV’s most romantic couple in Netflix’s No1 UK hit Nobody Wants This. But in real life, Kristen Bell’s relationship is a little more unconventional — as she admits she would not bat an eyelid if husband Dax Shepard cheated. Kristen, 45, said of infidelity: “Kind of who cares, to be…

Source link