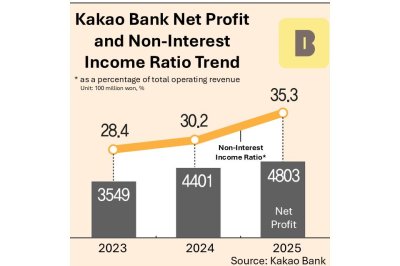

Chart shows Kakao Bank’s quarterly net profit and the rising share of non-interest income from 2023 to 2025. Graphic by Asia Today and translated by UPI

Feb. 4 (Asia Today) — Kakao Bank posted record earnings last year as growth in non-interest income offset pressure on lending revenue caused by tighter household loan regulations, the company said Tuesday.

The internet-only bank said net profit for 2025 reached 480.3 billion won ($348.6 million), up 9.1% from a year earlier. Fourth-quarter net profit rose 24.5% year over year to 105.2 billion won ($76.3 million), marking the first time quarterly earnings topped 100 billion won.

The results exceeded market expectations despite stricter government oversight of household lending in the second half of the year, which forced Kakao Bank to cut its loan growth target by half.

Interest income, still the bank’s largest revenue source, fell under regulatory pressure. Loan interest income declined 2.9% to 1.99 trillion won ($1.45 billion) from 2.05 trillion won ($1.49 billion) in 2024.

By contrast, non-interest income – including fees, platform revenue and fund management gains – jumped 22.5% to 1.08 trillion won ($790.6 million), surpassing 1 trillion won for the first time. Non-interest income accounted for 35.3% of total operating income, up about 5 percentage points from a year earlier.

Fund management performance was a major contributor. Kakao Bank said profits from the segment climbed about 28% to 670.8 billion won ($487.2 million), aided by expanded bond purchases in a high-interest-rate environment and a more diversified investment strategy.

Fee and platform revenue also continued to rise. Despite lower merchant fees for check cards, advertising revenue and loan comparison service income increased 54% and 37%, respectively. Total fee and platform revenue reached 310.5 billion won ($225.5 million), up 2.9% from a year earlier.

Looking ahead, Kakao Bank said it plans to further strengthen non-interest income this year by expanding products and services and by seeking growth opportunities in global and artificial intelligence-related businesses. The bank also signaled interest in mergers and acquisitions involving payment and capital companies to broaden its business scope into areas such as infrastructure and equipment finance.

An industry source said sustaining growth in non-interest income will be critical as lending expansion remains constrained, adding that the success of new business lines will play a key role in shaping future performance.

— Reported by Asia Today; translated by UPI

© Asia Today. Unauthorized reproduction or redistribution prohibited.

Original Korean report: https://www.asiatoday.co.kr/kn/view.php?key=20260205010001717