WASHINGTON — Jeffrey Rosenberg is still trying to understand why President Trump would free the man who defrauded him out of a quarter of a million dollars.

Rosenberg, a retired wholesale produce distributor living in Nevada, has supported Trump since he entered politics, but the president’s decision in November to commute the sentence of former private equity executive David Gentile has left him angry and confused.

“I just feel I’ve been betrayed,” Rosenberg, 68, said. “I don’t know why he would do this, unless there was some sort of gain somewhere, or some favor being called in. I am very disappointed. I kind of put him above this kind of thing.”

Trump’s decision to release Gentile from prison less than two weeks into his seven-year sentence has drawn scrutiny from securities attorneys and a U.S. senator — all of whom say the White House’s explanation for the act of clemency is not adding up. It’s also drawn the ire of his victims.

“I think it is disgusting,” said CarolAnn Tutera, 70, who invested more than $400,000 with Gentile’s company, GPB Capital. Gentile, she added, “basically pulled a Bernie Madoff and swindled people out of their money, and then he gets to go home to his wife and kids.”

Gentile and his business partner, Jeffry Schneider, were convicted of securities and wire fraud in August 2024 for carrying out what federal prosecutors described as a $1.6-billion Ponzi scheme to defraud more than 10,000 investors. After an eight-week trial, it took a jury five hours to return a guilty verdict.

More than 1,000 people attested to their losses after investing with GPB, according to federal prosecutors who described the victims as “hardworking, everyday people.”

When Gentile and Schneider were sentenced in May, Joseph Nocella Jr., the Trump-appointed U.S. attorney in the Eastern District of New York, and Christopher Raia, a senior official in the Justice Department, called their punishment “well deserved” and a warning to would-be fraudsters.

“May today’s sentencing deter anyone who seeks to greedily profit off their clients through deceitful practices,” Raia said in a statement.

Then, on Nov. 26 — just 12 days after Gentile reported to prison — Trump commuted his sentence with “no further fines, restitution, probation, or other conditions,” according to a grant of clemency signed by Trump. Under those terms, Gentile may not have to pay $15 million that federal prosecutors are seeking in forfeiture.

Karoline Leavitt, the White House press secretary, told reporters this month that prosecutors had failed to tie “supposedly fraudulent” representations to Gentile and that his conviction was a “weaponization of justice” led by the Biden administration — even though the sentences and convictions were lauded by Trump’s own appointees.

The White House declined to say who advised Trump in the decision or whether Trump was considering granting clemency to Schneider, Gentile’s co-defendant. Attorneys for Gentile and Schneider did not respond to a request seeking comment.

Adam Gana, a securities attorney whose firm has represented more than 250 GPB investors, called the White House’s explanation “a word salad of nonsense,” and questioned why Trump granted Gentile a commutation, which lessens a sentence, rather than a pardon, which forgives the offense itself.

“If the government wasn’t able to prove their case, why not pardon David Gentile? And why is his partner still in prison?” Gana said. “It’s left us with more questions than answers.”

‘It hurts a lot’

To Rosenberg, Tutera and two other investors interviewed by The Times, the president’s decision stripped away any sense of closure they felt after Gentile and Schneider were convicted.

Rosenberg has tried not to dwell on the $250,000 he lost in 2016, after a broker “painted a beautiful picture” of steady returns and long-term profits. The investments were supposed to generate income for him during retirement.

“A quarter of a million dollars, it hurts a lot,” Rosenberg said. “It changed a lot of things I do. Little trips that I wanted to take with my grandkids — well, they’re not quite as nice as they were planned on being.”

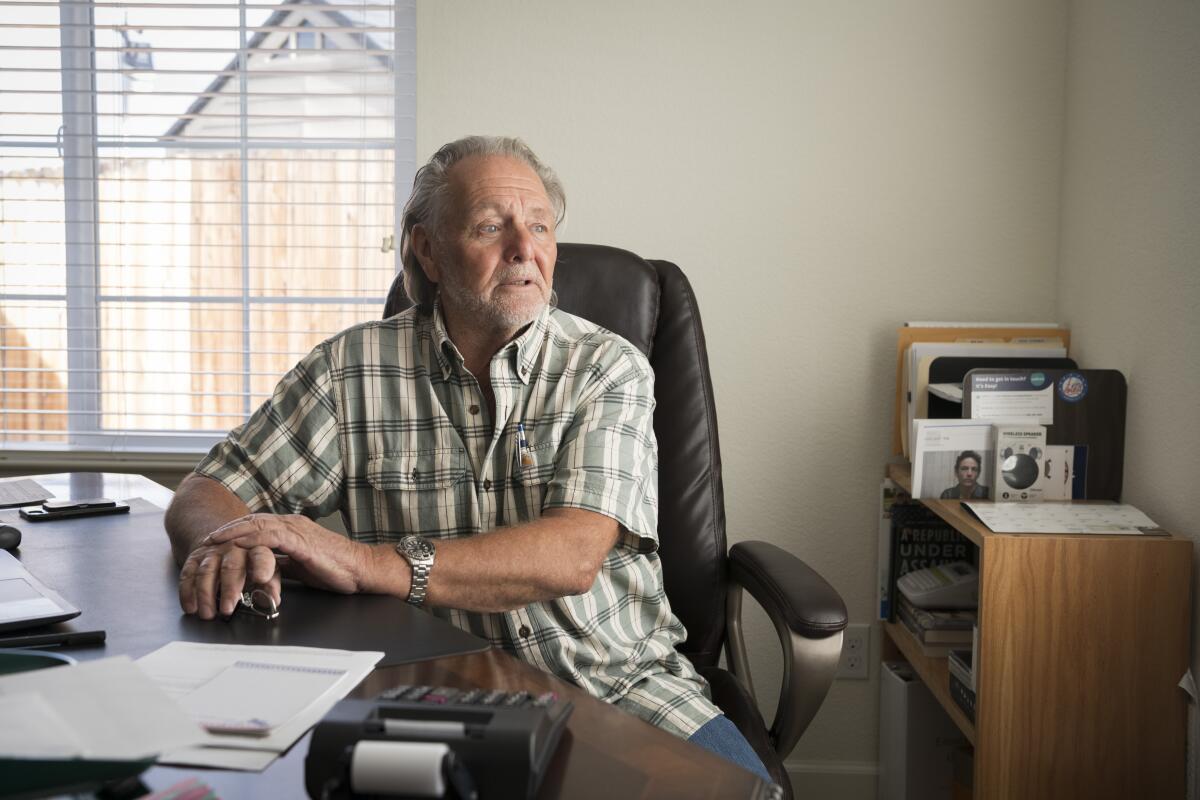

Jeffrey Rosenberg, a longtime Trump supporter, said he felt “betrayed” after the president granted clemency to convicted fraudster David Gentile.

(Scott Sady / For The Times)

Tutera, who runs a hormone replacement therapy office in Arizona, invested more than $400,000 with GPB at the recommendation of a financial advisor. She hoped the returns would help support her retirement after her husband had died.

“I was on grief brain at the time and just feel I was taken advantage of and really sold a bill of goods,” said Tutera, 70. Now, she says: “I have to keep working to make up for what I was owed.” She has been able to recover only about $40,000.

Tutera said her sister, Julie Ullman, and their 97-year-old mother also fell victim to the scheme. Their mother lost more than $100,000 and now finds herself spending down savings she had planned to leave to her children and not trusting people, she said.

“That’s really sad,” Tutera said. “People, unfortunately, have turned into thieves, liars and cheaters, and I don’t know what’s happened to the world, but we’ve lost our way to be kind.”

Ullman, 58, who manages a medical practice in Arizona, said the financial loss was life-changing.

“I’m going to have to work longer than I thought I would because that was my retirement fund,” Ullman said.

Mei, a 71-year-old licensed acupuncturist who asked to not use her full name out of embarrassment, said a broker introduced her to the GPB investment funds at a lunch meeting targeting divorced women. She eventually invested $500,000 and lost all of it. It was only through lawsuits that she was able to recover roughly $214,000 of her money, she said.

Mei had planned to retire in New York to be close to her children. But the loss of income has forced her to live in China, where the cost of living is much lower, six months out of the year, she said.

Mei fears Trump’s decision to commute Gentile’s sentence will allow these schemes to continue.

“Donald Trump is promoting more white-collar financial criminals, for sure,” Mei said. “How unfair.”

Bob Van De Veire, a securities attorney who has represented more than 100 GPB investors, said he has mostly handled negligence cases against the brokers who touted GPB investments.

“Based on all the red flags that were present, they should have never sold these investments at all,” Van De Veire said.

Gana, the securities attorney, added that he will continue to fight for victims in civil court, noting the clemency only addressed the criminal conviction.

The commutation caught the eye of Sen. Ruben Gallego (D-Ariz.), who sent a letter to the White House last week asking several questions: Why, for example, did Gentile receive clemency while Schneider did not? And what were the trial errors cited as a reason for the commutation? He said victims deserve answers.

“They will not forget that when they needed their government to stand with them against the man who stole their futures, their President chose to stand with the criminal instead,” Gallego wrote.

Rosenberg, the retiree from Nevada, said he still supports the president but can’t help but think Trump’s decision makes him “look like another of the swamp” that Trump says he wants to drain.

“I think Trump does a lot of good things,” he said, “but this is a bad one.”

Still, Rosenberg is hopeful Trump may do right by the victims — even if it’s just by admitting he made a mistake.

“I would like to think that he was fed some bad information somewhere along the way,” he said. “If that is the case … at least come forward and say, ‘I regret it.’ ”