After 14 days, two “College GameDays,” two “Monday Night Footballs” and one election night, the protracted contract dispute between YouTube TV and Walt Disney Co. is finally over.

As my colleague Meg James reported last week, the two sides settled Friday after agreeing on a multi-year distribution deal for YouTube to carry Disney-owned programming.

Financial terms of the deal were not disclosed.

Both sides touted the agreement as a win for consumers. Disney Entertainment Co-Chairs Alan Bergman and Dana Walden and ESPN chief Jimmy Pitaro said in a joint statement that the deal “recognizes the tremendous value of Disney’s programming and provides YouTube TV subscribers with more flexibility and choice.”

For its part, YouTube also noted that the settlement “preserves the value of our service for our subscribers” and “future flexibility in our offers.” The Google-owned platform also apologized to consumers for the “disruption,” saying it appreciated people’s patience during the dispute.

Of course, reaching an agreement is good for customers who had lost access to ESPN, ABC News election coverage and other programming during the two-week blackout.

But this is far from the last impasse that sports fans and other viewers will see — if history is any guide.

In fact, the number of blackouts related to carriage and contract disputes has been increasing over the last decade, particularly as the health of the television business has declined, raising the economic stakes for all sides.

Back in the day, contracts between content providers and distributors would last for five years or more because the industry was more stable and little would change over the course of an agreement.

That’s obviously all different now, with most deals today lasting about two to three years, reflecting rapid changes in a TV business that has been upended by streaming platforms.

In today’s TV landscape — with cable cord-cutters aplenty and many more options to watch your favorite shows and sports teams — negotiations are more fraught.

Traditional pay TV providers like DirecTV and Charter Communications are scrambling to retain their subscribers, while legacy media companies like Disney are trying to support their networks — particularly channels such as ESPN that have invested huge sums for those all-important sports rights that keep viewers engaged.

And in the midst of it all is the growing power of live TV streaming distributors, especially YouTube TV, which has become a much bigger force in the TV business.

The platform’s subscriber base has been quickly growing.

YouTube is approaching 10 million subscribers, making it the third-largest pay-TV distributor, behind Charter Communications and Comcast. Back in February, when it reached a deal with Paramount Global to avert a CBS blackout, that number was reported at 8 million.

Such growth is giving YouTube TV — with the financial backing of tech giant Google — more clout in contract negotiations, making them more willing to push back against fee increases demanded by legacy Hollywood media companies.

Disney sought rates similar to those paid by major distributors, including around $10 a subscriber per month for ESPN, CNBC reported.

“They realize their power,” said Brent Penter, associate analyst at Raymond James. “And they’re trying to use it.”

But Disney is no wilting flower, either. Last week, Disney’s Chief Financial Officer Hugh Johnston struck a tough tone on CNBC when talking about the negotiations, saying, “We’re ready to go as long as they want to.”

The Burbank entertainment giant has some of the most popular programming around, meaning it can command the biggest fees from providers. It also owns a competitor to YouTube TV in Hulu + Live TV and its new ESPN Unlimited direct-to-customer streaming service.

But in this dispute, Disney temporarily lost the distribution fees and potentially advertising dollars for any of its programs that a YouTube TV subscriber didn’t watch, making it a costly standoff.

No one wins in a blackout situation. But if you had to pick a winner, analysts say it might be the alternatives to YouTube TV — services like Fubo, Sling TV, DirecTV Stream and Hulu + Live TV.

If you’re a diehard Eagles fan who also happens to be a YouTube TV subscriber, and you refused to miss the game against the Packers last Monday, you might have signed up for temporary passes through one of these services. And if you liked it, well, you might choose to keep that subscription instead.

That also goes back to the complicated web of options consumers must wade through to find their favorite teams and shows.

“There is friction out there,” said Ric Prentiss, managing director at Raymond James. “Blackouts raise it to a head, where people say, ‘Wait, I don’t know how to navigate this,’ and they start looking at other alternatives.”

Stuff We Wrote

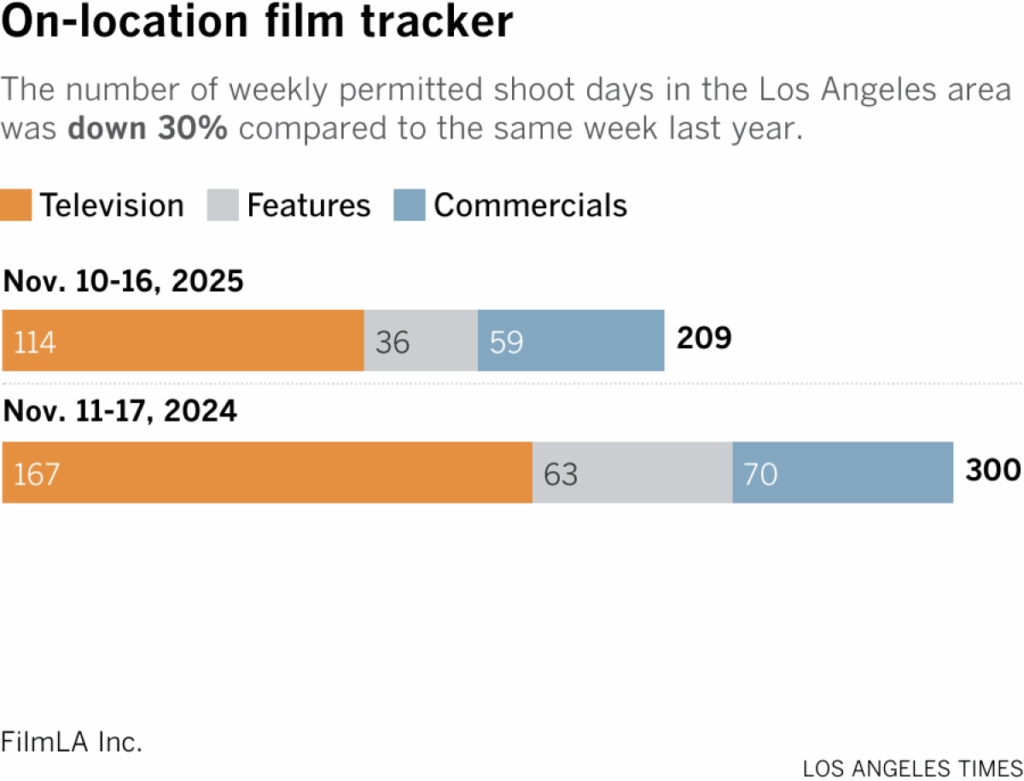

Film shoots

Number of the week

TV station owner Sinclair Inc. has an eye toward dominating the TV market. The Baltimore-based company, which is known for its conservative bent, has acquired about 8% of rival broadcaster E.W. Scripps, according to a recent filing with the U.S. Securities and Exchange Commission.

Sinclair also said in the filing that it has had “constructive discussions” with Scripps about potentially combining, though no deal has been reached. Scripps, however, has suggested that it is not interested in a merger.

Finally …

It might be a sign of the economy. My colleague, Suhauna Hussain, wrote about how McDonald’s is seeing lower traffic from one of its core customer bases, low-income households.