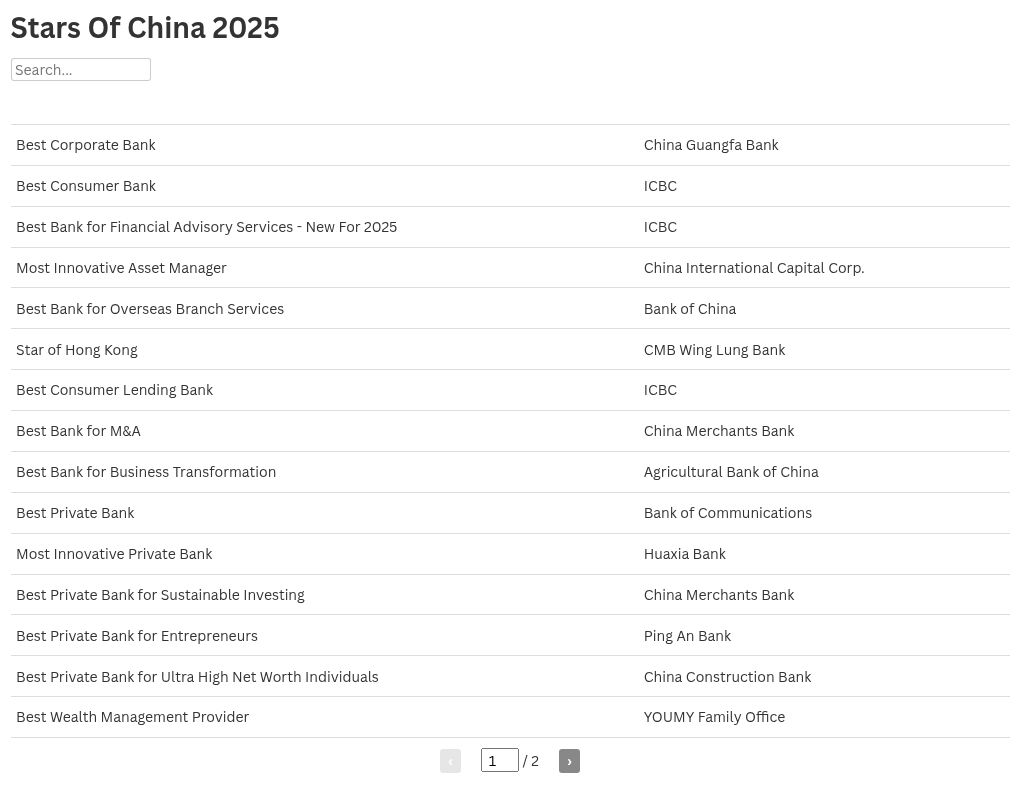

Global Finance Presents 2025 Stars of China Winners.

Best Corporate Bank

China Guangfa Bank

Guangdong Province is ground zero for manufacturers of smartphones, electric vehicles, and robots. It is home to tech giants Tencent and BYD. And its capital, Guangzhou, is home base for a digital champion of corporate finance, China Guangfa Bank, this year’s Best Corporate Bank.

With 1.4 trillion yuan in corporate deposits as of January 1 and 789 billion yuan in corporate loans issued last year, Guangfa is not the country’s largest corporate bank, but true to its Guangdong roots, it leads competitors in digital banking solutions. Its Digital Guangfa strategy complements a stream of improvements in online, mobile, and WeChat banking for corporate clients. Guangfa applies fintech to supply chain services through its e-Second platform, integrating portals and corporate online banking, enabling clients to apply for and sign contracts via mobile device.

For cross-border e-commerce companies, the Guangfa Hui payment system allows one-stop fund collection with real-time and pending exchange settlement, currency withdrawal, and automatic foreign exchange declaration for international settlement, supporting Amazon, among other providers. Guangfa’s corporate arm, meanwhile, is stepping up tech-sector support; its outstanding loan balance to science and tech businesses grew 25% in 2024.

Best Transaction Bank

China Guangfa Bank

Tariffs may slow Chinese export growth, but for now, growth continues. Supporting the country’s export juggernaut are transaction innovations led by China Guangfa Bank, Best Transaction Bank in 2025.

Guangfa has developed a system for integrating corporate billing and supply chain finance services through its international trade and investment service, Cross-Border InstantPass. The service is an umbrella for nine sub-systems including Instant Settlement and Customs Duty InstantPass. The subsystems digitize the entire cross-border transaction process, from export revenue collection and exchange to import payment and letter-of-credit operations. Guangfa also facilitates pilot programs for cross-border trade and investment openness, for example by integrating online banking functions for capital account transactions and making cross-border financing more convenient through streamlined cross-border payments in renminbi.

Best Bank For Renminbi Internationalization

China Guangfa Bank

Proof that the renminbi, or yuan, is gaining global traction is visible worldwide, wherever Chinese engineering companies are building infrastructure. A leader in cross-border, cross-currency banking solutions for these firms, and a major force for renminbi acceptance, is China Guangfa Bank, Best Bank for Renminbi Internationalization this year.

Guangfa enhances the role of renminbi through its Cross-Border RMB Express Channel tool for enterprises, which integrates renminbi and foreign currencies in liquidity pools. The bank also offers state-owned companies an onshore-offshore integrated renminbi and foreign currency settlement system, providing unified allocation of currencies for their domestic and overseas subsidiaries. The customizable system cuts account maintenance costs and drives efficiency by allowing a firm to use its domestic funds to finance overseas projects. It also helps facilitate cross-border goods trading, direct investment, and cross-border financing, addressing the demands of enterprises that likewise advocate renminbi internationalization.

Best Consumer Bank

ICBC

China remains home to the world’s most dedicated savers, despite a trimming of savings deposit rates by big banks in 2024 and again last spring. One bank’s focus on those resilient consumers—for whom basic savings pay rates currently below 1%—rewards loyal depositors while scaling up savings through wealth management products. That bank is ICBC, Best Consumer Bank of 2025.

As of January 1, ICBC held 6.4 trillion yuan in demand deposits and 12 trillion yuan in time deposits from its consumer clients. Responding to consumer demand for greater personal asset growth, ICBC has doubled down as a wealth management provider. In April, it launched a rewards program through its iBean digital services suite and opened a platform that broadens digital services to include investment guidance through an AI-driven wealth management assistant. Anti-fraud and consumer protection measures have been enhanced, and the bank posted a 45% decline in customer complaints for the first half of 2025, year-on-year. It recorded a 93% customer satisfaction rate in 2024, up 2% year-on-year.

Best Bank For Financial Advisory Services

ICBC

Financial firms of all sizes advertise comprehensive advisory services. But scale and initiative are needed to cover all the bases. ICBC leverages its size to deliver a comprehensive range of services, winning Global Finance’s first Best Bank for Financial Advisory Services award.

ICBC’s investment banking division applies its research, risk control, and fintech resources to its ESG Advisory Service, which offers management, transaction, and risk consulting. Its private banking arm recently collaborated with ICBC Credit Suisse Asset Management to offer China’s first fund investment advisory scheme for family trusts, complementing a similar scheme for charity trusts.

For small and micro entrepreneurs, the ICBC Matchmaker Platform provides advisory services geared toward full-lifecycle development with planning tools such as business scenario modeling. And corporate banking clients eyeing fundraisers can take advantage of consulting for strategic planning, restructuring plans, and equity private placement. ICBC also offers recommendations for listing sponsors and underwriters to its fundraising clients.

Best Consumer Lending Bank

ICBC

Digital financial advice is nice, but meeting face-to-face across a credit officer’s desk has advantages. ICBC’s retail customers benefit both ways from the bank’s ongoing efforts to enhance their experience both online and offline while boosting consumer support for China’s real economy, making ICBC this year’s Best Consumer Lending Bank.

Between January and June, ICBC’s personal loan portfolio expanded by 213 billion yuan and personal business loans jumped 184 billion yuan. To counteract a weak housing market, the bank beefed up its Housing Ecosystem program, which makes loans for purchases of auctioned property mortgages and makes loans for parking spaces and rental housing. It also promotes marketing for housing developers and real estate agents and in the past year launched a housing resale platform. As of July 1, its residential mortgage portfolio stood at 5.9 trillion yuan.

ICBC has also enhanced its consumer lending programs for electric vehicles and elder care services. Along with expanding its digital offerings, it has broadened personal loan services at branch outlets; today, some 90% of ICBC’s outlets market personal loans, serving 25 million customers.

Best Bank For Sustainable Infrastructure

ICBC

ICBC has adopted a whole-lifecycle approach to sustainable infrastructure finance, offering a toolbox of construction- and development-friendly financing vehicles that helped earn it the title as 2025’s Best Bank for Sustainable Infrastructure.

ICBC provides engineering, construction, and related government contractors what it calls “full-cycle empowerment, full-scenario coverage, and full-market service,” using loans, bonds, M&A, asset restructuring, asset securitization, and REITs to support infrastructure projects at every development stage. Two REIT projects during the past year highlight its success. ICBC issued a 1.06 billion-yuan REIT for wind farms in Inner Mongolia capable of powering up to 150,000 homes while a highway-management REIT worth 5.6 billion yuan is financing Hebei Province’s portion of an expressway serving the tech-focused Xiong’an industrial area.

Innovation In Fintech

ICBC

Fintech’s bells and whistles grab attention, but in the final analysis, income and client growth are what prove an app’s value. Generating value is at the core of ICBC’s effort to create fintech apps that both make money and turn techie heads, earning the bank recognition this year for Innovation in Fintech.

Since introducing customer-banker videoconferencing almost a decade ago, ICBC has set the pace for fintech in China, its innovations underpinned by research with a focus on interactive technologies that appeal to Gen Z clients. ICBC strives to enhance the mobile app experience and build an immersive virtual reality with, for example, virtual digital humans in the form of lifelike 3D avatars with perception, cognition, and facial expressions.

In the financial services area, ICBC credits its “intelligent agent” AI system with logging 42,000 person hours annually, generating 500 million yuan. In the credit domain, a time-saving financial analysis tool has so far reviewed more than 20,000 loans worth a combined 1 trillion yuan.

Best Bank For Belt And Road

ICBC

The world’s largest concentrated solar plant in Dubai, Africa’s tallest building in Cairo, and improvements to South Africa’s Telkom 5G wireless network are a few of the recent projects logged by China’s Belt and Road Initiative with support from ICBC, this year’s Best Bank for Belt and Road.

ICBC has arranged project finance for hundreds of projects in more than 70 countries while serving as a customer partner for cross-border cooperation in areas including export credit, syndicated loans, lease factoring, and advisory services as well as for financing projects, cross-border M&A, aircraft, and ships. Chinese enterprises have benefited from infrastructure contracts and new trade channels facilitated by ICBC. The bank is a financial advisor for major oil, gas, and mineral projects involving resource development, pipeline storage, and product terminals and a resource development advisor to Fortune 500 companies.

Most Innovative Asset Manager

China International Capital Corp.

For asset managers serving Chinese government entities, the quest for return is an exercise in balancing low-risk appetite and statemandated support for innovative investment targets such as technology stocks. The asset management arm of China International Capital Corp. (CICC), 30 years old in 2025, balances these objectives in a competitive market; it chalked up a 13% annual gain in asset management income to 1.3 billion yuan in 2024 and wins this year’s Most Innovative Asset Manager award.

The National Social Security Fund and corporate annuities were among 738 portfolios managed by CICC in 2024, contributing to total assets under management of 552 billion yuan and benefiting some 50 million people. CICC found innovative ways to deliver returns despite a soft economy in 2024 that prompted heightened compliance and risk control requirements for Chinese asset managers. The firm broadened corporate coverage and enhanced digital and platform capabilities to improve quality of customer service while contributing to Beijing’s national goals by supporting growth in technology, green, pension, and digital finance.

Best Bank For Overseas Branch Services

Bank of China

Global footprints vary for international banks. Some cover a few major cities; others, like Bank of China (BOC)—winner of 2025’s Best Bank for Overseas Branch Services award—stretch out with branches even in distant lands.

Beijing’s strategic moves, such as the Belt and Road Initiative for infrastructure construction, the renminbi internationalization effort, and its free trade zone agreements, have spurred BOC’s overseas expansion. Its services for trade partners and Chinese expats are extensive and easy to find; the most recent branch openings, in Port Moresby, Papua New Guinea, and Riyadh, Saudi Arabia, brought the number of countries and regions with BOC physical bank outlets to 64, including 44 Belt and Road countries.

Since becoming the world’s first renminbi clearing bank in 2003, BOC has expanded to provide clearing services in 16 regions of Asia, Europe, Africa, and the Americas. Renminbi clearing banks opened this year in Port Louis, Mauritius, and Vientiane, Laos. Established branches in New York, London, Milan, Seoul, and Tokyo augment BOC’s global footprint.

Best Bank For Green Bonds

Bank of China

Chinese green bond issues passed the half-trillion-dollar mark last year, solidifying the country as a top global bond issuer for renewable energy, electric vehicles, and other environmentally friendly efforts. Driving this success is Bank of China, the most active Chinese-funded institution for domestic and international green bond underwriting for the past five years and 2025’s Best Bank for Green Bonds.

The bond framework gives international investors an avenue to support China’s development. Recent highlights include the world’s first sustainability-linked green and social bonds, issued through the bank’s subsidiary in Frankfurt, Germany, which raised 2.5 billion yuan. BOC’s branch in Dubai issued in September 2024 a $400 million green bond to fund renewable energy and non-carbon transportation projects in the United Arab Emirates. And BOC was lead underwriter on Brazilian pulp producer Suzano’s 1.2 billion yuan green bond, issued in China as a panda bond.

Best Bank For Risk Management

Bank of China

Chinese banks strive to optimize their credit structure while serving the national economy. A recent dip in the real estate market—a key driver of GDP growth—has complicated that effort. Bank of China (BOC) has risen to the challenge by balancing its approach to real estate credit and its support for national economic goals, earning it Best Bank for Risk Management honors.

In step with government policy directing financial institutions to place equal emphasis on home rentals and home ownership, BOC’s corporate unit has tweaked its risk management strategy to expand financing for rental housing development companies, including government-subsidized housing and urban villages. BOC is also a conduit for government debt relief measures. And it has adjusted its credit strategy by, for example, adopting a data tracking system for credit risk monitoring and an early warning mechanism.

Star Of Hong Kong

CMB Wing Lung Bank

Covid-era questions about Hong Kong’s future as a hub of international finance have fallen by the wayside with the tightening of business ties between the mainland and the city. Encouraging tighter oversight are cross-border equities trading schemes, bond exchanges, and Hong Kong banks that also operate in mainland cities including Shenzhen and Guangzhou. Foremost among these multi-city banks is CMB Wing Lung Bank, a subsidiary of the mainland’s China Merchants Bank and Star of Hong Kong.

Capitalizing on Hong Kong’s status as a Chinese semiautonomous region with legacy global business ties, CMB Wing Lung boasts more than 30 branches and business outlets in Hong Kong, Macau, and China and is licensed in each jurisdiction for corporate banking, bond trading, foreign exchange business, and wealth management. This year, the bank was approved as a renminbi foreign exchange market maker for the China Foreign Exchange Trade System Free Trade Zone to execute transactions for institutional clients. Earlier, it launched a family office advisory service for high-net-worth families, sparking double-digit growth in private banking and private wealth management-related assets under management between last December and June.

CMB Wing Lung also operates an app used by 420,000 mainland and Hong Kong customers.

Best Bank For M&A

China Merchants Bank

Roadshows can fall into a rut when bank-organized M&A presentations turn routine. China Merchants Bank has abandoned formulaic roadshows, applying a fresh approach to its stream of high-profile M&A projects that helped win the 2025 Best Bank for M&A award.

CMB’s M&A Buyer-Seller Service System, an information exchange platform for equity and institutional investors eyeing M&A action, is part of this success story. The platform enhanced the bank’s 270-plus roadshows last year with project-targeted advisory services while advising potential investors on transaction design, channel matching, and due diligence.

In the past year, CMB has helped public companies raise more than 100 billion yuan while sponsoring an assortment of deals involving high-profile companies from hypermarket retailer Sun Art to jewelry giant Chow Tai Fook. Against the backdrop of a recent slowdown in M&A volume in China, CMB’s business has grown, finalizing projects in 2024 valued at about 190 billion yuan.

Best Private Bank For Sustainable Investing

China Merchants Bank

Private banking serves a discriminating clientele, many of whom are particularly concerned to build their portfolio around sustainable investments. China Merchants Bank’s private banking division recently stepped up consumer rights protection and established an ESG secretariat, factors that helped distinguish it as this year’s Best Private Bank for Sustainable Investing.

The secretariat, which reports to CMB’s head office, optimizes ESG information disclosure and conducts sustainability knowledge promotion and education. Its annually updated consumer rights protection plan incorporates financial education promotion at the bank’s headquarters and branches, with a stated commitment to “public welfare, effectiveness, innovation, and sustainability.”

CMB reported a 13.6% increase in its private banking customers between 2023 and 2024, to some 169,000.

Best Bank For Business Transformation

Agricultural Bank of China

Beijing’s clarion call for financial institutions to support domestic consumption hit home with the country’s largest rural lender, Agricultural Bank of China, which has responded by launching an assortment of consumerf riendly lending and other programs. Its rapid response required flexibility and significant change, earning it this year’s title as Best Bank for Business Transformation.

Writing in a People’s Bank of China publication, ABC Executive Vice President Lin Li described efforts to support consumers whose expenditures contributed to 44% of China’s economic growth last year. Efforts included targeted financing for home improvements as well as helping consumers swap used for new appliances and vehicles. ABC has also stepped up design work on local consumer lending programs tailored for China’s huge population and diverse rural and urban markets. This year, the bank is expected to better the 561 billion yuan in personal consumption loans it reported in 2024.

ABC is also targeting small and micro enterprises engaged in export as part of a broader lending approach. For the first three months of 2025, the bank reported 131.2 billion yuan in loans to 17,200 such enterprises.

Best Private Bank

Bank of Communications

For some private banks, client investment research is just a box to check on a to-do list. For others, investment research is woven into the fabric of their daily activities. The latter describes the private banking division of Bank of Communications, recognized this year as Best Private Bank.

BOCOM branch teams integrate research support for private banking clients through the entire workflow process: tracking economic and asset market trends, identifying allocation opportunities, and warning of risks. A WeChat channel and the bank’s mobile app broadcast research reports weekly, monthly, and quarterly. The bank also offers personalized investment advice. Clients receive BOCOM’s internal research, bolstered by daily morning and weekly strategy meetings. Biweekly, clients can access the bank’s trademark Single Chart to Understand Investment report on asset allocation.

Last year, research supported the launch of a US dollar wealth product for BOCOM’s private bank clients that earned a healthy 11.95% annual rate.

Most Innovative Private Bank

Huaxia Bank

Private banking has been an eager adopter of digital solutions for portfolio and asset allocation tasks. But private clients get more than digital basics at Huaxia Bank, recognized this year as Most Innovative Private Bank.

Huaxia’s digital tools cover internal asset allocation, asset diagnosis, and product portfolio management, supporting local branch marketing efforts and customer management. The bank has developed asset allocation and investment research report functions that automatically offer clients asset allocation strategies. The bank also offers an asset allocation “simulation competition” platform that simulates positionbuilding, allowing users to build product portfolio and allocation strategies around various asset positions; it also uses simulation to train staff.

Huaxia’s in-house digital arsenal also includes monitoring tools such as post-investment transaction and performance tracking. These complement the bank’s unique index of green and low-carbon companies listed on the Shanghai and Shenzhen exchanges. In 2021, the CSI Huaxia Bank New Economy Wealth Index became the industry’s first to spotlight green and low-carbon activities promoted by the government.

Best Private Bank For Entrepreneurs

Ping An Bank

Chinese entrepreneurs may succeed on their own, but they also learn from successful competitors. Ping An Bank satisfies that personal drive and competitive curiosity by organizing client tours of companies ranging from electronic device maker iFlytek to Shaanxi Auto, disseminating best practices and fostering industry collaboration. These learning events helped earn Ping An the title as Best Private Bank for Entrepreneurs for 2025.

Facility tours are one perk the bank offers entrepreneur clients through its Qi Wang Hui, or Enterprise Vision Association, platform. The service helps them expand their sales channels through a mobile commerce platform, offers image building to enhance media visibility, and provides access to Ping An’s consumer commerce system and nationwide database of highnet-worth individuals. On the financial side, Ping An’s entrepreneurial solutions cover investment, wealth management, corporate governance, and private lifestyle services.

Best Private Bank For Ultra High Net Worth Individuals

China Construction Bank

China’s highest wealth bracket is trending higher. No wonder this year’s Best Private Bank for Ultra High Net Worth Individuals is a mobile institution with offices around the world: China Construction Bank.

Teams of private banking professionals have offices at each CCB Private Banking Center in London, New York, Toronto, Tokyo, Sydney, Singapore, and Hong Kong, complementing similar centers in more than 200 Chinese cities. When overseas, private bank clients in the ultra-high-net-worth bracket—including individuals, families, and executives—can do business in their native tongue with an account manager and get help streamlining communications with local government authorities.

Best Wealth Management Provider

YOUMY Family Office

YOUMY Family Office, a niche firm, serves more than 500 Chinese ultra-high-net-worth individuals and families and is this year’s Best Wealth Management Provider. A pioneer in China’s family office field, in the decade since its launch, YOUMY has invested more than 10 million yuan annually in data and investment research systems. The result has been continuous improvement in the capabilities and resources it offers for family asset management in the legal, tax planning, and asset allocation areas.

YOUMY today manages some 15 billion yuan in client assets while its minority foreign shareholder, Italy’s Azimut, manages about 650 billion yuan. YOUMY also acts as a resource for other firms, providing consulting and training to more than 100 smaller family offices.

Best Bank For Corporate Social Responsibility

DBS Bank (China)

It began years ago as an initiative to help fledgling entrepreneurs in areas such as low-income health care. Today, the DBS Foundation is a far-reaching nonprofit tasked with encouraging entrepreneurs as well as youth education, the environment, and community building across China. Behind it is DBS Bank (China), 2025’s Best Bank for Corporate Social Responsibility.

DBS integrates social enterprise support into its corporate culture by procuring goods and services from target enterprises for employee and client events. Strategic partnerships drive community programs that lift the lives of vulnerable groups. To date, more than 33 million yuan in donations have funded 1,000 socially involved enterprises. The foundation also contributes to online financial education for 140,000 students in rural schools. In March, it helped launch a program of home renovations for low-income families with schoolchildren needing study space. In July, innovating elder care in Shanghai and Singapore was the topic of a cross-border conference backed by the bank’s Impact Beyond Dialogue program.

Most Innovative Bank

China Zheshang Bank

Small and medium-sized enterprises selling products overseas are frequently vexed by foreign exchange volatility. To help SMEs in Zhejiang Province, the provincial branch of the State Administration of Foreign Exchange recently launched an online financial services platform that facilitates low-cost FX hedging and derivatives. When the platform went live, China Zheshang Bank became the country’s first bank to put it to work, helping earn it the title as 2025’s Most Innovative Bank.

CZ Bank also reported the initiative’s first success story when a garment exporter in Shaoxing locked in the yuan-US dollar exchange rate for a deal worth $1.2 million. The derivatives contract was completed at a fraction of the usual cost and in one day, not the usual three. As of July 1, CZ Bank had provided exchange rate hedging to about 3,600 SMEs.

While incorporating the FX services platform into its customer operations, the bank has introduced several custom hedging plans that help SMEs choose the best FX settlement period according to their risk tolerance. It also opened a financial consulting studio in July for exchange rate hedging, reaching 500,000 customers online.

Innovation In Payments

SY Holdings

The fast-fashion business model that’s propelled Asian e-commerce companies to superstar status is not without challenges. So-called shipped-but-unsettled orders that go out before customer payments are received pose a challenge that SY Holdings tackles for clients, earning the Shenzhen-based fintech this year’s Innovation in Payments award.

SY operates a self-developed, AI-driven industrial intelligence platform with risk control, supplier management, supply chain process, inventory, and procurement functions. Since 2013, it has helped arrange some 270 billion yuan in order procurement and financing services for more than 19,000 SMEs. Notably, it has facilitated working capital for e-commerce companies with shipped-but-unsettled orders, including SHEIN and Shopee, by embedding digital financing services into client platforms. As of June, SY reported this payments service had increased clients’ working capital eightfold year-on-year.

Best SME Services Bank

Postal Savings Bank of China

Action speaks louder than words for any bank committed to doing business with SMEs in China’s entrepreneurial climate. From matchmaking marketing events for potential clients to loans for grain farmers, Postal Savings Bank of China (PSBC) has taken an innovative approach to the sector, distinguishing it as 2025’s Best SME Services Bank.

PSBC regularly uses customized marketing maps to dispatch 10,000 financial agents from the bank’s 40,000 outlets to engage SMEs nationwide. Needs are assessed and services tailored. In one recent month, more than 4,000 matchmaking events and 5,000 product introductions involved some 150,000 businesses. Novel product offerings include the U Grain Easy Loan high-credit-limit program for SMEs doing grain storage and processing, attesting to PSBC’s deep roots with China’s farmers and commitment to national food security. The bank also built last year a digital platform for SMEs that streamlines tax planning, payroll, and other functions, serving 74,000 clients as of December 2024. As of January 1, PSBC reported 1.63 trillion yuan in outstanding SME loans, accounting for 18% of all its lending.

Best Asset Manager

China AMC

While some tap the brakes, China is forging ahead with carbon-cutting energy and green investment initiatives. Powering the expansion are institutions like China AMC, which boasts a fast-growing assets under management and the country’s largest client base and is this year’s Best Asset Manager.

Underscoring China AMC’s influence as an active promoter of environmentally friendly investment targets is its expansive clientele, which includes more than 240 million retail and 313,000 institutional investors. The firm in 2018 was the first Chinese financial institution to join Berkshire Hathaway, Tata Steel, and other giants in the Climate Action 100+ initiative as well as the first Chinese asset manager where a CEO-led, firm-level ESG Committee supervises implementation of ESG strategies. China AMC’s offices have been carbon neutral for three years.

Best Foreign Bank Asset Manager

CMB International Asset Management

Financial services from asset management to private equity funds are following investors as they crisscross the border between the mainland and Hong Kong. A leader in keeping abreast of the cross-border pace is CMB International Asset Management, this year’s Best Foreign Bank Asset Manager.

A subsidiary of China Merchants Bank, CMBIAM is registered in Hong Kong and listed as a qualified foreign institutional investor in Beijing, enabling it to provide advisory services to securities and asset management clients on the mainland while based in Hong Kong. Supplying diverse investment strategies in equities and bonds, private equity, funds of funds, and customized investment products, it also offers cross-border investments as well as services in Asia Pacific and global capital markets. The bank’s Hong Kong public funds business started at zero in February 2024 and in 13 months grew to HK$23 billion (about $2.95 billion) in assets.

Most Advancing Trading Technology

CMB Wealth Management

Wealth management providers are a popular equity and bond trading channel for retail investors shifting out of real estate and savings accounts. CMB Wealth Management has made technology, including AI, an integral part of its service in this area, earning it the honor for 2025’s Most Advancing Trading Technology.

CMB Wealth has grown rapidly since opening its doors in 2019, with bond trading more than doubling and transactions climbing fivefold. An example of its innovative approach is its self-developed HARBOR platform, which integrates investment research, trading, settlement, risk management, accounting, disclosure, and regulatory reporting. Enhancing the platform is an AI bond trading bot, which CMB Wealth introduced in 2023 and which proactively monitors bonds for portfolio managers. When external price movements occur, the bot triggers alerts, enabling the manager to react and avoid missing target prices. It also provides automated compliance alerts.