ITV’s Coronation Street aired shock scenes on Monday night which saw a villain killed off without any warning after subjecting two characters to a load of abuse

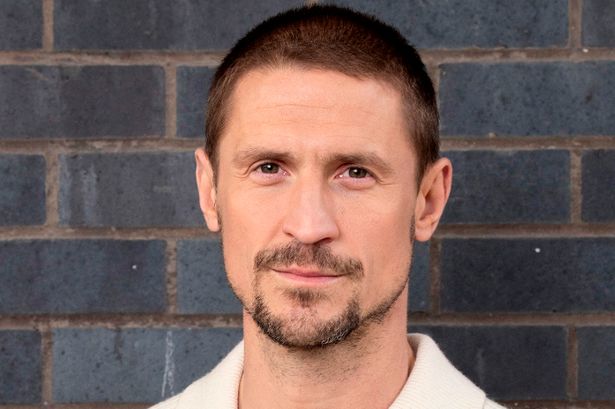

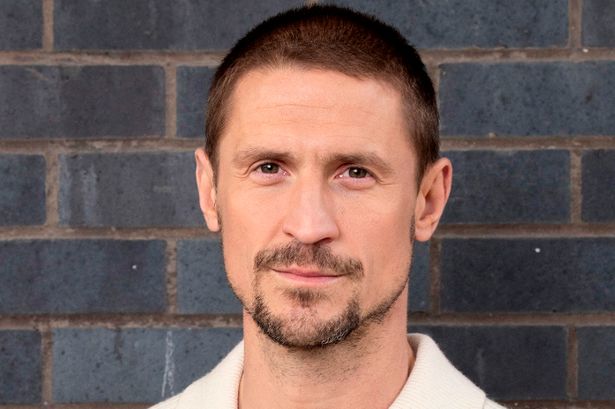

Coronation Street aired shock scenes on Monday night in which a villain was killed off without any warning. Richard Winsor, 43, has been playing homophobic church clerk Noah Hedley on the long-running serial for the past few months, and was placed at the centre of a controversial storyline.

When Theo Silverton (James Cartwright) made his debut on the programme, he was introduced as a married man who had two kids with wife Danielle (Natalie Anderson) before it was revealed that he had been put through conversion therapy earlier in life. After his wife left him once his affair with Todd Grimshaw (Gareth Pierce) was exposed, she struck up a relationship with Noah, and he has been on a campaign of hate ever since.

In the latest trip to the nation’s favourite street, viewers watched as Theo geared up for a custody hearing concerning his children Millie and Miles, with Todd and Noah sitting in on the whole thing in court as well. Throughout it all, Noah made homophobic comments , which led to an outburst from Todd. He left and waited at home, where Theo told him he had been granted a ‘shared care agreement order,’ and the pair went to the Bistro for lunch.

READ MORE: Coronation Street’s William Roache reveals two-year feud with legendary co-starREAD MORE: Coronation Street’s Todd Grimshaw left on verge of tears after vicious attack

However, Noah turned up and things between them immediately got heated as he subjected Todd and Theo to a torrent of abuse as he revealed that Danielle was set to appeal the decision.

He told them: “I’m concerned. People like you are allowed to live near kids, twisting their little minds so they end up like you.” Todd interjected with, ‘That’s enough!’ but Noah shot back: “I don’t think it, not while disgusting perverts like you are allowed to do what they want.” He labelled homosexuality as ‘a form of mental illness,’ and when Theo simply told him he ‘couldn’t get to them’ now, Noah simply said: “We’ll see…” and walked out.

A short time later, Todd and Theo had been joined in the Bistro by Todd’s adoptive daughter Summer (Harriet Bibby) and Dee Dee Bailey (Channique Sterling-Brown) to celebrate. But things took another dramatic turn when Natalie burst into the restaurant that Noah had died.

Looking for answers, she demanded: “What did you do to him? What did you do to Noah?! He’s dead! The last I heard he was coming to see you.” When asked how Noah had died, she explained through tears: “I found him in his front room, I called 999. The paramedic said he’d had a heart attack.”

Dee Dee assured Danielle that no one could make someone have a heart attack and it must have been an underlying condition. Danielle, hysterical by this point, then proclaimed: “This is all my fault. I did all this! Come on, Theo, you hate me!” but he insisted that was not the case, and they will always be connected in some form because of the children they have together.

Back at their flat, Theo had burst into tears over the shock news and admitted there was a time in his life that he ‘loved’ Noah. He explained: “He wasn’t always the bad guy. He was my friend. Maybe the best friend I’ve ever had. That’s why it was so much harder when he started to change. I loved him. I looked up to him. I thought he cared about me but maybe it was never real. Do you know what? I hate myself for saying this but I miss him. I always will.”

In recent weeks, viewers have seen Todd become a victim of control as he was forbidden from seeing former boyfriend Billy Mayhew (Daniel Brocklebank), and in disturbing scenes that aired last month, Theo grabbed hold of him and forced him to eat a kebab. The night before Noah’s death, Todd had thrown a small gathering to celebrate moving into their new flat together, but Theo took issue with the whole thing and made Todd sleep in the spare bedroom.

At the end of Monday’s episode, Theo told Todd: “I can’t do this without you. I mean it. If you ever left me…” before Todd assured him he wouldn’t. Theo warned him: “You’d better not!”

Coronation Street runs Mondays, Wednesdays and Fridays at 8pm on ITV1. Episodes can also be downloaded on ITVX.

Like this story? For more of the latest showbiz news and gossip, follow Mirror Celebs on TikTok , Snapchat , Instagram , Twitter , Facebook , YouTube and Threads .