Canada Inflation Eases to 1.7%, Driven by Falling Gas Prices

(Bloomberg) — Canadian consumer prices moderated slightly and underlying pressures broadly eased. Read More

Source link

(Bloomberg) — Canadian consumer prices moderated slightly and underlying pressures broadly eased. Read More

Source link

Asian stock markets see big gains amid growing expectations of an interest rate cut by the US Federal Reserve.

Japan’s benchmark stock market index has topped its all-time high for a second straight day amid expectations of an interest rate cut in the United States and easing trade tensions between Washington and Beijing.

The Nikkei 225 rose above 43,421 points on Wednesday after better-than-expected US inflation data bolstered the case for a rate cut by the US Federal Reserve at its next committee meeting in September.

The milestone came after the Nikkei on Tuesday breached the 42,999-point mark for the first time.

In the US, the benchmark S&P 500 and tech-heavy Nasdaq Composite also closed at record highs on Tuesday after rising 1.13 percent and 1.39 percent respectively, as investors cheered the latest inflation data release, which showed consumer prices rising a lower-than-expected 2.7 percent in July.

The inflation data added to a positive turn in investor sentiment following US President Donald Trump’s announcement on Monday of a 90-day extension of his pause on crippling tariffs on Chinese goods.

Other Asian stock markets also racked up big gains on Wednesday, with Hong Kong’s Hang Seng Index and South Korea’s KOSPI rising about 2.50 percent and 1 percent, respectively.

The Fed and its chair, Jerome Powell, have for months been under intense pressure from Trump to lower interest rates.

A cut in the benchmark rate would deliver a boost to the US economy, the biggest driver of global growth, by lowering borrowing costs for American households and businesses.

But the Fed has been reluctant to cut the rate due to concerns it could stoke inflation at a time when Trump’s sweeping tariffs are already putting pressure on prices.

“Jerome ‘Too Late’ Powell must NOW lower the rate,” Trump said in a post on Truth Social on Tuesday, claiming that the Fed chair had done “incalculable” damage to the economy by not lowering borrowing costs.

On Tuesday, CME Group’s FedWatch tool raised the likelihood of a September rate cut to 96.4 percent, up from 85.9 percent the previous day.

Miran, who currently sits on the White House’s Council of Economic Advisers, has advocated for a far-reaching overhaul of Fed governance.

United States President Donald Trump has said he will nominate Stephen Miran, a top economic adviser to the US Federal Reserve’s board of governors, for four months, temporarily filling a vacancy while continuing his search for a longer-term appointment.

The president announced his decision on Thursday.

Miran, the chair of the White House’s Council of Economic Advisers, would fill a seat vacated by Governor Adriana Kugler, a Biden appointee who is stepping down Friday. Kugler is returning to her tenured professorship at Georgetown University.

The term expires January 31, 2026, and is subject to approval by the Senate. Trump said the White House continues to search for someone to fill the 14-year Fed board seat that opens on February 1.

Miran, who served as an economic adviser in the Department of the Treasury during the first Trump administration, has advocated for a far-reaching overhaul of Fed governance that would include shortening board member terms, putting them under the clear control of the president, and ending the “revolving door” between the executive branch and the Fed and nationalising the Fed’s 12 regional banks.

The appointment is Trump’s first opportunity to exert more control over the Fed, one of the few remaining federal agencies that is still independent. Trump has relentlessly criticised the current chair, Jerome Powell, for keeping short-term interest rates unchanged – a major point of contention between the White House and the central bank.

Miran has been a major defender of Trump’s income tax cuts and tariff hikes, arguing that the combination will generate enough economic growth to reduce budget deficits. He has also played down the risk that Trump’s tariffs will generate higher inflation, a major source of concern for Powell.

Trump has unsuccessfully pressured Fed policymakers – who include Powell, his six fellow board members and the 12 Fed bank presidents – to lower rates. Appointing Miran to the central bank, even in a placeholder role, gives the president a potentially more direct route to pursue his desire for easier monetary policy.

It is unclear how much time Miran would have at the Fed to try to deploy his ideas, or even vote on interest rates, though.

All Fed nominees require Senate confirmation, a process that includes a hearing before the Senate Banking Committee, a vote from that panel advancing the nomination and a series of floor votes before the full Senate, where Democrats have been slowing the pace of approval for Trump appointments.

“Stephen Miran is a Trump loyalist and one of the chief architects of the President’s chaotic tariff policy that has hurt Americans’ wallets,” the Senate Banking Committee’s top-ranking Democrat, Elizabeth Warren, said on X following the announcement. “I’ll have tough questions for him about whether he’d serve the American people or merely serve Donald Trump.”

The Senate is on summer recess until September 2.

There are just four policy-setting meetings, including one on September 16-17, before the end of what would be Miran’s term.

Fed policymakers kept the policy rate in its current 4.25 percent to 4.5 percent range at their July meeting, with Powell citing somewhat elevated inflation and the concern that Trump’s tariffs could keep it that way as reasons to keep policy restrictive.

Several central bankers this month have raised concerns about labour market weakness, and at least a couple have expressed renewed confidence that tariffs may not push up inflation as much as earlier thought. Those views echo the arguments made by two Fed governors who last month dissented on the decision to leave policy on hold.

A WARNING has been issued to savers missing out on hundreds of pounds ahead of a key Bank of England (BoE) decision this week.

People risk the cash blow because they’re leaving money in low-paying easy access accounts.

The latest data from Moneyfactscompare.co.uk reveals someone with £10,000 in savings could earn an extra £300 by switching to an account with a higher interest rate.

Adam French, from the comparison site, said savers were in danger of their hard-earned cash “languishing” by making the mistake.

“Simply switching a £10,000 savings pot away from a high street bank’s easy access account to a market-leading one-year fix can leave you £300 better off in 12 months’ time.

“Not a bad return for a few minutes’ work, if you aren’t going to need access to the money sooner.”

The warning comes ahead of the BoE’s Monetary Policy Committee (MPC) meeting on Thursday (August 7) where it will decide what to do with the base rate.

The base rate is charged to high street banks and other lenders and usually reflected in savings and mortgage rates.

Any fall is good news for mortgage holders who tend to see rates plummet, but it spells bad news for those with savings accounts.

The bank is widely expected to cut the base rate, which currently sits at 4.25%.

The MPC, made up of nine members, last met in June when it decided to keep interest rates unchanged.

Six members voted to keep rates at the existing level while three members voted for a cut to 4%.

The BoE uses the base rate to control inflation, with a hike designed to discourage spending and keep prices in check.

The current Consumer Price Index (CPI) measure of inflation is 3.6%, over the BoE’s 2% target.

However, the MPC is under pressure to lower interest rates to get the stagnating economy growing.

You can’t do anything to control what the BoE does with the base rate, but you can make your savings work harder.

One way to do this is by locking your savings into a fixed-term account.

These accounts pay out an interest rate for a set period of time, from anywhere between six months and five years.

Fixed-rate savings accounts generally offer better interest rates in exchange for you not being to withdraw any cash.

Just bear in mind you may have to pay a charge for any early withdrawals.

Second, it’s worth making the most of ISAs which allow you to save money without having to pay tax on any interest earned.

You can spread a total of £20,000 across various ISA types including Cash ISAs and Stocks and Shares ISAs.

And of course, shop around for the best deals so you’re not left with a low-paying savings account.

Comparison sites like moneyfactscompare.co.uk and moneysavingexpert.com can help you find the best account suited to you.

If you are trying to find the best savings rate there are websites you can use that can show you the best rates available.

Doing some research on websites such as MoneyFacts and price comparison sites including Compare the Market and Go Compare will quickly show you what’s out there.

These websites let you tailor your searches to an account type that suits you.

There are three types of savings accounts fixed, easy access, and regular saver.

A fixed-rate savings account offers some of the highest interest rates but comes at the cost of being unable to withdraw your cash within the agreed term.

This means that your money is locked in, so even if interest rates increase you are unable to move your money and switch to a better account.

Some providers give the option to withdraw but it comes with a hefty fee.

An easy-access account does what it says on the tin and usually allow unlimited cash withdrawals.

These accounts do tend to come with lower returns but are a good option if you want the freedom to move your money without being charged a penalty fee.

Lastly is a regular saver account, these accounts generate decent returns but only on the basis that you pay a set amount in each month.

WASHINGTON — For weeks, President Trump was promising the world economy would change on Friday with his new tariffs in place. It was an ironclad deadline, administration officials assured the public.

But when Trump signed the order Thursday night imposing new tariffs, the start date of the punishing import taxes was pushed back seven days so the tariff schedule could be updated. The change in tariffs on 66 countries, the European Union, Taiwan and the Falkland Islands was potentially welcome news to countries that had not yet reached a deal with the U.S. It also injected a new dose of uncertainty for consumers and businesses still wondering what’s going to happen and when.

Trump told NBC News in a Thursday night interview the tariffs process was going “very well, very smooth.” But even as the Republican president insisted these new rates would stay in place, he added: “It doesn’t mean that somebody doesn’t come along in four weeks and say we can make some kind of a deal.”

Trump has promised that his tax increases on the nearly $3 trillion in goods imported to the United States will usher in newfound wealth, launch a cavalcade of new factory jobs, reduce the budget deficits and, simply, get other countries to treat America with more respect.

The vast tariffs risk jeopardizing America’s global standing as allies feel forced into unfriendly deals. As taxes on the raw materials used by U.S. factories and basic goods, the tariffs also threaten to create new inflationary pressures and hamper economic growth — concerns the Trump White House has dismissed.

As the clock ticked toward Trump’s self-imposed deadline, few things seemed to be settled other than the president’s determination to levy the taxes he has talked about for decades. The very legality of the tariffs remains an open question as a U.S. appeals court on Thursday heard arguments on whether Trump had exceeded his authority by declaring an “emergency” under a 1977 law to charge the tariffs, allowing him to avoid congressional approval.

Trump was ebullient as much of the world awaited what he would do.

“Tariffs are making America GREAT & RICH Again,” he said Thursday morning on Truth Social.

Others saw a policy carelessly constructed by the U.S. president, one that could impose harms gradually over time that would erode America’s power and prosperity.

“The only things we’ll know for sure on Friday morning are that growth-sapping U.S. import taxes will be historically high and complex, and that, because these deals are so vague and unfinished, policy uncertainty will remain very elevated,” said Scott Lincicome, a vice president of economics at the Cato Institute. “The rest is very much TBD.”

Trump initially imposed the Friday deadline after his previous “Liberation Day” tariffs in April resulted in a stock market panic. His unusually high tariff rates announced then led to recession fears, prompting Trump to impose a 90-day negotiating period. When he was unable to create enough trade deals with other countries, he extended the timeline and sent out letters to world leaders that simply listed rates, prompting a slew of hasty agreements.

Swiss imports will now be taxed at a higher rate, 39%, than the 31% Trump threatened in April, while Liechtenstein saw its rate slashed from 37% to 15%. Countries not listed in the Thursday night order would be charged a baseline 10% tariff.

Trump negotiated trade frameworks over the past few weeks with the EU, Japan, South Korea, Indonesia and the Philippines — allowing the president to claim victories as other nations sought to limit his threat of charging even higher tariff rates. He said Thursday there were agreements with other countries, but he declined to name them.

Asked on Friday if countries were happy with the rates set by Trump, U.S. Trade Representative Jamieson Greer said: “A lot of them are.”

The EU was awaiting a written agreement on its 15% tariff deal. Switzerland and Norway were among the dozens of countries that did not know what their tariff rate would be, while Trump agreed after a Thursday morning phone call to keep Mexico’s tariffs at 25% for a 90-day negotiating period. The president separately on Thursday amended an order to raise certain tariffs on Canada to 35%.

European leaders face blowback for seeming to cave to Trump, even as they insist that this is merely the start of talks and stress the importance of maintaining America’s support of Ukraine’s fight against Russia. Canadian Prime Minister Mark Carney has already indicated that his country can no longer rely on the U.S. as an ally, and Trump declined to talk to him on Thursday.

India, with its 25% tariff announced Wednesday by Trump, may no longer benefit as much from efforts to pivot manufacturing out of China. While the Trump administration has sought to challenge China’s manufacturing dominance, it is separately in extended trade talks with that country, which faces a 30% tariff and is charging a 10% retaliatory rate on the U.S.

Major companies came into the week warning that tariffs would begin to squeeze them financially. Ford Motor Co. said it anticipated a net $2 billion hit to earnings this year from tariffs. French skincare company Yon-Ka is warning of job freezes, scaled-back investment and rising prices.

Federal judges sounded skeptical Thursday about Trump’s use of a 1977 law to declare the long-standing U.S. trade deficit a national emergency that justifies tariffs on almost every country.

“You’re asking for an unbounded authority,” Judge Todd Hughes of the U.S. Court of Appeals for the Federal Circuit told a Justice Department lawyer representing the administration.

The judges didn’t immediately rule, and the case is expected to reach the Supreme Court eventually.

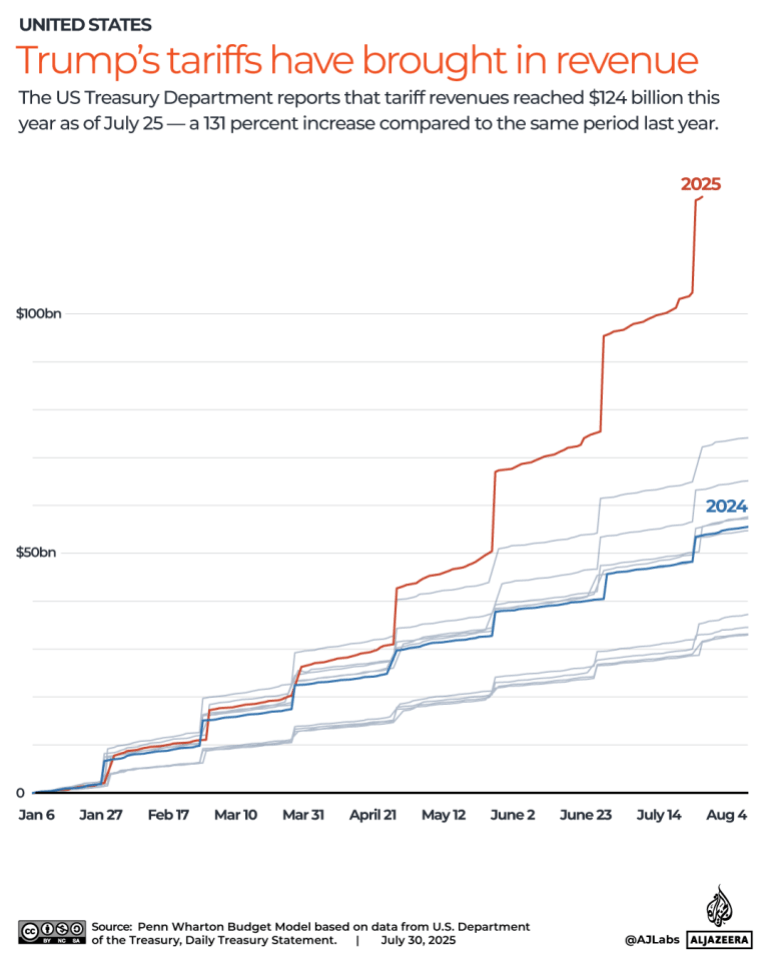

The Trump White House has pointed to the increase in federal revenues as a sign that the tariffs will reduce the budget deficit, with $127 billion in customs and duties collected so far this year — about $70 billion more than last year.

There are not yet signs that tariffs will lead to more domestic manufacturing jobs, and Friday’s employment report showed the U.S. economy now has 37,000 fewer manufacturing jobs than it did in April.

On Thursday, one crucial measure of inflation, known as the Personal Consumption Expenditures index, showed that prices have climbed 2.6% over the 12 months that ended in June, a sign that inflation may be accelerating as the tariffs flow through the economy.

The prospect of higher inflation from the tariffs has caused the Federal Reserve to hold off on additional cuts to its benchmark rates, a point of frustration for Trump, who on Truth Social, called Fed Chair Jerome Powell a “TOTAL LOSER.”

But before Trump’s tariffs, Powell seemed to suggest that the tariffs had put the U.S. economy and much of the world into a state of unknowns.

“There are many uncertainties left to resolve,” Powell told reporters Wednesday. “So, yes, we are learning more and more. It doesn’t feel like we’re very close to the end of that process. And that’s not for us to judge, but it does — it feels like there’s much more to come.”

Boak writes for the Associated Press. AP writer Paul Wiseman contributed to this report.

The White House has launched an aggressive public relations campaign promoting a narrative of economic strength during the first six months of United States President Donald Trump, with claims of his policies fueling “America’s golden age”.

But an Al Jazeera analysis of economic data shows the reality is more mixed.

Trump’s claims of his policies boosting the US economy suffered a blow on Friday when the latest jobs report revealed that the country had added a mere 73,000 jobs last month, well below the 115,000 forecasters had expected. The only additions were in the healthcare sector, which added 55,000 jobs, and the social services sector added 18,000.

US employers also cut 62,075 jobs in July — up 29 percent from cuts in the month before, and 140 percent higher than this time last year, according to the firm Challenger, Gray and Christmas, which tracks monthly job cuts. Government, tech, and retail sectors are the industries that saw the biggest declines so far this year.

It comes as this month’s jobs and labour turnover report showed an economic slowdown. There were 7.4 million open jobs in the US, down from 7.7 million a month before.

The Department of Labour on Friday released downward revisions to both the May and June jobs reports, significantly changing the picture the White House had previously painted.

“For the FOURTH month in a row, jobs numbers have beat market expectations with nearly 150,000 good jobs created in June,” the White House said in a July 3 release following the initial June report.

The Labor Department had reported an addition of 147,000 jobs in June. On Friday, it sharply revised down that number to just 14,000. May’s report also saw a big downgrade from 144,000 to only 19,000 jobs gained. Trump has since fired the head of the agency that produces the monthly jobs data, alleging that the data had been manipulated to make him look bad.

Even before the revisions, June’s report was the first to reflect early signs of economic strain tied to the administration’s tariff threats, as it revealed that job growth was concentrated in areas such as state and local government and healthcare. Sectors more exposed to trade policy – including construction, wholesale trade, and manufacturing – were flat. Meanwhile, leisure and hospitality showed weak growth, even in peak summer, reflecting falling travel demand both at home and abroad.

The administration also claimed that native-born workers accounted for all job gains since January. That assertion is misleading as it implies that no naturalised citizens or legally present foreign workers gained employment.

However, it is true that employment among foreign-born workers has declined – by over half a million jobs – claims that native-born workers are replacing foreign-born labour, are not supported by the jobs data.

Jobs lost in sectors with high foreign-born employment, including tech, have been abundant, driven by tariffs and automation, particularly AI. In fact, recent layoffs in tech have been explicitly attributed to AI advancements, not labour displacement by other groups.

Companies including Recruit Holdings — the parent company of Indeed and Glassdoor, Axel Springer, IBM, Duolingo and others have already made headcount reductions directly attributed to AI advancements.

The pace of rise of wage growth, an indicator of economic success, has slowed in recent months. That is partly due to the Federal Reserve keeping interest rates steady in hopes of keeping inflation stable.

According to the Bureau of Labor Statistics, wages have been outpacing inflation since 2023, after a period of declining real wages following the COVID pandemic.

Wage growth ticked up by 0.3 percent in July from a month prior. Compared with this time last year, wage growth is 3.9 percent, according to Friday’s Labor Department jobs report.

Earlier this year, the White House painted a picture that wage growth differed between the era of former President Joe Biden and now under Trump because of policy.

“Blue-collar workers have seen real wages grow almost two percent in the first five months of President Trump’s second term — a stark contrast from the negative wage growth seen during the first five months of the Biden Administration,” the White House said in a release.

However, Biden and Trump inherited two very different economies when they took office. Biden has to deal with a massive global economic downturn driven by the onset of the COVID-19 pandemic.

Trump, on the other hand, during his second term, inherited “unquestionably the strongest economy” in more than two decades, per the Economic Policy Institute, particularly because of the US economy’s rebound compared with peer nations.

Inflation peaked in mid-2022 during Biden’s term at 9 percent, before falling steadily because of the Federal Reserve’s efforts to manage a soft landing.

A July 21 White House statement claimed, “Since President Trump took office, core inflation has tracked at just 2.1 percent.” On Wednesday, Treasury Secretary Scott Bessett said “inflation is cooling” in a post on X.

However, the Consumer Price Index report, which tracks core inflation – a measure that excludes the price of volatile items such as food and energy – was 2.9 percent in the most recent report and overall inflation was at 2.7 percent in June.

The most recent Consumer Price Index report, published July 15, shows that on a monthly basis, prices on all goods went up in June by 0.3 ,percent which is 2.7 percent higher from this time last year.

Grocery prices in particular are up 2.4 percent from this time last year and 0.3 percent from the prior month. The cost of fruits and vegetables went up 0.9 percent, the price of coffee increased by 2.2 percent and the cost of beef went up 2 percent.

New pending tariffs on Brazil, as Al Jazeera previously reported, could further drive up the cost of beef in the months to come.

Trump has pointed to falling egg prices in particular as evidence of economic success, after Democrats attacked his administration over their price in March. He has even gone so far as to claim that prices are down by 400 percent. That figure is mathematically impossible – a 100 percent decrease would mean eggs are free.

During the first few months of Trump’s term egg prices surged, and then dropped due to an outbreak of, and then recovery from, a severe avian flue outbreak, which had been hindering supply – not because of any specific policy intervention.

In January, when Trump took office egg prices were $4.95 per dozen as supply was constrained by the virus. By March, the average egg price was $6.23. But outbreak and high prices drove away consumers, allowing farmers with healthier flocks to catch up on the supply side. As a result, prices fell to an average of $3.38. That would be a 32 percent drop since the beginning of his term and a 46 percent drop from their peak price – far from the 400 percent Trump claimed.

Trump also recently said petrol prices are at $1.98 per gallon ($0.52 per litre) in some states. He doubled down on that again on Wednesday. That is untrue. There is not a single state that has those petrol prices.

According to Gasbuddy, a platform that helps consumers find the lowest prices on petrol, Mississippi at $2.70 a gallon ($0.71 per litre) has the cheapest gas, and the cheapest petrol station in that state is currently selling gas at $2.37 ($0.62 per litre).

AAA, which tracks the average petrol price, has it at $3.15 per gallon ($0.83 per litre) nationwide, this is up from the end of January when it was $3.11 ($0.82 per litre).

While petrol prices have gone down since Trump took office, they are nowhere close to the rate he has continually suggested. In July 2024, for instance, the average price for a gallon of petrol nationwide was $3.50 ($0.93 per litre).

On Wednesday, the White House said that “President Trump has reduced America’s reliance on foreign products, boosted investment in the US”, citing the positive GDP data that had come out that morning.

That is misleading. While the US economy grew at a 3 percent annualised rate in the second quarter, surpassing expectations, that was a combination of a rebound after a weak first quarter, a drop in imports – which boosted GDP, and a modest rise in consumer spending.

The data beneath the headline showed that private sector investment fell sharply by 15.6 percent and inventories of goods and services declined by 3.2 percent, indicating a slowdown.

The administration recently highlighted gains in industrial production, pointing to a boost in domestic manufacturing. Overall, there was a 0.3 percent increase in US industrial production in June. That was after stagnating for two months.

There have been isolated gains, such as increases in aerospace and petroleum-related sectors—1.6 percent and 2.9 percent, respectively.

But production of durable goods — items that are not necessarily for immediate consumption— remained flat, and auto manufacturing fell by 2.6 percent last month as tariffs dampened demand. Mining output also decreased by 0.3 percent.

According to the Department of Commerce’s gross domestic product report, manufacturing growth among non-durable goods has slowed. While there was a 1.3 percent increase, that’s a decline from 2.3 percent in the previous quarter.

This could change in the future, as several companies across a range of sectors have pledged to increase US production, including carmaker Hyundai and pharmaceutical giant AstraZeneca, which just pledged a $50bn investment over the next five years.

In April, the White House replaced country-specific tariffs with a 10-percent blanket tariff while maintaining additional levies on steel, cars, and some other items. It then promised to deliver “90 trade deals in 90 days.” That benchmark was not met. By the deadline, only one loosely fleshed out deal — with the United Kingdom — had been announced. As of 113 days later, the US has announced comparable deals with just a handful more countries and the European Union. The EU deal still needs parliamentary approval.

Contrary to the administration’s claims, tariffs do not pressure foreign exporters — they are paid by US importers and ultimately are likely to be passed on to US consumers. Companies, including big box retailer Walmart and toymaker Mattel, have announced price hikes as a direct result. Ford, for example, raised prices on three Mexico-assembled models due to tariff pressures.

To protect their own economies, many countries have pivoted their trade policies away from the US. Brazil and Mexico recently announced a new trade pact.

The White House and its allies continue to defend tariffs by highlighting the increased revenue they bring to the federal government, which is true. Since Trump took office, the US has brought in more than $100bn in revenue, compared with $77bn in the entire fiscal year 2024. The price of imports for consumers has only risen about 3 percent, but many expect that will change as the import taxes are passed on to consumers.

The White House did not respond to Al Jazeera’s request for comment.

US President Trump alleged that the data had been manipulated to make him look bad.

United States President Donald Trump has removed the head of the agency that produces the monthly jobs figures after a report showed hiring slowed in July and was much weaker in May and June than previously reported.

Trump, in a post on his social media platform on Friday, alleged that the figures were manipulated for political reasons and said that Erika McEntarfer, the director of the Bureau of Labor Statistics (BLS), who was appointed by former President Joe Biden, should be fired. He provided no evidence for the charge.

“I have directed my Team to fire this Biden Political Appointee, IMMEDIATELY,” Trump said on Truth Social. “She will be replaced with someone much more competent and qualified.”

Trump later posted: “In my opinion, today’s Jobs Numbers were RIGGED in order to make the Republicans, and ME, look bad.”

After his initial post, Labor Secretary Lori Chavez-DeRemer said on X that McEntarfer was no longer leading the bureau and that William Wiatrowski, the deputy commissioner, would serve as the acting director.

“I support the President’s decision to replace Biden’s Commissioner and ensure the American People can trust the important and influential data coming from BLS,” Chavez-DeRemer said.

Friday’s jobs report showed that just 73,000 jobs were added last month and that 258,000 fewer jobs were created in May and June than previously estimated. The report suggested that the economy has sharply weakened during Trump’s tenure, a pattern consistent with a slowdown in economic growth during the first half of the year and an increase in inflation during June that appeared to reflect the price pressures created by the president’s tariffs.

“What does a bad leader do when they get bad news? Shoot the messenger,” Democratic Senate Leader Chuck Schumer of New York said in a Friday speech.

Trump has sought to attack institutions that rely on objective data for assessing the economy, including the Federal Reserve and, now, the BLS. The actions are part of a broader mission to bring the totality of the executive branch – including independent agencies designed to objectively measure the nation’s wellbeing – under the White House’s control.

McEntarfer was nominated by Biden in 2023 and became the commissioner of the BLS in January 2024. Commissioners typically serve four-year terms, but since they are political appointees, they can be fired. The commissioner is the only political appointee of the agency, which has hundreds of career civil servants.

The Senate confirmed McEntarfer to her post 86-8, with now Vice President JD Vance among the yea votes.

Trump focused much of his ire on the revisions the agency made to previous hiring data. Job gains in May were revised down to just 19,000 from 125,000, and for June they were cut to 14,000 from 147,000. In July, only 73,000 positions were added. The unemployment rate ticked up to a still-low 4.2 percent from 4.1 percent.

“No one can be that wrong? We need accurate Jobs Numbers,” Trump wrote. “She will be replaced with someone much more competent and qualified. Important numbers like this must be fair and accurate, they can’t be manipulated for political purposes.”

The monthly employment report is one of the most closely-watched pieces of government economic data and can cause sharp swings in financial markets. The disappointing figure sent US market indexes about 1.5 percent lower on Friday.

While the jobs numbers are often the subject of political spin, economists and Wall Street investors – with millions of dollars at stake – have always accepted US government economic data as free from political manipulation.

HOMEWARE giant Wayfair has slashed its UK workforce by more than half in just two years, as it grapples with tumbling sales and a sharp drop in profit.

The US-based furniture retailer, which operates across Britain, cut staff numbers from 847 in 2022 to just 405 by the end of 2024, according to fresh filings with Companies House.

The dramatic reduction follows a tough period for the business, with UK turnover plunging from £83.4million in 2022 to just £59.4million last year.

Profits also took a hit, with pre-tax earnings slipping from £2.6million to £2.2million over the same period.

Wayfair said it had made a 17 per cent cut to administrative expenses and was now focused on “driving cost efficiency” and “nailing the basics” as it tried to steady the ship.

Despite the ongoing slowdown, bosses remain upbeat about the retailer’s long-term prospects and said the group is working towards maintaining profitability and generating positive free cash flow.

The wider company reported a net revenue of $11.9billion (£8.8billion) globally last year – down $152million (£112million) on the year before.

International sales fell to $1.5billion (£1.1billion), while revenue in its core US market dropped to $10.4billion (£7.7billion).

Wayfair recorded a net loss of $492million (£363million) despite raking in $3.6billion (£2.7billion) in gross profits.

There was some relief in early 2025, as first-quarter results showed a $1billion (£740million) rise in total revenue, thanks to a modest recovery in US sales.

However, international takings continued to fall, dipping by $37million (£27million) to $301million (£223million).

Wayfair isn’t the only retailer feeling the pinch on the high street. Furniture favourite MADE.com collapsed into administration in 2022 after failing to find a buyer, leading to hundreds of job losses.

Habitat also shut down all standalone stores in 2021, moving exclusively online after years of underperformance.

Even major players have been forced to adapt.

Wilko closed its doors for good in 2023 after nearly a century in business, with more than 400 stores shutting and 12,000 staff affected.

Argos has continued to reduce its physical footprint, shutting dozens of standalone shops and moving into parent company Sainsbury’s stores to save costs.

Retail experts say changing consumer habits, rising costs and weaker demand are continuing to batter the home and furniture sector.

Many shoppers have tightened their belts amid soaring bills and higher interest rates, with big-ticket items like sofas and beds often the first to be cut from household budgets.

Wayfair bosses said the company remains “resilient” in the face of economic uncertainty and is pressing ahead with its long-term strategy to streamline operations and stay competitive.

The British Retail Consortium has predicted that the Treasury’s hike to employer NICs will cost the retail sector £2.3billion.

Research by the British Chambers of Commerce shows that more than half of companies plan to raise prices by early April.

A survey of more than 4,800 firms found that 55% expect prices to increase in the next three months, up from 39% in a similar poll conducted in the latter half of 2024.

Three-quarters of companies cited the cost of employing people as their primary financial pressure.

The Centre for Retail Research (CRR) has also warned that around 17,350 retail sites are expected to shut down this year.

It comes on the back of a tough 2024 when 13,000 shops closed their doors for good, already a 28% increase on the previous year.

Professor Joshua Bamfield, director of the CRR said: “The results for 2024 show that although the outcomes for store closures overall were not as poor as in either 2020 or 2022, they are still disconcerting, with worse set to come in 2025.”

Professor Bamfield has also warned of a bleak outlook for 2025, predicting that as many as 202,000 jobs could be lost in the sector.

“By increasing both the costs of running stores and the costs on each consumer’s household it is highly likely that we will see retail job losses eclipse the height of the pandemic in 2020.”

MILLIONS receiving benefits are in line for one-off boosts to help ease the pain on budgets at certain pressure points over the coming months.

As long as you are claiming qualifying benefits, you could receive several cash injections before the end of the year,

Here are all the one-off payments on the cards…

You can get help with the cost of living through the Household Support Fund.

The pot is worth £421 million and distributed by local councils.

Each authority has different qualifying criteria and gives support in different ways and for different amounts.

It means that what you are able to apply for depends on where you live, as well as your financial situation.

The money is usually given as cash transfer or through shopping or food vouchers.

For example, in some parts of the country such as Portsmouth you can get as much as £1,000.

Whereas households in other areas including Doncaster may be more likely to get up to £300 to support with gas, electricity and food costs.

To find out, you’ll need to look what your council offers and apply directly.

Thousands of households on benefits receive a tax-free £10 cash boost from the Department for Work and Pensions (DWP).

The tax-free £10 payment is paid to eligible households usually during the first full week of December.

To qualify for the payment you must be present or “ordinarily resident” in the UK, Channel Islands, Isle of Man or Gibraltar.

Households will also need to claim at least one of the 20 qualifying benefits within the same period.

The bonus is for those who receive Universal Credit plus mone of the qualifying benefits.

To claim your part of the Christmas cash, you’ll need to be claiming at least one of the following DWP’s benefits:

If you’re part of a married couple, in a civil partnership or live together, you’ll both get the cash bonus – as long as you both are eligible.

If you or your partner do not get one of the above qualifying benefits, then they could still get the bonus if they are over the state pension age by the end of the qualifying week.

The Winter Fuel Payment is made every year to help cover the cost of energy over the colder months.

It has been changed in recent months so that fewer can claim.

However, the cash boost, worth up to £300, is still valuable for those who quality – particularly those on Pension Credit.

The cash is usually paid in November and December, with some made up until the end of January the following year.

If you haven’t got your payment by then, you need to call the office that pays your benefits.

Households eligible for the payment are usually told via a letter sent in October or November each year.

If you think you meet the criteria, but don’t automatically get the winter fuel payment, you will have to apply on the government’s website.

If you’re based in Scotland, you could receive a child winter heating assistance payment of £255.80.

You get child winter heating payment for a child or young person under 19 who lives in Scotland and who is entitled to:

They must be entitled to the relevant disability benefit during the ‘qualifying week’, which is the week beginning on the third Monday in September (w/c Septmber 15 in 2025).

You do not have to make a claim for the payment, but it should be paid by Social Security Scotland, usually in November.

If you think you’re entitled but have not received payment by the end of December, you should contact Social Security Scotland on 0800 182 2222.

The Warm Home Discount is an automatic £150 discount off energy bills.

As the money is a discount, there is no money paid to you, but you’ll get the payment automatically if your electricity supplier is part of the scheme and you qualify.

You’ll have to be in receipt of one of the following benefits to qualify for one of the payments:

If you don’t claim any of the above benefits, you won’t be eligible for the payment.

Cold weather payments are dished out when temperatures are recorded as, or forecast to be, zero degrees or below, on average, for seven consecutive days between November 1 and March 31.

Eligible Brits are then given extra money to help heat their homes.

You get £25 for each seven-day period where the weather is below zero Celsius on average during this time frame.

You can check if your area has had a cold weather payment by popping your postcode into the government’s tool on its website.

You’ll need to be on certain benefits to qualify, which are:

Those in Scotland don’t get cold weather payments but may be able to receive a winter heating payment instead.

Student maintenance loans are paid to university students to help cover living costs such as rent.

They are usually paid at the start of each new term, so you typically receive three payments a year.

Maintenance Loans are paid straight into your student bank account in three (almost) equal instalments throughout the year.

The amount you will receive depends on where in the UK you’re from, whether you’ll be living at home or not, your household income and how long you’re studying for.

The average Maintenance Loan is approximately £6,116 a year.

YOU can use a benefits calculator to help check that you are not missing out on money you are entitled to

Charity Turn2Us’ benefits calculator works out what you could get.

Entitledto’s free calculator determines whether you qualify for various benefits, tax credit and Universal Credit.

MoneySavingExpert.com and charity StepChange both have benefits tools powered by Entitledto’s data.

You can use Policy in Practice’s calculator to determine which benefits you could receive and how much cash you’ll have left over each month after paying for housing costs.

Your exact entitlement will only be clear when you make a claim, but calculators can indicate what you might be eligible for.

United States President Donald Trump’s tariffs are set to come into effect on August 1. They mark a significant escalation in US trade policy, leading to higher prices for consumers and bigger financial hits for companies.

Trump had initially postponed “reciprocal tariffs”, which he had announced on April 2, giving countries time to reach trade deals with the US.

On Sunday, US Commerce Secretary Howard Lutnick said the August 1 tariffs were a “hard deadline”.

Several countries are facing a slew of tariffs on August 1. While the situation remains dynamic, different levies are going to hit countries ranging from 15 percent on Japan and the European Union to 50 percent on Brazil.

Trump has struck a series of bilateral trade deals in the last few days.

With the EU, the US secured $750bn in energy purchases and reduced tariffs on steel via a quota system. In exchange, it lowered auto tariffs from 30 percent to 15 percent, applying the same rate to pharmaceuticals and semiconductors.

Japan committed $550bn in investments targeting US industries such as semiconductors, AI and energy, while increasing rice imports under a 100,000-tonne duty-free quota. It will also purchase US commodities like ethanol, aircraft and defence goods.

Indonesia reportedly agreed to duty-free access for many US products and increased energy and agricultural imports, although Jakarta has only confirmed tariff cuts and key commodity purchases so far.

The United Kingdom gained aerospace and auto export benefits, while granting the US duty-free beef quotas and a 1.4 billion litre ethanol quota.

China saw its reciprocal tariffs slashed from 145 percent to the baseline 10 percent that was imposed on all countries. In addition, there’s a 20 percent punitive tariff for fentanyl trafficking. A temporary pause for the final tariff rate has been extended until August 12 while the two hammer out a deal. China matched the cut and eased non-tariff measures, resuming rare earth exports and accepting Boeing deliveries.

Deals with the Philippines, Cambodia and Vietnam also include tariff adjustments and market access, though not all terms have been confirmed by those governments.

According to a Reuters news agency tracker, which looks at how companies are responding to Trump’s tariff threats, the first-quarter earnings season saw automakers, airlines and consumer goods importers take the worst hit by tariff threats.

Levies on aluminium and electronics, such as semiconductors, led to increased costs.

“When you start to see tariffs at 20 or more, you reach a point where firms may stop importing altogether,” Joseph Foudy, an economics professor at the New York University Stern School of Business, told Al Jazeera.

“Firms simply postpone major decisions, delay hiring, and economic activity declines,” Foudy added.

Economists widely agree that the impact of tariffs implemented so far has not been fully felt, as many businesses built up their stockpiles of inventories in advance to mitigate rising costs.

In an analysis published last month, BBVA Research estimated that even the current level of US tariffs – including a baseline 10 percent duty on nearly all countries, and higher levies on cars and steel – could slow economic growth and reduce global gross domestic product (GDP) by 0.5 of a percentage point in the short term, and by more than 2 percentage points over the medium term.

According to HBS Pricing Lab reports, prices of US-made and imported goods saw modest seasonal declines through early March, with imports falling slightly more. The first 10 percent US tariff on Chinese goods (February 4) had little effect, but prices rose after broader tariffs were imposed on March 4, including a 25 percent tariff on Canadian and Mexican imports and another 10 percent tariff on China. Imported goods prices jumped by 1.2 points, while prices of domestic goods rose by half as much.

After a 10 percent global tariff was announced on April 2, “Liberation Day”, and 145 percent on China on April 10, import prices rose more sharply. A brief price dip followed the May 12 tariff rollback on Chinese goods, but trends resumed by June. Overall, import prices rose about 3 percent since March – small compared to headline tariff rates.

Trump’s tariffs have brought in revenue from higher duties paid by importers. Between January 2 to July 25, the US Treasury Department data shows that the US generated $124bn this year from tariffs. This is 131 percent more than the same time last year.

In early July, Treasury Secretary Scott Bessent said this could grow to $300bn by the end of 2025 as collections accelerate from Trump’s trade campaign.

Oral arguments over United States President Donald Trump’s power to impose tariffs have kicked off before a US appeals court after a lower court ruled he had exceeded his authority by imposing sweeping new levies on imported goods.

The appeals court judges on Thursday sharply questioned whether what Trump calls his “reciprocal” tariffs, announced in April, were justified by the president’s claim of emergency powers.

A panel of all the court’s active judges – eight appointed by Democratic presidents and three appointed by Republican presidents – is hearing arguments in two cases brought by five small US businesses and 12 Democratic-led US states.

The judges on the US Court of Appeals for the Federal Circuit in Washington, DC, pressed government lawyer Brett Shumate to explain how the International Emergency Economic Powers Act (IEEPA), a 1977 law historically used for sanctioning enemies or freezing their assets, gave Trump the power to impose tariffs.

Trump is the first president to use IEEPA to impose tariffs.

The judges frequently interrupted Shumate, peppering him with a flurry of challenges to his arguments.

“IEEPA doesn’t even say tariffs, doesn’t even mention them,” one of the judges said.

Shumate said the law allows for “extraordinary” authority in an emergency, including the ability to stop imports completely. He said IEEPA authorises tariffs because it allows a president to “regulate” imports in a crisis.

The states and businesses challenging the tariffs argued they are not permissible under IEEPA and the US Constitution grants Congress, and not the president, authority over tariffs and other taxes.

Neal Katyal, a lawyer for the businesses, said the government’s argument that the word “regulate” includes the power to tax would be a vast expansion of presidential power.

Tariffs are starting to build into a significant revenue source for the federal government as customs duties in June quadrupled to about $27bn, a record, and through June have topped $100bn for the current fiscal year, which ends on September 30. That income could be crucial to offset lost revenue from extended tax cuts in a Trump-supported bill that passed and became law this month.

“Tariffs are making America GREAT & RICH Again,” Trump wrote in a social media post on Thursday. “To all of my great lawyers who have fought so hard to save our Country, good luck in America’s big case today.”

But economists said the duties threaten to raise prices for US consumers and reduce corporate profits. Trump’s on-again, off-again tariff threats have roiled financial markets and disrupted US companies’ ability to manage supply chains, production, staffing and prices.

Dan Rayfield, the attorney general of Oregon, one of the states challenging the levies, said the tariffs are a “regressive tax” that is making household items more expensive.

Since Trump began imposing his wave of tariffs, companies ranging from carmaker Stellantis to American Airlines, temporarily suspended financial guidance for investors, which has since started again but has been revised down. Companies across multiple industries, including Procter and Gamble, the world’s largest consumer goods brand, announced this week that it would need to raise prices on a quarter of its goods.

The president has made tariffs a central instrument of his foreign policy, wielding them aggressively in his second term as leverage in trade negotiations and to push back against what he has called unfair practices.

Trump has said the April tariffs, which he placed on most countries, are a response to persistent US trade imbalances and declining US manufacturing power. However, in recent weeks, he’s used them to increase pressure on nontrade issues.

He hit Brazil with 50 percent tariffs over the prosecution of former Brazilian President Jair Bolsonaro, a key Trump ally who is on trial for an alleged coup attempt after he lost the 2022 presidential election.

Trump also threatened Canada over its move to recognise a Palestinian state, saying a trade deal will now be “very hard”.

He said tariffs against China, Canada and Mexico were appropriate because those countries were not doing enough to stop fentanyl from crossing US borders. The countries have denied that claim.

On May 28, a three-judge panel of the US Court of International Trade sided with the Democratic states and small businesses that are challenging Trump.

It said IEEPA, a law intended to address “unusual and extraordinary” threats during national emergencies, did not authorise tariffs related to longstanding trade deficits. The appeals court has allowed the tariffs to remain in place while it considers the administration’s appeal. The timing of the court’s decision is uncertain, and the losing side will likely appeal quickly to the US Supreme Court.

The case will have no impact on tariffs levied under more traditional legal authorities, such as duties on steel and aluminium. The president recently announced trade deals that set tariff rates on goods from the European Union and Japan after smaller trade agreements with Britain, Indonesia and Vietnam.

Trump’s Department of Justice has argued that limiting the president’s tariff authority could undermine ongoing trade negotiations while other Trump officials have said negotiations have continued with little change after the initial setback in court. Trump has set a deadline of Friday for higher tariffs on countries that don’t negotiate new trade deals.

There are at least seven other lawsuits challenging Trump’s invocation of IEEPA, including cases brought by other small businesses and California.

July 31 (UPI) — The Federal Reserve‘s preferred inflation gauge rose more than expected in June, according to a report by the U.S. Bureau of Economic Analysis released Thursday.

The personal consumption expenditures index, or PCE, rose 0.3% in June from the previous month and 2.6% from June 2024. Core PCE, which excludes volatile food and energy prices rose 2.8% on an annual basis.

The annual increases were higher than analysts’ expectations of a 2.5% increase for PCE and 2.7% rise for core PCE.

Additionally, when measured at a monthly rate, Americans saw their income increase by 0.3%, or $71.4 billion. However, after taxes that increase in dollars dips to around $61 billion, and the value of the goods and services bought by or for American citizens, or personal consumption expenditures, also rose 0.3% to $69.9 billion.

As for savings, residents held on to $1.01 trillion in personal savings in June, and when measured as a percentage of disposable income, those personal savings came in at 4.5%.

Inflation was also evident via the consumer price index, or CPI, as that rose 0.3% for urban consumers increased 0.3% since June when seasonally adjusted, and 2.7% over the last 12 months not seasonally adjusted, despite dipping as low as 2.3% in April.

The Fed continues to hold short-term interest rates steady at a range of 4.25% to 4.5% following its meeting earlier this week, with Fed Chair Jerome Powell citing earlier this month that the impact of President Donald Trump‘s reciprocal tariff strategy is the reason the Fed hasn’t gotten back to cutting rates.

Trump, who has been pushing for the Fed to lower rates, posted to Truth Social Thursday in regard to the Fed’s hold, saying Powell “is costing our Country TRILLIONS OF DOLLARS,” and called him a TOTAL LOSER.”

Having extended most of the 2017 Tax Cuts and Jobs Act and added even more tax breaks, Congress is once again punting on the central fiscal question of our time: What kind of government do Americans want seriously enough to pay for?

Yes, the Big Beautiful Bill avoided a massive tax increase and includes pro-growth reforms. It also adds to the debt — by how much is debatable — and that’s before we get to the budgetary reckoning of Social Security and Medicare’s impending insolvency. Against that backdrop, it’s infuriating to see a $9-billion rescission package — one drop in the deficit bucket — met with cries of bloody murder.

The same can be said of the apocalyptic discourse surrounding the Big Beautiful Bill’s reduction in Medicaid spending. In spite of the cuts, the program is projected to grow drastically over the next 10 years. In fact, the reforms barely scratch the surface considering its enormous growth under President Biden.

Maybe we wouldn’t keep operating this way — pretending like minor trims are major reforms while refusing to tackle demographic and entitlement time bombs ticking beneath our feet — if we stayed focused on the question of what, considering the cost, we’re willing to pay for.

Otherwise, it’s too easy to continue committing a generational injustice toward our children and grandchildren. That’s because all the benefits and subsidies that we’re unwilling to pay for will eventually have to be paid for in the future with higher taxes, inflation or both. That’s morally and economically reprehensible.

Admitting we have a problem is hard. Fixing it is even harder, especially when politicians obscure costs and fail to recognize the following realities.

First, growing the economy can, of course, be part of the solution. It creates more and better opportunities, raising incomes and tax revenue without raising tax rates — the rising tide that can lift many fiscal boats. But when we’re this far underwater, short of a miracle produced by an energy and artificial intelligence revolution, growth alone simply won’t be enough.

Raising taxes on the rich will fall short, too. Despite another round of loud calls to do so, like those now emanating from the New York City mayoral campaign, remember: The federal tax code is already highly progressive.

Here’s something else that should be common knowledge: Higher tax rates do not automatically translate to more tax revenue. Not even close. Federal revenues have consistently hovered around 17% to 18% of GDP for more than 50 years — through periods of high tax rates, low tax rates and every combination of deductions, exemptions and credits in between.

This remarkable stability is no fluke. It reflects a basic reality of human behavior: When tax rates go up, people don’t simply continue what they’ve been doing and hand over more money. They work less, take compensation in non-taxable forms, delay selling assets, move to lower-tax jurisdictions or increase tax-avoidance strategies.

Meanwhile, higher rates reduce incentives to invest, hire, and create or expand businesses, slowing growth and undermining the very revenue gains legislators expect. It’s why economic literature shows that fiscal-adjustment packages made mostly of tax increases usually fail to reduce the debt-to-GDP ratio.

Real-world responses mean that higher tax rates rarely generate what static models predict as we bear the costs of less work, less innovation and less productivity leading to fewer opportunities for everyone, rich or poor.

If the underlying structure of the system doesn’t change, no amount of rate fiddling will sustainably result in more than 17-18% in tax collections.

Political dynamics guarantee further disappointment. When Congress raises taxes on one group, it often turns around and cuts taxes elsewhere to offset the backlash. Then, when the government does manage to collect extra revenue — through windfall-profits taxes, inflation causing taxpayers to creep into higher brackets, or a booming economy — that money rarely goes toward deficit reduction. It gets spent, and then some.

It’s long past time to shift the conversation away from whether tax cuts should be “paid for.” Instead, ask what level of spending we truly want with the money we truly have.

I suspect that most people aren’t willing to pay the taxes required to fund everything our current government does, and that more would feel this way if they understood our tax-collection limitations. That points toward the need to cut spending on, among other things, corporate welfare, economically distorting subsidies, flashy infrastructure gimmicks, and Social Security and Medicare.

Until we align Congress’ promises with what we’re willing and able to fund, we’ll continue down this dangerous path of illusion, denial, and intergenerational theft — as we cope with economic decline.

Veronique de Rugy is a senior research fellow at the Mercatus Center at George Mason University. This article was produced in collaboration with Creators Syndicate.

The world’s largest consumer goods maker said it will have to raise prices on a quarter of its products starting in August.

Procter & Gamble has said it will need to raise prices on a quarter of the goods it sells in the United States starting this month in order to mitigate costs it has faced because of the tariffs imposed by US President Donald Trump.

On Tuesday, in conjunction with its earnings report, the world’s largest consumer goods maker named Shailesh Jejurikar as its new chief executive officer as the company navigates tariff-driven uncertainty weighing on the sector.

The price hikes have been communicated to retailers such as Walmart and Target and are in the mid-single digits across categories, a spokesperson said, and will be seen on shelves starting in August.

In May, Walmart also announced that it would need to raise prices on goods sold at the big box retailer because of the economic impact of tariffs.

P&G topped fourth-quarter estimates for its earnings report. The Cincinnati, Ohio-based firm reported revenue of $20.89bn for the quarter. Organic sales grew about 2 percent in fiscal 2025, driven by P&G’s portfolio of branded pantry staples, as well as higher pricing, particularly for fresher products. But that comes as growth is expected to slow.

P&G expects fiscal 2026 annual net sales growth of between 1 percent and 5 percent, largely below estimates of a 3.09 percent growth.

Market growth slowed from where it was at the start of the year in both the US and Europe, and volatile macroeconomic, geopolitical and consumer dynamics were resulting in headwinds that were not anticipated at the start of the year, CFO Andre Schulten said during a call with journalists.

“The consumer clearly is more selective in terms of shopping behaviour in our categories, and we see a desire to find value either by going into larger pack sizes in club channel or online or big box retailers or by lowering the cash outlay,” Schulten said.

The comments from the company reinforce how consumers, particularly in the lower-income category, are seeking value as they look to stretch their household budgets. Packaged food maker Nestle said last week that consumer spending in North America remained weak.

“Given the immense pressure put on US consumers in particular, the organic growth is a very good sign that long-term earnings projections should hold up,” said Brian Mulberry, portfolio manager at Zacks Investment Management.

P&G, which makes household basics spanning from Bounty paper towels to Metamucil fibre supplements, estimated tariffs will increase its costs by about $1bn before tax for fiscal 2026. That compares with projections of between $1bn and $1.5bn made in April.

The company rolled out a restructuring effort in June to exit some brands and cut about 7,000 jobs over the next two years to increase productivity. Prices rose about 1 percent in the fourth quarter, while volumes were flat.

P&G expects fiscal 2026 core net earnings per share growth in the range of $6.83 and $7.09, compared with estimates of $6.99, according to estimates compiled by LSEG.

On Wall Street, the company’s stock over the last five days is down 0.5 percent, down 1.1 percent for the month and since the beginning of the year, it has tumbled 5.15 percent.

The International Monetary Fund has raised its global growth forecasts for 2025 and 2026 slightly, citing stronger-than-expected purchases in advance of an August 1 jump in tariffs imposed by the United States and a drop in the effective US tariff rate to 17.3 percent from 24.4 percent.

In its forecast on Tuesday, it warned, however, that the global economy faced major risks including a potential rebound in tariff rates, geopolitical tensions and larger fiscal deficits that could drive up interest rates and tighten global financial conditions.

“The world economy is still hurting, and it’s going to continue hurting with tariffs at that level, even though it’s not as bad as it could have been,” said Pierre-Olivier Gourinchas, IMF chief economist.

In an update to its World Economic Outlook from April, the IMF raised its global growth forecast by 0.2 percentage point to 3 percent for 2025 and by 0.1 percentage point to 3.1 percent for 2026. However, that is still below the 3.3 percent growth it had projected for both years in January and the pre-pandemic historical average of 3.7 percent.

It said global headline inflation was expected to fall to 4.2 percent in 2025 and 3.6 percent in 2026, but noted that inflation would likely remain above target in the US as tariffs passed through to consumers in the second half of the year.

The US effective tariff rate – measured by import duty revenue as a proportion of goods imports – has dropped since April, but remains far higher than its estimated level of 2.5 percent in early January. The corresponding tariff rate for the rest of the world is 3.5 percent, compared with 4.1 percent in April, the IMF said.

US President Donald Trump has upended global trade by imposing a universal tariff of 10 percent on nearly all countries since April and threatening even higher duties to kick in on Friday. Far higher tit-for-tat tariffs imposed by the US and China were put on hold until August 12, with talks in Stockholm this week potentially leading to a further extension.

The US has also announced steep duties ranging from 25 percent to 50 percent on automobiles, steel and other metals, with higher duties soon to be announced on pharmaceuticals, lumber, and semiconductor chips.

Such future tariff increases are not reflected in the IMF numbers, and could raise effective tariff rates further, creating bottlenecks and amplifying the effect of higher tariffs, the IMF said.

Gourinchas said the IMF was evaluating new 15-percent tariff deals reached by the US with the European Union and Japan over the past week, which came too late to factor into the July forecast, but said the tariff rates were similar to the 17.3 percent rate underlying the IMF’s forecast.

“Right now, we are not seeing a major change compared to the effective tariff rate that the US is imposing on other countries,” he said, adding it was not yet clear if these agreements would last.

“We’ll have to see whether these deals are sticking, whether they’re unravelled, whether they’re followed by other changes in trade policy,” he said.

Staff simulations showed that global growth in 2025 would be roughly 0.2 percentage point lower if the maximum tariff rates announced in April and July were implemented, the IMF said.

The IMF said the global economy was proving resilient for now, but uncertainty remained high and current economic activity suggested “distortions from trade, rather than underlying robustness”.

Gourinchas said the 2025 outlook had been helped by what he called “a tremendous amount” of front-loading as businesses tried to get ahead of the tariffs, but he warned that the stockpiling boost would not last.

“That is going to fade away,” he said, adding, “That’s going to be a drag on economic activity in the second half of the year and into 2026. There is going to be pay back for that front loading, and that’s one of the risks we face.”

Tariffs were expected to remain high, he said, pointing to signs that US consumer prices were starting to edge higher.

“The underlying tariff is much higher than it was back in January, February. If that stays … that will weigh on growth going forward, contributing to a really lackluster global performance.”

One unusual factor has been a depreciation of the dollar, not seen during previous trade tensions, Gourinchas said, noting that the lower dollar was adding to the tariff shock for other countries, while also helping ease financial conditions.

US growth was expected to reach 1.9 percent in 2025, up 0.1 percentage point from April’s outlook, edging up to 2 percent in 2026. A new US tax cut and spending law was expected to increase the US fiscal deficit by 1.5 percentage points, with tariff revenues offsetting that by about half, the IMF said.

It lifted its forecast for the euro area by 0.2 percentage point to 1 percent in 2025, and left the 2026 forecast unchanged at 1.2 percent. The IMF said the upward revision reflected a historically large surge in Irish pharmaceutical exports to the US; without it, the revision would have been half as big.

China’s outlook got a bigger upgrade of 0.8 percentage point, reflecting stronger-than-expected activity in the first half of the year, and the significant reduction in US-China tariffs after Washington and Beijing declared a temporary truce.

The IMF increased its forecast for Chinese growth in 2026 by 0.2 percentage point to 4.2 percent.

Overall, growth is expected to reach 4.1 percent in emerging markets and developing economies in 2025, edging lower to 4 percent in 2026, it said.

The IMF revised its forecast for world trade up by 0.9 percentage point to 2.6 percent, but cut its forecast for 2026 by 0.6 percentage point to 1.9 percent.

As United States President Donald Trump blasts his way through tariff announcements, one thing is clear, experts say: Some level of duties is here to stay.

In the past few weeks, Trump has announced a string of deals – with the European Union, Japan, Indonesia, Vietnam and the Philippines – with tariffs ranging from 15 percent to 20 percent.

He has also threatened Brazil with a 50 percent tariff, unveiled duties of 30 percent and 35 percent for major trading partners Mexico and Canada, and indicated that deals with China and India are close.

How many of Trump’s tariff rates will shake out is anybody’s guess, but one thing is clear, according to Vina Nadjibulla, vice president of research and strategy at the Asia Pacific Foundation of Canada: “No one is getting zero tariffs. There’s no going back.”

Trump’s various announcements have spelled months of chaos for industry, leaving businesses in limbo and forcing them to pause investment and hiring decisions.

The World Bank has slashed its growth forecasts for nearly 70 percent of economies – including the US, China and Europe, and six emerging market regions – and cut its global growth estimate to 2.3 percent, down from 2.7 percent in January.

Oxford Economics has forecast a shallow recession in capital spending in the Group of Seven (G7) countries – Canada, France, Germany, Italy, Japan, the United Kingdom and the US – lasting from the second quarter to the third quarter of this year.

“What we’re seeing is the Donald Trump business style: There’s lots of commotion, lots of claim, lots of activity and lots of b*******,” Robert Rogowsky, professor of international trade at the Middlebury Institute of International Studies, told Al Jazeera.

“That’s his business model, and that’s how he operates. That’s why he’s driven so many of his businesses into bankruptcy. It’s not strategic or tactical. It’s instinctive.”

Rogowsky said he expects Trump to push back his tariff deadline again, after delaying it from April to July, and then to August 1.

“It’s going to be a series of TACO tariffs,” Rogowsky said, referring to the acronym for “Trump Always Chickens Out”, a phrase coined by Financial Times columnist Robert Armstrong in early May to describe the US president’s backpedalling on tariffs in the face of stock market turmoil.

“He will bump them again,” Rogowsky said. “He’s just exerting the image of power.”

Trump’s back-and-forth policy moves have characterised his dealings with some of the US’s biggest trade partners, including China and the EU.

China’s tariff rate has gone from 20 percent to 54 percent, to 104 percent, to 145 percent, and then 30 percent, while the deadline for implementation has shifted repeatedly.

The proposed tariff rates for the EU have followed a similar pattern, going from 20 percent to 50 percent to 30 percent, and then 15 percent following the latest trade deal.

The EU’s current tariff rate only applies to 70 percent of goods, with a zero rate applying to a limited range of exports, including semiconductor equipment and some chemicals.

European steel exports will continue to be taxed at 50 percent, and Trump has indicated that new tariffs could be on the way for pharmaceutical products.

Despite the trade deals, many details of how Trump’s tariffs will work in practice remain unclear.

Whether Trump announces more changes down the track, analysts agree that the world has entered a new phase in which countries are seeking to become less reliant on the US.

“Now that the initial shock and anger [at Trump policies] has subsided, there is a quiet determination to build resilience and become less reliant on the US,” Nadjibulla said, adding that Trump was pushing countries to address longstanding issues that had been untouchable before.

Canada, for instance, is tackling inter-provincial trade barriers, a politically sensitive issue historically, even as it looks elsewhere to increase exports, said Tony Stillo, director of Canada Economics at Oxford Economics.

“It would be foolhardy not to provide to the US, seeing as it’s our largest market, but it also makes us more resilient to provide to other markets as well,” Stillo told Al Jazeera.

Canadian Prime Minister Mark Carney has reached out to the EU and Mexico and indicated his wish to improve his country’s strained relations with China and India.

This month, Canada expanded its exports of liquified natural gas beyond the US market, with its first shipment of cargoes to Asia.

To mitigate the fallout of Trump’s tariffs, Ottawa has been offering relief to Canadian businesses, including automakers, and has instituted a six-month pause on tariffs on some imports from the US to give firms time to re-adjust their supply chains.

There is also “some relief” in the fact that other countries “don’t seem to be imitating the Trump show [by levying their own tariffs]. They’re witnessing this attempt to strong-arm the rest of the world, but it doesn’t seem to be working,” Mary Lovely, the Anthony M Solomon senior fellow at the Peterson Institute for International Economics (PIIE), told Al Jazeera.

But the world is watching how the tariffs will affect the US economy, as “that will also be instructive to other countries”, Lovely said.

“If we see a slowdown, as we expect, it becomes a cautionary tale for others.”

Although the US stock market is near an all-time high, it is heavily weighted towards the “magnificent seven”, said Lovely, referring to the largest tech companies, and that reflects just one part of the economy.

Trump’s tariffs come on top of other growing challenges for exporters the world over, including China’s subsidy-heavy industrial policy that allows its businesses to undercut its competitors.

“We’ve entered a period of global economic alignment with the reintroduction of industrial policies,” Nadjibulla said, explaining that more and more governments are likely to roll out support for their domestic industries.

“Each country will have to navigate these and find ways to de-risk and reduce overreliance on the US and China.”

Still, countries seeking to support their homegrown industries will have to do so while reckoning with the World Trade Organization and rules-based trade agreements such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, Nadjibulla said.

“It will take some tremendous leadership around the world to corral this wild mustang [Trump] before he breaks up the world order,” Rogowsky said.

“But it will break because I do think Donald Trump will drive us into a recession.”

United States President Donald Trump arrived at the Federal Reserve’s headquarters in Washington to tour the site of a $2.5bn renovation of two historical buildings, which the White House criticises as overly costly and ostentatious, as tensions escalate between the administration and the independent overseer of the nation’s monetary policy.

Thursday’s rare presidential visit to the Fed is happening less than a week before the central bank’s 19 policymakers gather for a two-day rate-setting meeting, where they are widely expected to leave the US central bank’s benchmark interest rate in the 4.25-4.50 percent range.

Trump has repeatedly demanded that the Fed lower rates by 3 percentage points and has frequently raised the possibility of firing Fed Chairman Jerome Powell, though the president has said he does not intend to do so.

On Tuesday, Trump called the Fed chief a “numbskull”.

On Thursday, Trump publicly scorned Powell for the cost of an extensive building renovation as the two officials began a tour of the unfinished project.

Trump said the project cost $3.1bn, much higher than the Fed’s $2.5bn figure, while Powell, standing next to him, silently shook his head.

“This came from us?” Powell said, before he figured out that Trump was including the renovation of the Martin Building, which was finished five years ago.

“Do you expect any more additional cost overruns?” Trump asked.

“Don’t expect them,” Powell said.

Trump said in his career as a real estate developer, he would fire someone for cost overruns. The president joked that he would back off Powell if he lowered interest rates.

“I’d love him to lower interest rates,” Trump said, as Powell stood by, his face expressionless.

Powell typically spends the Thursday afternoon before a rate-setting meeting doing back-to-back calls with Fed bank presidents as part of his preparations for the session.

Elevated by Trump to the top Fed job in 2018, and then reappointed by former President Joe Biden four years later, Powell last met with Trump in March when the Republican president summoned him to the White House to press him to lower rates.

The visit takes place as Trump battles to deflect attention from a political crisis over his administration’s refusal to release files related to convicted sex offender Jeffrey Epstein, reversing a campaign promise. Epstein died in 2019.

White House officials have ramped up Trump’s pressure campaign on Powell in recent weeks, accusing the Fed of mismanaging the renovation and suggesting poor oversight and potential fraud.

White House budget director Russell Vought has pegged the cost overrun at “$700m and counting”, and Treasury Secretary Scott Bessent called for an extensive review of the Fed’s non-monetary policy operations, citing operating losses at the central bank as a reason to question its spending on the renovation.