Image source: The Motley Fool.

Date

Friday, Oct. 17, 2025, at 8 a.m. ET

Call participants

- President & Chief Executive Officer — Mikael Bratt

- Chief Financial Officer — Fredrik Westin

- Vice President, Investor Relations — Anders Trapp

Need a quote from a Motley Fool analyst? Email [email protected]

Risks

- Regional Production Mix — Adjusted operating margin was negatively impacted by a 20 basis point dilution in Q3 2025, due to not-yet-recovered tariffs and the partial recovery of tariff compensations.

- Engineering Income Decline — “We expect higher depreciation costs due to new manufacturing capacity to meet demand in the key regions, and that the temporary decline in engineering income will persist, driven by the timing of specific customer development projects,” said CEO Mikael Bratt.

- European OEM Production Stoppages — “We continue to see downside risks for Europe’s light vehicle production, driven by announced production stoppage at several key customers,” explained Bratt.

Takeaways

- Net Sales — $2.7 billion, up 6% year-over-year, with organic sales growth of 4% excluding currency effects and including tariff compensation.

- Adjusted Operating Income — $271 million, up 14% year-over-year, with a 10.0% adjusted operating margin, 70 basis points above last year.

- Gross Margin — 19.3%, an increase of 130 basis points year-over-year, primarily driven by improved direct labor efficiency, headcount reductions, and supplier compensation.

- Operating Cash Flow — $258 million in operating cash flow, representing a 46% increase, supported by higher net income and a net $53 million negative impact from working capital.

- Free Operating Cash Flow — $153 million in Q3 2025 compared to $32 million in Q3 2024, due to higher operating cash flow and a $40 million reduction in net capital expenditures.

- Adjusted EPS — Diluted adjusted earnings per share increased 26% or $0.48, mainly from $0.29 higher operating income, $0.09 taxes, and $0.08 lower share count.

- Shareholder Returns — Dividend raised to $0.85 per share; $100 million in share repurchases completed, with 0.8 million shares retired.

- China Performance — Sales to Chinese domestic OEMs grew by nearly 23%, outpacing their light vehicle production growth by 8%.

- India Performance — India contributed one-third of global organic growth, now representing 5% of total sales, with content per vehicle rising from $120 in 2024 to $140 in 2025.

- Tariff Compensation — 75% of tariff costs recovered; remainder expected to be compensated by year-end.

- Capital Expenditures — CapEx net was 3.9% of sales, down from 5.7% in Q3 2024, with company guidance now at 4.5% for the full year 2025.

- Leverage Ratio — Net leverage at 1.3 times, maintained below the 1.5 times target.

- Strategic Initiatives — New second R&D center in China, partnership with CATARC, and a joint venture with HSAE to produce advanced safety electronics announced.

- Outlook and Guidance — Organic sales projected to increase by ~3% and adjusted operating margin expected at 10%-10.5% for full-year 2025; operating cash flow guidance of ~$1.2 billion; tax rate forecasted at ~28%.

Summary

Autoliv (ALV -2.72%) delivered record net sales and adjusted operating income in Q3 2025, reflecting successful execution of efficiency initiatives. Management confirmed transactions to deepen presence in China and cited the joint venture with HSAE as an entry into advanced automotive safety electronics. Working capital increased by $197 million in Q3 2025 compared to Q3 2024, mainly due to higher accounts receivable from strong sales and delayed tariff reimbursements, which management described as temporary effects. The company achieved a 94% coil-off accuracy rate in Q3 2025, highlighting this improvement as a significant contributor to its operational targets. Light vehicle production outperformed the market, driven by strong organic momentum in India and among Chinese OEMs, although negative regional and customer mixes offset some gains in Q3 2025.

- Chief Financial Officer Fredrik Westin said, “The $50 million there is a one-time, and it is compensation from a supplier for historical costs that we had versus our customers there. It is one time in the quarter here, for previous costs that we have had.”

- Management noted, “we expect to be in the middle of the range” for full-year 2025 adjusted operating margin guidance, after citing headwinds from lower out-of-period inflation compensation, higher depreciation, and temporary engineering income declines heading into the fourth quarter.

- CEO Mikael Bratt stated, “Expanding in China is key to strengthening Autoliv’s innovation, global competitiveness, and long-term growth,” underlining China as a principal driver of strategy and resource allocation.

- The shift toward normalized capital expenditures follows the completion of large-scale, multi-region footprint investments over recent years, enabling lower capital intensity moving forward.

Industry glossary

- Coil-off Accuracy: Percentage metric tracking adherence of parts inventory depletion to schedule, reflecting production planning effectiveness and supply chain reliability.

- OEM: Original Equipment Manufacturer; refers here to carmakers that buy Autoliv’s safety products for installation in new vehicles.

- ECU: Electronic Control Unit, a core component in automotive electronics, governing safety features like active seatbelts and detection systems.

- RD&E: Research, Development & Engineering expenses, comprising spending on new products, process improvement, and engineering-driven customer projects.

- CapEx: Capital expenditures, defined as spending on property, plant, and equipment.

Full Conference Call Transcript

Operator: Good day, and thank you for standing by. Welcome to the Autoliv, Inc. third quarter 2025 financial results conference call and webcast. (Operator Instructions) Please note that today’s conference is being recorded. I would now like to turn the conference over to your first speaker, Anders Trapp, Vice President of Investor Relations.

Please go ahead.

Anders Trapp: Thank you, Lars. Welcome, everyone, to our third quarter 2025 earnings call. On this call, we have our President and Chief Executive Officer, Mikael Bratt; our Chief Financial Officer, Fredrik Westin; and me Anders Trapp, VP, Investor Relations. During today’s earnings call, we will highlight several key areas, including our record-breaking third quarter sales and earnings, as well as our continued strategic investments to drive long-term success with Chinese OEMs. We also provide an update on market developments and the evolving tariff landscape impacting the automotive industry.

Finally, our robust balance sheet and strong asset returns reinforce our financial resilience and support sustained high levels of shareholder returns. Following the presentation, we will be available to answer your questions. And as usual, the slides are available at autoliv.com.

Turning to the next slide, we have the Safe Harbor Statement, which is an integrated part of this presentation and includes the Q&A that follows. During the presentation, we will reference some non-U.S. GAAP measures. The reconciliations of historical U.S. GAAP and non-U.S. GAAP measures are disclosed in our quarterly earnings release available on autoliv.com and in the 10-Q that will be filed with the SEC or at the end of this presentation. Lastly, I should mention that this call is intended to conclude with a reach CET, so please wait for your questions in person. I now hand it over to our CEO, Mikael Bratt.

Mikael Bratt: Thank you, Anders. Looking on the next slide, I am pleased to share yet another record-breaking quarter, underscoring our strong market position. This success is a testament to the strength of our customer relationships and our commitment to continuous improvement as we navigate the complexities of tariffs and other challenging economic factors. We saw a significant sales growth driven by higher-than-expected light vehicle production across multiple regions, especially in China and North America. Our high growth in India continues, accounting for one-third of our global organic growth. I am pleased to highlight that our sales growth with Chinese OEMs has returned to outperformance, driven by recent product launches and encouraging development.

Looking ahead, we anticipate to significantly outperform light vehicle production in China during the fourth quarter. We improved our operating profit and operating margin compared to a year ago. This strong performance was primarily driven by well-executed activities to improve efficiency, higher sales, and a supplier compensation for an earlier recall. We successfully recovered approximately 75% of the tariff costs incurred during the third quarter and expect to recover most of the remaining portions of existing tariffs later this year. The combination of not-yet-recovered tariffs and the dilutive effects of the recovered portion resulted in a negative impact of approximately 20 basis points on our operating margin in the quarter.

We also achieved record earnings per share for the third quarter. Over the past five years, we have more than tripled our earnings per share, mainly driven by strong net profit growth but also supported by a reduced share count. Our cash flow remained robust despite higher receivables driven by higher sales and tariff compensations later in the quarter. Our solid performance, combined with a healthy debt level ratio, supports continuous strong shareholder returns. We remain committed to our ambition of achieving $300 to $500 million annual in stock repurchases, as outlined during our Capital Markets Day in June.

Additionally, we have increased our quarter dividend to $0.85 per share, reflecting our confidence in our continued financial strength and long-term value creation. Expanding in China is key to strengthening Autoliv’s innovation, global competitiveness, and long-term growth. To support our growing partnerships with Chinese OEMs, we are investing in a second R&D center in China. In October, we announced a new important collaboration in China, as illustrated on the next slide. We have signed a strategic agreement with CATARC, the leading research institution setting standards in the Chinese automotive sector. This partnership marks a new chapter in our commitment to shaping the future of automotive safety.

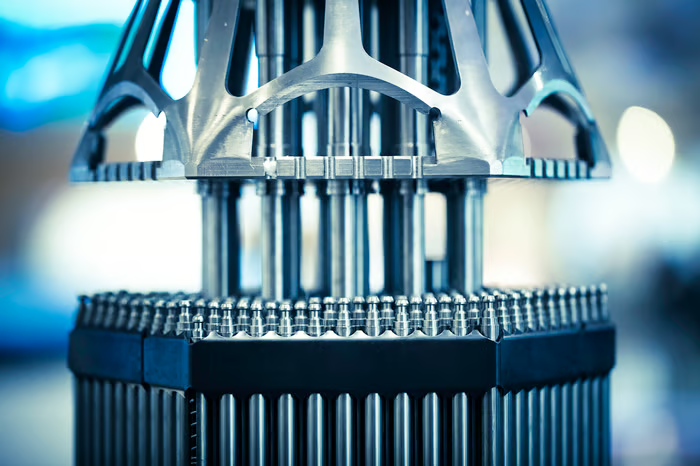

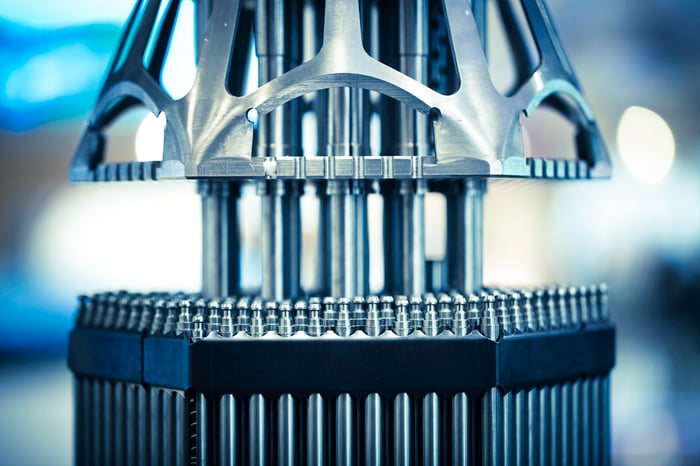

Together with CATARC, we aim to define the next generation of safety standards and enhance the safety on the roads in China and globally. We are also broadening our reach in automotive safety electronics, as shown on the next slide. We recently announced our plans to form a joint venture with HSAE, a leading Chinese automotive electronics developer, to develop and manufacture advanced safety electronics. The joint venture will concentrate on high-growth areas in advanced safety electronics, including ECUs for active seatbelts, hands-on detection systems for steering wheels, and the development and production of steering wheel switches.

Through this new joint venture, we intend to capture more value from steering wheels and active seatbelts while minimizing CapEx and competence expansions, enabling faster market entry with lower technology and execution risks. Looking now on financials in more detail on the next slide. Third quarter sales increased by 6% year-over-year, driven by strong outperformance relative to light vehicle production in Asia and South America, along with favorable currency effects and tariff-related compensations. This growth was partly offset by an unfavorable regional and customer mix. The adjusted operating income for Q3 increased by 14% to $271 million, from $237 million last year. The adjusted operating margin was 10%, 70 basis points better than in the same quarter last year.

Operating cash flow was a solid $258 million, an increase of $81 million, or 46% compared to last year. Looking now on the next slide, we continue to deliver broad-based improvements, with particularly strong progress in direct costs and SG&A expenses. Our positive direct labor productivity trend continues as we reduced our direct production personnel by 1,900 year-over-year. This is supported by the implementation of our strategic initiatives, including automation and digitalization. Our gross margin was 19.3%, an increase of 130 basis points year-over-year. The improvement was mainly the result of direct labor efficiency, headcount reductions, and compensation from a supplier.

Our G&E net costs rose both sequentially and year-over-year, primarily due to lower engineering income due to timing of specific customer development projects. Thanks to our cost-saving initiatives, SG&A expenses decreased from the first half-year level. Combined with the increased gross margin, this led to 70 basis points improvement in adjusted operating margin. Looking now on the market developments in the third quarter on the next slide. According to S&P Global data from October, global light vehicle production for the third quarter increased 4.6%, exceeding the expectations from the beginning of the quarter by 4 percentage points. Supported by the scrapping and replacement subsidy policy, we continue to see strong growth for domestic OEMs in China.

Light vehicle demand and production in North America have proven significantly more resilient than previously anticipated. In contrast, light vehicle production in other high-content-per-vehicle markets, namely Western Europe and Japan, declined by approximately 2% to 3%, respectively. The global regional light vehicle production mix was approximately 1 percentage point unfavorable during the quarter, despite the important North American market showing a positive trend. In the quarter, we did see coil-off volatility continue to improve year-over-year and sequentially from the first half-year. The industry may experience increased volatility in the fourth quarter, stemming from a recent fire incident at an aluminum production plant in North America and production adjustments by a key European customer in response to shifting demand.

We will talk about the market development more in detail later in the presentation. Looking now on sales growth in more detail on the next slide. Our consolidated net sales were over $2.7 billion, the highest for the third quarter so far. This was around $150 million higher than last year, driven by price volume, positive currency translation effects, and $14 million from tariff-related compensations. Excluding currencies, our organic sales growth by 4%, including tariff costs and compensations. China accounted for 90% of our group sales. Asia, excluding China, accounted for 20%. Americas for 33%, and Europe for around 28%. We outline our organic sales growth compared to light vehicle production on the next slide.

Our quarterly sales were robust and exceeded our expectations, driven by strong performance across most regions, particularly in the Americas, West Asia, and China. Based on light vehicle production data from October, we underperformed light vehicle production by 0.7% globally, as a result of a negative regional mix of 1.3%. We underperformed slightly in Europe, primarily due to an unfavorable model and customer mix. In the rest of Asia, we outperformed the market with 8%, driven primarily by strong sales growth in India and, to a lesser extent, in South Korea.

While the organic light vehicle production mix shifts continued to impact our overall performance in China, our sales to domestic OEMs grew by almost 23%, 8% more than their light vehicle production growth. Our sales development with the global customers in China was 5% lower than their light vehicle production development, as our sales declined to some key customers, such as Volkswagen, Toyota, and Mercedes. On the next slide, we show some key model launches. The third quarter of 2025 went through a high number of new launches, primarily in Asia, including China. Although some of these new launches in China remained undisclosed here due to confidentiality, the new launches reflect a strong momentum for Autoliv in these important markets.

The models displayed here feature Autoliv content per vehicle from $150 to close to $400. We’re also pleased to have launched airbags and seatbelts on another small Japanese vehicle, A-Cars. This is a meaningful forward step because Autoliv has historically had limited exposure to this segment in Japan. In terms of Autoliv’s sales potential, the Onvo L90 is the most significant. Higher content per vehicle is driven by front center airbags on five of these vehicles. Now looking at the next slide, I will now hand it over to Fredrik Westin.

Fredrik Westin: Thank you, Mikael. I will talk about the financials more in detail now on the slides, so turn to the next slide. This slide highlights our key figures for the third quarter of 2025 compared to the third quarter of 2024. The net sales were approximately $2.7 billion, representing a 6% increase. The gross profit increased by $63 million, and the gross margin increased by 130 basis points. The drivers behind the gross profit improvement were mainly lower material costs, positive effects from the higher sales, and improved operational efficiency. This was partly offset by negative effects from recalls and warranty, depreciation, and unrecovered tariff costs.

The adjusted operating income increased from $237 million to $271 million, and the adjusted operating margin increased by 70 basis points to 10.0%. The reported operating income of $267 million was $4 million lower than the adjusted operating income.

Adjusted earnings per share diluted increased 26% or by $0.48, where the main drivers were $0.29 from higher operating income, $0.09 from taxes, and $0.08 from a lower number of shares. This marks our ninth consecutive quarter of growth in adjusted earnings per share, underscoring the strength of our ongoing operational improvements and further bolstered by a reduced share count from our share buyback program. Our adjusted return on capital employed was a solid 25.5%, and our adjusted return on equity was 28.3%. We paid a dividend of $0.85 per share in the quarter, and we repurchased shares for $100 million and retired 0.8 million shares. Looking now on the adjusted operating income bridge on the next slide.

In the third quarter of 2025, our adjusted operating income increased by $34 million.

Operations contributed with $43 million, mainly from high organic sales and from the execution of operational improvement plans supported by better coil-off volatility. The out-of-period cost compensation was $8 million lower than last year. Costs for RD&E net and SG&A increased by $30 million, mainly due to lower engineering income. The net currency effect was $6 million positive, mainly from translation effects. Last year’s supplier settlement and this year’s supplier compensation combined had a $29 million positive impact. The combination of unrecovered tariffs and the dilutive effect of the recovered portion resulted in a negative impact of approximately 20 basis points on our operating margin in the quarter. Looking now at the cash flow on the next slide.

The operating cash flow for the third quarter of 2025 totaled $258 million, an increase of $81 million compared to the same period last year, mainly as a result of higher net income, partly offset by $53 million negative working capital effects. The negative working capital was primarily driven by higher receivables, reflecting strong sales and delayed tariff compensations toward the end of the quarter. Capital expenditures net decreased by $40 million. Capital expenditures net in relation to sales was 3.9% versus 5.7% a year earlier. The lower level of capital expenditures net is mainly related to lower footprint CapEx in Europe and Americas and less capacity expansion in Asia.

The free operating cash flow was $153 million compared to $32 million in the same period the prior year from higher operating cash flow and the lower CapEx net.

The cash conversion in the quarter, defined as free operating cash flow in relation to the net income, was around 87%, in line with our target of at least 80%. Now looking at our trade working capital development on the next slide. The trade working capital increased by $197 million compared to the prior year, where the main drivers were $165 million in higher accounts receivables, $8 million in higher accounts payables, and $40 million in higher inventories. The increase in trade working capital is mainly due to increased sales and temporarily higher inventories. In relation to sales, the trade working capital increased from 12.8% to 13.9%.

We view the increase in trade working capital as temporary, as our multi-year improvement program continues to deliver results. Additionally, enhanced customer coil-off accuracy should enable a more efficient inventory management. Now looking at our debt leverage ratio development on the next slide.

Autoliv’s balanced leverage strategy reflects our prudent financial management, enabling resilience, innovation, and sustained stakeholder value over time. The leverage ratio remains low at 1.3 times, below our target limit of 1.5 times, and has remained stable compared to both the end of the second quarter and the same period last year. This comes despite returning $530 million to shareholders over the past 12 months. Our net debt increased by $20 million, and the 12 months trailing adjusted EBITDA was $41 million higher in the quarter. With that, I hand it back to you, Mikael.

Mikael Bratt: Thank you, Fredrik. On to the next slide. The outlook for the global auto industry has improved, particularly for North America and China.

While the industry continues to navigate the trade volatility and other regional dynamics, S&P now forecasts global light vehicle production to grow by 2% in 2025, following growth of over 4% in the first nine months of the year. Their outlook for the fourth quarter has significantly improved. Nevertheless, they still anticipate a decline in light vehicle production of approximately 2.7% in the quarter. In North America, the outlook for light vehicle production has been significantly upgraded, driven by resilient demand and low new vehicle inventories. However, a recent fire incident at an aluminum production plant in North America may impact our customers.

For Europe, S&P forecasts a 1.8% decline in light vehicle production for the fourth quarter, despite some easing of U.S. import tariffs. We continue to see downside risks for Europe’s light vehicle production, driven by announced production stoppage at several key customers.

In China, light vehicle production is expected to decline by 5%, primarily due to an exceptionally strong Q4 in 2024. Nevertheless, S&P anticipates sustained growth in Chinese LVP over the medium term, supported by favorable government policies for new energy vehicles, more relaxed auto loan regulations, and increasing export volumes. The outlook for Japan’s light vehicle production has improved, as car makers are increasingly shifting exports to markets outside the U.S., aiming to mitigate reduced export volumes to the U.S. In South Korea, domestic demand has been steadily recovering, while exports have also risen, driven by increased shipments to other regions, compensating for the decline in exports to the U.S. Now looking on our way forward on the next slide.

We expect the fourth quarter of 2025 to be challenging for the automotive industry, with lower light vehicle production and geopolitical challenges.

However, our continued focus on efficiency should help offset some of these headwinds. Consistent with typical seasonal patterns, the fourth quarter is expected to be the strongest of the year. Despite the expected decline in global light vehicle production year-over-year, we foresee higher sales and continued outperformance, particularly in China. Unfortunately, we are also facing some year-over-year headwinds. Unlike the past three years, we do not expect out-of-period inflation compensation in the fourth quarter, given the shift in the inflationary environment. We expect higher depreciation costs due to new manufacturing capacity to meet demand in the key regions, and that the temporary decline in engineering income will persist, driven by the timing of specific customer development projects.

These factors combine in the reason for why we currently expect the full-year adjusted operating margin to come in at the midpoint of the guided range.

However, our solid cash conversion and balance sheet provide fast expansions and a robust foundation for maintaining high shareholder returns. Turning to the next slide. This slide shows our full-year 2025 guidance, which excludes effects from capacity alignment and antitrust-related matters. It is based on no material changes to tariffs or trade restrictions that are in effect as part of 2025, as well as no significant changes in the macroeconomic environment or changes in customer coil-off volatility or significant supply chain disruptions. Our organic sales are expected to increase by around 3%. The guidance for adjusted operating margin is around 10% to 10.5%.

With only one quarter remaining of the year, we expect to be in the middle of the range. Operating cash flow is expected to be around $1.2 billion. We now expect CapEx to be around 4.5% of sales, revised from the previous guidance of around 5%.

Our positive cash flow and strong balance sheet support our continued commitment to a high level of shareholder return. Our full-year guidance is based on a global light vehicle production growth of around 1.5% and a tax rate of around 28%. The net currency translation effect on sales will be around 1% positive. Looking on the next slide. This concludes our formal comments for today’s earnings call, and we would like to open the line for questions from analysts and investors. I now hand it back to Ras.

Operator: Thank you, Sir. As a reminder to ask a question, please press star 1 and 1 on your telephone and wait for your name to be announced. To withdraw your question, please press star 1 and 1 again. Once again, please press star 1 and 1 and wait for your name to be announced. To withdraw your question, please press star 1 and 1 again. We are now going to proceed with our first question. The questions come from the line of Colin Langan from Wells Fargo Securities. Please ask your question.

Colin Langan: Oh, great. Thanks for taking my questions. You raised your light vehicle production forecast, you know, from down a half to up 1.5%, but organic sales didn’t change. Why aren’t you seeing any benefit from the stronger production environment on your organic?

Fredrik Westin: Yeah. Thanks for your question. There are a couple of components here. I mean, the first one is that some of these adjustments that we also now take into account are for past quarters. Some of the volumes have been raised also in the first half, whereas we had already recorded our sales for that. That doesn’t, yeah. We had a different outdoor underperformance in the first half of the year. That’s one part of the explanation. We also see a larger negative mix now after nine months and also expect that for the full year.

That is close to 2 percentage points, this negative market mix, which is also one of the reasons, and that’s, say, even less unfavorable now than we saw a quarter ago. Those are some explanations.

On top of that, we see that some of the launches in China have been a bit delayed, and that they are not coming through fully in line with our expectations that we had here about a quarter ago. Those are the main reasons why you don’t see that LVP estimate increase come through on our organic sales guidance.

Colin Langan: Got it. The margin in the quarter was very strong. I thought Q3 is typically one of your weaker margins. Anything unusual in the quarter? I noticed you flagged supplier settlements. I kind of get the non-repeat of bad news last year. Is the $15 million of supplier compensation additional good news? Is that one-time in nature? How should we think of that? Anything else that’s maybe possibly one-time in nature in the quarter that drove the strong margin?

Fredrik Westin: Yeah. The $50 million there is a one-time, and it is compensation from a supplier for historical costs that we had versus our customers there. It is one time in the quarter here, for previous costs that we have had. I would say here also that, I think what you saw in the quarter here was that we had slightly higher sales than expected. That was an important component, of course. I think most importantly here is that we continue to see a very strong delivery of the internal improvement work that we are so focused on and that we have been focused on for a while, leading to our targets here.

Good work done by the whole Autoliv team here across the whole value chain.

Colin Langan: Got it. All right. Thanks for taking my questions.

Operator: Thank you. We are now going to proceed with our next question. The questions come from the line of Björn Inoson from Danske Bank. Please ask your question.

Björn Inoson: Hi. Thanks for taking my question. On your implied guidance for Q4 and also on your a little bit cautious comments on Q4, it looks like there are a little bit of temporary negative effects that you are talking about. Should we extrapolate the Q4 trends looking into 2026? Are you quite happy with the productivity work and also that coil-offs look again a little bit better? Should we have as a base assumption that you should progress again towards the midterm target of 12%? How should we look upon that? Thank you.

Fredrik Westin: Yeah. I think, first of all, that we feel confident when it comes to our ability to eventually get to our 12% target. No doubt about that. What you see here in the Q3, Q4 movement is nothing if you read into that. I think, as I said before, we see very good progress in terms of the activities that we control ourselves. We see really good traction when it comes to the strategic initiatives that we have outlined some time back. Good progress there. I think when you look at Q4 over Q4, it’s, I would say, more of, first of all, a normalization of the quarters. Q4 is still the strongest quarter in the year.

Of course, in the previous last two, three years, it has been more pronounced since we had this out-of-period compensation that we referred to earlier, which you will not see in the same way now in this quarter in Q4 2025. There is a difference there. I would say also, you have seen a little bit stronger Q3 when it comes to sales. There is a timing effect between Q3 and Q4 compared to when we looked into the second half. There is also a part of the explanation. The bottom line, we feel comfortable with our own progress towards the targets that we have. Maybe just to build on that, just one more detail on the fourth quarter.

We do expect that we will have a slightly lower engineering income also in the fourth quarter, as you saw now in the third quarter.

This is temporary, and it’s very dependent on how the engineering activities are with certain customers. This should then also recover in 2026.

Björn Inoson: Okay. Yeah. I saw that comment. Did you say it’s likely to be recovered in early next year then?

Fredrik Westin: In next year overall, yes.

Björn Inoson: Overall. Okay.

Fredrik Westin: You should see a recovery ratio that is more in line with or a bit higher now than what you see in the second half of this year. That’s, again, very dependent on engineering activities with certain customers and how they reimburse us.

Björn Inoson: Okay. Got it.

Fredrik Westin: Yeah. In some cases, it’s built in the piece price. In some cases, it’s paid like engineering income specifically. Depending on how that mix looks over time, of course, you have some smaller fluctuation. That is really what we refer to here.

Björn Inoson: Okay. Very clear. Thank you.

Operator: Thank you. We are now going to proceed with our next question. The questions come from the line of Gautam Narayan from RBC Capital Markets. Please ask your question.

Gautam Narayan: Hi. Thanks for taking the question. Maybe a follow-up to that last one, the Q4 guidance. You call out three headwinds: the less compensation on inflation, I guess the higher depreciation, and then this engineering income. Just wondering if you could dimensionalize those three in terms of order of magnitude for Q4. I mean, we know the engineering income is temporary. The other two, you know, I guess, depends on certain factors. Just trying to dimensionalize those three in terms of what is temporary and what continues. I have a follow-up.

Fredrik Westin: Yeah. I think the engineering income, you can look at Q3 on a year-by-year basis and how that as a % of sales. That, I think, is a pretty good indication also for how that could be in the fourth quarter. That’s the largest headwind we will have. The next one is the fact that we had this out-of-period compensation from our customers related to inflation compensation last year. That falls away this year. That’s the second largest. The third largest is the depreciation expense increase.

Gautam Narayan: Okay. On the China commentary, we did see that BYD is losing share in China due to some government initiatives and whatnot. I would have thought that alone would maybe benefit you guys more. I know macro in China, the domestics are doing better than the globals. I see that. I understand that. Just wondering if the share loss that BYD is seeing—I know you’re under-indexed to them—is benefiting you guys. Thanks.

Fredrik Westin: Yeah. I mean, in the overall mix, of course, since we are only selling components to them, and you see their portion of the total market, you know, flattening out, of course, it’s supportive in the sense of measuring our outperformance relative to the COEMs, LVP as such. Mathematically, yes, you have that effect there.

Gautam Narayan: Great, thanks a lot. I’ll turn it over.

Operator: Thank you. We are now going to proceed with our next question. Our next questions come from the line of Michael Aspinall from Jefferies. Please ask your question.

Michael Aspinall: Thanks, Sam. Good day, Mikael, Fredrik, and Anders. One first on India. It was one-third of the organic growth. Can you just remind us where we are in the shift in content per vehicle in India, and how large India is in terms of sales now?

Fredrik Westin: Yeah. I think we are. See the strong development in India there. As I said, one-third of the growth in the quarter. It’s today around 5% of our turnover is coming from India. It’s not long ago, it was around 2%. A significant increase of importance there. We have a very strong market share in India, 60%. Of course, we are benefiting well from the volume growth you see there. We are expecting India to continue to grow. We have also invested in our investment footprint there to be able to defend our market share and to capture the growth here.

Content-wise, we expect it to go from, you know, it went from $120 in 2024 to roughly $140 this year. You have both content and light vehicle production growth in India to look forward to.

We expect it to go further up to around $160 to $170 in the next couple of years.

Michael Aspinall: Great. Excellent. Thank you. One more. Just on the JV with Hang Cheng, who were you purchasing these items from before? Were you purchasing from Hang Cheng and now to JV, or have you formed a JV with them and were purchasing from someone else previously?

Fredrik Westin: I mean, they have been an important supplier to us in the past as well. Of course, we have worked with them and established a very good relationship there. I couldn’t say it has been exclusively with them. We have a global supplier base here, but we see great opportunity here to not only produce but also develop components for our future models and programs here as we work together here, both on development and manufacturing.

Michael Aspinall: Okay. They’re moving, I guess, from a supplier, and now you guys are going to be working together?

Fredrik Westin: Yeah, yeah, exactly.

Michael Aspinall: Okay. Great. Thank you.

Fredrik Westin: Thank you.

Operator: Thank you. We are now going to proceed with our next question. The questions come from the line of Vijay Rakesh from Mizuho. Please ask your question.

Vijay Rakesh: Yeah. Hi, Mikael. Just quickly on the China side, I know you mentioned subsidies. When you look at the NEV and the scrapping subsidy, I believe it is down like 50% this year. Do you expect that to be extended to 2026, or is there going to be another step down? Then follow up.

Mikael Bratt: Yeah. I would say we are not speculating in that. I guess it’s anybody’s guess here. I think overall, we definitely look very positively on China. As we have mentioned here before, we are growing our share with the Chinese OEMs here and had good developments in the quarter here. We are also investing in China as well here. As I mentioned in the presentation here earlier, I mean, we are investing in a second R&D center in Wuhan to make sure that we also continue to work closer with the broader base of customers there, so adding capacity. We talked about JV just now here. The partnership with CATARC here is an important step here.

All in all, looking positively on China going forward here for sure. Subsidies or not, we will see, but overall, it’s pointing in the right direction here.

Vijay Rakesh: Got it. As you look at the European market, a lot of talk about price competition and imports coming in from Asia and tariffs, etc. How do you see the European auto market play out for 2026? Thanks.

Mikael Bratt: Yeah. I think we wait to comment on ’26 for the next quarterly earnings here when it’s time for it. As we have said here for the remainder of the year, we are cautious about the European market more from a demand point of view than anything else. I think that’s really the main question mark around the market than anything else in terms of OEM reshuffling or anything like that. I mean, it’s really the end consumer question here.

Vijay Rakesh: Got it.

Mikael Bratt: When it comes to Europe.

Vijay Rakesh: Yeah.

Operator: Thank you. We are now going to proceed with our next question. The questions come from the line of Emmanuel Rosner from Wolfe Research. Please ask your question.

Emmanuel Rosner: Oh, great. Thank you so much. My first question is actually a follow-up. I think on Colin’s question around the organic growth outlook, which is unchanged despite the better LVP. I’m not sure that I understood all the factors, but if we wanted to frame it as like growth above market, initially, you were going to grow 3% despite a shrinking market. Now you’re growing 3% in a market that would be growing 1.5%. Can you maybe just go back over the factors that are driving this different expectations for outperformance?

Fredrik Westin: Yeah. In that sense, the largest change over the capital quarters here since we started the year is the negative market mix. As I said, we now see a negative market mix for the full year of around 2%. That has deteriorated over the course of the year. That’s the largest part. We have also seen here in the third quarter the negatives in customer mix for us, mostly in North America and Europe. That’s also a deviation to what we expected going into the year. The last one that I already mentioned before is that we see some delays on the new launches, in particular in China.

They’re not coming through at the same pace that we had expected originally.

Emmanuel Rosner: Understood. Thank you. If I go back to your framework and your midterm margin targets, can you just maybe remind us the drivers that will get you from the 10 to 10.5% this year to towards the 12%? Where are we tracking on some of those? I did notice that you mentioned improved coil-off accuracy, both sequentially and year-over-year. Is that something that you expect to continue in and that will be helpful for that?

Fredrik Westin: Yeah. I mean, the framework has not changed as you would probably expect. It’s still, if we take 2024 as the base point with 9.7% adjusted operating margin, we still expect 80 basis points improvement from the indirect headcount reduction. In the reported numbers here now, you don’t see a movement in that, but we had about 260 employees from a labor law change in Tunisia that we now have to account for headcount. That distorts that number. If you adjust for that, we would also have shown further progress on the indirect headcount reduction. That is well on track. We said 60 basis points from normalization of coil-offs. That is developing well.

We saw 94% coil-off accuracy here and also in the third quarter, which is an improvement on a year-over-year basis.

We also talked about that we have decreased our direct headcount by 1,900 people despite that organic growth was at 4% on a year-over-year basis. That’s tracking very well. The remaining 90 basis points would be from growth component, where we are maybe a little bit behind now this year as we laid, or as you talked about before, and from automation digitalization. There again, you can see, I think, on the gross margin, even if you exclude the settlement here with a supplier, you can also see there that we are progressing well on that component.

Emmanuel Rosner: Thank you.

Operator: Thank you. We are now going to proceed with our next question. The questions come from the line of Jairam Nathan from Daiwa Capital Markets America. Please ask your question.

Jairam Nathan: Hi. Thanks for taking my question. I just wanted to kind of go back to the announcement out of China. I just wanted to understand better the timing. It seems it kind of coincided with also the announcement of Adient, the zero-gravity product. Just one, is this timing related to some new business win or more opportunities there?

Fredrik Westin: You’re talking about JV or?

Jairam Nathan: The JV, the CATARC partnership, as well as the kind of announced you kind of finalized the Adient zero-gravity product. Yeah.

Fredrik Westin: I was going to say they’re not connected at all as such. The JV here is really to vertically integrate in an effective way together with a partner to gain a broader product offering here to say that we offer also, yeah, more to our end customer, basically. CATARC is, of course, a development collaboration to make safer vehicles, safer roads for everyone. It’s including light vehicles, commercial vehicles, and vulnerable road users, meaning two-wheelers, etc. It is a broad-based research collaboration there. The Adient, of course, is connected to the zero-gravity. I mean, yeah, to some extent, of course, they are all about safety products as such, but they are not connected in any way.

Jairam Nathan: Okay. Thanks. Just to follow up, I wanted to understand the lower CapEx. Is that something that can be maintained as a % of sales into the future?

Fredrik Westin: Yeah. I think, I mean, we have been talking about this in the past also that our ambition is to bring down the CapEx levels in relation to sales compared to where we have been. We have been through a cycle here where we have invested a lot in our facilities around the world, Europe, where we have consolidated and upgraded a number of plants, India investments we talked about before, expanding capacity in China. We also upgraded in Japan, etc. In the last couple of years, we have invested heavily in upgrading our industrial footprint. We are coming out now into a more normalized phase here. That is why we can bring it down here.

We are not expecting to see CapEx jump up back in the near term here.

Jairam Nathan: Okay, thank you. That’s fine.

Operator: Thank you. We are now going to proceed with our next question. The questions come from the line of Hampus Engellau from Handelsbanken. Please ask your question.

Hampus Engellau: Thank you very much. A quick question from my side. Maybe a bit of a nitty-gritty question, but if I remember correctly, you covered about 80% of the tariff cost in the second quarter, and the remaining 20% came in Q3. Now you’re moving around 20% for Q3 you will get in Q4. Is the net effect like 100% compensation if you account for the things that came from second quarter to Q3, or are you still a net negative there on the margin?

Fredrik Westin: Yeah, please go ahead. … Oh, please go ahead. … Okay. Yeah. Sorry. Let’s take this first, so we’re done with that one. We are still net negative here. As we said, we have received some of the outstanding $20 million in the second quarter in Q3, but most of it remains still. In the third quarter here, we got $75 million. We have accumulated more outstandings from Q2 to Q3. As we have indicated here, we still expect to get full compensation and catch up on this in the fourth quarter close. I think we are fully compensated. That’s our expectations here. Of course, the work is ongoing here as we speak with that, but that’s the net result right now.

Hampus Engellau: Fair enough. The last question was more related to from what you see today in terms of launches for 2026, and you maybe compare that to 2025 if you could share some light on that.

Fredrik Westin: I have no figure yet for 2026 to share with you here, but I think in general terms, I mean, we have a good order intake here to support our overall market position here. We see, however, some mixed, especially on the EV side, planned programs or launches being delayed or canceled here. There are some reshuffling there. What kind of impact that will have in 2026 compared to 2025, we are not ready to communicate that yet. As I said, we have good order intake here to support our market position.

Hampus Engellau: Thank you very much.

Operator: Thank you. We are now going to proceed with our next question. The questions come from the line of Edison Yu from Deutsche Bank. Please ask your question.

Edison Yu: Hi. This is Winnie on for Edison. Thanks for taking the call. My first question is on the supplier contract news that came out of GM, indicating maybe like a more less favorable contract terms for suppliers on a go-forward basis. I’m just curious if this is something that’s more isolated and more depends on like the OEM, or do you see like heading into 2026 maybe a broader trend that can pose potentially as a headwind heading into next year? I have a follow-up.

Fredrik Westin: No, I don’t want to comment specific customer contracts or conditions here. Of course, it’s a constantly ongoing development here in terms of what the OEMs want to put into their contract. I would say that I see a good ability to manage those clauses and contracts that are put in front of us here. I must say I don’t feel any major concerns around a more difficult situation. I think we are quite successful in negotiating and settling contracts with our customers here. Nothing exceptional there from our point of view, I would say.

Edison Yu: Got it. Thank you. On the Ford supplier impact, you did mention some potential impacts into Ford Q. I was just curious if you can help us delineate that. Is that something to be concerned about, or is it more of a negligible impact for you guys?

Fredrik Westin: Yeah. I think, I mean, every car that is not produced is not a good thing, of course, especially for the customer in question here. You have seen the announcements made by the OEMs here. Just as a reference, the Ford 150 is around 1% of our global sales. It’s not good, but it’s manageable, I would say, from our point of view. Just as a reference.

Edison Yu: Thank you so much.

Operator: Thank you. We are now going to proceed with our next question. The questions come from the line of Dan Levy from Barclays Bank. Please ask your question.

Dan Levy: Hi. Great. Thank you for taking the question. I just wanted to follow up on that prior question. You know, the headlines on Xperia yesterday causing some potential supply issues. Just how much of that of a potential risk have you seen or heard on that in the fourth quarter for European production?

Fredrik Westin: For the European production, no, I think it’s too early to comment on that. I mean, it’s just a few days, hours, or almost into the situation here. I think, first of all, we have a very good supply chain team that are on alert here and are managing through the situation here. We have been here before with supply chain constraints. I would say the last couple of years, there’s been many topics here. The team is well prepared to maneuver through this. We’ll see and come back on that. I would say it’s too early to be too granular or too detailed around that. As I said, it’s early days here.

We don’t see too much yet from the customers.

Dan Levy: Thank you. Just as a follow-up, I wanted to double-click on the China performance. You did very well outperformance with the domestic OEMs. In spite of that, the total China performance was negative 3 points, even though the domestics are the clear majority. I think we were all a bit surprised. I know you sort of unpacked this a bit before in one of the prior questions. Can you maybe just explain the dynamics of why, even though you outperformed the domestics, the overall China performance was negative? What can you explain what flips going forward that is leading you to say that your China growth going forward should outperform?

Fredrik Westin: Yeah. I mean, we still, for us, as we said before here, we believe that we will see improvements here in the quarter to come. I think it is a really important milestone here, what we reported on the COEM outperformance, which was really strong here in the quarter. Still, the global OEMs is a bigger majority of our total sales, and some of our customers here that are significant had a negative mix impact on us this quarter, unfortunately. That was on the negative side here. We don’t see this as a major trend shift here. It’s a mixed effect that we see from quarter to quarter here.

I think the important takeaway here is that we see this strong growth development with the Chinese OEMs that is also growing their share of the total market.

Fredrik Westin: That sets us up for, I would say, good development in China over time.

Dan Levy: Okay. Thank you.

Operator: Given the time constraint, this concludes the question and answer session. I will now hand back to Mr. Mikael Bratt for closing remarks.

Mikael Bratt: Thank you very much, Ras. Before we conclude today’s call, I want to reaffirm our commitment to meeting our financial targets. We remain focused on cost efficiency, innovation, quality, sustainability, and mitigating tariffs. With ongoing market headwinds, we anticipate strong fourth quarter performance. Our fourth quarter call is scheduled for Friday, January 30, 2026. Thank you for your attention. Until next time, stay safe.

Operator: This concludes today’s conference call. Thank you all for participating. You may now disconnect your lines. Thank you.