A Third Venezuelan Oil Nationalization? Not if the Citizen is the Owner

Recently, the United States reached a new historic milestone: it produced over 13.6 million barrels per day, a staggering feat for a country that many thought had peaked in 2008 when production bottomed out at 5 million bpd. This staggering increase was not achieved by a state giant, but by an ecosystem of thousands of independent operators driven by market-based incentives that, in Venezuela, might seem from another planet.

Meanwhile, Venezuela has traveled the opposite path: from a proud peak of 3.7 million bpd in 1970, it has collapsed to a stagnant output below 1 million bpd.

In Texas, the landowner owns the oil; in Venezuela, it is the State—which claims, all the while, to represent us all.

The hundred-year war

Since the Los Barrosos II blowout in December 1922, our oil history has been defined by a relentless tug-of-war between private capital and the State over the capture of oil rent. This conflict is not unique to Venezuela, but as we enter this “third opening,” the question is unavoidable: how do we prevent a third nationalization?

Having done it twice before (1976 and 2006), Venezuela has established a precedent that alters risk assessment across all investment horizons. How can we guarantee investors that history won’t repeat itself? While often sold as a patriotic triumph, nationalization is a terminal breach of contract and a direct assault on property rights, deterring the very capital profiles that otherwise would be participating. International arbitration, legal reforms, and institutional frameworks are necessary, but they are not sufficient.

Government take and the global race

To put things in perspective: before the 2026 reform, the Venezuelan fiscal system was among the least competitive on the planet. Between royalties on gross income, income tax (ISLR), and “windfall profit” taxes, the State extracted a “Government Take” that often exceeded 80%, with marginal tax rates reaching up to 95% depending on price thresholds. In a scenario where the operator’s net margin was squeezed to a minimum, production became a game of survival and reinvestment became technically impossible.

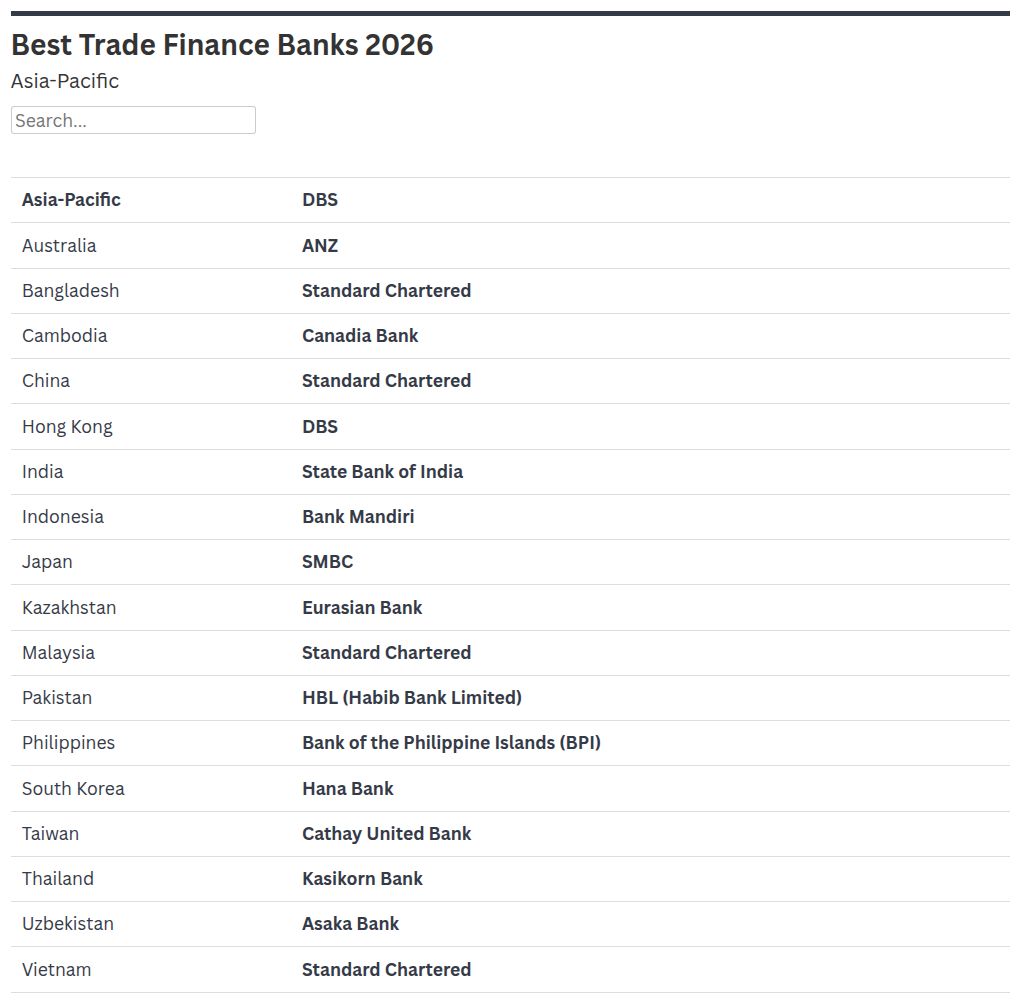

While the January 2026 reform moves in the right direction, we aren’t just competing against our own past; we are competing against the world. Consider the current margins (Operator Share) in the region:

- Canada (Alberta, Heavy Oil): Private 50%-55% | Government 45%-50%

- Texas (Permian Basin): Private 45%-55% | Government 45%-55%

- Colombia (New Reforms): Private 40% | Government 60%

- Brazil (Pre-Salt): Private 39% | Government 61%

- Guyana (2025 Model): Private 25%-35% | Government 65%-75%

- Venezuela (2026 Law): Private 20%-35% | Government 65%-80%

Even with the recent reform, Venezuela is far from being a “bargain” for long-term investment.

The proposal: from State-partner to citizen-owner

To mitigate expropriation risk and attract long-term capital, I propose a model built on four foundational pillars:

- Private Capital-Citizen Partnership: The State is removed from operations. Incentives are aligned directly between citizens—the ultimate owners of the subsoil—and those who risk the capital to extract it.

- Zero Corporate Taxes (Tax Displacement): Eliminate corporate income tax, royalties, and all “shadow” taxes at the source. This slashes the operational break-even to technical average levels of $30 to $40 per barrel, turning “iron cemeteries” into profitable ventures even in low-price environments. This is not a tax holiday, but a redirection of the fiscal take: the operator delivers a major share of the value directly to the citizens, while the State sustains itself by taxing the total income of the citizenry and companies in the rest of the economy.

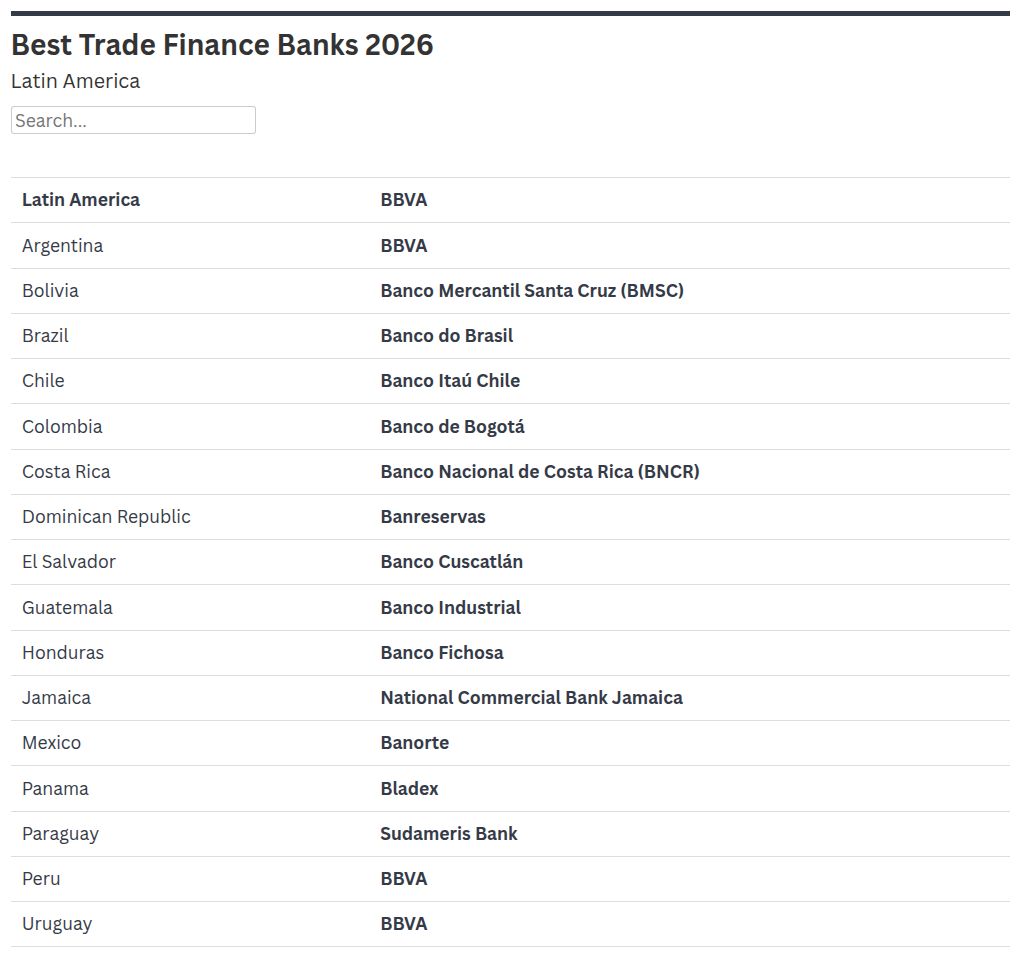

- The Citizen Dividend (Oil-to-Cash): Instead of paying a traditional tax to a discretionary Treasury, the operator delivers 50% of its net profit—effectively a flat tax paid to the owners—directly into a sovereign trust (or similar non-state mechanism) managed by top-tier international banks. While 50% is a significant share, the absence of any other fiscal burden makes this model one of the most competitive in the region. This trust distributes periodical dividends to every Venezuelan citizen, including those abroad. The State then funds its operations by taxing these dividends as part of the citizens’ total income via personal income tax (ISLR) and other tax sources from a diversified economy. This ensures that the government’s budget depends on the collective prosperity of its people, not on political control over the oil.

- The Citizen as “Guardian” and Auditor: This is the ultimate shield. In 1976 and 2006, the State nationalized because it was easy to seize control from a “multinational” and hand it to a bureaucracy. Under this scheme, any government attempting to expropriate would be taking directly from the pockets of 30 million owners. Transparency is embedded: citizens monitor production and distributions through real-time digital platforms, independent audits, and other decentralized oversight mechanisms. The citizen ceases to be a spectator and becomes the industry’s most powerful defender.

Unlike the State, whose lust for oil rent is political and lacks immediate consequences for those in power, the citizen acts with the prudence of an owner—because they become one. Under this model, any attempt to “suffocate” the private partner translates immediately into a drop in personal dividends. Private ownership of the benefit is, in itself, the best guarantee of stability for capital.

Application and reality

Under this model, the direct net profit split for the oil industry would be: Private 50%, Citizens 50%, State 0%.

This “State 0%” applies exclusively to the source to insulate the industry from political rent-seeking. It does not mean a zero-revenue State; the government continues to fund its functions, but through a transparent tax system (ISLR, VAT) derived from a citizen-owned economy.

To illustrate, with oil at $100 and production at 3.5 million bpd, each citizen would have received $1,500 annually ($6,000 for a family of four). At a $60 base price, the dividend would be $640 per person. Today, with production stalled below one million barrels, a citizen would receive a mere $185. It is modest, but it represents the starting point of a virtuous cycle where the State only prospers if its citizens do first.

Herein lies the virtue of the model: the alignment of interests. Under the current system, citizens watch from the sidelines as oil wealth vanishes into the state vortex. With this approach, each Venezuelan has a personal stake: the more their private partner thrives, the more they themselves benefit. Citizens move from passive critics to primary stakeholders in the nation’s industrial growth.

Considerations for a new Venezuela

Under other circumstances, I might not be a proponent of direct “cash” transfers. But given the alternatives, it is the “lesser evil”. The political class will likely claim this is neither feasible nor “patriotic.” For many politicians, the incentive is two-fold: the salivating prospect of managing an immense oil “booty,” and the recurring ideal of “doing good” with other people’s resources.

Still in doubt? Look at our track record: despite having the world’s largest proven reserves and over 20 different administrations of every political stripe since 1922, the State captured and managed over $1.2 trillion in rent between 1920 and 2015. The result? A Guinness world record in squandered booms, the largest migration in the hemisphere without a formal war, and unprecedented institutional destruction.

Isn’t it time to withdraw the State from oil?

This proposal would achieve:

- Real competitiveness: By matching Texas and Alberta margins (50%+ for the private sector), we compensate for institutional risks with top-tier global profitability.

- A limited State: The State ceases to be an inefficient businessman and becomes an arbiter: providing control, arbitration, and security. Its funding would come from taxing other economic activities, forcing it to foster general prosperity rather than living off the subsoil.

- A path towards a dividend-producing nation: Why not extend this to all extractive activities (gas, gold, iron, rare earths)? Perhaps the gold of the Arco Minero would stop being a black hole and become a direct dividend, shielding resources from looting and opacity.

The January 2026 reform is just a sigh in a prolonged agony. We cannot expect different results by doing the same thing. The “Hundred-Year War” over oil rent has left the State as a jailer rich in promises and a citizenry poor in realities.

Avoiding a third nationalization requires moving the subsoil out of the political arena and into the sphere of economic freedom. The US does not dominate markets by government mandate, but through an ecosystem that rewards risk and efficiency. Venezuela can emulate this success, but only by breaking the State lock and allowing a fabric of investors to flourish in direct alliance with citizens.

True sovereignty is not the State running the wells; it is Venezuelans themselves being the real owners of the benefits. Only through this pact of ownership can we hope that oil becomes, at last, an engine of development and not the tool of our own institutional destruction.