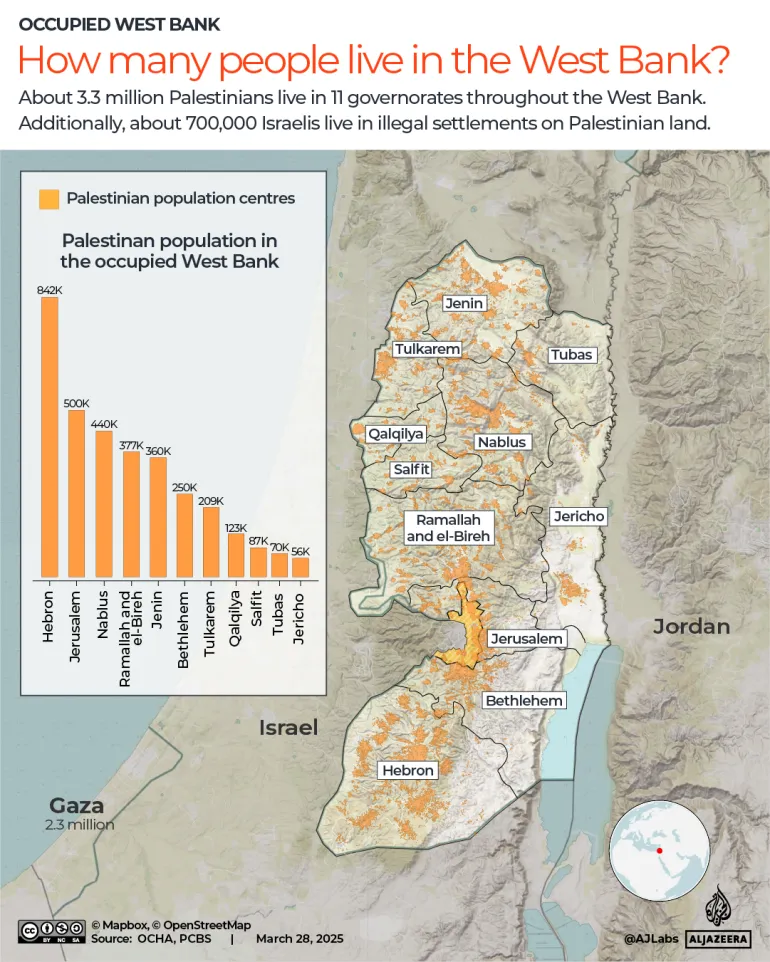

Israeli occupation authorities have intensified their campaign of forced displacement across the occupied West Bank, issuing expulsion orders to an entire Bedouin community east of Ramallah and escalating demolition policies in occupied East Jerusalem.

The measures come amid a surge in settler violence targeting educational institutions in the Jordan Valley and residential homes in Qalqilya, further shrinking the living space for Palestinians under military occupation.

‘Zone of expulsion’

On Sunday morning, Israeli forces raided the Abu Najeh al-Kaabneh Bedouin community in al-Mughayyir village, east of Ramallah.

Local sources confirmed to the Wafa news agency that soldiers delivered a military order requiring the community’s 40 residents to dismantle their homes and leave the area within 48 hours. The army declared the site a “closed military zone”, a tactic frequently used to clear Palestinian land for settlement expansion.

During the raid, Israeli troops arrested three foreign solidarity activists attempting to document the eviction order.

The expulsion order is part of a widening campaign of ethnic cleansing in the region. It follows the complete displacement of the Shallal al-Auja community north of Jericho, which concluded on Saturday. After years of systematic harassment, the last three families of the community were forced to leave, marking the erasure of a presence that once included 120 families.

Al-Aqsa provocations

In occupied East Jerusalem, Israel’s municipal policies of urban restriction continued to displace Palestinians.

On Sunday, Yasser Maher Dana, a Palestinian resident of the Jabal Mukaber neighbourhood, was coerced into demolishing his 100-square-metre (1,076-square-foot) home. The structure, located in the al-Salaa district, housed four family members.

Israeli authorities routinely force Palestinians in East Jerusalem to execute their own demolition orders to avoid paying exorbitant fees charged by municipal crews and forces if they carry out the destruction themselves. These demolitions are justified by a lack of building permits, which rights groups say are nearly impossible for Palestinians to obtain in the city.

Simultaneously, in Silwan, south of Al-Aqsa Mosque, the municipality issued a demolition order for a residential room belonging to the al-Taweel family, granting them a 10-day deadline. This follows notices issued three days before demolishing two homes belonging to brothers in the Wadi Qaddum neighbourhood.

Tensions also rose at the Al-Aqsa Mosque compound, stormed by dozens of Israeli settlers under heavy police protection. According to the Jerusalem governorate, the incursion included a provocative “wedding blessing” ritual performed by settlers for a bride in the courtyards, a violation of the site’s status quo.

Settlers attack schools and homes

In the northern Jordan Valley, Israeli settlers, backed by the military, disrupted the school day at the al-Maleh School.

Azmi Balawneh, the director of education in Tubas, reported that settlers blocked teachers from reaching the school, which serves children from the vulnerable Bedouin communities of al-Hadidiya, Makhoul, and Samra.

This harassment coincides with the establishment of a new illegal settlement outpost in the al-Maleh area just a week ago. In the nearby Khirbet Samra, settlers erected a new tent on Sunday morning to seize more pastoral land.

Meanwhile, in the village of Faraata, east of Qalqilya, settlers from the illegal “Havat Gilad” outpost attacked the home of Hijazi Yamin.

Yamin told Wafa that settlers pelted his house and unleashed an attack dog on his family, trapping his wife and seven children inside.

“We live in a constant state of insecurity,” Yamin said, noting this was the second attack in a week. “I am afraid to leave my wife and children alone or let them go to school.”

Military raids and closures

Israeli forces conducted multiple raids across the West Bank on Sunday, arresting at least four Palestinians. In Hebron, two brothers were arrested following a raid on their family home. More arrests were reported in the village of Duma, south of Nablus, and in the town of al-Ubeidiya, east of Bethlehem.

In the northern city of Jenin, military vehicles stormed the city centre and the Jabel Abu Dhuhair neighbourhood. During the incursion, troops deliberately destroyed street vendors’ carts at the Cinema Roundabout, targeting the local economy.

Movement restrictions also tightened significantly. For the second consecutive day, the Israeli army closed the main entrance to Turmus Aya, north of Ramallah, and blocked the Atara military checkpoint since the early morning hours, severing connections between northern and central West Bank cities. According to the Colonization and Wall Resistance Commission, Israel now operates 916 military checkpoints and gates throughout the West Bank.