Yangon, Myanmar – Voters in parts of Myanmar are heading to the polls on Sunday for an election that critics view as a bid by the country’s generals to legitimise military rule, nearly five years after they overthrew the government of Nobel Laureate Aung San Suu Kyi.

The multi-phased election is unfolding amid a raging civil war, with ethnic armed groups and opposition militias fighting the military for control of vast stretches of territory, stretching from the borderlands with Bangladesh and India in the west, across the central plains, to the frontiers with China and Thailand in the north and east.

Recommended Stories

list of 4 itemsend of list

In central Sagaing, voting will take place in only a third of the region’s townships on Sunday. Another third will be covered during a second and third phase in January, while voting has been cancelled altogether in the remainder.

Fighting, including air raids and arson, has intensified in several areas.

“The military is deploying troops and burning villages under the guise of ‘territorial dominance’,” said Esther J, a journalist based there. “People here are saying this is being done for the election.”

In most of the region, “we haven’t seen a single activity related to the election,” she said. “No one is campaigning, organising or telling people to vote.”

Across Myanmar, voting has been cancelled in 56 of the country’s 330 townships, with more cancellations expected. The conflict, triggered by the 2021 coup, has killed an estimated 90,000 people and displaced more than 3.5 million, according to monitoring groups and the United Nations. It has left nearly half of the country’s population of 55 million in need of humanitarian assistance.

“People [in Sagaing] say they have no interest in the election,” said Esther J. “They do not want the military. They want the revolutionary forces to win.”

Shifting battlefield

For much of last year, the Myanmar military appeared to be losing ground.

A coordinated offensive launched in late 2023 by the Three Brotherhood Alliance – a coalition of ethnic armed groups and opposition militias – seized vast areas, nearly pushing the military out of western Rakhine state and capturing a major regional military headquarters in the northeastern city of Lashio, about 120km (75 miles) from the Chinese border. Armed with commercial drones modified to carry bombs, the rebels were soon threatening the country’s second-largest city of Mandalay.

The operation – dubbed 1027 – marked the most significant threat to the military since the 2021 coup.

But the momentum has stalled this year, largely because of China’s intervention.

In April, Beijing brokered a deal in which the Myanmar National Democratic Alliance Army agreed to surrender the city of Lashio, without a single shot being fired. The military subsequently reclaimed key towns in north and central Myanmar, including Nawnghkio, Thabeikkyin, Kyaukme and Hsipaw. In late October, China brokered another agreement for the Ta’ang National Liberation Army to withdraw from the gold mining towns of Mogok and Momeik.

“The Myanmar military is definitely resurgent,” said Morgan Michaels, a research fellow at the International Institute for Strategic Studies (IISS). “If this current trend continues, the Myanmar military could be back in a relatively dominant position in a year or so, maybe two.”

The military turned the tide by launching a conscription drive, expanding its drone fleet and putting more combat credible soldiers in charge. Since announcing mandatory military service in February 2024, it has recruited between 70,000 to 80,000 people, researchers say.

“The conscription drive has been unexpectedly effective,” said Min Zaw Oo, executive director at the Myanmar Institute for Peace and Security. “Economic hardship and political polarisation pushed many young men into the ranks,” he said, with many of the recruits technically adept and serving as snipers and drone operators. “The military’s drone units now outmatch those of the opposition,” he added.

According to the Armed Conflict Location & Event Data Project (ACLED), a monitoring group, air and drone attacks by the military have increased by roughly 30 percent this year. The group recorded 2,602 air attacks that it said killed 1,971 people – the highest toll since the coup. It said Myanmar now ranks third in the world for drone operations, behind only Ukraine and Russia.

China, meanwhile, has applied pressure beyond brokering ceasefires.

According to analysts, Beijing pressed one of the strongest armed ethnic groups, the United Wa State Army, to cut off weapons supplies to other rebels, resulting in ammunition shortages across the country. The opposition forces have also suffered from disunity. “They are as fragmented as ever,” said Michaels of the IISS. “Relationships between these groups are deteriorating, and the ethnic armed organisations are abandoning the People’s Defence Forces,” he said, referring to the opposition militias that mobilised after the coup.

China’s calculations

China, observers say, acted for fear of a state collapse in Myanmar.

“The situation in Myanmar is a ‘hot mess’, and it’s on China’s border,” said Einar Tangen, a Beijing-based analyst at the Centre for International Governance Innovation. Beijing, he said, wants to see peace in Myanmar to protect key trade routes, including the China-Myanmar Economic Corridor that, when completed, will link its landlocked Yunnan province to the Indian Ocean and a deep seaport there.

Tangen said Beijing harbours no love for the military, but sees few alternatives.

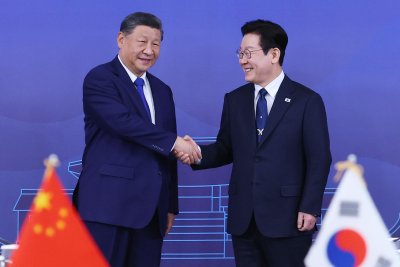

Indeed, after the coup, Beijing refrained from normalising relations with Myanmar or recognising coup leader Min Aung Hlaing. But in a sign of shifting policy, Chinese President Xi Jinping met Min Aung Hlaing twice this year. During talks in China’s Tianjin in August, Xi told Min Aung Hlaing that Beijing supports Myanmar in safeguarding its sovereignty, as well as “in unifying all domestic political forces” and “restoring stability and development”.

Tangen said China sees the election as a path to more predictable governance. Russia and India, too, have backed the process, though the UN and several Western nations have called it a “sham”. But Tangen noted that while Western nations denounce the military, they have done little to engage with the rebels. The United States has dealt further blows by cutting off foreign aid and ending visa protections for Myanmar citizens.

“The West is paying lip service to the humanitarian crisis. China’s trying to do something but doesn’t know how to solve it,” Tangen said.

Limited gains, lasting war

The military’s territorial gains, meanwhile, remain modest.

In northern Shan state, Myanmar’s largest, the military has recaptured only 11.3 percent of the territory it had lost, according to the Institute for Strategy and Policy – Myanmar, a think tank. But it is western Rakhine State that remains the “larger and more intense theatre of war”, said Khin Zaw Win, a Yangon-based analyst.

There, the Arakan Army is pushing beyond the borders of the state, overrunning multiple bases, and pushing east in a move that threatens the military’s defence industries. In northern Kachin state, the battle for Bhamo, a gateway to the north, is approaching its first anniversary, while in the southeast, armed groups have taken a “number of important positions along the border with Thailand”, he said.

So the military’s recent gains in other parts were “not that significant”, he added.

ACLED, the war monitor, also described the military’s successes as “limited in the context of the overall conflict”. In a briefing this month, Su Mon, a senior analyst at ACLED, wrote that the military remains in a “weakened position compared to before the 2021 coup and Operation 1027 and is unable to assert effective control over the areas it has recently retaken”.

Still, the gains give the military “more confidence to proceed with the elections”, said Khin Zaw Win.

The military-backed Union Solidarity and Development Party, which has fielded the most candidates, is expected to form the next government. Aung San Suu Kyi’s National League for Democracy has been dissolved, and she remains held incommunicado, while other smaller opposition parties have been barred from participating.

Khin Zaw Win said he does not expect the election to “affect the war to any appreciable extent” and that the military might even be “deluded to go for a complete military victory”.

But on the other hand, China could help de-escalate, he said.

“China’s mediation efforts are geared toward a negotiated settlement,” he noted. “It expects a ‘payoff’ and does not want a protracted war that will harm its larger interests.”

Zaheena Rasheed wrote and reported from Kuala Lumpur, Malaysia, and Cape Diamond reported from Yangon, Myanmar.