What has US Supreme Court said about Trump’s trade tariffs? Does it matter? | Trade War News

The US Supreme Court has questioned US President Donald Trump’s authority to use emergency powers to impose sweeping tariffs on trading partners around the world.

In a closely watched hearing on Wednesday in Washington, DC, conservative and liberal Supreme Court judges appeared sceptical about Trump’s tariff policy, which has already had ramifications for US carmakers, airlines and consumer goods importers.

Recommended Stories

list of 3 itemsend of list

The US president had earlier claimed that his trade tariffs – which have been central to his foreign policy since he returned to power earlier this year – will not affect US businesses, workers and consumers.

But a legal challenge by a number of small American businesses, including toy firms and wine importers, filed earlier this year, has led to lower courts in the country ruling that Trump’s tariffs are illegal.

In May, the Court of International Trade, based in New York, said Trump did not have the authority to impose tariffs and “the US Constitution grants Congress exclusive authority to regulate commerce”. That decision was upheld by the Court of Appeals for the Federal Circuit in Washington, DC, in August.

Now, the Supreme Court, the country’s top court, is hearing the issue. Last week, the small business leaders, who are being represented by Indian-American lawyer Neal Katyal, told the Court that Trump’s import levies were severely harming their businesses and that many have been forced to lay off workers and cut prices as a result.

In a post on his Truth Social Platform on Sunday, Trump described the Supreme Court case as “one of the most important in the History of the Country”.

“If a President is not allowed to use Tariffs, we will be at a major disadvantage against all other Countries throughout the World,” he added.

What happened in Wednesday’s Supreme Court hearing, and what could happen if the court rules against Trump’s tariffs?

Here’s what we know:

What was discussed at the Supreme Court on Wednesday?

During a hearing which lasted for nearly three hours, the Trump administration’s lawyer, Solicitor General D John Sauer, argued that the president’s tariff policy is legal under a 1977 national law called the International Emergency Economic Powers Act (IEEPA).

According to US government documents, IEEPA gives a US president an array of economic powers, including to regulate trade, in order “to deal with any unusual and extraordinary threat, which has its source in whole or substantial part outside the United States, to the national security, foreign policy, or economy of the United States, if the President declares a national emergency with respect to such threat”.

Trump invoked IEEPA in February to levy a new 25 percent tax on imports from Canada and Mexico, as well as a 10 percent levy on Chinese goods, on the basis that these countries were facilitating the flow of illegal drugs such as fentanyl into the US, and that this constituted a national emergency. He later paused the tariffs on Canada and Mexico, but increased China’s to 20 percent. This was restored to 10 percent after Trump met Chinese President Xi Jinping last month.

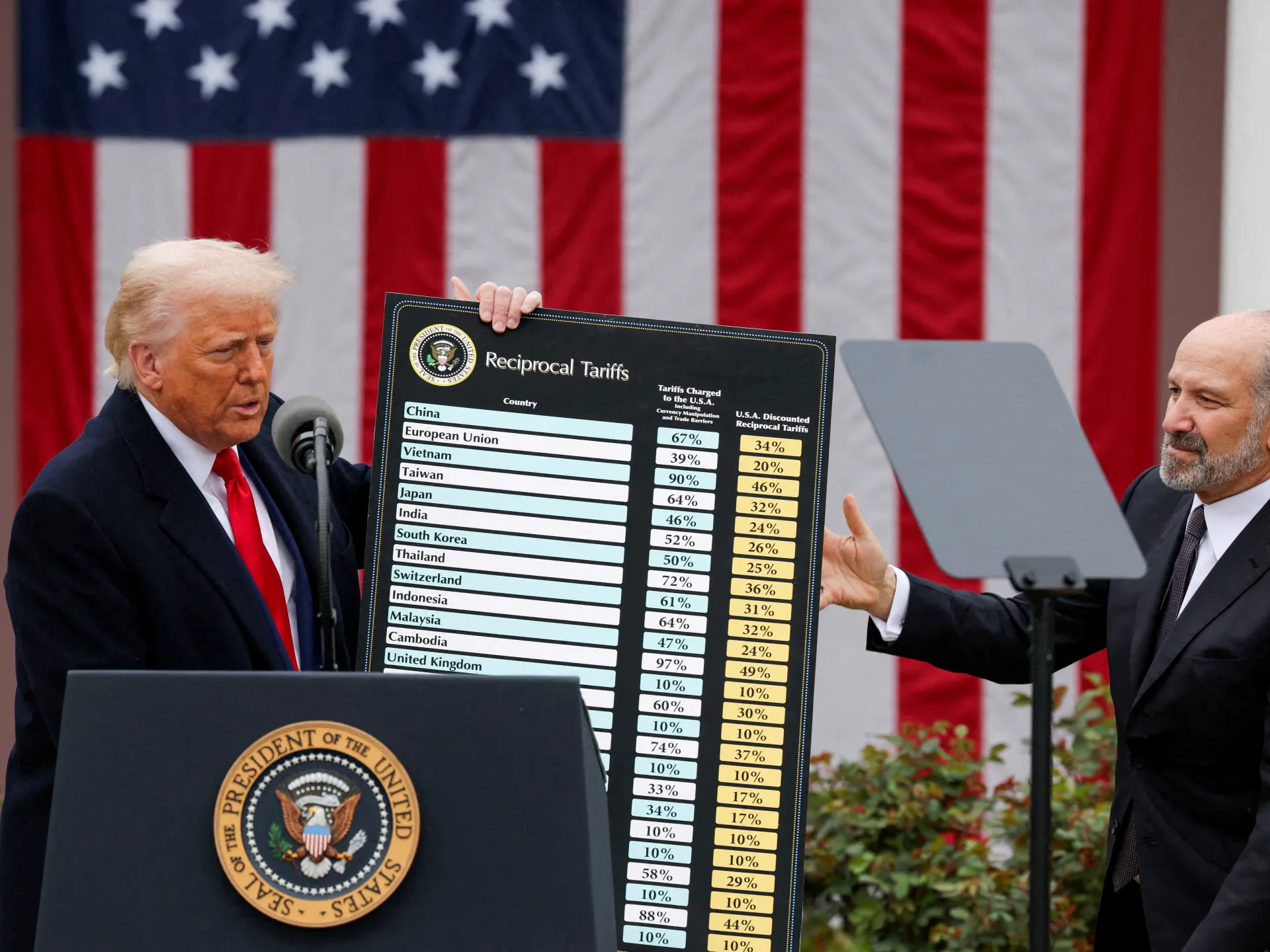

In April, when he imposed reciprocal tariffs on imports from a wide array of countries around the world, he said those levies were also in line with IEEPA since the US was running a trade deficit that posed an “extraordinary and unusual threat” to the nation.

Sauer argued that Trump had imposed the tariffs using IEEPA since “our exploding trade deficits have brought us to the brink of an economic and national security catastrophe”.

He also told the court that the levies are “regulatory tariffs. They are not revenue-raising tariffs”.

But Neal Katyal, the lawyer for the small businesses that have brought the case, countered this. “Tariffs are taxes,” Katyal said. “They take dollars from Americans’ pockets and deposit them in the US Treasury. Our founders gave that taxing power to Congress alone.”

What did the judges say about tariffs?

The judges raised another sticking point: Also, under the US Constitution, only Congress has the power to regulate tariffs. Justice John Roberts noted that “the [IEEPA] statute doesn’t use the word tariff.”

Liberal Justice Elena Kagan also told Sauer, “It has a lot of actions that can be taken under this statute. It just doesn’t have the one you want.”

Conservative Justice Amy Coney Barrett, who was appointed by Trump during his first term as president, asked Sauer, “Is it your contention that every country needed to be tariffed because of threats to the defence and industrial base?

“I mean, Spain, France? I could see it with some countries, but explain to me why as many countries needed to be subject to the reciprocal tariff policy,” Coney Barrett said.

Sauer replied that “there’s this sort of lack of reciprocity, this asymmetric treatment of our trade, with respect to foreign countries that does run across the board,” and reiterated the Trump administration’s power to use IEEPA.

Liberal Justice Sonia Sotomayor took issue with the notion that the tariffs are not taxes, as asserted by Trump’s team. She said, “You want to say that tariffs are not taxes, but that’s exactly what they are.”

According to recent data released by the US Customs and Border Protection agency, as of the end of August, IEEPA tariffs had generated $89bn in revenues to the US Treasury.

During the court’s arguments on Wednesday, Justice Roberts also suggested that the court may have to invoke the “major questions” doctrine in this case after telling Sauer that the president’s tariffs are “the imposition of taxes on Americans, and that has always been the core power of Congress”.

The “major questions” doctrine checks a US executive agency’s power to impose a policy without Congress’s clear directive. The Supreme Court previously used this to block former President Joe Biden’s policies, including his student loan forgiveness plan.

Sauer argued that the “major questions” doctrine should not apply in this context since it would also affect the president’s power in foreign affairs.

Why is this case the ultimate test of Trump’s tariff policy?

The Supreme Court has a 6-3 conservative majority and generally takes several months to make a decision. While it remains unclear when the court will make a decision on this case, according to analysts, the fact that this case was launched against Trump at all is significant.

In a recent report published by Max Yoeli, senior research fellow on the US and Americas Programme at UK-based think tank Chatham House, said, “The Supreme Court’s outcome will shape Trump’s presidency – and those that follow – across executive authority, global trade, and domestic fiscal and economic concerns.”

“It is likewise a salient moment for the Supreme Court, which has empowered Trump and showed little appetite to constrain him,” he added.

Penny Nass, acting senior vice president at the German Marshall Fund’s Washington DC office, told Al Jazeera that the verdict will be viewed by many as a test of Trump’s powers.

“A first impact will be the most direct judicial restraint at the highest level on Presidential power. After a year testing the limits of his power, President Trump will start to see some of constraints on his power,” she said.

According to international trade lawyer Shantanu Singh, who is based in India, the global implications of this case could also be huge.

“One objective of these tariffs was to use them as leverage to get trade partners to do deals with the US. Some countries have concluded trade deals, including to address the IEEPA tariffs,” he told Al Jazeera.

After the imposition of US reciprocal tariffs in April and again in August, several countries and economic blocs, including the EU, UK, Japan, Cambodia and Indonesia, have struck trade deals with the US to reduce tariffs.

But those countries were forced to make concessions to get those deals done. EU countries, for example, had to agree to buy $750bn of US energy and reduce steel tariffs through quotas.

Singh pointed out that an “adverse Supreme Court ruling could bring into doubt the perceived benefit for concluding deals with the US”.

“Further, trade partners who are currently negotiating with the US will have to also adjust their negotiating objectives in light of the ruling and how the administration reacts to it,” he added.

Other countries including India and China are currently actively engaged in trade talks with the US. Trade talks with Canada were terminated by Trump in late October over what Trump described as a “fraudulent” advertisement featuring former President Ronald Reagan speaking negatively about trade tariffs, which was being aired in Canada.

What happens if the judges rule against Trump?

Following Wednesday’s Supreme Court Hearing, US Treasury Secretary Scott Bessent, who was at the court with Secretary of Commerce Howard Lutnick, told Fox News that he was “very optimistic” that the outcome of the case would be in the government’s favour.

“The solicitor general made a very powerful case for the need for the president to have the power,” he said and refused to discuss the Trump administration’s plan if the court ruled against the tariff policy.

However, Singh said if the Supreme Court does find these tariffs illegal, one immediate concern will be how tariffs collected so far will be refunded to businesses, if at all.

“Given the importance that the current US administration places on tariffs as a policy tool, we can expect that it would quickly identify other legal authorities and work to reinstate the tariffs,” he said.

Nass added: “The President has many other tariff powers, and will likely quickly recalibrate to maintain his deal-making efforts with partners,” she said, adding that there would still be very complicated work for importers on what to do with the tariffs already collected in 2025 under IEEPA.

During Wednesday’s hearing, Justice Coney Barrett asked Katyal, the lawyer for the small businesses contesting Trump’s tariffs, whether this process of paying money back would be “a complete mess”.

Katyal said the businesses he’s representing should be given a refund, but added that it is “very complicated”.

“So, a mess,” Coney Barrett stated.

“It’s difficult, absolutely, we don’t deny that,” Katyal said in response.

In an interview with US broadcaster CNN in September, trade lawyers said the court could decide who gets the refunds. Ted Murphy, an international trade lawyer at Sidley Austin, told CNN that the US government “could also try to get the court to approve an administrative refund process, where importers have to affirmatively request a refund”.

What tariffs has Trump imposed so far, and what has their effect been?

Trump has imposed tariffs of varying rates on imports from almost every country in the world, arguing that these levies will enrich the US and protect the domestic US market. The tariff rates range from as high as 50 percent on India and Syria to as low as 10 percent on the UK.

The US president has also imposed a 50 percent tariff on all copper imports, 50 percent on steel and aluminium imports from every country except the UK, 100 percent on patented drugs, 25 percent levies on cars and car parts manufactured abroad, and 25 percent on heavy-duty trucks.

According to the University of Pennsylvania’s Penn Wharton Budget Model, which analyses the US Treasury’s data, tariffs have brought in $223.9bn as of October 31. This is $142.2bn more than the same time last year.

In early July, Treasury Secretary Bessent said revenues from these tariffs could grow to $300bn by the end of 2025.

But in an August 7 report, the Budget Lab at Yale University estimated that “all 2025 US tariffs plus foreign retaliation lower real US Gross Domestic Product (GDP) growth by -0.5pp [percentage points] each over calendar years 2025 and 2026”.

Meanwhile, according to a Reuters news agency tracker, which follows how US companies are responding to Trump’s tariff threats, the first-quarter earnings season saw carmakers, airlines and consumer goods importers take the worst hit from tariff threats. Levies on aluminium and electronics, such as semiconductors, also led to increased costs.

Reuters reported that as tariffs hit factory orders, big manufacturing companies around the world are also struggling.

In its latest World Economic Outlook report released last month, the International Monetary Fund (IMF) said the effect of Trump’s tariffs on the global economy had been less extreme.

“To date, more protectionist trade measures have had a limited impact on economic activity and prices,” it said.

However, the IMF warned that the current resilience of the global economy may not last.

“Looking past apparent resilience resulting from trade-related distortions in some of the incoming data and whipsawing growth forecasts from wild swings in trade policies, the outlook for the global economy continues to point to dim prospects, both in the short and the long term,” it said.