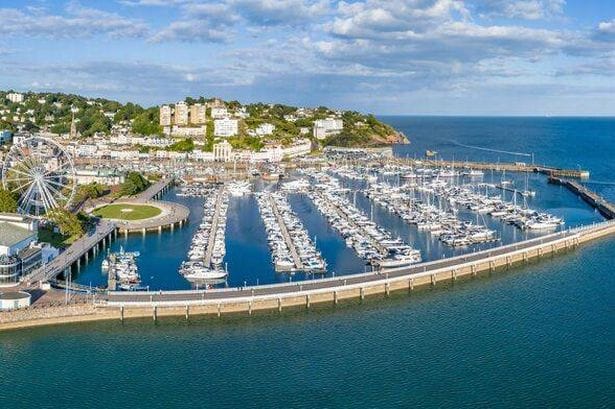

The English Riviera is a 22-mile stretch of the South Devon coast with Torquay at its northern end. It’s sometimes compared to the French Riviera, but it’s a very different place

Stand on the promenade of this legendary seaside resort when the weather’s pleasant, and you could easily mistake yourself for being somewhere on the Mediterranean rather than in Britain. Lines of palm trees flutter in the wind, waves gently wash onto an expansive sandy shore and gleaming art-deco structures perch on the hillside overhead.

Take a closer look, though, and there are telltale signs you’re actually on the English coast rather than somewhere along the French Riviera. Reach reporter Milo Boyd is pretty sure traditional fish and chip outlets, seaside souvenir shops and penny arcade machines aren’t common sights along the Côte d’Azur.

And whilst a typical July afternoon in this Devon resort of 50,000 residents reaches around 20C with some cloud cover, the French Riviera basks in 29C temperatures with glorious sunshine and clear blue skies.

Parallels drawn between the Devon shoreline and the glamorous French destination date back to Victorian times, when tourists likened the mild microclimate and stunning landscape of Torbay – a 22-mile section of the South Devon coast with Torquay at its northern tip – to the 186 miles of the original Riviera.

Whilst the French Riviera sometimes faces criticism for being overly warm, rather posh, and costly, Torquay regularly receives brutal assessments of an entirely different nature.

Actually, it appears to attract an unfair share of criticism, reports Devon Live.

Last year, a Which? survey declared Torquay as Brits’ most disliked seaside destination, whilst The Telegraph ranked it as their 13th most disappointing coastal location.

Even one of Milo’s taxi drivers couldn’t resist having a dig, branding the high street as a “dump”. The decision-making process of these competition judges is a mystery to him, and their lack of taste in coastal spots is evident.

After a weekend getaway in Torbay, Milo was captivated and intrigued by Torquay, a seaside town unlike any other he has encountered in the UK.

Food and drink in Torquay

One of the town’s most appealing and tasty features is its food. Sure, you can find the traditional cod and chips every 10m along the seafront as you would in most UK seaside towns, but Torquay has much more to offer.

Milo had the good fortune to get a quick tour of the town’s food scene through an invitation to the 7 Chefs event on 4 October. Over seven hours, guests are treated to seven different seafood dishes, each crafted by a different chef and served in a different independent restaurant.

This annual event is highly sought after, making stops at the Michelin-starred Elephant for some braised octopus, the sibling-run Ollie’s for a generous lobster thermidor, delicately prepared oysters at No. 7 Fish Bistro and Offshore for its unique take on mussels with katsu.

If you fancy indulging in top-quality seafood and British-produced wines, then this event is perfect for you.

It might only happen once annually and set you back £120, but you’ll require a solid 364 days to recover after tackling diver-caught scallops at The Yacht, a generous helping of fish and chips at Pier Point, and cheese with far too much port at Twenty1 Lounge.

“Lightweight,” one of my fellow foodie companions shouted after me as he ordered another couple of reds for good measure, whilst Milo hauled his aching frame into a taxi.

The event also runs in Brixham on the opposite side of the bay.

The vibrant, boutique village houses one of England’s largest fishing markets and restaurants, including Olive, The Prince William, and The Mermaid, where many of the 40 fish and shellfish varieties landed here are consumed.

‘The Queen of the English Riviera’

Torquay is often dubbed ‘the Queen of the English Riviera’, and rightfully so.

On a bright day, the magnificent art deco properties crown the hillside overlooking the bay, sparkling in the sunlight like gems in a tiara.

Torbay lies just beyond the western tip of the Jurassic Coast and comprises Devonian limestones intersected with red ochre deposits.

These form a intricate landscape featuring elements like the wave-carved Berry Head platform and natural caves. On a Sunday afternoon, Milo was given a tour by Nigel Smallbones, the ranger at Berry Head Nature Reserve for 27 years.

He showed Milo the roosting spot of a 1,600-strong guillemot colony, the cave system where his son monitors the 56 resident horseshoe bats, and explained how rock enthusiasts travel from as far as China to appreciate the geology.

A short half-hour drive around the bay led me to Kents Cavern – a prehistoric cave system unearthed by some tough Victorians. It’s an awe-inspiring place that continues to yield significant scientific discoveries, including the jawbone of a Neolithic girl likely devoured by cave hyenas, and a colossal bear skull.

If exploring a cavern filled with stalagmites and stalactites isn’t your cup of tea, just up the road lies a piece of British comedy history – the hotel that inspired John Cleese’s Fawlty Towers. Perhaps due to its somewhat infamous association, the hotel has since been replaced by a block of flats and a commemorative blue plaque.

One stark difference between the Rivieras is their approach to drinking. Milo was genuinely taken aback and impressed by the amount his fellow restaurant-goers consumed, and how some managed to stomach a full English breakfast on a sunrise boat trip the next morning.

Such passion and resilience would be hard to find on the French Riviera.

Locals he spoke with admitted that Torquay’s nightlife isn’t what it used to be, with several mourning the loss of two clubs that once offered unlimited drinks for under a tenner.

Nevertheless, the party atmosphere endures through the 1,200-capacity Arena Torquay, which is hosting an Ibiza throwback evening next week, alongside a string of bars along the quayside.

With roaming packs of stag and hen parties, some donning lederhosen in honour of Oktoberfest, Torquay remains regarded as a cracking spot for a night out.

Devon’s temperate climate and breezy conditions mean its flourishing vineyard industry creates light, refreshing wines that complement seafood perfectly – a fortunate match.

Torquay also boasts several gin distilleries.

Laurance Traverso, director of the Coastal Distillery Co, served me a delightful G&T from his waterside headquarters.

So what’s behind the animosity?

There’s undoubtedly a segment of the British public that simply doesn’t rate Torquay.

If you rock up for a family break and have the bad luck of being drenched for seven days straight, Milo can see their point.

Some townsfolk have grown fed up with the high street and how districts beyond the seafront and tourist hotspots have deteriorated.

Local Sophie Ellis-Marsden revealed: “I avoid that end of town. I don’t have much nice to say, to be honest. The waterfront is lovely, and that’s the only thing that is.

“It’s nice, don’t get me wrong, I moved here from Milton Keynes for the sea, but it needs more work. More shops just seem to be shutting down. Everything’s gone, and I don’t really know why.”

The local authority appears determined to tackle these problems head-on.

Significant investment has already been made, with much more planned for the future.

The Strand at the harbourside has been transformed into a piazza-style promenade, featuring expanded pedestrian zones for dining and seating, plus improved public transport connections.

A former Debenhams department store is earmarked for demolition, to be replaced with new homes, cafés, restaurants, and an upmarket hotel.

Additional proposals are in the works for the town centre, along with further development at The Strand, which the council estimated would create approximately 80 full-time jobs, £32 million in wages, and attract 86,000 new visitors over a 30-year period.

The total cost of the scheme is reported to be £70 million.