5 Things to Know About Coca-Cola Stock Before You Buy

This blue-chip staple remains a great long-term investment.

There’s a strong argument that no other brand is as recognizable worldwide as Coca-Cola (KO 0.12%). There are very few places you can go in the world and not find Coca-Cola’s products. This vast distribution and brand recognition are largely why Coca-Cola has been a beverage powerhouse for decades.

The beverage giant has also been a staple in many portfolios for decades, bringing some stability and attractive income to the table. If you’re interested in adding this blue-chip stock to your portfolio, here are five things you should know beforehand.

Image source: Getty Images.

1. Coca-Cola is still a prime dividend stock

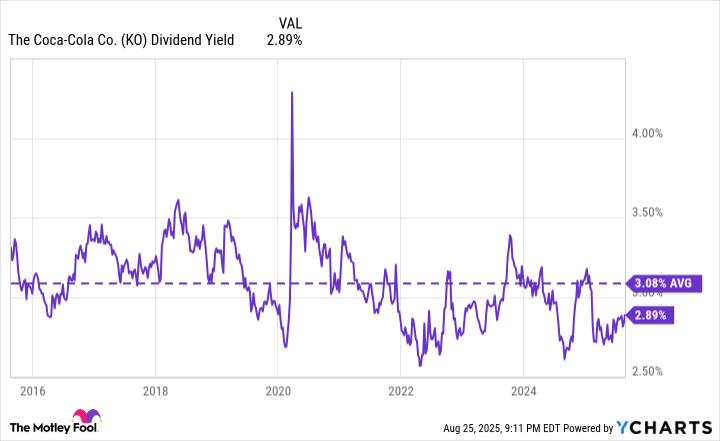

The first thing to know about Coca-Cola’s stock has to do with its main appeal: its reliable, above-average dividend. The current quarterly dividend is $0.51, with an average yield of around 2.9%, just below its 3% average for the past decade.

This yield is more than double the S&P 500 average, which is great, but the long-term attraction is the consistency with which Coca-Cola increases its annual dividend. When it announced it would increase its quarterly dividend to $0.51 ($2.04 annually) in February, this marked the company’s 63rd consecutive year of increases, making it a Dividend King. The dividend has doubled since 2012.

KO Dividend Yield data by YCharts

2. Coca-Cola has offset stagnant volume with pricing power

When your brand moat is as strong as Coca-Cola’s, it gives you pricing power that lesser-established brands typically don’t have. This is a great thing for Coca-Cola because its volume has been flat to slightly down in recent times.

The second quarter (Q2) is a key example of Coca-Cola’s pricing power at work. Although its global unit case volume declined by 1% year over year, its organic revenue (revenue that excludes currency swings and acquisitions/divestitures) increased by 5% year over year.

Coca-Cola uses a metric called price/mix, which tells you how much more money it’s making by either raising prices or selling more profitable products instead of just selling more products overall. In the second quarter, this price/mix was 6%, which is illustrated by the difference in volume decline and revenue growth.

3. Coca-Cola Zero Sugar is leading growth for Coca-Cola

Coca-Cola’s flagship Coca-Cola soda will likely always be its bread and butter, but recent changes in consumer preferences have brought a new growth beverage to the light. Coca-Cola Zero Sugar — which, as the name implies, is a sugar-free alternative to the Classic Coke — is Coca-Cola’s fastest-growing brand.

In Q2, Coca-Cola Zero Sugar volume grew 14% year over year. Below is how other specific beverages and categories performed in the quarter:

| Beverage, Category, or Subcategory | Volume Growth or Decline |

|---|---|

| Coca-Cola Zero Sugar | +14% |

| Coffee | +1% |

| Water | 0% |

| Tea | 0% |

| Sparkling soft drinks | -1% |

| Trademark Coca-Cola | -1% |

| Sparkling flavors | -2% |

| Sports drinks | -3% |

| Juice, dairy, and plant-based | -4% |

Source: Coca-Cola’s second quarter results.

It’s important to note that Coca-Cola Zero Sugar is a specific drink that falls in the “Trademark Coca-Cola” subcategory that also includes Coca-Cola Classic, Diet Coke, and other regional-specific Coke variants (like Coca-Cola Sin Azúcar in Latin America).

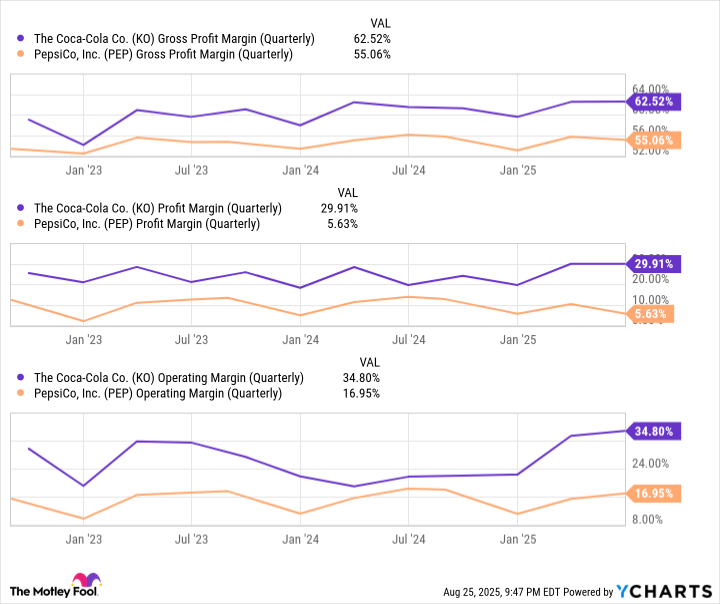

4. Coca-Cola continues to have industry-leading margins

Unlike its main competitor, PepsiCo, Coca-Cola only sells beverages. Its main business model is selling concentrates and syrups to its bottling partners, who then produce the products and distribute them themselves.

This slimmed-down operation has helped Coca-Cola operate with industry-leading margins because it doesn’t have to indulge in the food business, which can be capital-intensive and much less profitable. Here is how Coca-Cola’s various margins compare to PepsiCo:

KO Gross Profit Margin (Quarterly) data by YCharts

5. Coca-Cola isn’t afraid to adjust its portfolio

Despite how successful a lot of Coca-Cola’s brands are, the company continues to reshape its portfolio to adjust to what consumers want, both adding what works and removing what doesn’t work. At one point, Coca-Cola’s portfolio consisted of over 400 brands. Today, it consists of around 200.

It has adapted to consumers leaning toward sugar-free options, the growth of plant-based beverages, and the popular alcohol ready-to-drink segment. The latter is especially noteworthy because Coca-Cola had traditionally steered clear of the alcohol segment, but began making attempts to become a total beverage company.

This willingness to adapt is important when you’re investing in a company like Coca-Cola for the long term. It also explains how the company has maintained its market-leading position for so long.