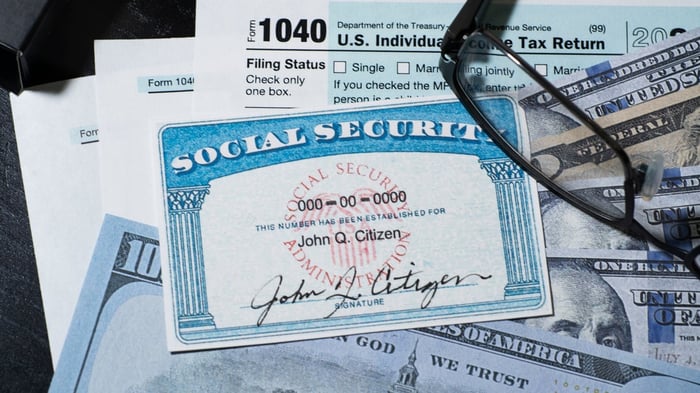

4 Reasons You Could Regret Your Early Social Security Claim

If you claim Social Security early, you could find yourself wishing you had made a different choice as you cope with smaller monthly benefits.

You’ll make many decisions when preparing for retirement. Choosing when to file for Social Security benefits is one of the most important of those choices.

You have a long period when you could file for benefits, as you can claim as early as 62, but can also wait and increase the amount of your benefits until age 70. Picking the right moment within that eight-year timespan helps you maximize your income and build a more secure retirement.

For many people, an early claim seems like the obvious answer since you can start collecting right away and enjoying the benefits you’ve worked hard to earn all your life. In reality, though, claiming at a young age — and especially before your designated full retirement age — could be something you end up really regretting.

Here’s why.

Image source: Getty Images.

An early claim limits your ability to work

If you start receiving Social Security before your designated full retirement age (FRA), your decision could impact your ability to work because when you earn too much before FRA, your benefit checks are reduced or even eliminated.

For example, in 2025, if you won’t reach FRA during the entire year, then once you earn more than $23,400, you’ll lose $1 in benefits for every $2 earned above that limit. This could quickly lead to your Social Security checks disappearing entirely, since the Social Security Administration withholds full checks when you go above the limit.

This rule prevents double-dipping of benefits and a paycheck in the years before you reach FRA, and it can lead to a lot of hassle if you’re trying to track earnings to avoid losing benefits.

Eventually, you do get credit if checks are withheld, as your benefit is recalculated at your full retirement age to account for the missed money — but the process of slowly recovering the benefits you missed out on due to exceeding the work limits can be very frustrating.

You’ll take a big benefits cut that is permanent

Since you have an eight-year window to claim Social Security, there are rules in place to try to equalize out lifetime benefits so you get the same amount of money no matter when you claim.

One of those rules is that if you claim Social Security benefits before FRA, benefits are reduced by early filing penalties. But if you wait until after FRA, benefits are increased due to delayed retirement credits.

The penalties and credits apply monthly, as you’ll lose 5/9 of 1% of your standard benefit for each of the first 36 months you receive a check ahead of your FRA. If you claim even sooner, you lose an additional 5/12 of 1% for any of the prior months.

The monthly penalties add up to an annual 6.7% reduction from your standard benefit for years one, two, and three. For years four and five when you were collecting early Social Security benefits, the reduction in benefits is 5% annually. This means that a claim at 62 instead of at an FRA of 67 results in a 30% cut to benefits overall. That cut is permanent, and benefits will always be 30% smaller than they would have been had you waited to claim.

If you delayed beyond FRA until 70 instead, though, you’d have increased your benefits by 2/3 of 1% or 8% per year and received more benefits instead of smaller checks.

You’ll shrink your survivor benefits

You are not the only one who could regret your early Social Security claim. Your spouse could as well. When you die, your spouse either gets to keep receiving their own benefit or keep receiving yours. If you were the higher earner in your family and your Social Security benefit is a lot bigger, then keeping your benefit would be better for your surviving spouse.

The problem is, if you claimed Social Security ahead of schedule, you’d have shrunk your benefit — so your surviving spouse would be left with a smaller survivor benefit than they could have had. Since living on a single Social Security check instead of two is hard, your spouse could end up really wishing you hadn’t claimed early.

You stand a good chance of missing out on lifetime income

Finally, research has shown that around 7 in 10 retirees would find themselves with more lifetime income if they delay benefits until 70 instead of claiming at a younger age. If your goal is to maximize the lifetime income Social Security offers so you don’t have to rely as much on your 401(k) or other retirement plans, then you’ll want to avoid shrinking your lifetime income.

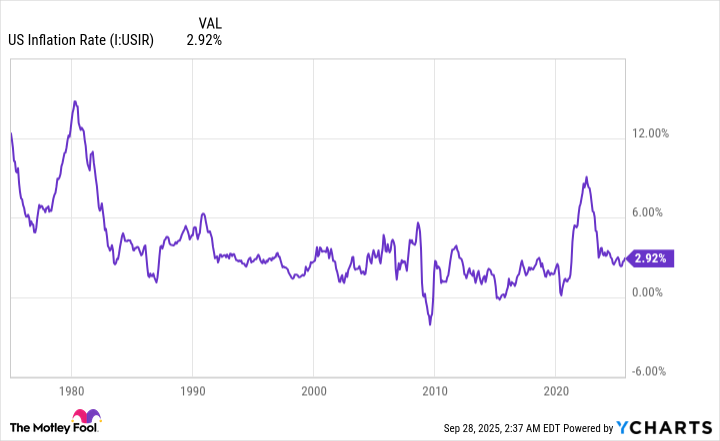

That’s especially true as Social Security is a reliable source of funds since there are cost-of-living adjustments built in that help you avoid losing buying power due to inflation.

Ultimately, an early claim is simply not the right option for many. When you are making your retirement plans, think seriously about whether you should prepare to try to put off your Social Security claim. If so, have a plan to do that, such as living on retirement savings until the day comes when you can claim a large benefit and set yourself and your spouse up for a more secure future.