The Republican-controlled U.S. Senate defied congressional norms and voted Wednesday to revoke California’s progressive vehicle emission standards that would’ve effectively banned the sale of new gasoline-only cars by 2035.

In a 51-44 vote, the Senate overturned a Biden-era waiver that enabled California and a contingent of Democratic-led states to enforce zero-emission requirements for the sale of new passenger vehicles. After several hours of debate and testimony, legislators struck down a landmark regulation that aimed to drastically accelerate electric vehicle sales in California and nearly a dozen other states that chose to follow its lead, substantially reducing air pollution and planet-warming carbon emissions from tailpipes.

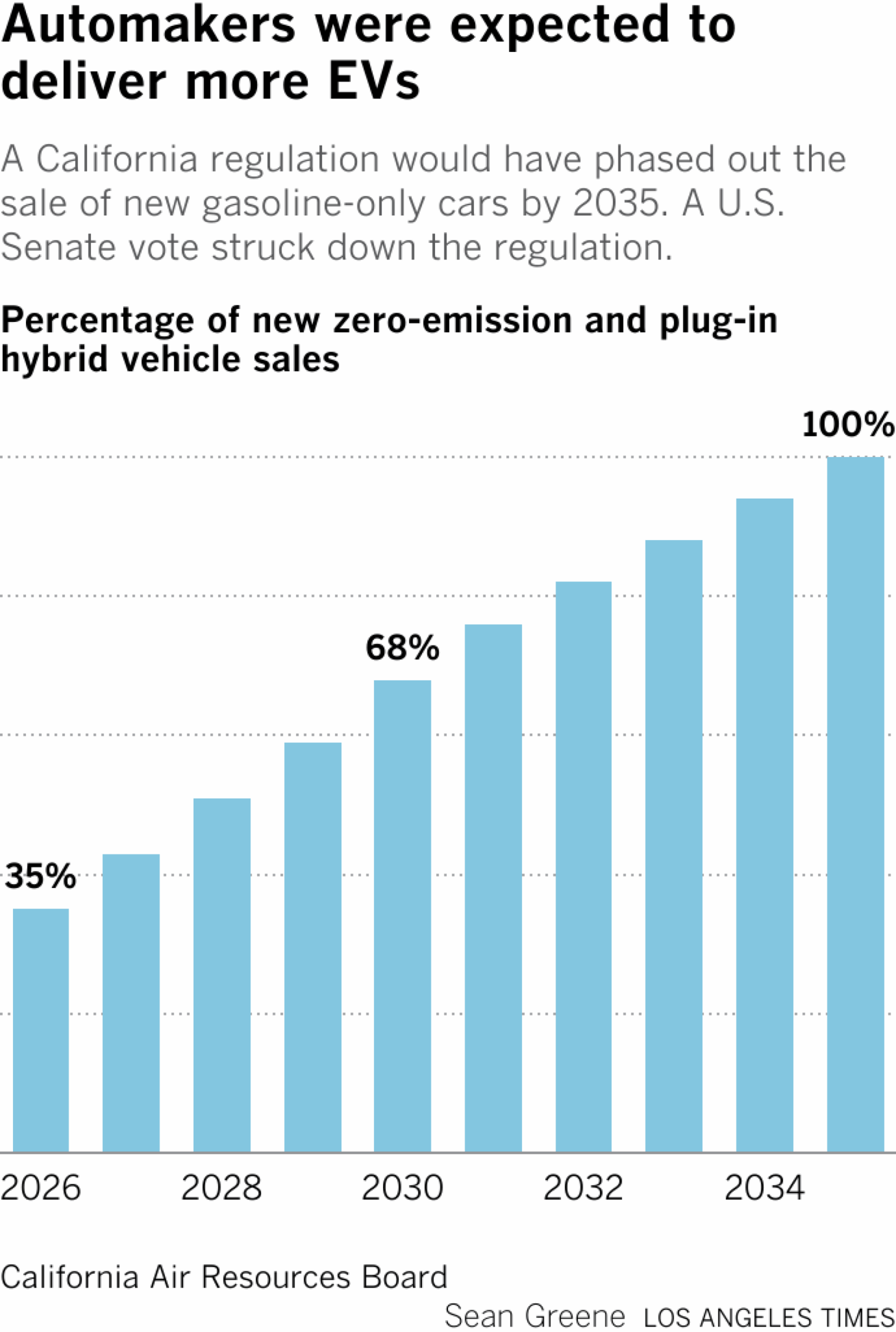

The Advanced Clean Cars II rule, enacted in 2022 by the California Air Resources Board and granted a federal waiver by the Biden administration’s Environmental Protection Agency in December 2024, required car manufacturers to sell an increasing percentage of zero-emission or plug-in hybrid vehicles to California dealerships over the next decade. Starting next year, the rule would have mandated that 35% of all new vehicles supplied to California dealerships be zero-emission vehicles or plug-in hybrids. By 2035, it would’ve prohibited the sale of new, gas-only cars statewide.

By invalidating the rule, Republican senators stamped out one of California’s most ambitious environmental policies and, more broadly, challenged the state’s authority to enact vehicle standards to combat its notoriously unhealthy air quality. If the measure is signed into law by President Trump and survives impending legal challenges, the vote would serve as a coup de grace to the state’s decades-long efforts to comply with federal smog standards in Southern California and meet California’s own ambitious climate goals.

The zero-emission requirements were expected to eliminate nearly 70,000 tons of smog-forming emissions and 4,500 tons of soot statewide by 2040, preventing more than 1,200 premature deaths and providing $13 billion in public health benefits, according to the California Air Resources Board. It also was expected to prevent the release of 395 million metric tons of carbon emissions — roughly the amount released by 100 coal plants in a year.

Ahead of the vote, Sen. Adam Schiff (D-Calif.) warned that nullifying this rule and stripping California’s regulatory power would have serious health effects across the state.

“We are sowing poison seeds for the future,” Schiff said. “Seeds that will grow to be more asthma and more sickness and more hospitalization and more death. That is the bleak but blatant reality of what we are debating here today.”

Republicans, however, argued that California’s zero-emission requirements threatened to cripple the American auto industry and significantly limit the options for car buyers. In the coming days, Republicans plan to undo additional California clean-air rules that require the state’s heavy-duty truck fleet to adopt cleaner engines and a growing percentage of zero-emission vehicles.

“Democrats have this delusional dream of eliminating gas-powered vehicles in America,” Sen. John Barrasso (R-Wyo.) said Tuesday from a lectern on the floor of the U.S. Capitol. “They want to force-feed electric vehicles to every man and woman who drives in this country. Well, Republicans are ready to use the Congressional Review Act to end this Democrat electric vehicle fantasy.”

Republicans moved ahead with the vote despite the warnings from the Government Accountability Office and the Senate Parliamentarian that the waivers could not be overturned with the Congressional Review Act — a law that was meant to allow legislators to inspect and potentially block federal rules adopted in the waning days of a previous presidential administration.

Sen. Alex Padilla (D-Calif.), the ranking member of the Senate Committee on Rules and Administration, said the vote was a flagrant abuse of the Congressional Review Act. He threatened to block or delay the confirmation process for four Trump nominees to the U.S. Environmental Protection Agency if Senate Republicans voted to overturn California’s vehicle emission standards.

“It appears that Republicans want to overturn half a century of precedent in order to undermine California’s ability to protect the health of our residents by using the Congressional Review Act to revoke California’s waivers that allow us to set our own vehicle emission standards,” Padilla said. “Republicans seem to be putting the wealth of the big oil industry over the health of our constituents.”

Environmental advocates, many of whom had spent years supporting California’s emissions standards, expressed their disappointment in the vote.

“This is a major blow to the decades-long public health protections delivered under the Clean Air Act,” said Will Barrett, senior director of nationwide clean air advocacy for the American Lung Assn. “It is more important than ever that California and all other states that rely on Clean Air Act waivers continue to cut tailpipe pollution through homegrown, health-protective policies.”

Because of its historically poor air quality, California has been an innovator in clean car policy, enacting the nation’s first tailpipe emissions standards in 1966. California was later granted the special authority to adopt vehicle emission standards that are more strict than the federal government’s under the Clean Air Act. But the state must seek a federal waiver from the U.S. EPA for any specific rule to be enforceable.

In the five decades since then, the state has enacted dozens of rules to reduce air pollution and planet-warming greenhouse gases. Padilla stressed that these rules were largely meant to alleviate lung-aggravating smog, which was a persistent threat where he grew up in Los Angeles.

“On a pretty regular basis, we would be sent home from grade school because of the intensity and dangers of smog that settled over the San Fernando Valley,” Padilla said. “That’s the case for far too many Californians, still to this day. But it’s the reason why, decades ago, Congress recognized both California’s unique air quality challenges and its technical ingenuity, and granted California special authority to do something about it.”

Due to its enormous economy and population, automakers have conformed to California’s rules. In addition, many Democrat-led states have chosen to adhere to California’s auto emissions rules, applying more pressure on car companies first to make cleaner engines and later to manufacture more electric vehicles.

California leads the nation in zero-emission vehicle sales. In 2023 and 2024, about 25% of new cars sold in California were zero-emission or plug-in hybrids, according to the California Energy Commission. This year, the share of zero-emission vehicle sales has slightly slumped, making up only 23% of light-duty vehicle sales.

But the Advanced Clean Cars II rule would require a jump in zero-emission sales next year, with at least 35% of vehicles supplied to car dealer lots to be zero-emission or plug-in hybrids.

Mike Stanton, president of the National Automobile Dealers Assn., contended that consumer demand for electric vehicles falls far below California’s requirements, in part, because of unreliable charging infrastructure.

“Banning gas and hybrid cars is a national issue that should be decided by Congress, not an unelected state agency,” Stanton wrote in a letter to senators, referring to the California Air Resources Board.

In February, EPA administrator Lee Zeldin brought the Biden-era waivers to Congress, suggesting that they were federal rules that had not been reviewed. However, none of California’s waivers for the state’s vehicle emission standards had been brought before Congress for review, because they were largely regarded as administrative orders.

The House of Representatives voted this month to advance the resolution to the Senate. Thirty-five Democratic lawmakers, including California Reps. George Whitesides (D-Agua Dulce) and Lou Correa (D-Santa Ana), joined with the Republican majority.

In the Senate, the 51-44 vote was split along party lines.

Experts say the Senate vote could have lasting implications for congressional procedures.

To topple California auto emission standards, Senate Republicans controversially invoked the Congressional Review Act, a 1996 law that allows an incoming Congress to rescind major federal rules approved near the end of a previous presidential administration. This process notably allows federal legislators to bypass a filibuster and requires only a simple majority to repeal federal rules rather than the typical 60 votes.

However, the Government Accountability Office, a nonpartisan government watchdog, said federal waivers for California emission standards were not subject to the Congressional Review Act, because the federal waiver is technically not a rule; it’s an order. The Senate Parliamentarian, a non-partisan advisor to the congressional body, upheld that interpretation, ruling that the Senate couldn’t use the Congressional Review Act to repeal California’s waivers.

The Senate vote proceeded in defiance of the parliamentarian’s ruling, marking a stunning rebuke of congressional norms.

The decision by Republican senators amounted to a “nuclear option” that would set a dangerous precedent, Padilla said.

“The old adage says, ‘What goes around comes around,’” he said. “It won’t be long before Democrats are once again in the driver’s seat, in the majority once again. And when that happens, all bets would be off.”