Want Decades of Passive Income? Buy This ETF and Hold It Forever.

Contrary to a common assumption, not every investment forces you to make a major either/or trade-off. You can have (most of) the best of both worlds.

If you’re looking for a low-maintenance income-generating investment that you can buy and hold indefinitely, an exchange-traded fund (ETF) is an obvious choice. And you’ve certainly got plenty of options.

Not all dividend ETFs are the same, though. There are better options than others. In fact, if you’re looking for a great all-around dividend-paying exchange-traded fund to buy and hold forever, one stands out above them all.

And it’s probably not the one you think it is.

More to the matter than mere yield

If you’ve done any amount of digging into dividend ETFs as a category, then you likely already know that the Schwab U.S. Dividend Equity ETF (SCHD 0.79%) currently boasts a trailing yield of 3.9%. That’s huge for a fund of this size and ilk (quality blue chip stocks), even topping the 2.5% yield you can get from the Vanguard High Dividend Yield ETF (VYM 0.44%) at this time.

Image source: Getty Images.

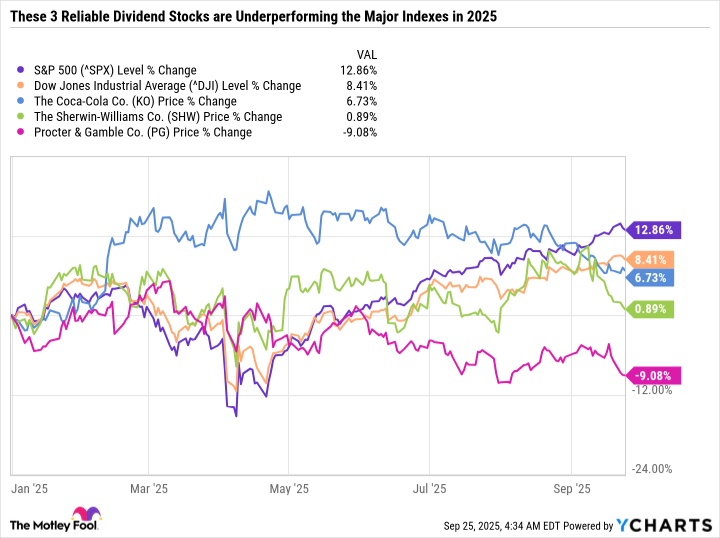

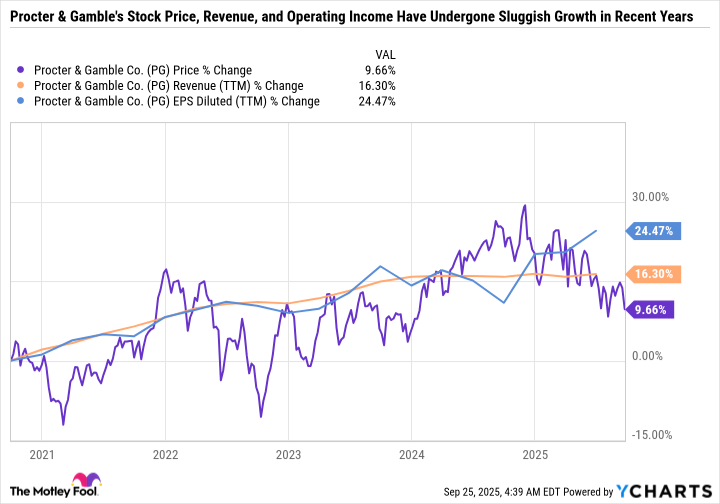

There’s more to the matter than merely plugging into a fund when its yield hits a particular number, however. Is the current dividend sustainable? Does it have a history of growing its payouts enough to keep up with inflation? Is the ETF also producing enough capital appreciation? When you start asking these questions, the Schwab U.S. Dividend Equity fund doesn’t exactly shine. It has underperformed the S&P 500 (^GSPC 0.53%) as well as most of the other major dividend funds since 2023, for instance, mostly because the Dow Jones U.S. Dividend 100 index that it mirrors doesn’t hold many — if any — of the tech stocks that have been lifted by the artificial intelligence megatrend.

That’s not inherently a bad thing, mind you. There may well come a time when these technology stocks struggle more than most while demand reignites for the components of the Dow Jones U.S. Dividend 100. Nevertheless, even factoring in its above-average dividend, the Schwab U.S. Dividend Equity ETF’s lingering subpar overall performance has made it tough to own for a while now. There’s also no obvious reason to think that relative weakness will soon end.

The best all-around choice

So which fund is the ideal all-around buy-and-hold “forever” dividend ETF? For many income-minded investors, it’s going to be the iShares Core Dividend Growth ETF (DGRO 0.53%).

It’s not a particularly popular fund. It has less than $35 billion in its asset pool, for perspective, versus more than $100 billion for the massive Vanguard Dividend Appreciation ETF (VIG 0.27%). Schwab’s U.S. Dividend Equity ETF is more sizable as well, with about $70 billion under management. You can also find yields better than DGRO’s current trailing yield of just under 2.2%.

Don’t let its smallish size and average yield fool you, though. The iShares Core Dividend Growth ETF packs enough punch where it counts the most. And it’s capable of packing this punch indefinitely.

This fund tracks the Morningstar US Dividend Growth Index. Like all of Morningstar‘s dividend growth indexes, this one only includes companies that have a track record of at least five straight years of annual payout hikes. It also excludes the highest-yielding 10% of stocks based on the premise that an unusually high yield can be a warning that trouble’s brewing for a business. In this vein, the index also excludes stocks of companies that pay out more than 75% of their earnings in the form of dividends.

Where the Morningstar US Dividend Growth Index really differentiates itself, however, is in the size of each position it holds. Although no holding is allowed to make up more than 3% of its total portfolio, its positions are weighted in proportion to the value of the stocks’ dividend payments. End result? This ETF’s biggest positions right now are Johnson & Johnson, Apple, JPMorgan Chase, Microsoft, and ExxonMobil. That’s an incredibly diverse group of stocks, although the fund’s other 392 holdings aren’t any less diverse.

Sure, many of these holdings don’t exactly boast massive dividend yields. Plenty of them do have impressive yields, though, and the ones that don’t are supplying value via price appreciation. It’s the balanced weighting of these different kinds of stocks that makes this ETF such a reliable overall performer.

The irony? Despite holding many low-yielding tickers of companies that don’t exactly prioritize their dividend payments, this fund’s quarterly per-share payment has nearly tripled over the course of the past decade. You’d be hard-pressed to find better from an ETF that also produces this kind of capital appreciation.

No compromise needed

None of this is to suggest that it would be a mistake to own any other income-focused exchange-traded fund. There are perfectly valid reasons for investing in something like the Schwab U.S. Dividend Equity ETF at this time, for instance, such as an immediate need for an above-average yield. It’s also not wrong to own more than one kind of dividend ETF, diversifying your investment income streams.

If you just want a super-simple dividend income option that you can buy and hold forever, though, the iShares Core Dividend Growth ETF is a fantastic but often overlooked choice. Unlike too many other investment options, with DGRO, you don’t have to sacrifice too much growth in exchange for reliable dividend income, or vice versa. It’s a balance of (nearly) the best of both worlds.

The only thing you can’t really get from the iShares Core Dividend Growth fund is a hefty starting dividend yield, but most long-term investors will consider that a fair trade-off.

JPMorgan Chase is an advertising partner of Motley Fool Money. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, JPMorgan Chase, Microsoft, Vanguard Dividend Appreciation ETF, and Vanguard Whitehall Funds-Vanguard High Dividend Yield ETF. The Motley Fool recommends Johnson & Johnson and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.