How ‘The Paper’ creators find humor in a struggling industry

This article contains spoilers from the first season of “The Paper.”

The journey to spin off the U.S. version of “The Office” has, until now, been long and slow. (That’s what she said.)

While the unconventional workplace comedy about a humdrum band of paper company employees, adapted from a beloved British series of the same name, famously got off to a sluggish start on NBC with a low-rated six-episode first season, it became a rare case study of how a risky gamble can become a pop culture phenomenon and one of the most popular sitcoms in TV history. Talks of expanding “The Office” universe began as early as Season 3, when another office branch was introduced. “Parks and Recreation” was initially conceived as a spinoff but morphed into a standalone series. Another centered on socially awkward Dwight Schrute (Rainn Wilson) would get dropped. The series eventually ended its nine-season run in 2013 with no offshoot. But it still managed to have an afterlife without one, as fans obsessively continued to watch it in syndication or on streaming platforms.

Once “The Office” began making headlines in 2020 for the being the most streamed show in America, Greg Daniels, who captained the U.S. adaptation and was initially concerned about tarnishing its legacy with offshoots, was coming around to the idea that it was safely insulated enough to withstand any attempt to find a way to build out its kooky world.

Finally, more than a decade after “The Office” went off the air, Peacock is hoping the spinoff series “The Paper” can recycle some of that show’s success while finding its own path.

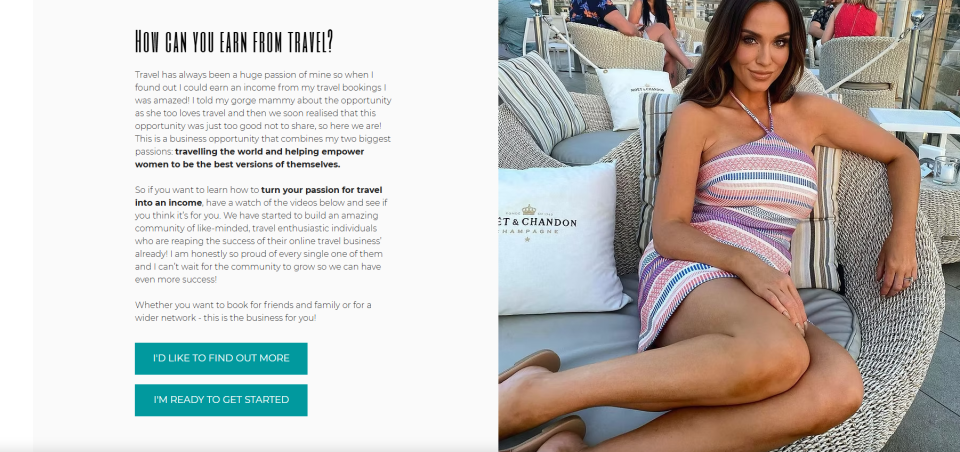

In “The Paper,” Domhnall Gleeson, left, stars as editor in chief Ned Sampson, and Tim Key plays executive Ken Davies.

(Aaron Epstein / Peacock)

This series shifts its focus to the staff at the Toledo Truth Teller, a struggling local newspaper in Ohio, which is being filmed by the same documentary crew that followed bumbling boss Michael Scott (Steve Carell) and his Scranton, Pa.-based Dunder Mifflin employees. (It’s a believable documentary subject when you consider the U.S. has lost more than one-third of its newspapers since 2005.) Daniels created the series with Michael Koman (“Nathan For You,” “How to With John Wilson”).

All 10 episodes of the first season were released Thursday on Peacock, and the show has been picked up for a second season. Daniels and Koman visited The Times earlier this month — and spoke in follow-up video calls — to discuss the comedy potential of a beleaguered industry, why Oscar is the obvious choice to be the crossover character in the spinoff and whether they plan to reference the president’s comments about the press. These are edited excerpts from the conversation.

The series was originally going to launch with four episodes, then switch to a weekly drop. But it was recently announced that the full season is dropping at once. What happened? And do you have strong feelings about release models?

Daniels: Every company is different. I do know that they’re [NBCUniversal] being incredibly supportive and there’s a giant team gaming out every move. I trust that they have the best of intentions and have a lot of good strategy. My inclination was always to sneak on the air without any fanfare whatsoever, and then maybe advertise after — that is very naive, apparently. One possible nice thing about it being handled this way is our superfans will be able to watch at their own convenience, and maybe before they’ve seen too many promos. I’ve always felt like the show was cut to be the introduction to the show itself. And the more you know jokes you see from later in the seasons, the more you’re coming at it with an unintended awareness of what’s to come. It may play better, just clean for all the superfans. Actually, I thought at first, the pace-out model would be good because that was how “The Office” was on NBC. But they did point out to me that probably the majority of “The Office” fans have watched it on streaming, where they could binge the whole thing.

Koman: It’s not really my area, but that’s how I like to watch things. I’m always happy when it’s up to me — I can make my own schedule, and I tend to watch things quickly.

The crisis facing local journalism doesn’t feel like an obvious backdrop for comedy — and if you’re in it, it’s more of a can’t-help-but-laugh–to-keep-from-crying vibe. How did you arrive at a newsroom as your backdrop and what was the pitch?

Daniels: You wouldn’t think that selling stationary was a particularly hilarious or glamorous place to set a show. I think that there are some intentional differences with this show, and in the sense that we didn’t want to repeat aspects of “The Office.” For me, I was incredibly protective of the original show and the cast. I just waited a long time to do something like this. The original “Office” cast was very supportive by the time it came about. Since it’s a documentary, if you’re going to really commit to that device, you have to think all the time about [how] there’s really camerapeople in the room; they’re trying to cover something; they wouldn’t be there to just cover what they thought was a funny workplace. They’re there to cover an actual story. And the hollowing out of local newspapers is an interesting story that you could imagine a documentary crew from PBS being like, “Oh, this is a good story.” Of course, since it’s a comedy show, the stuff that’s happening in the background is really the point of the show — all the funny interactions with people as they try to do stuff. Another way that we wanted it to be different was the whole interaction between Michael Scott and his staff — he was not a very inspirational boss, and Ned Sampson, played by Domhnall Gleeson, comes in and he does manage to inspire the people working there. And the question is more: Is he biting off way more than he can chew and his staff can chew? Or should they be right and believing in him?

Koman: I just think reality always makes the best backdrop. And it’s good if your characters are facing a challenge and you have something to root for.

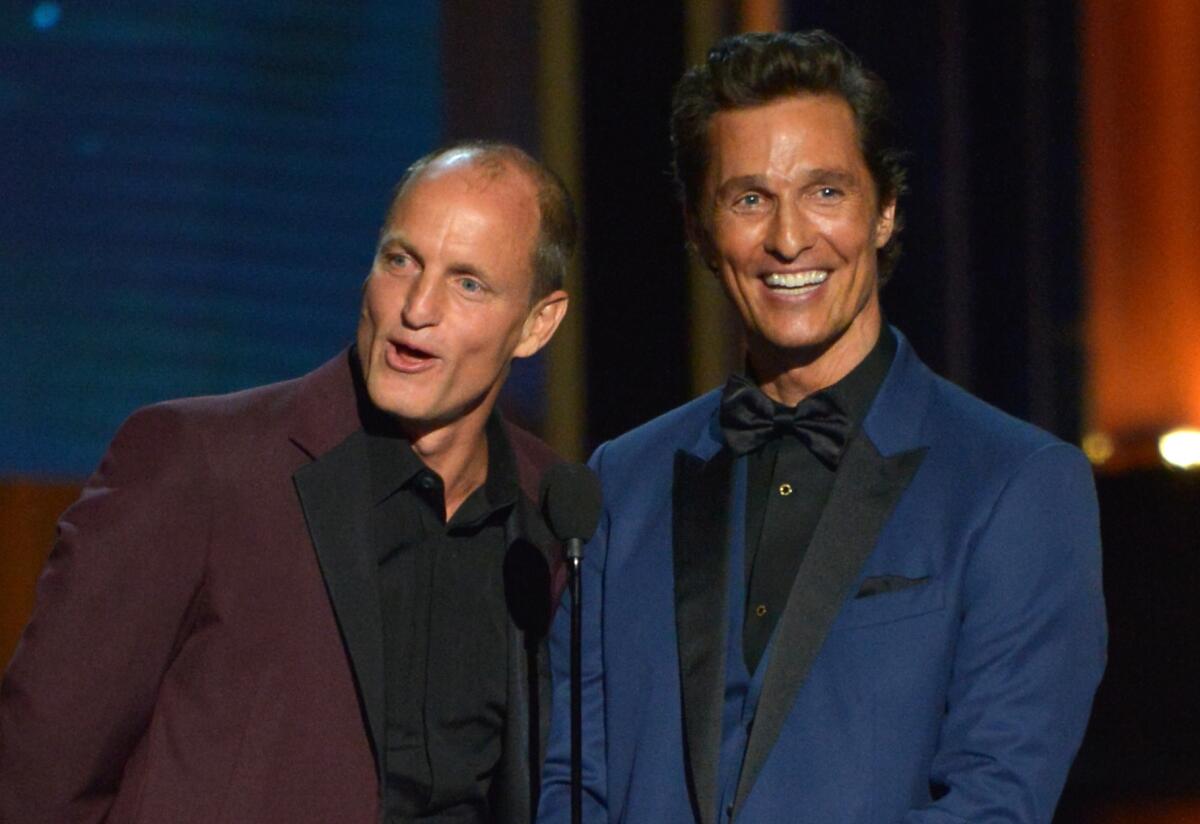

1. Clockwise from top left: Rainn Wilson as Dwight Schrute, Jenna Fischer as Pam Beesly, John Krasinksi as Jim Halpert, BJ Novak as Ryan Howard and Steve Carell as Michael Scott in “The Office.” 2. Carell, Krasinksi and Wilson in a scene from the NBC comedy. (Justin Lubin / NBC Universal)

How did you land on Toledo?

Daniels: That was really about the alliteration of the Toledo Truth Teller. There’s something about the Cleveland Plain Dealer that I think is a super interesting thing. The name of it, I thought, has always been very intriguing. It kind of reminds you of the independence of these big Midwestern newspapers, which is different from now. It really feels like the big newspapers are L.A., New York, Washington, Dallas. I know the Cleveland Plain Dealer is still quite healthy, which is great. But there is something about the Midwest that feels nostalgic.

Koman: If I think of the heyday of print journalism, Ohio is just a place that comes to mind. They had so many really important newspapers and great journalists that came out of there, so it just seemed like … if somebody was going to try to revive something, that’s a state, and Toledo itself, is a place where you can see it happening.

Daniels: Toledo also has a certain “Office-y,” Scranton thing to it. There was a time where we were looking at where the other locations that Dunder Mifflin has offices. And the list is very funny. It’s like Yonkers and Nashua, New Hampshire. It’s all these words that are just kind of fun to roll off your tongue.

Greg, you had been resistant to the idea of expanding “The Office” universe. “Parks and Recreation” was originally meant to be a spinoff, but it eventually evolved away from that. Why now? What changed?

Daniels: There’s two questions. One is, why now? And part of that is that “Upload” [Daniels’ Prime Video series] is wrapping up. When we first started discussing it, I didn’t know what was going to happen with “Upload.” I had sold it and I was committed to being the showrunner and it kept getting picked up, so I kept having to put off thinking about any kind of [“The Office”] spinoff. But [the final season of] “Upload” is dropping Aug. 25. The other part of your your question — over the years, since the finale, the show had this enormous blow-up on Netflix. It just felt like this show is pretty bulletproof at this point. Even if we did a s— job with a spinoff, it’s not going to go back in time and mess up “The Office,” which was my concern. “The Office” was such a beautiful and rare confluence of the cast and the time and the format and the writers and everything — it seemed very arrogant to think you could pull that off again. But then after a while, it’s like, “Well, you got to try.” You can’t be intimidated out of ever doing anything.

Greg Daniels says the staff of a struggling newspaper is as relatable as their Dunder Mifflin predecessors: “That quality of morale being low is very ‘Office’-like. The tone is intended to be similar without having the characters be similar.”

(Jason Armond / Los Angeles Times)

How did you arrive at former Dunder Mifflin accountant Oscar Martinez (Oscar Núñez) being the connecting character between the two shows?

Daniels: When you look at the finale of “The Office,” everybody was going off in their own direction that had a lot of, in my view, meaningful wrap-up of their story. Jim and Pam were moving to Boston with Darrell; Toby was in England. But Oscar didn’t really have a big arc. He was pretty much Oscar the whole way through, and it didn’t feel like it was going to undo anything with “The Office” to keep Oscar involved.

Koman: It made sense, just on a business level, that if one company was acquired by another, that some people would move over into that company. He was the one person who, I think, would have stayed.

Daniels: He was maybe the most self-possessed. He had the most dignity, I think, of most of the characters. The idea that the crew has found him again just seemed appropriate. He did run for elective office at the end of “The Office,” so I feel like he is susceptible to being inspired and do something for his community, so he seems like a person who could buy into what Ned is selling.

Koman: Also, he has kind of a cosmopolitan personality. The city is like a third larger than Scranton.

Greg, you gave us one of the great will–they/won’t–they relationships in TV history with Jim and Pam. There are a couple of office romances brewing on “The Paper.” The season ends with Ned and Mare (Chelsea Frei) kissing. Is there a specific challenge with crafting a slow burn in the streaming era? How did you want to approach things this time around?

Daniels: You need to have stakes in stories. If you’re going to be very realistic and relatable, the stakes in people’s stories are mostly romantic because most people don’t battle aliens to save the world or whatever. So, the highest stakes a normal person usually has is who they’re going to marry or who they’re seeing, or what drama they’re in in their personal lives. There’s a column the New York Times does about people who are getting married, how-they-met kind of thing, which I love, and you realize that there’s hundreds and hundreds of stories of how people meet. It’s not all Sam and Diane or Pam and Jim. My aim would be to not have the audience be like, “Who’s the next Pam and Jim? Is that Pam and Jim?” That’s their relationship. Those two actors were brilliant. You can’t replicate it, but it doesn’t mean that other characters aren’t going to be romantically interested in each other.

Pam Beesly (Jenna Fischer) and Jim Halpert (John Kraskinski), the friends-to-lovers duo affectionately known as JAM, in a scene from “The Office.” (Paul Drinkwater/NBC)

“The Paper” features characters like interim managing editor Esmeralda (Sabrina Impacciatore), compositor turned reporter Mare (Chelsea Frei) and new boss Ned (Domhnall Gleeson). Mare and Ned have a will-they/won’t-they dynamic in the sitcom. (Aaron Epstein/Peacock)

We had a sense, at least through Kelly Kapoor and her pop culture references, that “The Office” took place in our shared reality, but it didn’t directly comment on real world matters. But considering the show’s setting and Ned’s idealism about the profession, with President Trump’s ongoing remarks about the press, can you see a day where those remarks or ideas are more directly referenced in some form? Or do you want to stay clear of that?

Daniels: I think there’s so many voices that [are] constantly talking about that, just from a comedy standpoint; I’m very tired of it. There’s also so many opinions that are so strong. My inclination is to do the fundamentals — it’s a character comedy. These are characters. They’re in a world of journalism [and it] has a lot of bumping between human beings and ethics, and to tell those stories is valuable. No matter what side you’re on, you can look at it and, hopefully, if there’s truth in what’s being presented, you can take something valuable away.

Koman: It’s important to think of this as a local paper. Their struggle is to credibly tell local stories, which is what I think the city needs, more than anything — a voice to just tell people what’s going on. Beyond that, I think the way that a culture will seep into a show like this — you should always have a sense of reality and that this is taking place in the present. I think of their minds as being focused on: How can we be a good news source for Toledo?

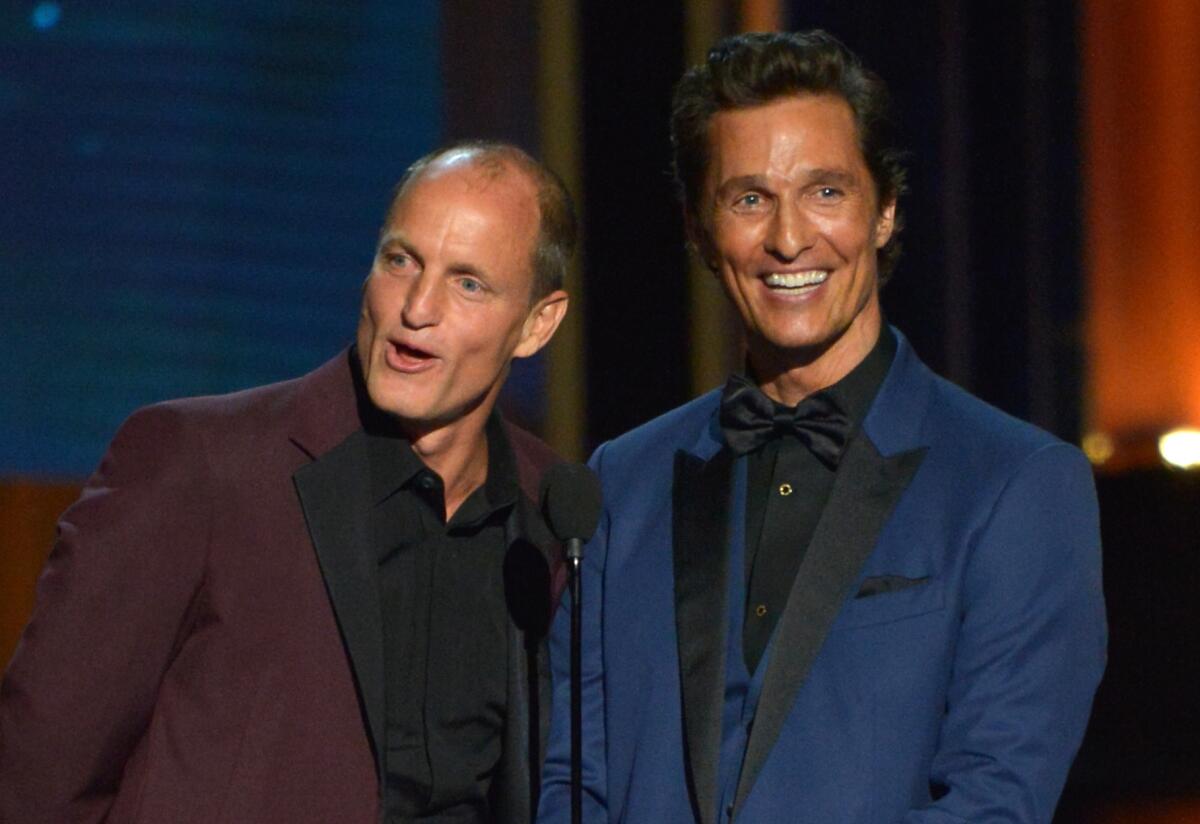

Michael Koman, who previously worked on docu-comedies “Nathan For You” and “How To With John Wilson,” on capturing the state of journalism realistically in “The Paper”: “What makes newspapers different than other businesses or other jobs is that people do arrive with a sense of enthusiasm for what they’re going to do. It seemed important that many of these people could have started their jobs like this, but now we’re meeting them at a point where that’s been tamped down enormously.”

(Jason Armond / Los Angeles Times)

The impulse when you hear about a spin-off or a reboot is to compare and to see who fits into what archetypes. Tell me about the types of characters you wanted to fill out in this newsroom.

Daniels: We tried to avoid that. What’s the point of doing something where everybody can go, “Oh, that’s the new Dwight”? They’re working in journalism and they have a very romantic, idealistic boss. He’s extremely interested in getting to the bottom of stories and being super rigorous and ethical, but he’s come in and replaced the temporary managing editor, Esmeralda, played by Sabrina Impacciatore, who has a very different view. She doesn’t really drill down that hard. She’s more about getting eyeballs.

Koman: What makes newspapers different than other businesses or other jobs is that people do arrive with a sense of enthusiasm for what they’re going to do. It seemed important that many of these people could have started their jobs like this, but now we’re meeting them at a point where that’s been tamped down enormously. Morale is low. In terms of who this group of people was, you could feel like that’s been dampened enormously and somebody new can come in who, either out of naivety or just optimism, thinks that he can revive it.

Daniels: That quality of morale being low is very “Office”-like. The tone is intended to be similar without having the characters be similar.

The title sequence is a montage of the various ways people make use of newspapers — rather than reading it. How would you describe your relationship to print journalism?

Daniels: When I first moved out here, I had a subscription to the L.A. Times, and the volume of papers was so gigantic, and it would come with these white ties to hold it all together. I built furniture in my apartment out of stacks of L.A. Times because they were so big. So it’d be like two weeks of them, I could make a stool and make a table with a full week’s worth stacked up.

Koman: Yes, I would say that digital media is all well and good until you need to pack glasses, then you hunt for a newspaper.

Daniels: One of my earliest memories is my parents trying to read the newspaper on their bed, and I wanted their attention, so I would roll onto the newspapers and look up at them, which would really irritate them. They were a big newspaper household.

Much like the news media, your industry is confronting budget constraints and technological disruption that is forcing changes to business models and programming strategies. What are your concerns about your industry right now?

Daniels: One of the big themes is the return to advertising. The streamers have all added ad tiers and that naturally is going to change the programming a bit. I don’t think, necessarily, [that] it’s bad. When you look at the heyday of Netflix, a lot of their biggest stuff had been developed under the old advertising model. I sometimes think about the French movie business, where it seems like they don’t care if something makes money or not. It’s just, if you’re in the club, you get to make movies over and over again. I’ve always felt like that there’s something more democratic about: You actually have to get people to watch your thing somehow.

Koman: The strangest thing about this industry is that it might change a lot, [but] the thing you’re making is a timeless product. You’re telling a story. There’s the part of it that is like, “Well, this will eventually be finished and will be presented somewhere” — and you have no control over how that’s going to change. But what you’re actually trying to make would have to hold up under any conditions.