3 Monster Stocks to Buy and Hold for the Next 10 Years

If you’re planning to be a long-term holder, make sure its stocks like these with durable competitive advantages.

If you’re looking for some monster returns, the stocks that can provide them come in many shapes and sizes. For this exercise, we’re going to identify three stocks that show significant revenue growth as well as improving free cash flow and gross margins.

These indicators emphasize better financial health, flexibility for growth, or returning extra value to shareholders. Here’s a look at three companies with rising top lines, while simultaneously bringing more dollars to their bottom lines.

One seller’s trash, another buyer’s treasure

First up is a company called Copart (CPRT -0.33%), which operates an online salvage-vehicle auctions that 11 countries across North America, Europe, and the Middle East. Copart makes over 3.5 million transactions annually through its virtual bidding platform that connects vehicle sellers with over 750,000 registered buyers.

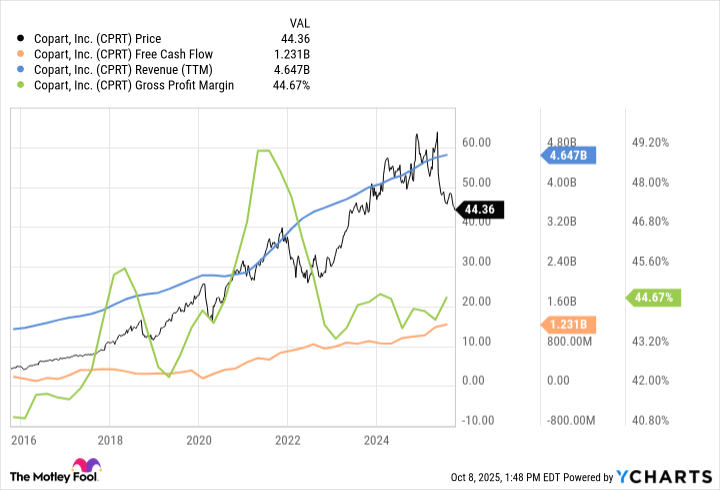

CPRT data by YCharts; TTM = trailing 12 months.

Copart has quickly grown into the largest online salvage-vehicle auction operator in the U.S. market and has grown its top line nearly fivefold since 2009 thanks to a strategy of land expansion and higher salvage volume. The company has contracts with large auto insurers, which have a plethora of vehicles deemed a total loss and sell them on consignment for high margins to dismantlers.

Image source: Getty Images.

Copart has been expanding. It’s crucial for the company to have ample land capacity to handle an influx of salvage vehicles on short notice and has nearly tripled its acreage since 2015, with an emphasis on areas at high risk of natural disasters. It’s also expanding into the salvage-vehicle resale process with offerings such as vehicle title transfer and salvage estimation services.

The company is expanding its business and its top line and has durable competitive advantages with the land it owns, creating a high-liquidity marketplace for buyers and sellers that isn’t easily replicable.

A recurring revenue dream

Autodesk (ADSK -2.19%) is an application software company servicing industries that span architecture, engineering, construction, product design and manufacturing, media, and entertainment. The company essentially enables the design, rendering, and modeling needs of those industries and has over 4 million paid subscribers across 180 countries.

Autodesk, while providing leading industry computer-aided design software, drives its success and durable competitive advantages through switching costs and network effects, which actually tend to reinforce each other. Widespread training on its software, often early in careers, not only gives people familiarity with the software, it also makes the cost of learning a competing software undesirable, unproductive, and time-consuming.

Furthermore, according to Morningstar, over 95% of its revenue is now recurring after the company transitioned away from licenses to a subscription model over the better part of the last decade. The change should enable the company to drive its top line even higher as it extracts more revenue per user with upsells and a more mature and loyal user base.

Autodesk even has upside if it can capture a chunk of the estimated 12 million to 15 million people using pirated versions of its software.

A hotel for every need

As of the end of 2024, InterContinental Hotels Group (IHG -1.01%) operated nearly 990,000 rooms across 19 brands that span from midscale through luxury segments. Holiday Inn and Holiday Inn Express are its largest and most recognizable brands, but it also has an assortment of lesser-known lifestyle brands that are recording strong demand.

While there’s a bit of U.S. economic uncertainty in the near term, InterContinental should be able to leverage its strong brand of assets to drive room share (i.e., market share) over the next decade. It has renovated and newer brands focusing on attractive midscale and extended-stay segments, as well as a loyalty program with roughly 145 million members to help drive growth.

The company also holds significant assets in international markets with those outside of the Americas generating 47% of total rooms for 2024, and it’s well positioned for the more than 1 billion middle-income consumers expected to be joining the global population over the next 10 years.

The company has over 99% of rooms managed or franchised, which provides an attractive recurring-fee business model highlighted by high return on invested capital (ROIC) as well as high switching costs for property owners.

Contracts often last from 20 to 30 years, also providing noteworthy cancellation costs for owners — all helping drive durable competitive advantages for IHG.

Are they buys?

For long-term investors, these three potentially monster stocks have proved they can rapidly grow their top line while also improving gross margins and pushing more dollars into free cash flow.

The kicker is that all three possess some form of competitive advantage that should sustain and enable growth over the next decade. If you’re looking for market beating returns, these three stocks are a great place to start your research — and perhaps a small position.