In 50-year fight to protect California’s coast, they’re still at it in their 80s

IMPERIAL BEACH, Calif. — Mike and Patricia McCoy answered the door of their cozy cottage in Imperial Beach, a short stroll from crashing waves and several blocks from the Tijuana River Estuary, where California meets Mexico and the hiking trails are named for them.

They offered me a seat in a living room filled with awards for their service and with books, some of them about the wonders of the natural world and the threat to its survival. The McCoys are the kind of people who look you in the eye and give you their full attention, and Patricia’s British accent carries an upbeat, birdsong tone.

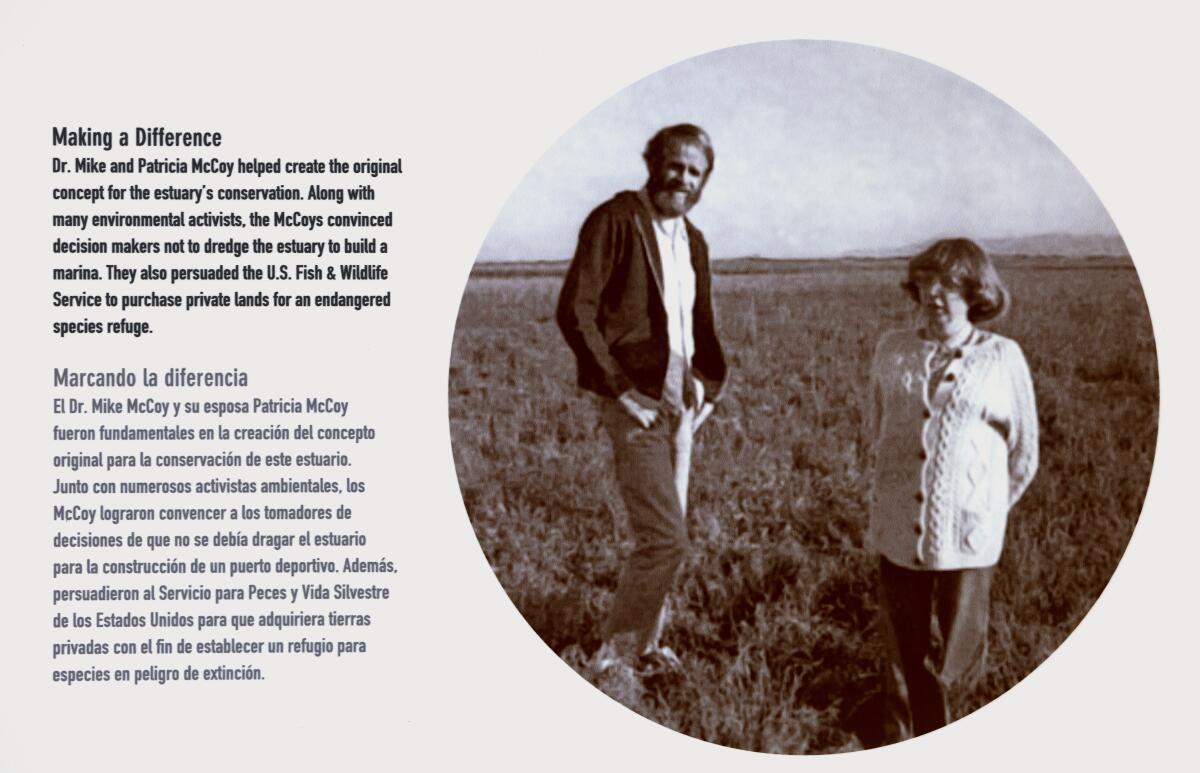

A sign shows coastal conservationists Mike and Patricia McCoy as young adults “Making a Difference” at the estuary.

(Hayne Palmour IV / For The Times)

In the long history of conservation in California, few have worked as long or as hard as the McCoys.

Few have achieved as much.

And they’re still at it. Mike at 84, Patricia at 89.

The McCoys settled in Imperial Beach in the early 1970s — Mike was a veterinarian, Patricia a teacher — when the coastal protection movement was spreading across the state amid fears of overdevelopment and privatization. In 1972, voters approved Proposition 20, which essentially laid down a hallmark declaration:

The California coast is a public treasure, not a private playground.

Four years later, the Coastal Act became state law, regulating development in collaboration with local government agencies, guaranteeing public access and protecting marine and coastal habitats.

During that time, the McCoys were locked in a fight worth revisiting now, on the 50th anniversary of the Coastal Act. There had been talk for years about turning the underappreciated Tijuana River Estuary, part of which was used as a dumping ground, into something useful.

Mike McCoy knew the roughly 2,500-acre space was already something useful, and vitally important. It was one of the last major undeveloped wetlands in Southern California and a breeding and feeding site for 370 bird species, along with fish, reptiles, rabbits, foxes, coyotes and other animals.

In McCoy’s mind, it needed to be restored, not repurposed. And certainly not as a giant marina, which would have destroyed a habitat that was home to several endangered species. At a 1977 Imperial Beach meeting packed with marina supporters, Mike McCoy drew his line in the sand.

The Tijuana Estuary in Imperial Beach is seen on Friday.

(Hayne Palmour IV / For The Times)

“I went up there,” McCoy recalled, pausing to say he could still feel the heat of the moment, “and I said, ‘You people, and I don’t care who you are, you’re not going to put a marina in that estuary. That’s sacrosanct. You don’t mess with that. That’s a fantastic system, and it’s more complex than you’d ever believe.’”

The estuary won, but the McCoys weren’t done. As I began talking with them about the years of advocacy that followed, Patricia’s modesty blushed.

“We don’t want to be blowing our own trumpet,” she said.

They don’t have to. I’m doing it for them, with the help of admirers who were happy to join the symphony.

Patricia went on to become a member of the Imperial Beach City Council and served for two years on the Coastal Commission, which oversees implementation of the Coastal Act. She also helped Mike and others take the estuary restoration fight to Sacramento, to Washington, D.C., and to Mexico.

“This is what a real power couple looks like,” said Sarah Christie, legislative director of the Coastal Commission. “They wield the power of nature and the power of the people. You can’t overstate their contribution to coastal protection.”

The McCoys’ signature achievement has been twofold, said Jeff Crooks, a San Diego wetlands expert. They helped establish the estuary as a protected wildlife refuge, and they also helped build the framework for the estuary to serve as a research center to monitor, manage and preserve the habitat and collaborate with other managed estuaries in the U.S.

“It’s been a living laboratory for 40-some years,” said Crooks, research coordinator for the Tijuana River National Estuarine Research Reserve.

Sewage and debris flow from Tijuana are an ever-present threat and decades-long source of frustration and anger in Imperial Beach, where beaches have been closed and some residents have planted “Stop the Stink” yard signs. Crooks said there’s been some progress on infrastructure improvements, with a long way to go.

Coastal conservationist Mike McCoy looks at a new interpretive sign at the Tijuana Estuary in Imperial Beach on Friday.

(Hayne Palmour IV / For The Times)

But “even though we’re beating it up,” Crooks said of the pollution flowing into the estuary, it’s been amazingly resilient in part because of constant monitoring and management.

Chris Peregrin, who manages the Tijuana Estuary for the state park system, said the nonprofit Tijuana Estuary Foundation has been a good partner, and the president of the foundation board is guess who:

Mike McCoy.

The foundation ”fills gaps that the state cannot,” Peregrin said. “As one example, they run the research program at the reserve.”

For all their continued passion about the mission in their own backyard, the McCoys fret about the bigger picture — the alarming increase in greenhouse gases and the biodiversity decline. Through the estuary window, they see a planet in peril.

“They both think big like that,” Crooks said. “Mike especially comes from the mindset that this is a ‘think globally and act locally’ kind of thing.”

“Restoration is the name of the game, not intrusion,” Mike told me, and he wasn’t talking just about the estuary.

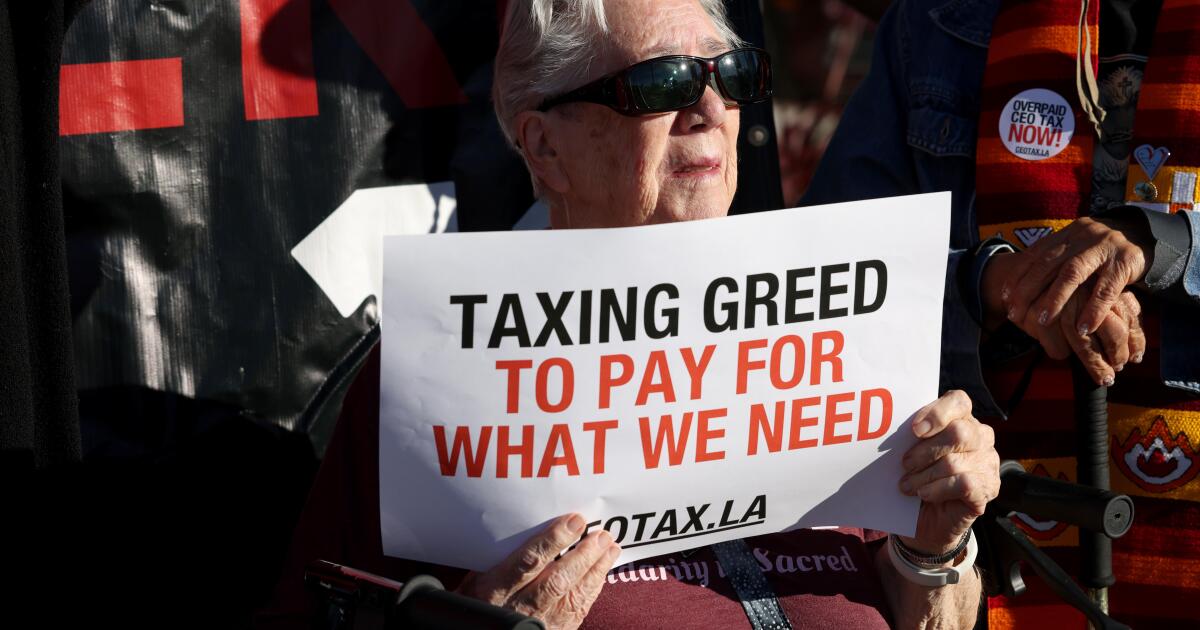

On the very week I visited the McCoys, the Trump administration delivered a crushing blow to the environmental movement, repealing a government finding that greenhouse gas pollution is a threat to the planet and public health. He called those claims, backed by overwhelming scientific consensus, “a giant scam.”

It’s easy to throw up your hands at such knuckle-dragging indifference, and Mike told me he has to keep reaching for more stamina.

But Serge Dedina, a former Imperial Beach mayor who was inspired by the McCoys’ activism as a youngster, sees new generations bringing fresh energy to the fight. Many of them work with him at Wildcoast, the international coastal conservation nonprofit he founded, with Patricia McCoy among his earliest collaborators.

“I wouldn’t be a conservationist and coastal activist without having worked with Patricia and Mike and being infused with their passion,” said Dedina. ”I think sometimes they underestimate their legacy. They’ve had a huge impact on a whole generation of scientists and conservationists and people who are doing work all along the coast.”

We can’t underestimate the legacy of the citizen uprising of 1972, along with the creation of an agency dedicated to coastal conservation. But it’s only fair to note, on the 50th anniversary of the Coastal Act, that not everyone will be reaching for a party hat.

The Coastal Act has been aggressively enforced, at times to a fault in the opinion of developers, homeowners, commercial interests and some politicians. Former Gov. Jerry Brown, who signed the act into law, once referred to Coastal Commission agency staffers as “bureaucratic thugs” for tight restrictions on development.

There’s been constant friction, thanks in part to political pressure and the clout of developers, and one of the many future threats to the core mission is the need for more housing throughout the state. The balance between new construction and continued conservation is sure to spark years of skirmishes.

Coastal conservationists Mike and Patricia McCoy on a trail named after them at the Tijuana Estuary Visitor Center in Imperial Beach.

(Hayne Palmour IV / For The Times)

But as the Coastal Commission website puts it in marking the anniversary, the major achievements of the past 50 years include the “wetlands not filled, the sensitive habitats not destroyed, the access trails not blocked, the farms and ranches not converted to urban uses, the freeways and gated communities and industrial facilities not built.”

In the words of the late Peter Douglas, who co-authored Proposition 20 and later served as executive director of the Coastal Commission, the coast is never saved, it’s always being saved.

Saved by the likes of Mike and Patricia McCoy.

I had the pleasure of walking through the estuary with Mike, past the plaque dedicated to him and his wife and “all who cherish wildlife and the Tijuana Estuary.” We also came upon one of the new interpretive signs that were to be dedicated Friday, including one with a photo of Mike and Patricia as young adults “Making a Difference.”

Mike pointed a finger here and there, explaining all the conservation projects through the year. We saw an egret and a rabbit, and when I heard a clacking sound, Mike brightened.

“That’s a clapper rail,” Mike said, an endangered bird that makes its home in the estuary.

The blowing of the trumpet isn’t just for the McCoys.

It’s a rallying call to those who might follow in their footsteps.

steve.lopez@latimes.com