The United States Senate narrowly passed President Donald Trump’s massive tax and spending bill on Tuesday, following intense negotiations and a marathon voting session on amendments.

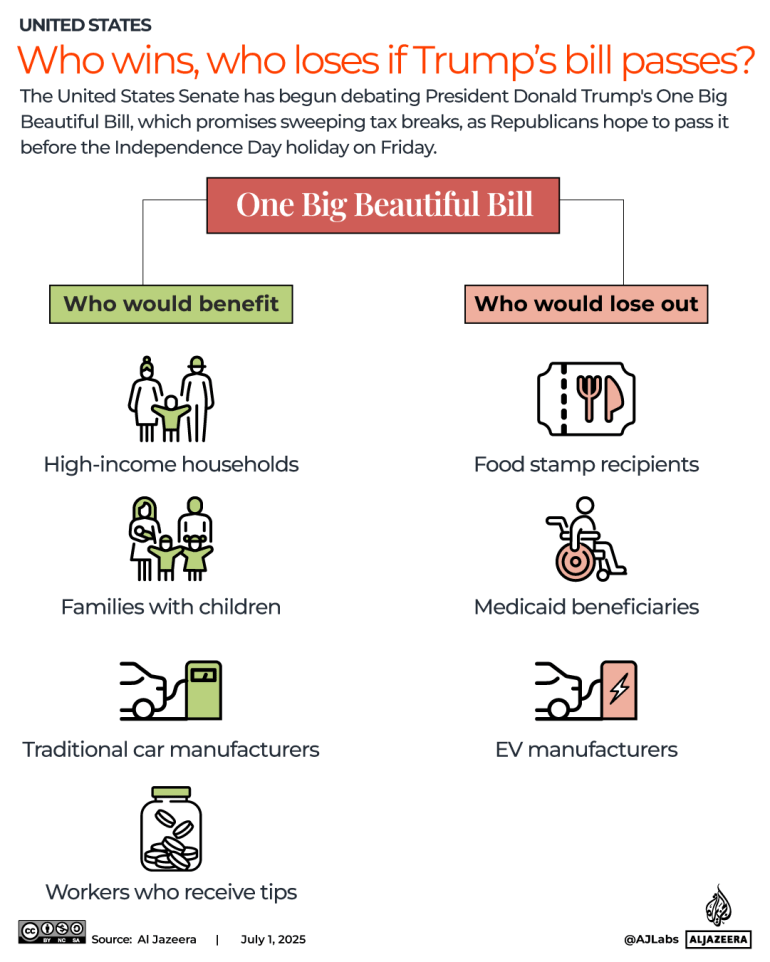

The bill, which still faces a challenging path to final approval in the House of Representatives, would impose deep cuts to popular health and nutrition programmes, among other measures, while offering $4.5 trillion in tax reductions.

The measure was approved after almost 48 hours of debate and amendment battles.

Here is what you need to know:

What is Trump’s ‘Big, Beautiful Bill’?

The bill is a piece of legislation that combines tax cuts, spending hikes on defence and border security, and cuts to social safety nets into one giant package.

The main goal of the bill is to extend Trump’s 2017 tax cuts, which are set to expire at the end of 2025. It would make most of these tax breaks permanent, while also boosting spending on border security, the military and energy projects.

The bill is partly funded by cutting healthcare and food programmes.

The nonpartisan Congressional Budget Office estimates Trump’s measure will increase the US debt by $3.3 trillion over the next 10 years. The US government currently owes its lenders $36.2 trillion.

The key aspects of the bill include:

Tax cuts

In 2017, Trump signed the Tax Cuts and Jobs Act, which lowered taxes and increased the standard deduction for all taxpayers, but it primarily benefitted higher-income earners.

Those tax breaks are set to expire this year, but the new bill would make them permanent. It also adds some more cuts he promised during his campaign.

There is a change to the US tax code called the SALT deduction (State and Local Taxes). This lets taxpayers deduct certain state and local taxes (like income or property taxes) on their federal tax return.

Currently, people can only deduct up to $10,000 of these taxes. The new bill would raise that cap from $10,000 to $40,000 for five years.

Taxpayers would also be allowed to deduct income earned from tips and overtime, as well as interest paid on loans for buying cars made in the US.

The legislation contains about $4.5 trillion in tax cuts.

Children

If the bill does not become law, the child tax credit – which is now $2,000 per child each year – will fall to $1,000, starting in 2026.

But if the Senate’s current version of the bill is approved, the credit would rise to $2,200.

Border wall and security

The bill sets aside about $350bn for Trump’s border and national security plans. This includes:

- $46bn for the US-Mexico border wall

- $45bn to fund 100,000 beds in migrant detention centres

- Billions more to hire an extra 10,000 Immigration and Customs Enforcement (ICE) agents by 2029 as part of Trump’s plan to carry out the largest mass deportation effort in US history.

Cuts to Medicaid and other programmes

To help offset the cost of the tax cuts and new spending, Republicans plan to scale back Medicaid and food assistance programmes for low-income families.

They say their goal is to refocus these safety net programmes on the groups they were originally meant to help, primarily pregnant women, people with disabilities and children – while also reducing what they call waste and abuse.

Medicaid helps Americans who are poor and those with disabilities, while the Supplemental Nutrition Assistance Program (SNAP) helps people afford groceries.

Currently, more than 71 million people depend on Medicaid, and 40 million receive benefits through SNAP. According to the Congressional Budget Office, the bill would leave an additional 11.8 million Americans without health insurance by 2034 if it becomes law.

Clean energy tax cuts

Republicans are pushing to significantly scale back tax incentives that support clean energy projects powered by renewables like solar and wind. These tax breaks were a key part of former President Joe Biden’s landmark 2022 law, the Inflation Reduction Act, which aimed to tackle climate change and reduce healthcare costs.

A tax break for people who buy new or used electric vehicles would expire on September 30 this year if the bill passes in its current form, instead of at the end of 2032 under current law.

Debt limit

The legislation would raise the debt ceiling by $5 trillion, going beyond the $4 trillion outlined in the version passed by the House in May.

Who benefits most?

According to Yale University’s Budget Lab, wealthier taxpayers are likely to gain more from this bill than lower-income Americans.

They estimate that people in the lowest income bracket will see their incomes drop by 2.5 percent, mainly because of cuts to SNAP and Medicaid, while the highest earners will see their incomes rise by 2.2 percent.

Which senators voted against the bill?

Republican Senator Susan Collins of Maine opposed due to deep Medicaid cuts affecting low-income families and rural healthcare.

Republican Senator Thom Tillis of North Carolina cited concerns over Medicaid reductions to his constituents. Tillis has announced that he will not seek re-election, amid threats from Trump that he would back a Republican challenger to Tillis.

Republican Senator Rand Paul of Kentucky voted “no” on fiscal grounds, warning that the bill would significantly worsen the national deficit.

Every member of the Democratic caucus, a total of 47 senators, also voted against the bill.

Who supported the bill in the Senate?

The remaining Republicans voted in favour, allowing the bill to pass 51–50, with the deciding vote cast by Vice President JD Vance.

Trump has set a July 4 deadline to pass the bill through Congress, but conceded on Tuesday that it would be “very hard to do” by that date, since the House now needs to vote on it. The House had passed an earlier version of the bill in May, but needs to look at it again due to the amendments brought by the Senate.

Notable Senator supporters include:

Senator Lisa Murkowski (representative of Alaska): Her backing was secured after Republicans agreed to Alaska-specific provisions, including delayed nutrition cuts and a new rural health fund, making her vote pivotal.

“I have an obligation to the people of the state of Alaska, and I live up to that every single day,” she told a reporter for NBC News.

Senators Rick Scott of Florida, Mike Lee of Utah, Ron Johnson of Wisconsin and Cynthia Lummis of Wyoming: These fiscally conservative senators shifted from hesitation to support following amendments to the bill.

Senate Majority Leader John Thune led the push to pass the legislation.

How have lawmakers and the public reacted?

Most Republican lawmakers celebrated it as a historic achievement.

Trump also expressed delight.

“Wow, music to my ears,” Trump said after a reporter told him the news. “I was also wondering how we’re doing, because I know this is primetime, it shows that I care about you,” he added.

Thune said after the vote: “In the end, we got the job done, and we’re delighted to be able to be partners with President Trump and his agenda.”

Democrats opposed it, calling it a giveaway to the wealthy at the expense of healthcare, food aid and climate policy.

“Today’s vote will haunt our Republican colleagues for years to come,” Democrat Chuck Schumer said in a floor speech after the vote.

“Republicans covered this chamber in shame,” he added.

The US Chamber of Commerce led a coalition of more than 145 organisations supporting the bill, emphasising it would “foster capital investment, job creation, and higher wages”.

They praised the permanent tax cuts and border security funding.

However, healthcare and hospital associations have warned that millions could lose coverage, driving up emergency and unpaid care costs. Environmental groups have also voiced strong opposition.

Public opinion on the bill is in decline, too.

“Initially, [Trump] had more than 50 percent of the support. Now, it is under 50 percent, and politicians know that,” Al Jazeera’s Alan Fisher said, reporting from Washington, DC.

“They are aware that this could lead to a cut in Medicaid. They are aware, even though Donald Trump had promised to protect it, that this could cut nutritional programmes, particularly for poorer families in the United States.

“And although they will get tax cuts, they have managed a lot of the time to be convinced by the Democratic argument that, yes, there are tax cuts, but billionaires will do much better out of this than the ordinary American people, and that is what’s changed the opinion polls,” he added.

What happens next?

The process begins with the House Rules Committee, which will meet to mark up the bill and decide how debate and consideration will proceed on the House floor.

After the bill passes through the Rules Committee, it will move to the House floor for debate and a vote on the rule, potentially as soon as Wednesday morning.

If the House of Representatives does not accept the Senate’s version of the bill, it could make changes and send it back to the Senate for another vote.

Alternatively, both chambers could appoint members to a conference committee to work out a compromise.

Once both the House and Senate agree on the final text, and it is passed in both chambers of Congress, the bill would go to Trump to be signed into law.