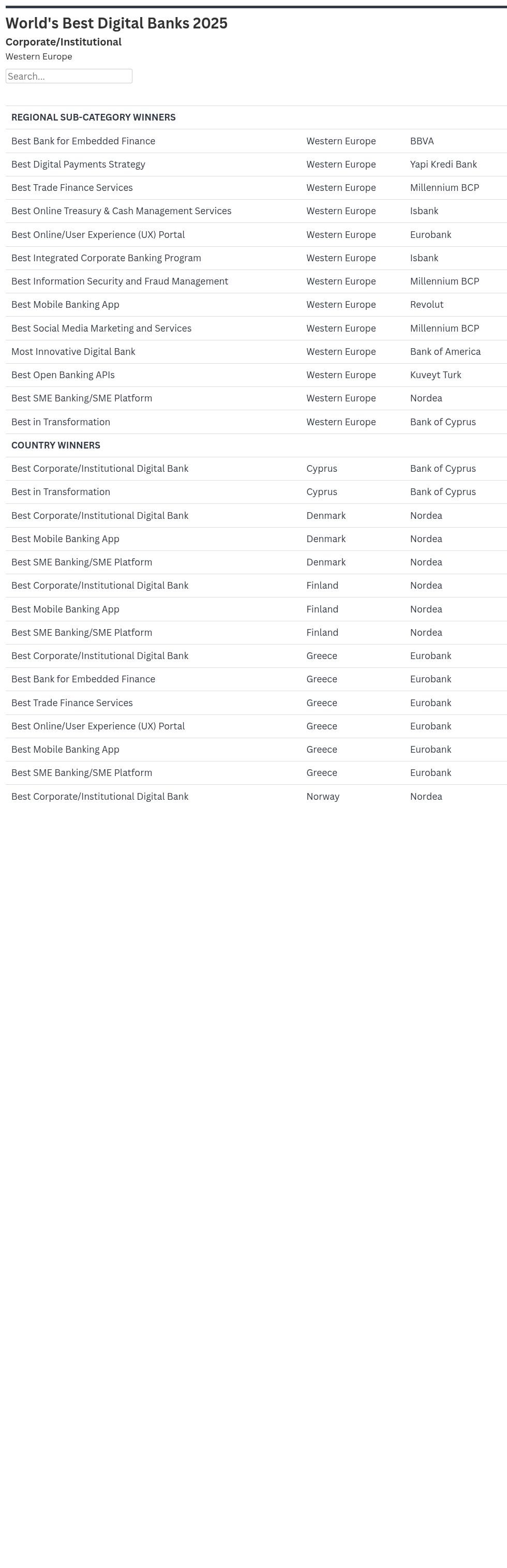

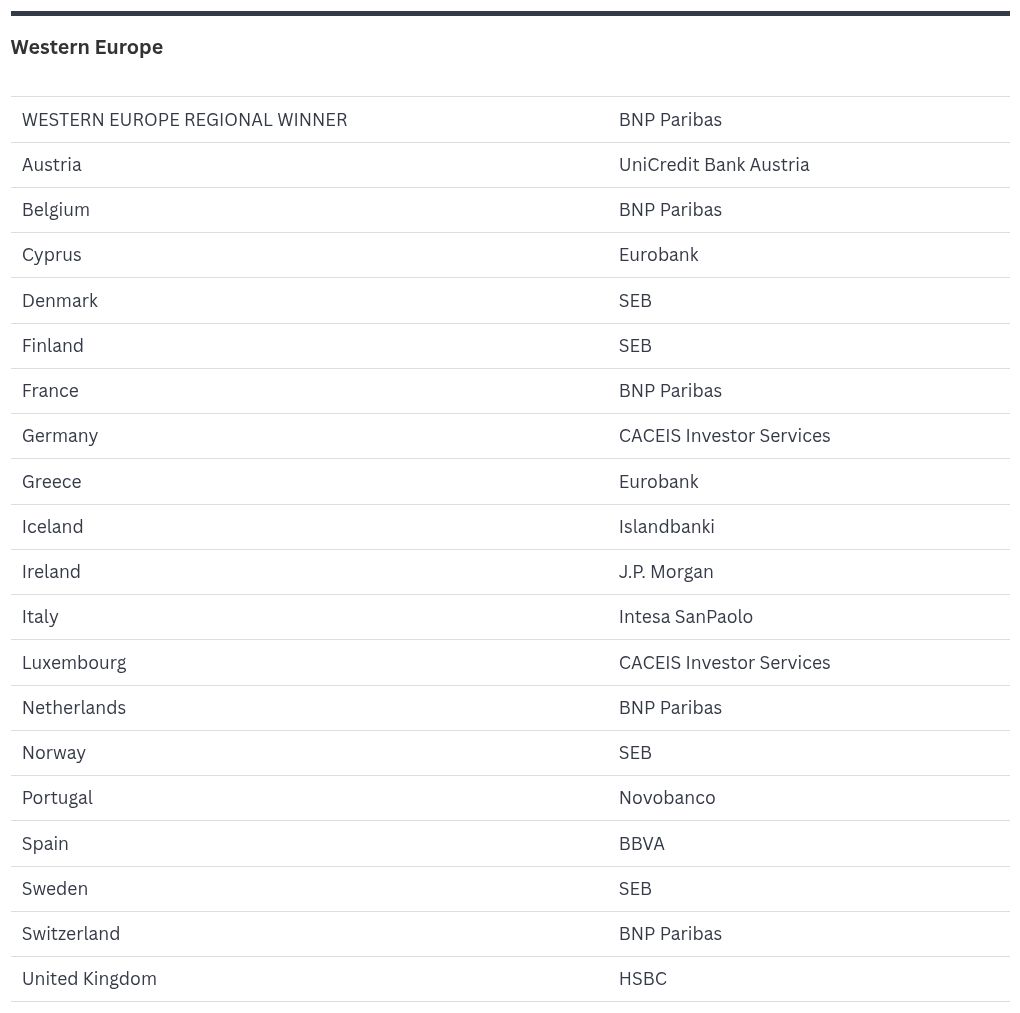

The 6 banks that are giving up to £200 free cash to customers

BRITAIN’S banks are giving away free cash payments of up to £200 each – and customers need to do one thing to be eligible to claim the money.

The extraordinary deals are being offered by major UK banks such as Lloyds and NatWest as part of the fight to boost customer numbers.

Nationwide is also among the list of banking giants handing out the free cash payments for changing bank accounts.

The deals are part of switching incentives, and also come with extra perks like cashback and savings rates well above the average.

Nationwide Building Society

The first bank on the list is giving out a handsome sum of £175 to customers who complete a full switch through the Current Account Switch Service (CASS).

Those joining can pick from three accounts: FlexPlus, FlexFirect or FlexAccount.

The FlexDirect account offers 5 per cent AER interest on balances up to £1,500 for the first 12 months.

It also offers 1 per cent cashback on debit card spending with a maximum of £5 per month.

Combining this with the switching bonus, cashback and interest, smart savers could horde up to £400 in free payments in the first year of joining.

Nationwide’s Director of Group Retail Products Tom Riley said: “It’s never been more rewarding to be a Nationwide member and that’s why we want to help more people benefit by offering this switching offer.”

The building society consistently ranks top for customer service and has already attracted over a million new customers through CASS since 2013.

Lloyds Bank

For a £200 free cash payment, Lloyds Bank is giving away bonuses to customers who make a switch.

People who move their existing account to a Club Lloyds or Lloyds Premier account can get the free cash.

But the payment comes on condition they set up three or more direct debits.

Lloyds Bank is one of the UK’s largest financial services organisations and serves tens of millions of Brits.

NatWest

For account holders switching with NatWest, customers can get up to £175 on one condition.

Those choosing a Select or Reward account can get the free cash.

But they must pay in £1,250 first.

And customers also need to login to the mobile app within 60 days.

Other major banks

RBS, part of NatWest Group, is also offering £175 for switching to a Select or Reward account, as long as they pay £1,250 and login to the app in 60 days.

First Direct is offering £175 for switching to its popular 1st Account.

Customers must pay in £1,000 minimum, set up two direct debits or standing orders, and make five debit card payments within 45 days.

The Co-operative Bank’s switch deal stands at £100, with customers able to make another £75.

Customers need to meet the same requirements as First Direct switchers over the next three months.

What energy bill help is available?

There’s a number of different ways to get help paying your energy bills if you’re struggling to get by.

If you fall into debt, you can always approach your supplier to see if they can put you on a repayment plan before putting you on a prepayment meter.

This involves paying off what you owe in instalments over a set period.

If your supplier offers you a repayment plan you don’t think you can afford, speak to them again to see if you can negotiate a better deal.

Several energy firms have schemes available to customers struggling to cover their bills.

But eligibility criteria vary depending on the supplier and the amount you can get depends on your financial circumstances.

For example, British Gas or Scottish Gas customers struggling to pay their energy bills can get grants worth up to £2,000.

British Gas also offers help via its British Gas Energy Trust and Individuals Family Fund.

You don’t need to be a British Gas customer to apply for the second fund.

EDF, E.ON, Octopus Energy and Scottish Power all offer grants to struggling customers too.

Thousands of vulnerable households are missing out on extra help and protections by not signing up to the Priority Services Register (PSR).

The service helps support vulnerable households, such as those who are elderly or ill.

Some of the perks include being given advance warning of blackouts, free gas safety checks and extra support if you’re struggling.

Get in touch with your energy firm to see if you can apply.

Financial expert Kate Steere said Nationwide’s package may be the best in value over 12 months, factoring in interest and cashback.

She said: “If you max out the savings and cashback alongside the switching bonus, you could be looking at nearly £400 in your first year.”

Lloyds is offering the highest single payout though, standing at £200 upfront.