Epstein’s shadow: Why Bill Gates pulled out of Modi’s AI summit | Technology News

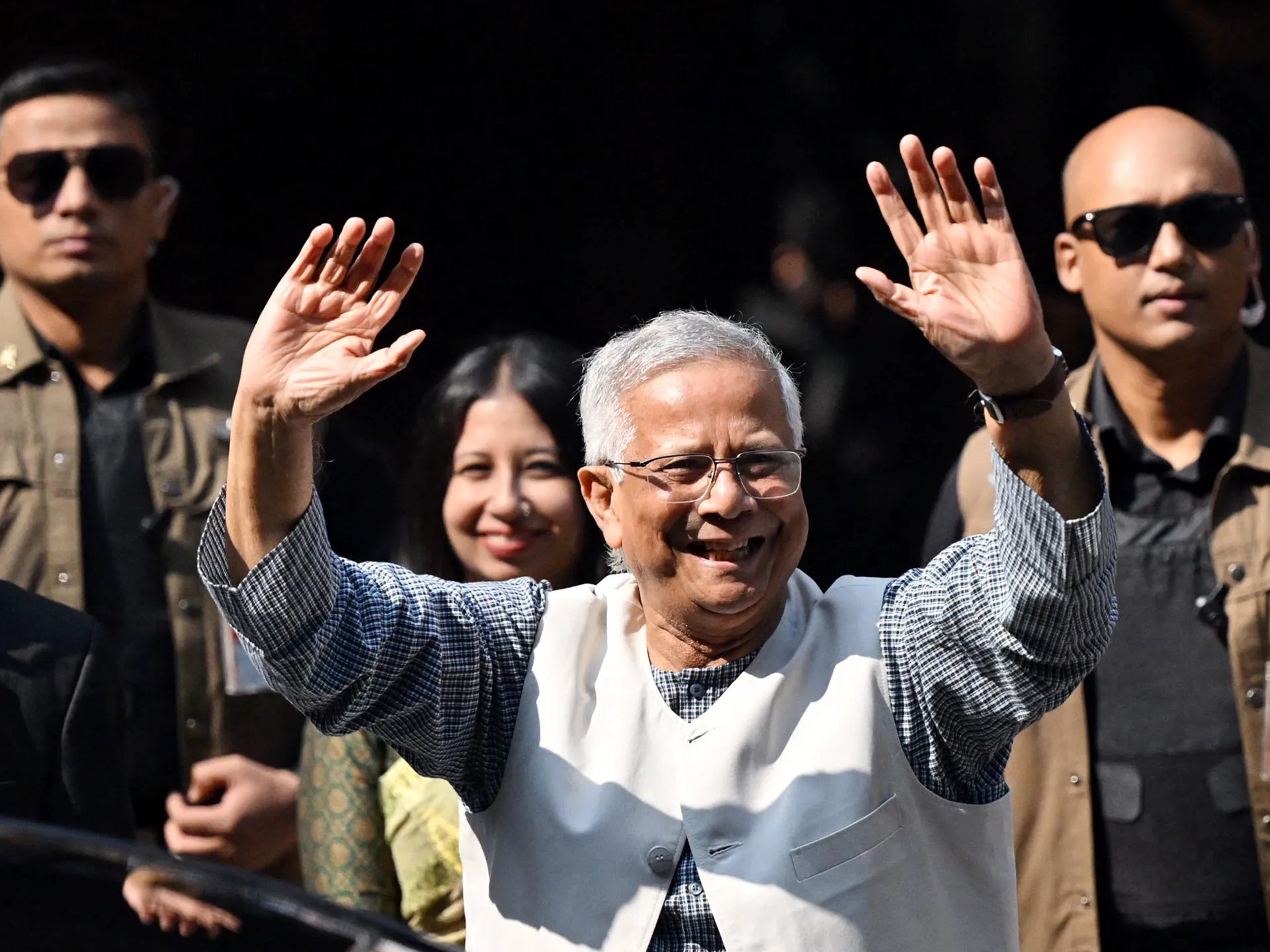

Microsoft founder Bill Gates has cancelled his keynote speech at India’s flagship AI summit just hours before he was due to take the stage on Thursday.

Gates, who has faced renewed scrutiny over his past ties to the late sex offender Jeffrey Epstein, withdrew to “ensure the focus remains on the AI Summit’s key priorities”, the Gates Foundation said in a statement.

Recommended Stories

list of 4 itemsend of list

The five-day India AI Impact Summit 2026 was meant to showcase India’s ambitions in the booming sector, with the country expecting to attract more than $200bn in investment over the next two years.

India’s Prime Minister Narendra Modi had billed the summit as an opportunity for India to shape the future of AI, drawing high-profile attendees, including French President Emmanuel Macron and Brazilian President Luiz Inacio Lula da Silva.

Instead, it has been dogged by controversy, from Gates’s abrupt exit to an incident in which an Indian university tried to pass off a Chinese-made robotic dog as its own innovation.

So, what exactly went wrong at India’s flagship AI gathering and why has it drawn such intense scrutiny?

Why Gates’s appearance became an issue

Bill Gates was due to deliver a short but high-profile speech highlighting the opportunities and risks posed by artificial intelligence.

However, in recent weeks, several opposition figures and commentators in Indian media weighed in after emails featuring his name were released in the Epstein files in late January, questioning whether his presence was appropriate.

Despite the discussion, all appeared to be proceeding as planned earlier in the week. On Tuesday, the Gates Foundation’s India office posted on X that Gates would attend the summit and “deliver his keynote as scheduled”.

Then, on Thursday, hours before the scheduled speech, it released a statement saying that “After careful consideration, and to ensure the focus remains on the AI Summit’s key priorities, Mr Gates will not be delivering his keynote address.”

It added that Ankur Vora, president of the Gates Foundation’s Africa and India offices, would deliver the speech instead.

What are the alleged links between Epstein and Gates?

Bill Gates was named in documents related to Epstein released in January by the US Department of Justice.

In a draft email included among the documents, Epstein alleged Gates had engaged in extramarital affairs and sought his help in procuring drugs “to deal with consequences of sex with Russian girls”.

It was unclear whether Epstein actually sent the email, and Gates denies any wrongdoing.

The Gates Foundation, in a statement to The New York Times, called the allegations “absolutely absurd and completely false”.

What has India’s government said?

Very little.

Despite criticism and calls from opposition figures to explain the invitation to Gates, the Indian government has not directly addressed the controversy that culminated in Gates’s withdrawal.

While unnamed government sources told local media he would not attend the summit, officials stopped short of explaining why.

Asked about Gates’s participation, Information Technology Minister Ashwini Vaishnaw declined to give a clear answer to reporters, while Modi made no reference to the issue in his public remarks.

Why are the Epstein files a sensitive subject for India?

The controversy surrounding Gates’s planned participation comes close on the heels of a series of disclosures in the Epstein files that have forced the Modi government on the backfoot.

In one email to an unidentified individual he referred to only as “Jabor Y”, Epstein referred to Modi’s historic visit – the first by an Indian prime minister – to Israel in July 2017.

Epstein wrote: “The Indian Prime minister modi took advice. and danced and sang in israel for the benefit of the US president. they had met a few weeks ago.. IT WORKED. !”

Modi’s visit to Israel – and his subsequent embrace of the Benjamin Netanyahu government, with military, intelligence and other ties strengthened over the past decade – had already drawn criticism from the opposition Congress party and others, who have accused him of reversing decades of Indian support for the Palestinian cause. India was the first non-Arab nation to recognise the Palestine Liberation Organization in 1974, and did not establish full diplomatic relations with Israel until 1992.

But the Epstein email turbocharged the opposition criticism of Modi’s Israel policy – with questions now also asked about whether it was influenced by Washington.

The Indian Ministry of External Affairs dismissed the Epstein email in an unusually sharply worded statement.

“Beyond the fact of the prime minister’s official visit to Israel in July 2017, the rest of the allusions in the email are little more than trashy ruminations by a convicted criminal, which deserve to be dismissed with the utmost contempt,” spokesperson Randhir Jaiswal said.

But the Epstein cloud continues to hover over India.

The files also show that India’s current oil minister, Hardeep Singh Puri, exchanged dozens of emails with Epstein after he joined Modi’s Bharatiya Janata Party in 2014.

In many of them, Puti appears to be taking Epstein’s help in getting US investors, such as LinkedIn’s Reid Hoffman, to visit India. In others, he appears to suggest that he had a fairly comfortable personal relationship with Epstein.

“Please let me know when you are back from your exotic island,” Puri wrote in December 2014, for instance, asking to set up a meeting in which Puri could give Epstein some books to “excite an interest in India”.

Puri, in a new conference, has claimed that he only met Epstein “three or four times”, but the Congress party has argued that the emails suggest a much closer relationship.

Gates’s work in India

The Gates Foundation has long been a key partner in India’s public health and development sectors, backing major vaccination drives, disease prevention campaigns and sanitation programmes.

At the same time, he has had vocal critics, including environmental activist Vandana Shiva, who has argued that Gates’s brand of “philanthro-imperialism” uses wealth to control global food systems.

Gates also faced heavy criticism after a 2024 podcast in which he said India was “a kind of laboratory to try things … that then, when you prove them out in India, you can take to other places” when discussing development programmes and the foundation’s work there.

‘Orion’ the robodog and other controversies

Beyond the fallout over Bill Gates’s cancelled keynote, the AI Impact Summit has faced several controversies.

One incident involved a robotic dog named “Orion”, which Galgotias University, based in the New Delhi suburban town of Greater Noida, presented as its own innovation.

Online users quickly identified the machine as a commercially available Chinese-made model, prompting organisers to ask the institution to vacate its stall.

The event also drew criticism on its opening day after facing logistical issues, including long queues and confusion over entry procedures, according to local media.

On Wednesday, large crowds were seen walking for miles after police cordoned off roads for VIP access.

Dhananjay Yadav, the CEO of a company exhibiting high-tech wearables, made headlines after he reported on social media that devices had been stolen from the company’s stand.

The Times of India later reported that two maintenance workers at the event had been arrested for allegedly stealing the wearables.