The Buffy the Vampire Slayer revival series is fast approaching and it’s time to revisit some of the show’s most memorable villains.

*Warning – this article contains major spoilers for all 7 seasons of Buffy the Vampire Slayer.*

Buffy the Vampire Slayer is chock-full of unforgettable baddies, but while some subtly slay, others just… suck?

With the reboot series led by Buffy icon Sarah Michelle Gellar on the cards, it’s only right to take a nostalgic look back at the good, the bad and the chaos-demon-ugly from all seven seasons of the cult classic, which is currently available to stream on ITVX.

The TV sensation created by Joss Whedon, which originally aired between 1997 and 2003, still boasts a loyal fanbase eagerly awaiting the return of the legendary character, reports Surrey Live.

In the meantime, from the ‘big bads’ of each season to the wicked ones lurking in the shadows, we’ve picked out 12 characters who might give you the heebie-jeebies – and one of them may catch you off guard.

12. Adam

Adam commits plenty of gruesome acts during his short time in season 4 of Buffy the Vampire Slayer, but his biggest sin is being entirely forgettable.

While we spend the season getting to know Riley, Professor Walsh and other members of the Initiative, we learn almost nothing interesting about this Frankenstein-like creation except that he wants to kill everything in sight.

11. The Master

The Master is the first major villain Buffy ever has to face but, while her season-long struggle to defeat him feels epic the first time you see it, he seems pretty bland on a re-watch.

In the end, the prosthetic effects and his somewhat corny dialogue makes him appear less threatening and, like Adam, we don’t learn much about him except that he wants evil to triumph.

10. The First

The First Evil is billed as the final, ultimate villain Buffy must defeat before the entire town of Sunnydale is swallowed into the hell mouth forever.

The First’s introduction to season 7 is chilling, as it uses imitation to trick Buffy and her friends to exploit their grief and insecurities.

However, as the season goes on its lack of physical presence becomes increasingly unexciting, and we spend far too much screen time with the minions doing its bidding.

9. Buffy’s Dad

While Buffy’s Dad isn’t strictly evil, he is a strong candidate for this list. At first, Hank Summers makes some effort with Buffy and we even see she has stayed with him over the summer between seasons 1 and 2.

However, by the time Joyce dies, it is apparent he barely speaks to his daughters, not even bothering to show up to the funeral despite Buffy ‘leaving messages all over the place’.

During that time, we learn he was in Spain with his secretary – and he doesn’t even notice when Buffy (temporarily) dies.

8. Caleb

Sadistic defrocked priest Caleb has a pathological hatred of women, which makes him one of the most sinister and unlikeable villains on this list.

We know he killed several girls while still in human form, before The First Evil granted him superhuman strength and other abilities in order to do its bidding.

He also nearly overpowers and kills Buffy before the show’s finale, making him one of her most formidable nemesies.

7. Dark Willow

One of the most tragic and painful storylines across Buffy’s run was Willow’s magic addiction battle in season 6, which mirrored many people’s real-life struggles with addiction.

When Warren kills Willow’s girlfriend Tara, this escalates and she goes on a murderous rampage, at first seeking revenge but ultimately attempting to destroy the world as dark magic consumes her.

This is one of the bleakest chapters of Buffy the Vampire Slayer, but it cannot be denied that Willow makes a powerful and complex villain.

6. Warren

Remember the earlier reference to villains who ‘just suck’? That’s Warren. This misogynistic sociopath is so hateable precisely because he’s still very clearly, pathetically human.

We are first introduced to him when he builds himself the ‘perfect’ robot girlfriend only to then discard her for another woman without bothering to tell her.

He then forms ‘The Trio’ alongside Andrew and Jonathan and, while at first they are painted as fairly harmless, things quickly get disturbing.

When Warren convinces The Trio to help him imprison his former girlfriend as a mindless sex slave, he ends up killing her as she tries to escape.

Later, he tries to shoot Buffy, instead killing Tara in the process before being gruesomely murdered by Willow.

5. Faith

Sometimes a hero and sometimes a villain, Faith doesn’t have an easy ride on Buffy the Vampire Slayer – and she often has herself to blame.

Eventually, Faith finds her redemption and is able to aid Buffy in her final fight against The First.

However, some of the best scenes in the show are when Buffy and Faith throw punches, with their perfectly-matched slayer strength culminating in some pretty epic fight scenes.

4. Mayor Richard Wilkins

Formerly human but now an immortal demon, Mayor Richard Wilkins is one of Buffy’s most memorable villains thanks to his unsettlingly cheery demeanor and wise words of advice.

While ultimately, his primary ambition is to transform into a giant snake and wreak havoc on Sunnydale, he also cares about good manners, cleanliness and forms a meaningful father-daughter bond with Faith.

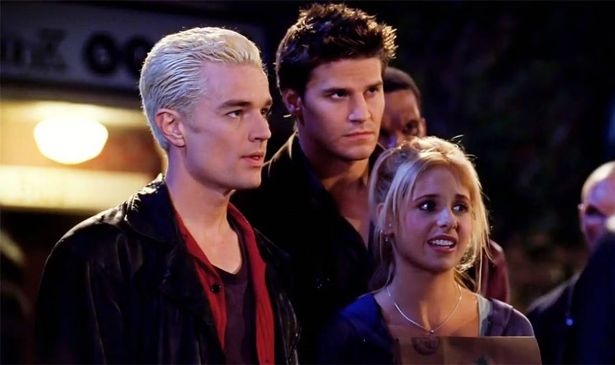

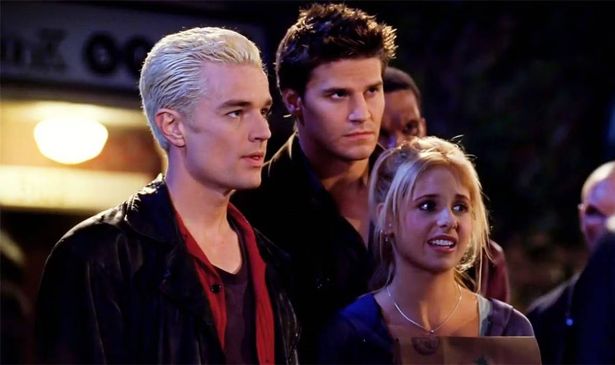

3. Spike and Drusilla

First introduced in season 2, vampires Spike and Drusilla totally transformed Buffy the Vampire Slayer when they appeared.

Both interesting characters in their own right, they felt decidedly more human than the villains that came before and also introduced plenty of humour and levity to proceedings.

Spike quickly became a fan favourite, being brought back again in season 3 before returning as a main cast member in season 4.

2. Glory

While Buffy is generally in the business of slaying demons, the stakes were raised in season 5 when she came face to face with a literal god.

Glory was a fantastic villain for the show because, while she was capable of witty one-liners, she also had some pretty terrifying powers.

Arguably, the show’s sense of jeopardy never felt stronger than it did in season 5, and Glory’s human weakness (Ben – Ben? I’m sure he was connected to her somehow? Were they roommates?) and backstory made the villain all the more compelling.

1. Angelus

Widely considered to be Buffy the Vampire Slayer’s ultimate villain, Angelus is one of the most evil characters in the Buffyverse.

However, it is really Buffy’s emotional connection to him that makes the drama all the more intense, as she has already fallen in love with Angel, the version of him with a soul.

After her former lover starts killing her friends and attempting to bring about the apocalypse, Buffy is tragically forced to kill him in order to save the world just moments after his soul is restored.

Rewatch all seven seasons of Buffy the Vampire Slayer on ITVX.