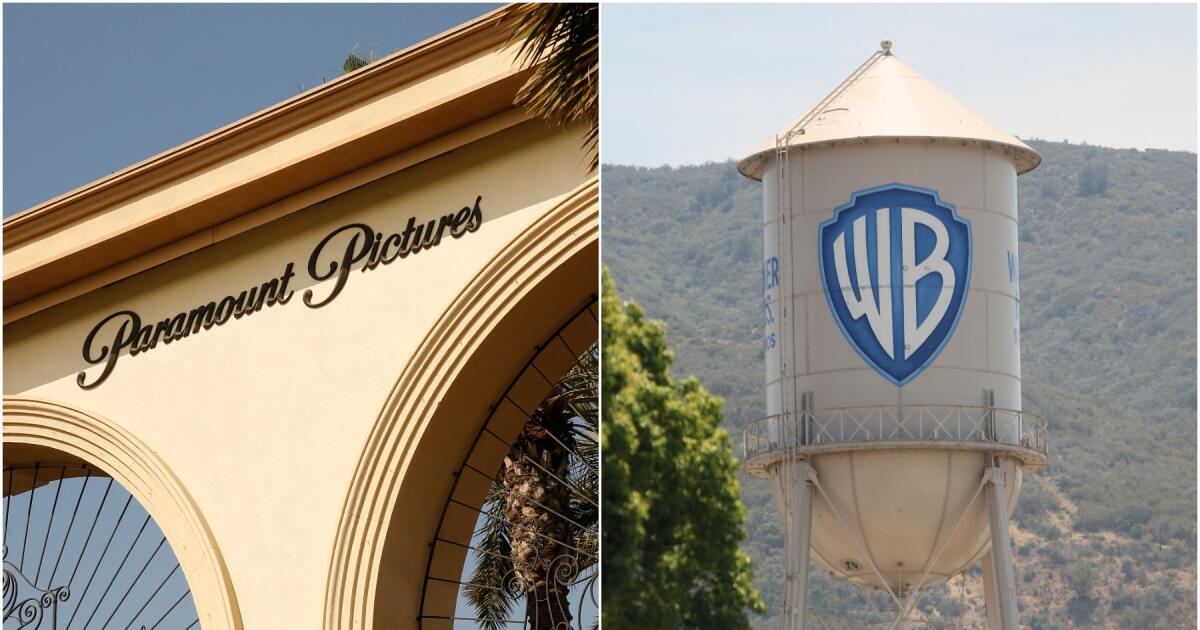

Paramount sweetens its offer for Warner Bros. Discovery

Paramount Skydance has sweetened its bid for Warner Bros. Discovery, adding a $2.8 billion “break fee” for Netflix and a payment to shareholders set to increase for every quarter after January 1, 2027 that the transaction does not close.

However, it’s not clear the latest move will do much to sway Warner Bros. Discovery’s board, which has endorsed a rival bid from Netflix.

The David Ellison-led company sent notice Tuesday of its revised offer to the Warner Bros. Discovery board, adding that it was open to further negotiation.

“While we have tried to be as constructive as possible in formulating these solutions, several of these items would benefit from collaborative discussion to finalize,” the letter states. “If granted a short window of engagement, we will work with you to refine these solutions to ensure they address any and all of your concerns.”

Paramount’s all-cash offer still stands at $30 a share. In addition to the termination payment and so-called “ticking fee” for shareholders of 25 cents per share — which the company said would total about $650 million in cash value each quarter — Paramount also said it would “eliminate” Warner’s $1.5 billion financing cost associated with its debt exchange offer.

The company also said it would “provide flexibility” for Warner to refinance its existing $15 billion bridge loan.

Ellison said the new additions to Paramount’s bid “underscore our strong and unwavering commitment to delivering the full value [Warner Bros. Discovery] shareholders deserve for their investment.”

“We are making meaningful enhancements — backing this offer with billions of dollars, providing shareholders with certainty in value, a clear regulatory path, and protection against market volatility,” he said in a statement.

Warner confirmed it received Paramount’s new offer and said in a statement Tuesday that it would “carefully review and consider” the revised bid.

However, the Warner board is “not modifying its recommendation” on its agreement to sell its studios, HBO and HBO Max to Netflix, and advised shareholders not to take “any action at this time” on Paramount’s tender offer to shareholders.