The Trump administration made no attempt to hide its goals when it came to tariffs. As the current U.S. president ran for office, he made it very clear to U.S. voters and the world that they should expect higher tariffs. And that’s exactly what his administration has offered up in dramatic fashion. Some on Wall Street worry that the tariffs could turn the bull market into a bear. Here’s how a long-term investor should be thinking about this issue.

The tariffs are coming! The tariffs are coming!

To simplify what is a fairly complex issue, a tariff is a tax imposed on imported goods. The Trump administration has been using tariffs in an aggressive attempt to reshape global trade. This will have an impact on the economy and the stock market, but what that might be is hard to define today. Simply put, so many things are up in the air right now that nobody knows where the chips are going to fall.

Image source: Getty Images.

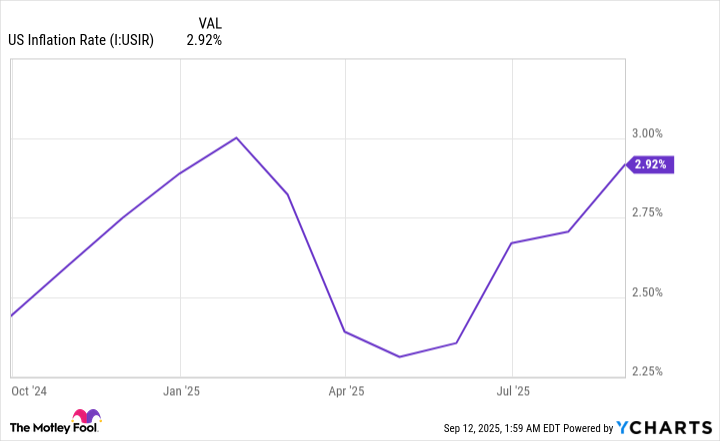

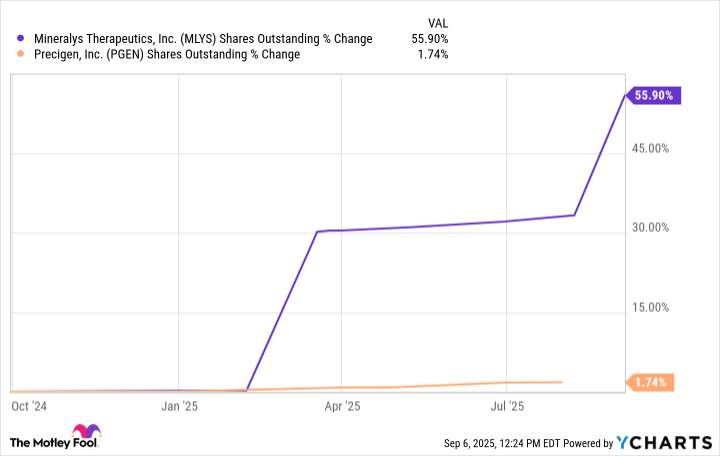

That said, one concern is that higher tariffs will eventually be passed through to consumers. That would increase inflation, crimp consumption, and lead to lower earnings for corporate America. The flip side of that argument is that companies have increased prices so much in recent years that they can’t easily push higher costs onto consumers, and, thus, companies are likely to absorb the tariff hit. That would mean lower profit margins. Even here, however, Wall Street could still end up in the dumps as companies earn less and investors react to that negative news.

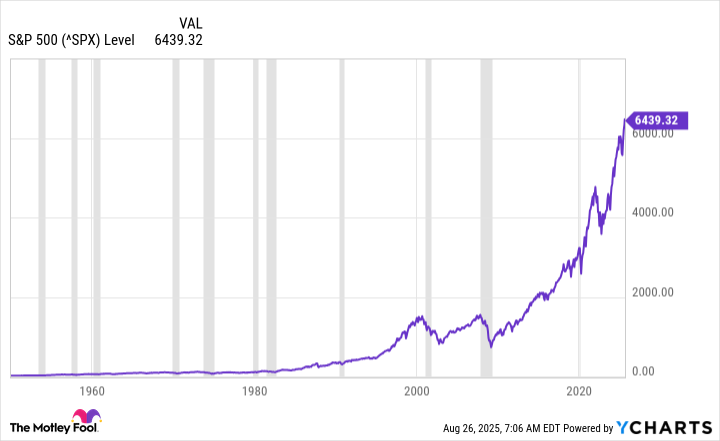

It seems like nothing good can come of this whole tariff thing. Except that, so far, the market hasn’t really paid much attention. The Vanguard S&P 500 ETF (VOO +0.00%) is up more than 10% so far in 2025. Yes, there was a brief market correction early in the year, but the S&P 500 index, which is what the Vanguard S&P 500 ETF tracks, seems to have shrugged that off, as it is again trading near all-time highs.

Don’t get too caught up in the short term

Here’s the big takeaway from the tariff kerfuffle: It is shockingly hard to predict performance on Wall Street. Some people get market turns right once, but very few have been able to time the ups and downs with any consistency. For most investors, trying to jump in and out of the market — a practice known as market timing — is a mistake.

It is far better to buy and hold for the long term, perhaps including an exchange-traded fund (ETF) like Vanguard S&P 500 ETF in the mix. Indeed, focusing on a well-diversified portfolio is key, as it will help to soften the impact of the market’s gyrations over time. Which brings the story back to the potential for a bear market. Simply put, there will be one.

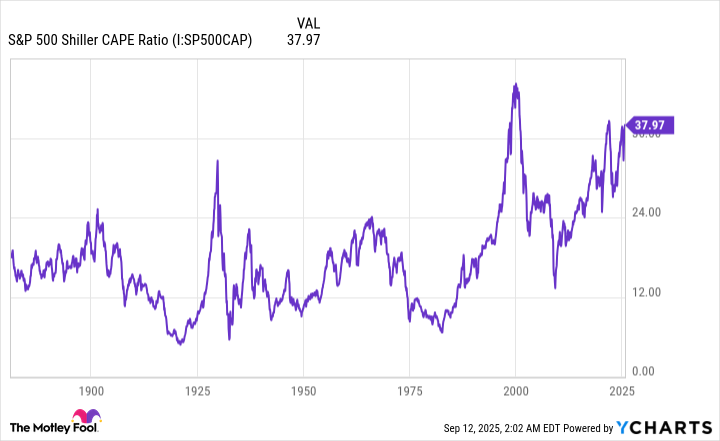

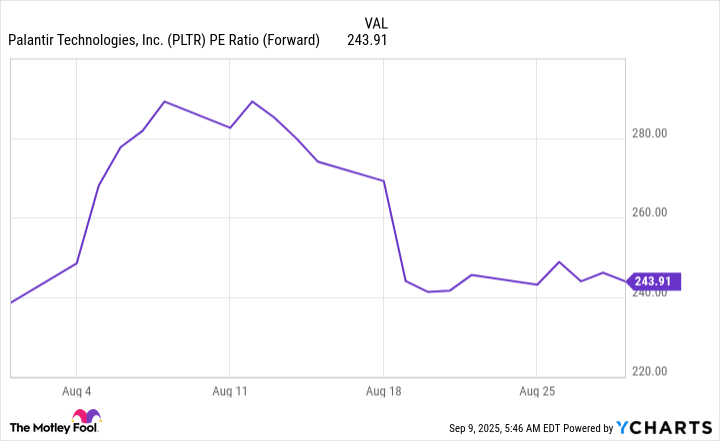

That’s not a prediction; it is just a statement of fact. Eventually, for some reason, investors will go from being bullish to being bearish. That’s just what market history tells us is the norm on Wall Street. Why it happens will be the topic of debate, and eventually, some common cause will be determined. Maybe it will be tariffs. It could also be geopolitical tensions, which are very high today. Or maybe artificial intelligence (AI) won’t turn out to be as profitable as investors expect, and that will lead the market lower, given that AI enthusiasm has helped lead the market higher.

Something will eventually give way, and there will be a bear market. Then, after some period of time, a bull market will arrive. It’s just how the market works. You should spend more of your time thinking about ways to save money and how to invest wisely. Investing wisely means taking into consideration the ever-present risk of a bear market.

Keep it simple and think long term

Far too often, investors get caught up in short-term market movements. The big picture is more important, including the sometimes erratic upward march of stocks over the long term. Sticking to an investment plan is hard, but it is likely to result in better long-term performance than trying to jump in and out of the market. Which is why a simple portfolio consisting of an S&P 500 index fund and a broadly diversified bond fund or ETF — say, in a 60% stock/40% bond breakdown — could be all you need.

Bonds help provide safety during market turmoil, and stocks provide growth over the long term. That combination will allow you to ride out bear markets without letting your emotions lead you into making investment mistakes (like selling everything you own and never investing again). Another option is just to buy a balanced mutual fund that does all the investing work for you. That leaves you to focus on saving money, which is where you will likely have the biggest impact on your long-term wealth, anyway.

If you do choose to buy individual stocks, which can be a lot of fun, don’t focus on the short term. Or to put it another way, think in decades, not days. When you do that, a bear market will probably end up looking like just a small hiccup. And it won’t really matter to you what precipitated the bear, anyway, because you will be too busy. You see, long-term investors often find their best investments during deep market declines.