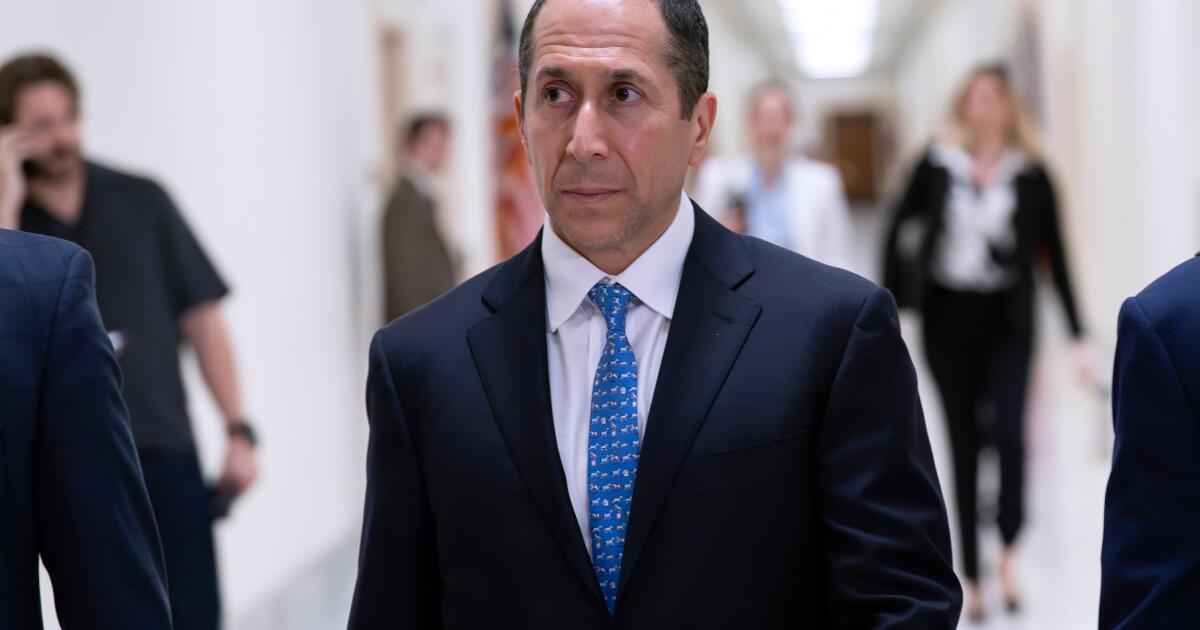

Epstein’s longtime accountant testifies on his wealth and business ties

WASHINGTON — House lawmakers were digging into Jeffrey Epstein’s sprawling financial portfolio on Wednesday as a committee deposed his former accountant and tried to understand his connections to some of the world’s wealthiest men.

Richard Kahn, who worked closely with Epstein for years and now serves as an executor of his estate, appeared for the closed-door deposition on Capitol Hill. He told lawmakers that he had not personally seen evidence of Epstein’s sexual abuse, but provided a fuller picture of how Epstein acquired his wealth. The wealthy financier made hundreds of millions of dollars over two decades, during which he struck up friendships with some of the world’s most powerful men.

Kahn “was under the impression that Epstein made his money as a tax advisor and a financial planner,” said Rep. James Comer, the Republican chair of the House Oversight Committee. Lawmakers argued that a fuller picture of Epstein’s finances could help the public understand how, for years, he was able to get away with trafficking and sexually abusing underage girls.

“Jeffrey Epstein’s sex trafficking ring would not have been possible without Richard Kahn, who managed Epstein’s money for years, authorized payments, including payments to victims and survivors,” said Rep. James Walkinshaw (D-Va.), who added that Kahn told them he was unable to recall details of some of the transactions and communications that he was asked about.

Kahn has said that he was unaware of Epstein’s sexual abuse and had not seen any of his victims.

Comer (R-Ky.) also said that lawmakers confirmed during the deposition that Epstein received significant amounts of money from former retail shopping chain executive Les Wexner, hedge fund manager Glenn Dubin, tech entrepreneur Steven Sinofsky, investor Leon Black and the Rothschilds, a wealthy banking family.

None of those people have been accused of wrongdoing in their relationships with Epstein, but Democrats on the committee argued that anyone with ties to the wealthy financier should be scrutinized. Wexner was deposed by the committee last month, and Comer has also called on Black, among several others, to appear for transcribed interviews.

Kahn also told lawmakers that Epstein had financial ties to Ehud Barak, who was the prime minister of Israel from 1999 to 2001, according to Democratic Rep. Suhas Subramanyam. Barak has not been accused of wrongdoing and has said he regrets his friendship with Epstein.

Comer also said Wednesday that the committee has reviewed over 40,000 documents that it subpoenaed from JPMorgan Chase and Deutsche Bank. Epstein was connected to at least 64 business entities, according to Comer.

Republican President Trump has strongly denied any wrongdoing in his own ties to Epstein, and Comer said that Kahn had never seen any financial transactions between Epstein and Trump. Comer said that Kahn is the latest witness to testify that they had never seen Trump doing anything wrong with Epstein.

“The investigation’s about getting the truth to the American people, trying to figure out how the government failed, answer questions we all have,” Comer said.

Groves writes for the Associated Press.