Microsoft vs. Apple: What’s the Better Artificial Intelligence (AI) Stock to Buy Today?

Microsoft’s Copilot is already helping generate billions in revenue, while Apple is in the midst of enhancing its iPhones with new AI features.

Microsoft (MSFT -0.15%) and Apple (AAPL 0.54%) are forever rivals. They are competitors in the personal computer market and for years have been the leading tech companies in the world. Even today, their valuations are similar. As of Tuesday’s close, Microsoft had a slight edge in market cap ($3.82 trillion versus $3.67 trillion).

There’s a new arena that could be their new battleground: artificial intelligence (AI). It’s still the early innings of AI deployment, and how their businesses evolve and adapt to AI remains a big question mark. But based on where they are today, which AI stock looks to be the better buy right now?

Image source: Getty Images.

Which company has the better overall growth prospects?

Both of these companies already have large, robust businesses that can benefit from AI. Apple is a big name in consumer electronics with its iPads and iPhones being highly coveted products and, in some cases, status symbols. Microsoft, meanwhile, has its core in the business world with companies all over using its office products and cloud software for their day-to-day operational needs. They also both sell personal computers, with Microsoft focusing more on practicality and real-world business use, while Apple’s focus has been on simplicity and ease of use for the average user.

They both have many opportunities where AI can enhance their existing products in services. But the edge for sheer growth potential has to go Microsoft, simply because of how much broader its business has become over the years, especially in gaming, with it wrapping up its massive $69 billion acquisition of Activision Blizzard a couple of years ago.

Which company will benefit the most from AI?

AI has tremendous potential applications for these businesses. Many Apple users have been eagerly awaiting the launch of new AI-powered features for the company’s iPhones and were disappointed when they learned many of the key ones related to Siri will be pushed back until next year.

When that happens, however, that could trigger a flurry of upgrades and growth for the business. I don’t think a slow-and-steady approach will necessarily hurt Apple. In fact, it could end up being a smart move for the tech company by taking its time and ensuring everything is rolled out smoothly, to ensure that user privacy is well protected in the process.

Microsoft has already been enhancing its products and services with AI capabilities. However, there’s been plenty of debate about just how successful its Copilot AI really is. Salesforce CEO Marc Benioff has referred to it as “Clippy 2.0,” in reference to the frustrating assistant that Microsoft had years ago that users didn’t find all that helpful.

Apple deserves an edge when it comes to AI potential, simply for the massive wave of upgrades that could be coming if it hits it out of the park with its new iPhone features.

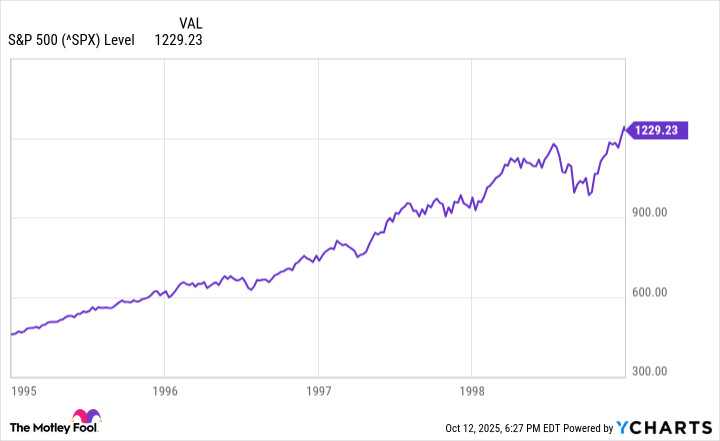

Which stock has the more attractive valuation?

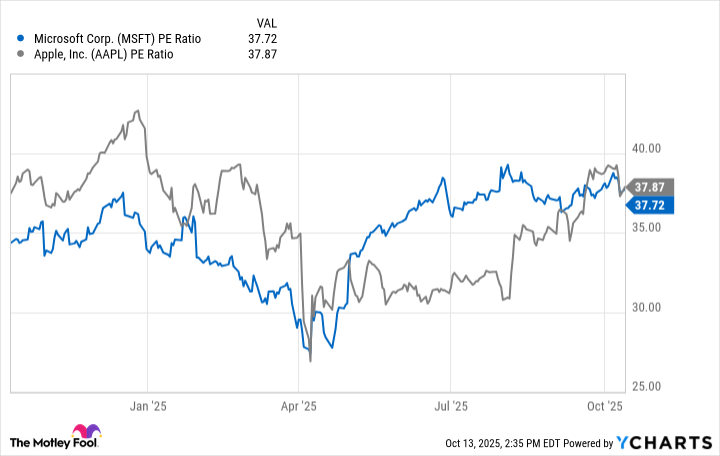

It’s always important to consider valuation when buying a stock, as buying at a high price may impact your ability to earn a good return from your investment in the future. For a while, Microsoft’s stock was trading at more of a premium to Apple’s stock, but in recent weeks, that gap has evaporated.

Data by YCharts.

This one is easy to decide: It’s a tie. Their price-to-earnings multiples are almost identical at this stage. But it is notable to see that prior to the announcement of reciprocal tariffs in April, it was Apple that was trading at more of a premium than Microsoft, and then the trend reversed, with Apple’s exposure to manufacturing its iPhones in China likely weighing down the stock for part of the year.

Which stock should you buy?

The stock I’d buy today is Apple. It has devoted fans who will be willing to upgrade to the newest iPhone, even under challenging economic conditions, if it means access to cutting-edge features. Apple may be slow in rolling out AI, but when it does, the execution can be a lot cleaner, polished, and better for users in the end than if it were rushed.

Microsoft, meanwhile, has been quick to rush out AI features for its software. However, in an increasingly crowded market for AI services, it may have a more difficult time keeping customers happy when there may be other, and potentially better, options to choose from.

Apple, may, in the end, benefit from being a bit slower in its AI deployment.

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Microsoft, and Salesforce. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.