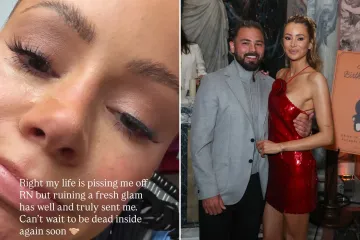

Olivia Attwood shares cryptic post about ‘price of staying where you are’ after shock split from husband Bradley

OLIVIA ATTWOOD has shared a cryptic post about the ‘price of staying where you are’ after her shock split from her husband Bradley Dack.

It was revealed two weeks ago that the husband and wife had split following a “breach of trust” on his part.

She’s since moved out of their marital home and moved into her own apartment.

The Loose Women star took to her Instagram stories this evening to repost a cryptic message from a quotes account.

It read: “If you’re worried about the cost of going for it you should see the price of staying exactly where you are.”

She’s been sharing a lot of quotes recently as she deals with the breakdown of her marriage to the footballer.

READ MORE ON OLIVIA ATTWOOD

The Love Island icon was left devastated after discovering her other half had broken her trust.

She’d been on a high after a “blissful” trip to the City of Love in the first week of January and felt surer than ever the marriage was back on track.

A source close to Olivia said: “Olivia’s been so open about their marriage struggles and everything she said on This Morning this month, and on her podcast, is true.

“She thought things were genuinely back on track and that Paris was a perfect break, it was blissful.

“She and Brad had proper, quality time together and they laughed and enjoyed each other like before.

“So to get back and discover he had breached her trust was a bolt from the blue.”

Olivia posted about moving house in December, and fans have speculated the couple actually secretly split months ago.

They had in fact sold their home in Cheshire to relocate closer to footballer Bradley’s club Gillingham FC and Oliva’s work in London.

But now they’ll look to sell up again as Olivia prepares to tackle life alone.

The source added: “Olivia, as always, has an incredibly busy time ahead with work, with Getting Filthy Rich series four on air and the launch of her new ITV2 show The Heat coming soon.”

Olivia has unfollowed her husband on social media after news of their split was revealed by The Sun.

Olivia and Bradley weathered a rocky 2025 during which they faced constant divorce rumours.

“There are ups and downs, there are things on his side which haven’t been great, there’s a mix of things,” she said in an interview last year.

“I have f***ed up and done stuff, Brad has f***ed up.”

Olivia also recalled the past year on her podcast Olivia’s House.

She said: “At the end of the day marriage is really f***ing hard. The rumour mill was in full swing. We really weren’t getting on very well.”

The pair first met and dated prior to her Love Island stint and ended up reconnecting after her split with Chris Hughes.

They got engaged in 2019 and after having to cancel their wedding plans due to coronavirus, they finally tied the knot in a ceremony at the Bulgari Hotel in June 2023.