Californians enrolled in Obamacare plans will see soaring premiums.

Californians renewing their public health plans or who plan to sign up for the first time will be in for sticker shock when open enrollment begins on Saturday. Monthly premiums for federally subsidized plans available on the Covered California exchange — often referred to as Obamacare — will soar by 97% on average for 2026.

The skyrocketing premiums come as a result of a conflict at the center of the current federal government shutdown, which began on Oct. 1: a budgetary impasse between the Republican majority and Democrats over whether to preserve enhanced, Biden-era tax credits that expanded healthcare eligibility to millions more Americans and kept monthly insurance costs affordable for existing policyholders. About 1.7 million of the 1.9 million Californians currently on a Covered California plan benefit from the tax credits.

Open enrollment for the coming year runs from Nov. 1 until Jan. 31. It’s traditionally the period when members compare options and make changes to existing plans and when new members opt in.

Only this time, the government shutdown has stirred uncertainty about the fate of the subsidies, first introduced during the COVID-19 pandemic and which have been keeping policy costs low, but will expire at the end of the year if lawmakers in Washington don’t act to extend them.

Californians window shopping on the exchange’s consumer homepage will have to make some tough decisions, said Covered California Executive Director Jessica Altman. The loss of the tax credits to subsidize premiums only adds to what can already be a complicated, time-consuming and frustrating process.

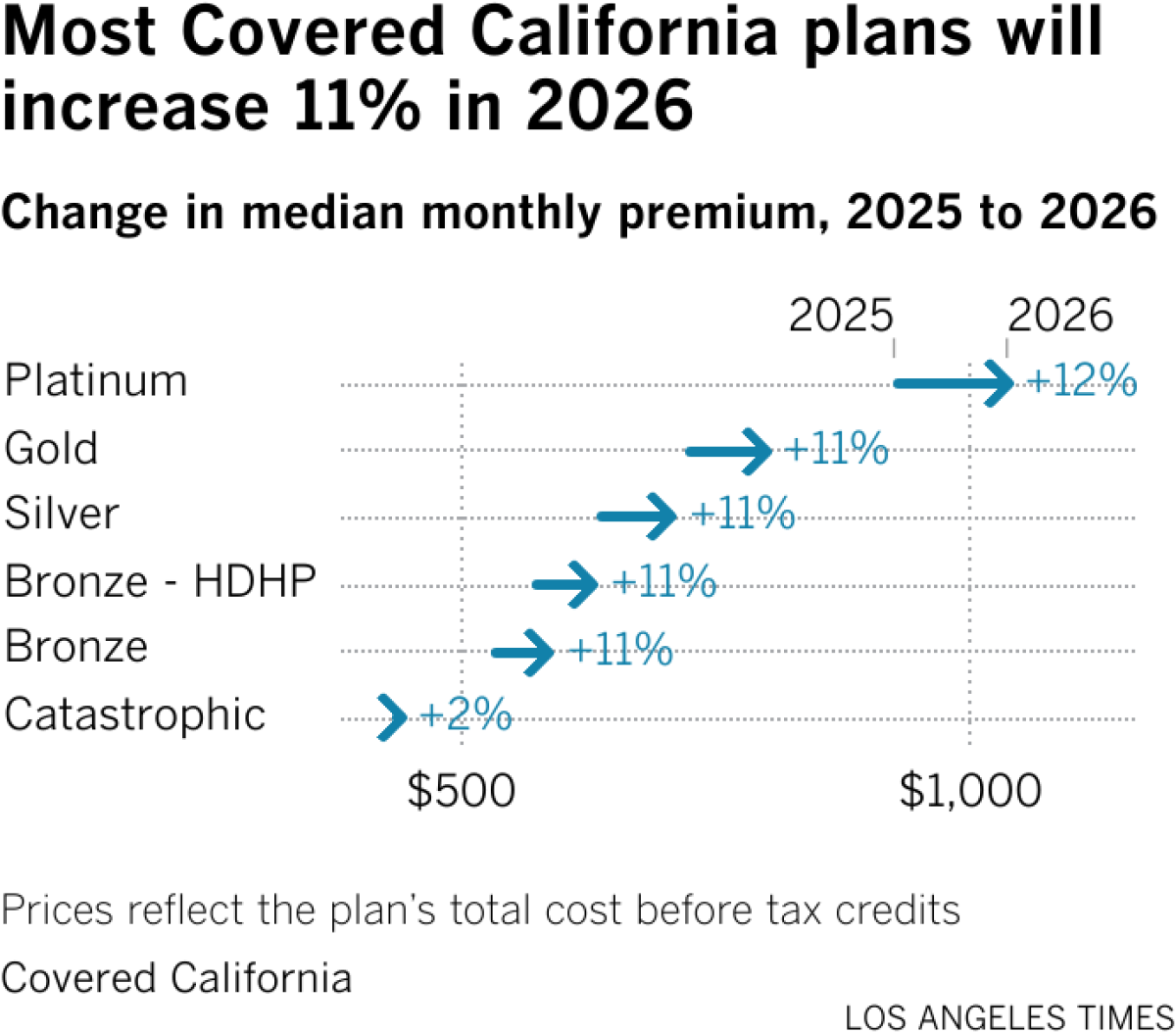

Even if the subsidies remained intact, premiums for plans offered by Covered California were set to rise by roughly 10% for 2026, due to spikes in drug prices and other medical services, Altman said.

Without the subsidies, Covered California said its members who receive financial assistance will see their monthly premiums jump by an additional $125 a month, on average, for 2026.

The organization projects that the cost increases will lead many Californians to simply go without coverage.

“Californians are going to be facing a double whammy: premiums going up and tax credits going away,” Altman said. “We estimate that as many as 400,000 of our current enrollees will disenroll and effectively be priced out of the health insurance that they have today. That is a devastating outcome.”

Indeed, the premium spike threatens to lock out the very Americans that the 2010 Affordable Care Act — President Obama’s signature domestic policy win — was intended to help, said Altman. That includes people who earn too much to qualify for Medicaid but who either make too little to afford a private plan or don’t work for an employer that pays a portion of the premiums.

That’s a broad swath of Californians — including many bartenders and hairdressers, small business owners and their employees, farmers and farm workers, freelancers, ride-share drivers, and those working multiple part-time gigs to make ends meet. The policy change will also affect Californians who use the healthcare system more frequently because they have ongoing conditions that are costly to treat.

By raising the tax-credit eligibility threshold to include Americans earning more than 400% of the federal poverty level, the Biden-era subsidies at the heart of the budget stalemate have brought an estimated 160,000 additional middle-income Californians into the system, Covered California said. The enhanced subsidies save members about $2.5 billion a year overall in out-of-pocket premium expenses, according to the exchange.

California lawmakers have tried to provide some relief from rising Covered California premiums by recently allocating an additional $190 million in state-level tax credits in next year’s budget for individuals who earn up to 150% of the federal poverty level. That would keep monthly premiums consistent with 2025 levels for a person making up to $23,475 a year, or a family of four bringing in $48,225 a year, and provide partial relief for individuals and households making slightly more.

Altman said the state tax credits will help. But it may not be enough. Forecasts from the Urban Institute, a nonprofit research group and think tank, also show a significant drop-off of roughly 400,000 enrolled members in Covered California.

The national outlook is even worse. The Congressional Budget Office warned Congress nearly a year ago that if the enhanced premium subsidies were allowed to expire, the ranks of the uninsured would swell by 2.2 million nationwide in 2026 alone — and by an average of 3.8 million Americans each year from 2026 to 2034.

Organizations that provide affordable Obamacare plans are preparing for Californians to get squeezed out of the system if the expanded subsidies disappear.

L.A. Care, the county’s largest publicly operated health plan, offers Covered California policies for 230,000 mostly lower-income people. About 90% of the Covered California consumers they work with receive subsidies to offset their out-of-pocket healthcare insurance costs, said Martha Santana-Chin, L.A. Care’s CEO. “Unless something drastic happens … a lot of those people are going to fall off of their coverage,” Santana-Chin said.

That outcome would ripple far and wide, she said — thanks to two factors: human behavior and basic economics.

If more and more people choose to go uninsured, more and more people will resort to visiting hospital emergency rooms for non-emergency care, disrupting and overwhelming the healthcare system.

Healthcare providers will be forced to address the cost of treating rising numbers of uninsured people by raising the prices they bill to insurers for patients who have private plans. That means Californians who are not Covered California members and don’t receive other federal healthcare aid will eventually see their premiums spike too, as private insurers pass any added costs down to their customers.

But right now, with the subsidies set to end soon and recent changes to Medicaid eligibility requirements threatening to knock some of the lowest-income Californians off of that system, both Altman and Santana-Chin said their main concern is for those who don’t have alternatives.

In particular, they are concerned about people of color, who are disproportionately represented among low-income Californians, according to the Public Policy Institute of California. Any hike in out-of-pocket insurance costs next year could blow the budget of a family barely getting by.

“$100, $150, $200 — that’s meaningful to people living on fixed incomes,” Altman said. “Where is that money coming from when you’re living paycheck to paycheck?”