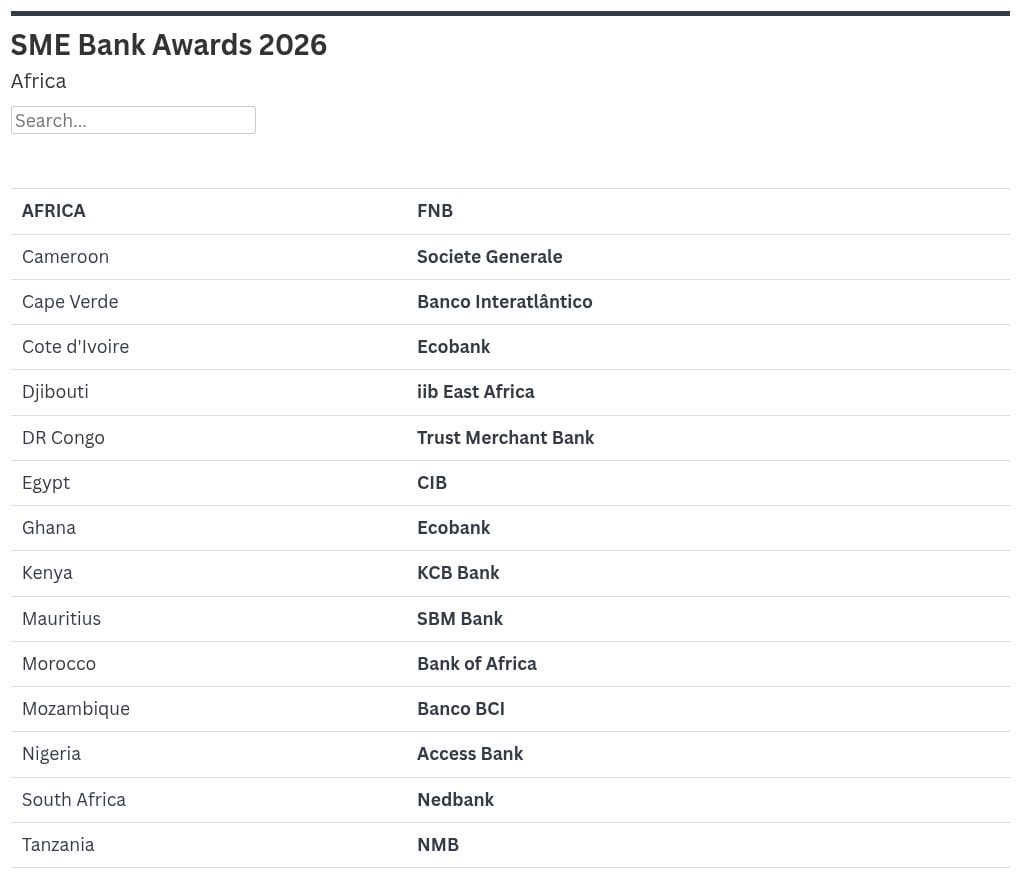

World’s Best SME Banks 2026: Africa

Small and midsize enterprises (SMEs) across Africa are driving innovation and inclusion despite persistent financing and productivity challenges.

Regional Winner | FNB

First National Bank (FNB) takes pride in being the largest bank for small and midsize enterprises (SMEs) in South Africa. The bank’s dominance in the field is rooted in a culture of walking with SMEs along their growth journey.

Last year, FNB’s loan book totaled $6.7 billion, with advances to SMEs accounting for approximately a third. With a formidable 1.3 million SME clients and 34% overall market share, FNB commands strong leadership in most aspects.

Cases in point are asset finance and revolving credit facility arrangements: The bank commands 51% and 42% market share in these, respectively. Growth in the commercial segment, which encompasses SMEs, remains steady, expanding by 6% year-overyear through June 2025.

FNB views its market dominance as a reflection of the real impact it has on SMEs, driven by innovation, digitalization, and a deep understanding of its customers. This is exemplified by some of its solutions, such as grant funding for catalytic projects and patient growth capital, which emphasizes sustained growth over short-term profits with flexible repayment terms.

The bank also prioritizes inclusive finance for Black-owned SMEs, a market that continues to struggle to access finance. For this segment, FNB goes even further to provide both equity and debt funding through its Vumela Enterprise Development Fund, which currently manages $38.9 million in assets.

By addressing structural barriers and enabling scalable growth, FNB ensures that SMEs continue to thrive. The ripple effect is inclusive economic transformation and job creation.

FNB is determined to replicate its home-market success across seven other African countries where it has a presence. Plans are also underway to expand the footprint into new markets, such as Ghana and Kenya.