Netflix amends Warner Bros. deal to all cash in bidding war

Netflix Inc. reached an amended, all-cash agreement to buy Warner Bros. Discovery Inc.’s studio and streaming business as it battles Paramount Skydance Corp. to acquire one of Hollywood’s most iconic entertainment companies.

Netflix, which previously agreed to pay $27.75 a share in cash and stock for the Warner assets, will pay the full amount in cash, according to a filing confirming an earlier Bloomberg News report on the revised terms. Warner Bros. plans to call a special meeting of shareholders to approve the deal. Netflix said stockholders should be able to vote on the transaction by April.

The changes are designed to expedite a sale and address claims by Paramount that its $30-a-share cash tender offer — for all of Warner, including cable channels like CNN and TNT — is superior. Paramount, the parent of CBS and MTV, has been urging investors to tender their shares.

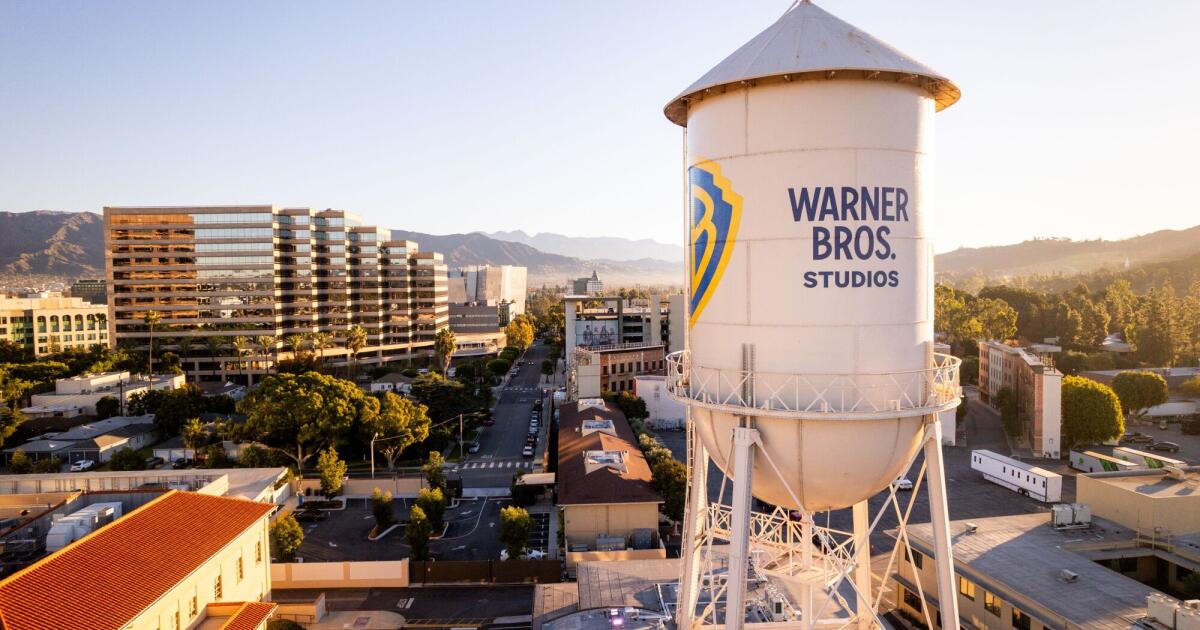

The battle for Warner Bros., known for films from Casablanca to Batman, is one of the biggest media deals in years and has the power to reshape the entertainment industry. Paramount has been aggressively pursuing Warner Bros. since September, while streaming leader Netflix emerged as a surprise suitor, entering the chase after Warner Bros. put itself up for sale in October.

The new terms neutralize one of the primary criticisms from Paramount: that the stock portion of the Netflix offer makes its bid inferior. Netflix’s shares have lost 29% since its pursuit of Warner Bros. came to light. Paramount shares have also declined about 29% over that time.

The Warner Bros. board “continues to support and unanimously recommend our transaction, and we are confident that it will deliver the best outcome for stockholders, consumers, creators and the broader entertainment community,” Ted Sarandos, co-chief executive officer of Netflix, said in a statement.

Paramount shares were down about 1% in premarket trading in New York. Netflix was up 1.4%.

Warner Bros. also addressed another criticism by outlining how it values its cable networks, which would be spun off to its stockholders in a separate company called Discovery Global.

Warner Bros. has spurned multiple offers from Paramount. Its unwanted suitor has threatened to launch a proxy fight and has sued to force Warner Bros. to disclose more information about the Netflix bid and the value of the cable properties.

Warner Bros.’ advisers value the cable networks from as little as 72 cents a share to as much as $6.86 a share, according to the filing. Paramount has claimed those properties have no value even though cable networks account for most of its own sales and profit.

Under the spinoff plans, Discovery Global would have $17 billion of debt as of June 30, 2026, decreasing to $16.1 billion by the end of the year. Warner and Netflix also amended the agreement so that Discovery Global will have $260 million less debt than initially planned as a result of stronger-than-expected cash flow last year.

The filing projects 2026 revenue of $16.9 billion for the new Discovery Global networks and adjusted earnings of $5.4 billion before interest, taxes, depreciation and amortization.

The latest proposal addresses Wall Street’s concerns around Netflix’s declining share value and speeds up a shareholder vote, Bloomberg Intelligence analyst Geetha Ranganathan wrote. It also raises the stakes for Paramount to increase its offer, something it has repeatedly refused to do. It may take a bid of more than $32 a share to sway the Warner Bros. board at this point, she said.

Netflix has lined up more debt from Wall Street banks to help finance its amended agreement. The company now has $42.2 billion of bridge loans in place, according to a filing Tuesday, a type of facility that is usually replaced with permanent debt like corporate bonds.

A combination of Warner Bros. and Netflix would marry two of the world’s biggest streaming providers, with some 450 million combined subscribers, and provide Netflix with a deep library of programming to counter challengers like Walt Disney Co. and Amazon.com Inc. Hollywood labor unions and movie theater owners have expressed concern that the deal will hurt their members and businesses.

Sarandos and Netflix co-CEO Greg Peters told investors at a UBS conference on Dec. 8 that they’re “super confident” their deal will be approved. Leaders of Netflix and Warner Bros. were in Europe last week meeting with regulators to convince them of the merits of a deal.

Netflix is scheduled to report fourth-quarter financial results on Tuesday after markets close.

David Ellison, Paramount’s CEO, has argued that a merger with his company would preserve a more traditional Hollywood structure and keep some of Warner Bros.’ legacy intact. He has posited that his all-cash offer, backed by his family trust, is financially superior and says it would have an easier time getting approved by regulators.

Ellison has been mounting an offensive of his own but has yet to convince the Warner Bros. board or an overwhelming majority of the company’s shareholders. Institutional investors are divided and have called for Paramount to increase its offer.

Shaw and Davis write for Bloomberg.