Should You Sell Nvidia Stock and Buy This Supercharged Quantum Computing Stock?

IonQ has outperformed Nvidia since the start of the AI arms race.

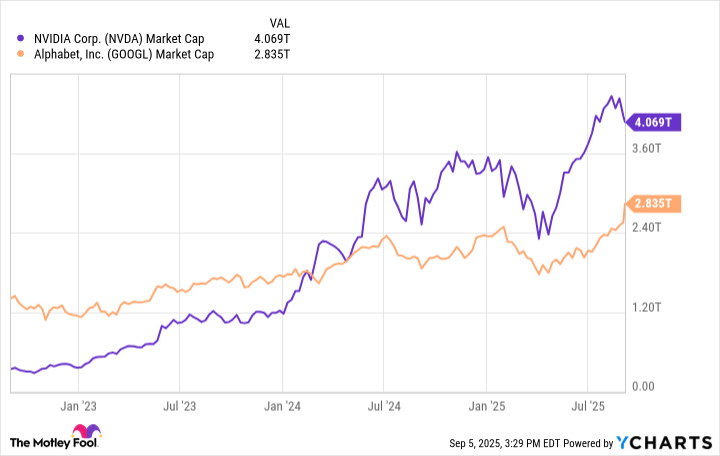

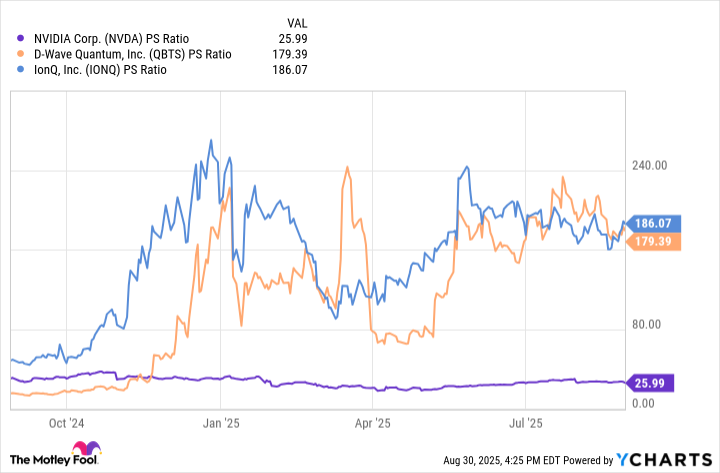

Nvidia (NVDA 0.86%) has been one of the most successful stocks in the artificial intelligence (AI) arms race, rising 1,130% since it began at the start of 2023. This has delivered long-term investors phenomenal returns, but there’s a new, exciting investment trend in town that could disrupt how investors view Nvidia’s success.

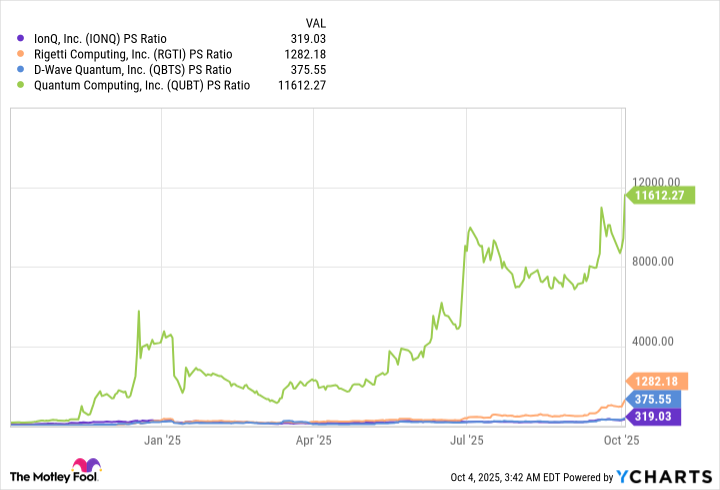

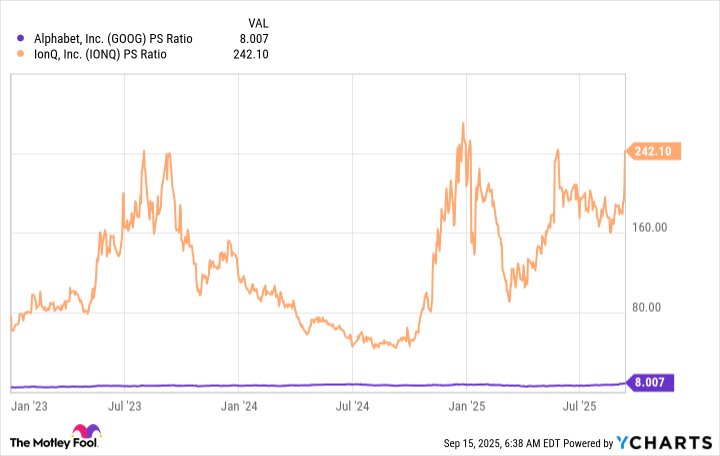

Quantum computing is one of the most popular industries to invest in, and its stocks have surged over the past few months as investor sentiment surrounding the industry has improved. One of the most popular options is IonQ (IONQ -3.92%), which is no stranger to success. If you’d invested in IonQ instead of Nvidia at the start of 2023, you’d be up 2,150% (at the time of this writing)!

That may have some investors thinking they’ve backed the wrong horse in the computing race. So, is it time to move on from Nvidia and scoop up shares of IonQ? Let’s find out.

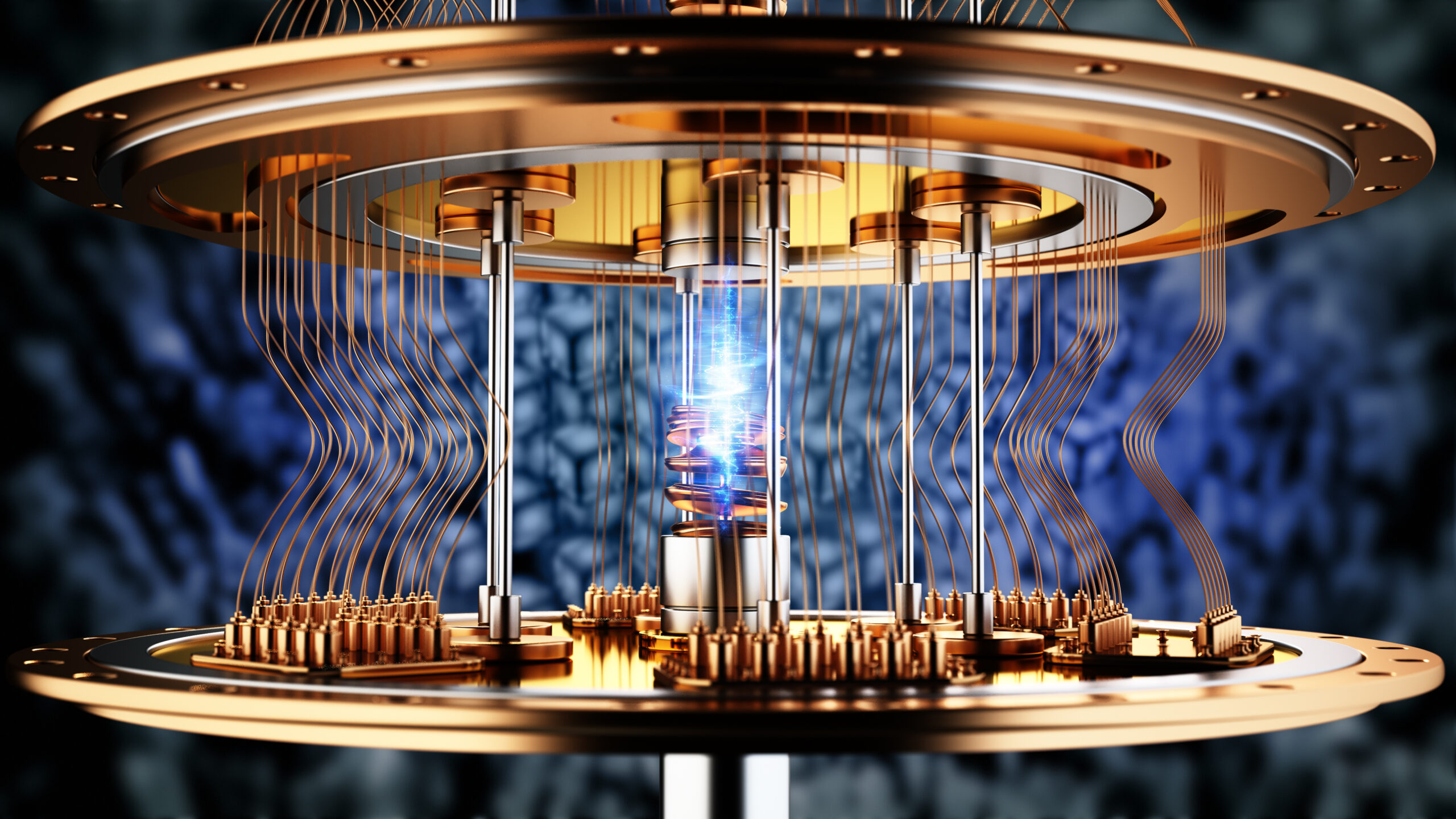

Image source: Getty Images.

Nvidia and IonQ are similar businesses

At their core, Nvidia and IonQ are quite close in terms of business pursuit. Nvidia makes graphics processing units (GPUs) alongside other equipment to optimize their performance. GPUs have become the gold standard in high-performance computing applications such as artificial intelligence, drug discovery, engineering simulations, and cryptocurrency mining. Their unique ability to process multiple calculations in parallel makes them a computing powerhouse, and AI hyperscalers have widely deployed them to train and run generative AI models.

IonQ appears to be a much earlier version of Nvidia, focusing on quantum computing rather than traditional computing methods. It’s developing a full-stack solution that provides clients with everything they need to run a quantum computer. Once quantum computing becomes mainstream, many believe it can have widespread use cases in applications like AI training and logistics network improvements. This could lead to a massive market opportunity, similar to what Nvidia experienced at the start of the AI arms race.

However, we’re still a ways away from quantum computing becoming relevant. IonQ and many other quantum computing companies point toward 2030 as the year when quantum computing will become a commercially viable technology. That’s five years out, and there’s still a lot of time for things to go wrong for IonQ (or go right).

IonQ competitor Rigetti Computing estimates that the annual value for quantum computing providers will reach $15 billion to $30 billion between 2030 and 2040. Should IonQ replicate Nvidia’s success by 2030, it could still have room to grow between now and then.

If we assume that the market reaches $15 billion annually in 2030 and IonQ replicates Nvidia’s dominant 90% market share and 50% profit margin, IonQ would be producing profits of $6.75 billion. At a 40 times earnings valuation, that would indicate IonQ could be a $270 billion company, more than a 10x from today’s $23 billion valuation.

But is that enough to warrant selling Nvidia shares to invest in IonQ?

Nvidia has a growth trend of its own

Over the next few years, capital expenditures relating to AI data centers are set to explode. Nvidia estimates that total capital expenditures in 2025 will total $600 billion, but reach $3 trillion to $4 trillion by 2030. If that plays out like Nvidia projects, the total amount of money spent on data center capital expenditures will rise at a compound annual growth rate of 42%. If Nvidia’s growth directly follows that trajectory, that means its stock could rise nearly 6 times in value.

So, which is more likely: Quantum computing becomes viable, IonQ establishes a dominant, Nvidia-like market share and achieves incredibly high margins, or Nvidia’s growth follows widely accepted AI spending trends? I think it’s more likely that the AI arms race continues in its current form, making holding on to Nvidia shares a smart decision. After all of the quantum computing investment hype, I think it’s time for investors to take a break from this sector and focus on some companies that have actual money flowing into them, rather than quantum computing-specific businesses like IonQ.