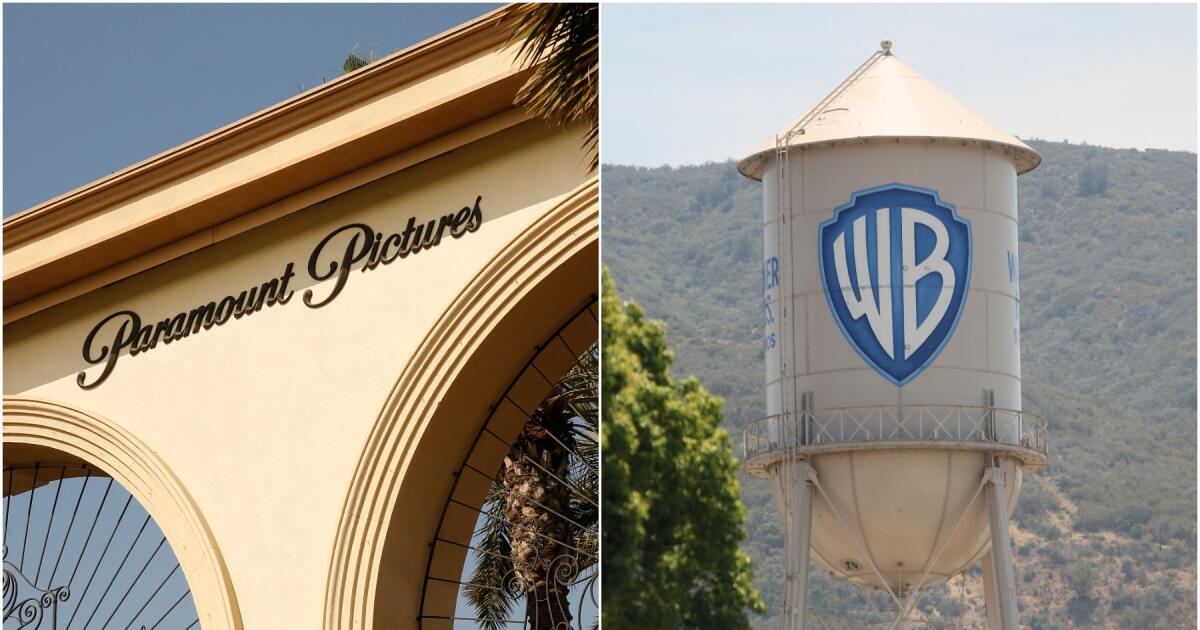

Many in Hollywood fear Warner Bros. Discovery’s sale will trigger steep job losses — at a time when the industry already has been ravaged by dramatic downsizing and the flight of productions from Los Angeles.

David Ellison‘s Paramount Skydance is seeking to allay some of those concerns by detailing its plans to save $6 billion, including job cuts, should Paramount succeed in its bid to buy the larger Warner Bros. Discovery.

Leaders of the combined company would search for savings by focusing on “duplicative operations across all aspects of the business — specifically back office, finance, corporate, legal, technology, infrastructure and real estate,” Paramount said in documents filed with the Securities & Exchange Commission.

Paramount is locked in an uphill battle to buy the storied studio behind Batman, Harry Potter, Scooby-Doo and “The Big Bang Theory.” The firm’s proposed $108.4-billion deal would include swallowing HBO, HBO Max, CNN, TBS, Food Network and other Warner cable channels.

Warner’s board prefers Netflix’s proposed $82.7-billion deal, and has repeatedly rebuffed the Ellison family’s proposals. That prompted Paramount to turn hostile last month and make its case directly to Warner investors on its website and in regulatory filings.

Shareholders may ultimately decide the winner.

Paramount previously disclosed that it would target $6 billion in synergies. And it has stressed the proposed merger would make Hollywood stronger — not weaker. The firm, however, recently acknowledged that it would shave about 10% from program spending should it succeed in combining Paramount and Warner Bros.

Paramount said the cuts would come from areas other than film and television studio operations.

A film enthusiast and longtime producer, David Ellison has long expressed a desire to grow the combined Paramount Pictures and Warner Bros. slate to more than 30 movies a year. His goal is to keep Paramount Pictures and Warner Bros. stand-alone studios.

This year, Warner Bros. plans to release 17 films. Paramount has said it wants to nearly double its output to 15 movies, which would bring the two-studio total to 32.

“We are very focused on maintaining the creative engines of the combined company,” Paramount said in its marketing materials for investors, which were submitted to the SEC on Monday.

“Our priority is to build a vibrant, healthy business and industry — one that supports Hollywood and creative, benefits consumers, encourages competition, and strengthens the overall job market,” Paramount said.

If the deal goes through, Paramount said that it would become Hollywood’s biggest spender — shelling out about $30 billion a year on programming.

In comparison, Walt Disney Co. has said it plans to spend $24 billion in the current fiscal year.

Paramount also added a dig at Warner management, saying: “We expect to make smarter decisions about licensing across linear networks and streaming.”

Some analysts have wondered whether Paramount would sell one of its most valuable assets — the historic Melrose Avenue movie lot — to raise money to pay down debt that a Warner acquisition would bring.

Paramount is the only major studio to be physically located in Hollywood and its studio lot is one of the company’s crown jewels. That’s where “Sunset Boulevard,” several “Star Trek” movies and parts of “Chinatown” were filmed.

A Paramount spokesperson declined to comment.

Sources close to the company said Paramount would scrutinize the numerous real estate leases in an effort to bring together far-flung teams into a more centralized space.

For example, CBS has much of its administrative offices on Gower in Hollywood, blocks away from the Paramount lot. And HBO maintains its operations in Culver City — miles from Warner’s Burbank lot.

Paramount pushed its deadline to Feb. 20 for Warner investors to tender their shares at $30 a piece.

The tender offer was set to expire last week, but Paramount extended the window after failing to solicit sufficient interest among Warner shareholders.

Some analysts believe Paramount may have to raise its bid to closer to $34 a share to turn heads. Paramount last raised its bid Dec. 4 — hours before the auction closed and Netflix was declared the winner.

Paramount also has filed proxy materials to ask Warner shareholders to reject the Netflix deal at an upcoming stockholder meeting.

Earlier this month, Netflix amended its bid, converting its $27.75-a-share offer to all-cash to defuse some of Paramount’s arguments that it had a stronger bid.

Should Paramount win Warner Bros., it would need to line up $94.65 billion in debt and equity.

Billionaire Larry Ellison has pledged to backstop $40.4 billion for the equity required. Paramount’s proposed financing relies on $24 billion from royal families in Saudi Arabia, Qatar and Abu Dhabi.

The deal would saddle Paramount with more than $60 billion of debt — which Warner board members have argued may be untenable.

“The extraordinary amount of debt financing as well as other terms of the PSKY offer heighten the risk of failure to close,” Warner board members said in a filing earlier this month.

Paramount would also have to absorb Warner’s debt load, which currently tops $30 billion.

Netflix is seeking to buy the Warner Bros. television and movie studios, HBO and HBO Max. It is not interested in Warner’s cable channels, including CNN. Warner wants to spin off its basic cable channels to facilitate the Netflix deal.

Analysts say both deals could face regulatory hurdles.