This Artificial Intelligence (AI) Stock Is Quietly Outperforming Nvidia in 2025

This company is essential to the success of Nvidia and nearly every other major chipmaker.

Nvidia is arguably the king of Wall Street these days. As the maker of high-performing graphics processing units (GPUs) that power artificial intelligence (AI) programs and large language models, Nvidia’s stock price exploded in the last three years, up nearly 1,500%. The company now boasts a market capitalization of $4.6 trillion, making it the biggest company in the world by valuation, and it seems to be a lock to reach $5 trillion soon.

While Nvidia is having another solid year in 2025, boasting a 41% gain, there’s another AI stock that’s doing even better — one that’s essential to the success of Nvidia and nearly every other major chipmaker.

Better than Nvidia

Taiwan Semiconductor Manufacturing (TSM 3.46%), better known as TSMC, is the biggest semiconductor fabricator in the world. It doesn’t design chips, but it builds them in its fabrication plants for Nvidia and other customers, including Broadcom, Advanced Micro Devices, Apple, Tesla, and more.

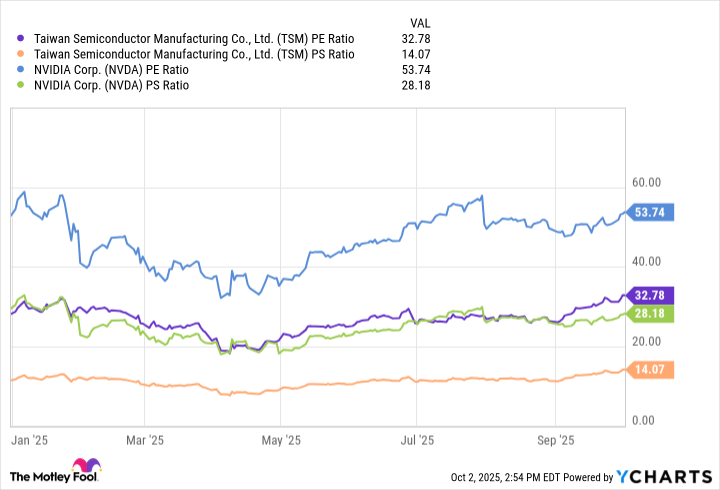

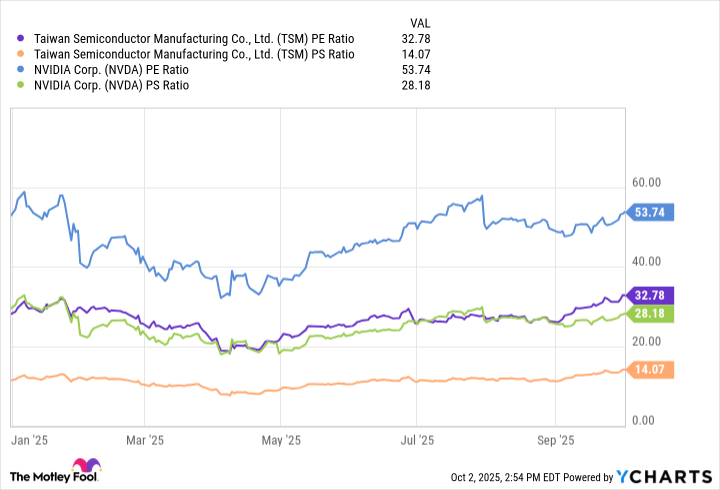

TSMC stock is up 45% so far this year, beating Nvidia’s year-to-date gain, and just set a new all-time high. And it’s also a better valued stock, with price-to-earnings and price-to-sales ratios that are much more appealing than Nvidia.

TSM PE Ratio data by YCharts

Now for the icing on the cake. Nvidia’s CEO loves Taiwan Semiconductor and recently tipped his cap to TSMC. “They are a world-class foundry and support customers of diverse needs. You can’t overstate the magic that is TSMC,” Jensen Huang told reporters in September.

Image source: The Motley Fool.

What makes TSMC tick?

Taiwan Semiconductor’s biggest business is making 3-nanometer and 5nm chips. The company gets 60% of its revenue from making the chips.

TSMC is one of a select few fabricators that can make the highly sought-after 3nm chips at scale, and that’s a big deal. The smaller the transistors on chips, the more that companies such as Tesla and Nvidia can cram into them to make them more powerful. And TSMC already has plans to mass-produce its 2nm process this year.

TSMC also makes semiconductors used in smartphones, making 5G communication possible for a mass audience. 5G allows wireless users to access the internet at broadband speeds, which means you can do pretty much anything you need from your laptop, tablet, or phone, including streaming high-resolution videos or content, or work remotely.

The company gets a smaller portion of its revenue from Internet of Things devices such as smart home products and wearable technology. It also makes chips for electric vehicles, driver assistance programs, and vehicle information and entertainment systems.

Revenue in the second quarter was $30.07 billion, up 44.4% from a year ago, with an outstanding net profit margin of 42.7%. And the numbers are expected to be even better next quarter, when the company is projecting revenue between $31.8 billion and $33 billion.

TSMC is also expanding rapidly, investing $165 billion into creating fabrication plants and other facilities in Arizona. That’s important to help insulate Taiwan Semiconductor from the threat of tariffs or other economic headwinds as the U.S. government seeks to bring manufacturing to American soil.

Should you buy Nvidia or TSMC?

If you’re just picking one stock to buy now, my choice would be TSMC. The company has a 70% market share in the foundry market, according to market research firm TrendForce, giving it an enormous moat. And when you consider the semiconductor industry is a $600 billion business that’s projected to reach $1 trillion annually by 2030, the market opportunity for Taiwan Semiconductor is huge.

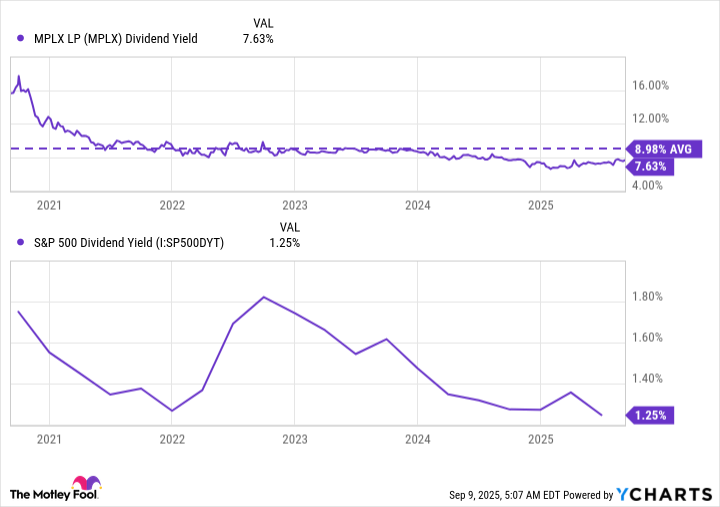

And it also has a dividend, which you don’t often see in an AI stock. Taiwan Semiconductor’s yield of 1.2% and payout of $3.34 per share won’t make you a millionaire, but it’s loads better than the skimpy $0.04 that Nvidia pays out annually.

All in, TSMC is a cheaper stock than Nvidia and is absolutely essential to the semiconductor and AI industries. But if you have room in your portfolio, you should invest in both. Together, TSMC and Nvidia are an unstoppable two-headed AI powerhouse that can anchor any portfolio.

Patrick Sanders has positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Nvidia, Taiwan Semiconductor Manufacturing, and Tesla. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.