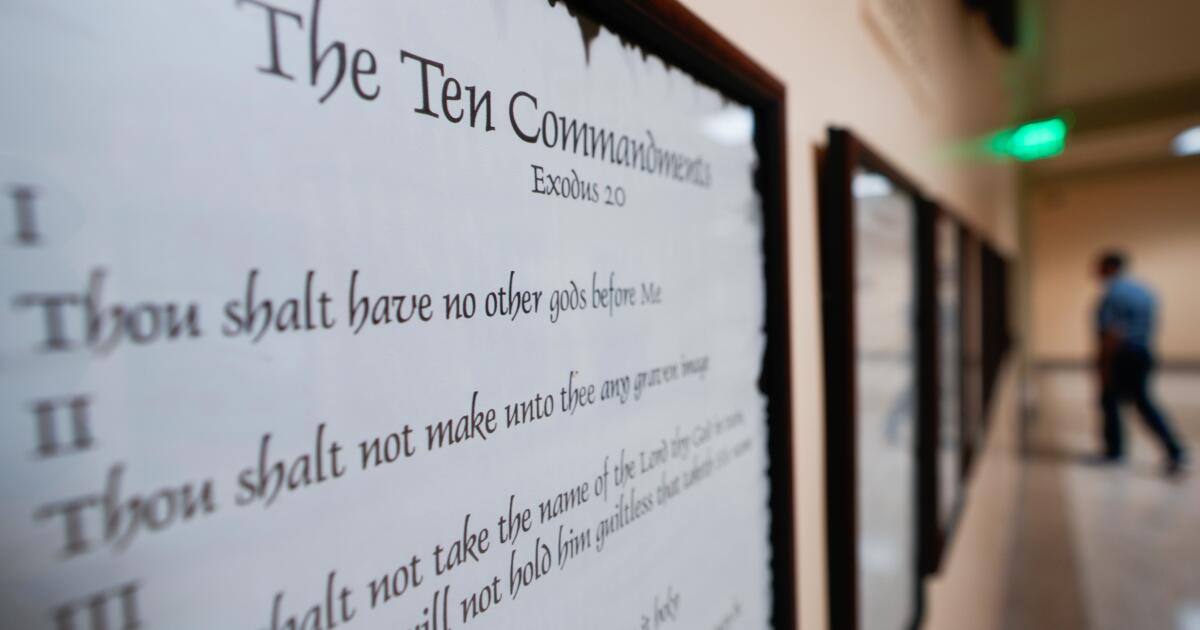

Court OKs Louisiana law requiring Ten Commandments in classrooms

NEW ORLEANS — A U.S. appeals court has cleared the way for a Louisiana law requiring poster-sized displays of the Ten Commandments in public school classrooms to take effect.

The 5th U.S. Circuit Court of Appeals voted 12 to 6 to lift a block that a lower court first placed on the law in 2024. In the opinion released Friday, the court said it was too early to make a judgment call on the constitutionality of the law.

That’s partly because it’s not yet clear how prominently schools may display the religious text, whether teachers will refer to the Ten Commandments during classes or if other texts like the Mayflower Compact or the Declaration of Independence will also be displayed, the majority opinion said.

Without those sorts of details, the panel decided that it did not have enough information to weigh any 1st Amendment issues that might arise from the law. In other words, there aren’t enough facts available to “permit judicial judgment rather than speculation,” the majority wrote in the opinion.

In a concurring opinion, Circuit Judge James Ho, an appointee of President Trump, wrote that the law “is not just constitutional — it affirms our nation’s highest and most noble traditions.”

The six judges who voted against the decision wrote a series of dissents, with some arguing that the law exposes children to government-endorsed religion in a place they are required to be, presenting a clear constitutional burden.

Circuit Judge James L. Dennis, an appointee of President Clinton, wrote that the law “is precisely the kind of establishment the Framers anticipated and sought to prevent.”

The ruling is the result of the court’s choice to rehear the case with all judges present after three of them ruled in June that the Louisiana law was unconstitutional. The reversal comes from one of the nation’s most conservative appeals courts, and one that’s known for propelling Republican policies to a similarly conservative U.S. Supreme Court.

Republican Gov. Jeff Landry celebrated the ruling Friday, declaring, “Common sense is making a comeback!”

The ACLU of Louisiana, one of several groups representing plaintiffs, pledged to explore all legal pathways to continue fighting the law.

Arkansas has a similar law that has been challenged in federal court. And a Texas law took effect on Sept. 1, marking the widest reaching attempt in the nation to hang the Ten Commandments in public schools.

Some Texas school districts were barred from posting them after federal judges issued injunctions in two cases challenging the law, but they have already gone up in many classrooms across the state as districts paid to have the posters printed themselves or accepted donations.

The laws are among pushes by Republicans, including Trump, to incorporate religion into public school classrooms. Critics say doing so violates the separation of church and state, while backers say the Ten Commandments are historical and part of the foundation of U.S. law.

Joseph Davis, an attorney representing Louisiana in the case, applauded the court for upholding the nation’s “time-honored tradition of recognizing faith in the public square.”

Families from a variety of religious backgrounds, including Christianity, Judaism and Hinduism, have challenged the laws, as have clergy members and nonreligious families.

The Freedom From Religion Foundation, another group involved in the challenge, called the ruling “extremely disappointing” and said the law will force families “into a game of constitutional whack-a-mole” where they will have to separately challenge each school district’s displays.

Louisiana Atty. Gen. Liz Murrill said after the ruling that she had sent schools several correct examples of the required poster.

In 1980, the Supreme Court ruled that a similar Kentucky law violated the Establishment Clause of the U.S. Constitution, which says Congress can “make no law respecting an establishment of religion.” The court found that the law had no secular purpose but served a plainly religious purpose.

And in 2005, the Supreme Court held that such displays in a pair of Kentucky courthouses violated the Constitution. At the same time, the court upheld a Ten Commandments marker on the grounds of the Texas state Capitol in Austin.

Schoenbaum and Boone write for the Associated Press.