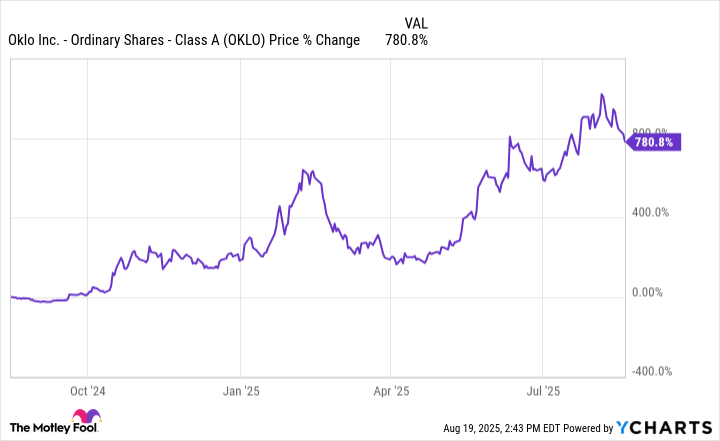

Oklo Stock Has Surged 736% Since April — 1 Reason Some Experts Are Worried

Oklo remains one of the hottest stocks on the market.

It seems as if all eyes are on Oklo (OKLO 1.39%) right now. Shares have surged in value by more than 700% since April. But when you look closer, Oklo’s entire industry is skyrocketing. Nuscale Power, another company focused on small modular nuclear reactors, has seen its valuation nearly quadruple since April.

Why are stocks like Oklo and Nuscale rising exponentially? There’s one primary factor to be aware of now for investors to consider.

Small-scale nuclear power may soon be a reality

For decades, small modular nuclear reactors have been relegated only to science fiction. In theory, the technology makes a lot of sense. Small modular reactors, commonly referred to as SMRs, can be deployed anywhere in the world, even in remote locations without any road access. Once built, they can produce fairly affordable power with minimal carbon emissions. And they don’t have as many issues with generation intermittency as other renewable energy sources like wind or solar.

Companies like Oklo and Nuscale, however, claim that they are just a handful of years away from constructing the world’s first commercial SMRs. Nuscale is already certified by the Nuclear Regulatory Council in the U.S. Oklo is currently in the application process. If successful, this industry could upend the global energy paradigm, delivering low-cost, low-carbon fuel at any scale, anywhere in the world.

Image source: Getty Images.

Here’s the problem: We still don’t know if what these companies are promising is even possible. Neither Oklo nor Nuscale has any existing orders from customers. And analysts are ready to point out the industry’s consistent failures over the years.

Many of these failures weren’t technological, but simply a matter of cost, with huge cost overruns the norm throughout history. “The technical and extreme cost challenges of SMRs has been known and widely reported on for years, raising the question of why the hype continues to grow,” observes Jim Green, a member of the Nuclear Consulting Group.

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool recommends NuScale Power. The Motley Fool has a disclosure policy.