Trump lashes out at justices, announces new 10% global tariff

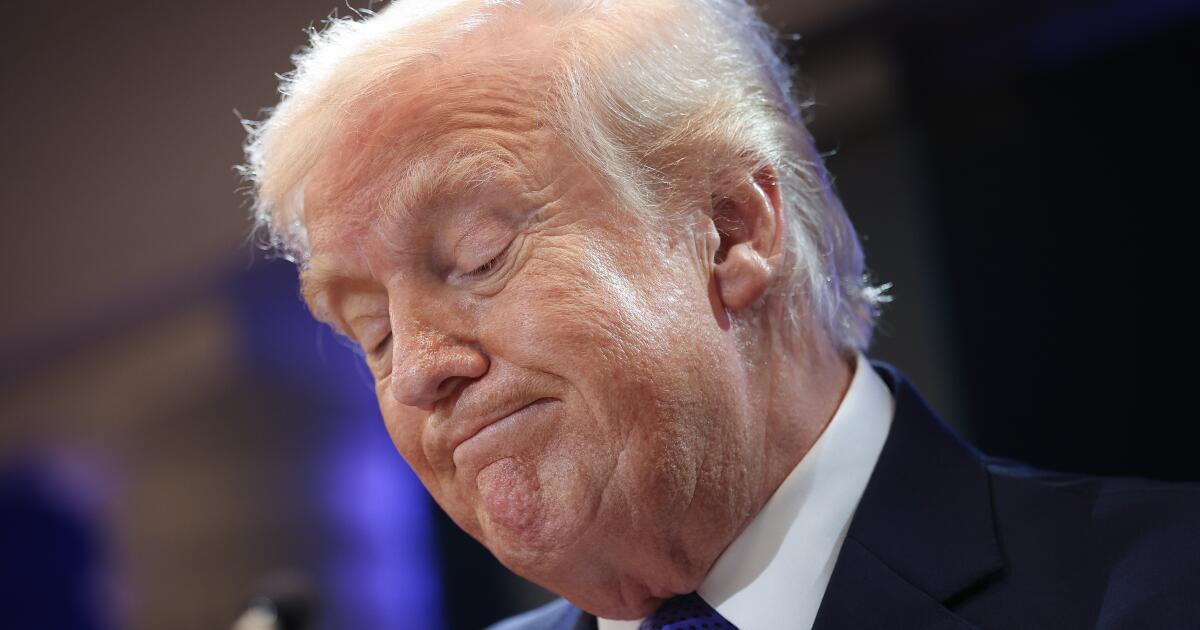

WASHINGTON — President Trump on Friday lashed out at Supreme Court justices who struck down his tariffs agenda, calling them “fools” who made a “terrible, defective decision” that he plans to circumvent by imposing new levies in a different way.

In a defiant appearance at the White House, Trump told reporters that his administration will impose new tariffs by using alternative legal means. He cast the ruling as a technical, not permanent setback, for his trade policy, insisting that the “end result is going to get us more money.”

The president said he would instead impose an across-the-board 10% tariff on imports on global trade partners through an executive order.

The sharp response underscores how central tariffs have been to Trump’s economic and political identity. He portrayed the ruling as another example of institutional resistance to his “America First” agenda and pledged to continue fighting to hold on to his trade authority despite the ruling from the nation’s highest court.

Trump, however, said the ruling was “deeply disappointing” and called the justices who voted against his policy — including Justices Neil M. Gorsuch and Amy Coney Barrett, whom he nominated to the court — “fools” and “lap dogs.”

“I am ashamed of certain members of the court,” Trump told reporters. “Absolutely ashamed for not having the courage to do what’s right for our country.”

For years, Trump has insisted his tariffs policy is making the United States wealthier and giving his administration leverage to force better trade deals, even though the economic burden has often fallen on U.S. companies and consumers. On the campaign trail, he has turned to them again and again, casting sweeping levies as the economic engine for his administration’s second-term agenda.

Now, in the heat of an election year, the court’s decision scrambles that message.

The ruling from the nation’s highest court is a rude awakening for Trump at a time when his trade policies have already caused fractures among some Republicans and public polling shows a majority of Americans are increasingly concerned with the state of the economy.

Ahead of the November elections, Republicans have urged Trump to stay focused on an economic message to help them keep control of Congress. The president tried to do that on Thursday, telling a crowd in northwest Georgia that “without tariffs, this country would be in so much trouble.”

As Trump attacked the court, Democrats across the country celebrated the ruling — with some arguing there should be a mechanism in place to allow Americans to recoup money lost by the president’s trade policy.

“No Supreme Court decision can undo the massive damage that Trump’s chaotic tariffs have caused,” Sen. Elizabeth Warren (D-Mass.) wrote in a post on X. “The American people paid for these tariffs and the American people should get their money back.”

California Gov. Gavin Newsom called Trump’s tariffs an “illegal cash grab that drove up prices, hurt working families and wrecked longstanding global alliances.”

“Every dollar your administration unlawfully took needs to be immediately refunded — with interest,” Newsom, who is eyeing a 2028 presidential bid, wrote in a post on X addressed to Trump.

The president’s signature economic policy has long languished in the polls, and by a wide margin. Six in 10 Americans surveyed in a Pew Research poll this month said they do not support the tariff increases. Of that group, about 40% strongly disapproved. Just 37% surveyed said they supported the measures — 13% of whom expressed strong approval.

A majority of voters have opposed the policy since April, when Trump unveiled the far-reaching trade agenda, according to Pew.

The court decision lands as more than a policy setback to Trump’ s economic agenda.

It is also a rebuke of the governing style embraced by the president that has often treated Congress less as a partner and more as a body that can be bypassed by executive authority.

Trump has long tested the bounds of his executive authority, particularly on foreign policies, where he has heavily leaned on emergency and national security powers to impose tariffs and acts of war without congressional approval. In the court ruling, even some of his allies drew a bright line through that approach.

Gorsuch sided with the court’s liberals in striking down the tariffs policy. He wrote that while “it can be tempting to bypass Congress when some pressing problems arise,” the legislative branch should be taken into account with major policies, particularly those involving taxes and tariffs.

“In all, the legislative process helps ensure each of us has a stake in the laws that govern us and in the Nation’s future,” Gorsuch wrote. “For some today, the weight of those virtues is apparent. For others, it may not seem so obvious.”

He added: “But if history is any guide, the tables will turn and the day will come when those disappointed by today’s result will appreciate the legislative process for the bulwark of liberty it is.”

Trump said the court ruling prompted him to use his trade powers in different ways.

In December, Treasury Secretary Scott Bessent asserted has the administration can replicate the tariff structure, or a similar structure, through alternative legal methods in the 1974 Trade Act and 1962 Trade Expansion Act.

“Now the court has given me the unquestioned right to ban all sort of things from coming into our country, to destroy foreign countries,” Trump said, as he lamented the court constraining his ability to “charge a fee.”

“How crazy is that?” Trump said.