Market chatter about the frothiness of the AI market seems to be picking up as OpenAI CEO Sam Altman claims that he too sees a bubble forming.

In this podcast, Motley Fool contributors Tyler Crowe, Lou Whiteman, and Rachel Warren discuss:

- OpenAI CEO Sam Altman’s comments about AI bubbles.

- Target and Estee Lauder under new leadership.

- Home Depot and Lowe’s in a race to own the building products space.

To catch full episodes of all The Motley Fool’s free podcasts, check out our podcast center. When you’re ready to invest, check out this top 10 list of stocks to buy.

A full transcript is below.

This podcast was recorded on August 20, 2025.

Tyler Crowe: The AI market is in a frothy mood again, and there’s some big shake ups in retail. This is Motley Fool Money.

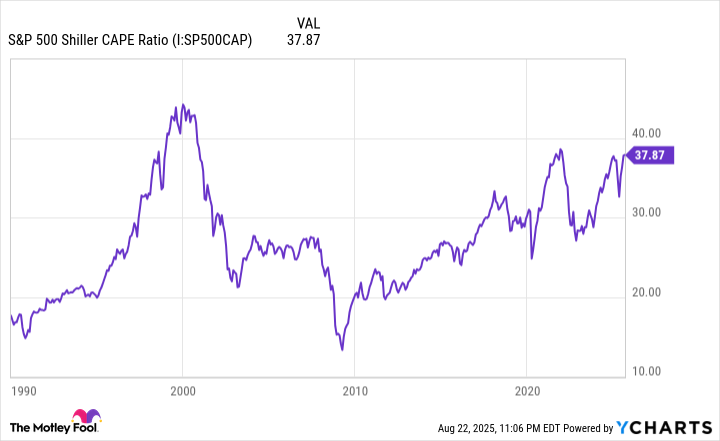

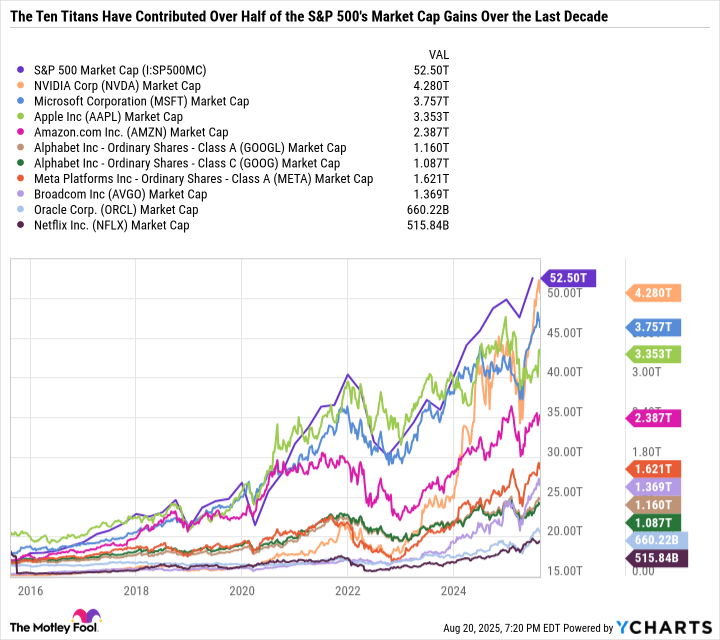

Welcome to Motley Fool Money. I’m Tyler Crowe, joined by longtime Fool contributors, Lou Whiteman and Rachel Warren. Second quarter earnings are coming to a close, but we still have some big companies reporting earnings and making some big management moves. Today, we’re going to cover management shakeups at Target and Estée Lauder and also some mergers and acquisitions activity in an arms race between Lowe’s and Home Depot. But before we begin with that, we’re going to start with everyone’s favorite family dinner conversation, which is, are we in an AI bubble? It’s been a driving force the AI story for much of the market in 2025. We’ve seen a lot of companies, more than double and post some incredible numbers so far this year, but it hasn’t been without hiccups. We had the DeepSeek crash, I guess, if you will, back in January, that sent markets into a tizzy. Then this week, I think it was actually over the weekend, OpenAI’s CEO Sam Altman actually said to reporters, and I quote, “Are we in a phase where investors as a whole are over excited about AI? My opinion is yes. Is AI the most important thing to happen in a very long time? My opinion is also yes.” Pretty bold and evocative statement from Sam Altman. In addition to those comments, we’ve seen some pretty sharp stock declines with some AI companies reporting earnings, and some of these darlings are down pretty considerably. Palantir is down almost 18% over the past week as of our recording, and CoreWeave the AI Data Center company is down 40% its reported earnings last week. Rachel and Lou, I want to toss this to you. Rachel, you can go first. What do you make of Sam Altman’s statement about AI and is the AI market looking bubbly to you?

Rachel Warren: I do think this was a really interesting comment from Mr. Altman, particularly given that OpenAI remains one of the most public and prominent players in the AI race. You remember many fears of an AI bubble hit a fever pitch earlier this year back when the Chinese start-up DeepSeek released their competitive reasoning model. They claimed that one version of their advanced large language models had been trained for under $6 million, and that’s compared to billions like OpenAI has spent. Then earlier this month, Altman said that OpenAI’s annual recurring revenue is on track to pass $20 billion this year, but they’re still unprofitable. Then the release of their latest GPT-5 AI model earlier this month, it wasn’t so great either, so much so that the company restored access to Legacy GPT-4 models for paying customers. I do think that we can trace some similarities to the dot-com bubble when you’re looking at the current AI boom. You have rapid surges in investment companies receiving massive funding rounds based on the potential of the underlying tech. Sometimes there isn’t a clear path to profitability. I do think that some companies might be getting a bit ahead of their skis in terms of valuation. But I think it’s important to underscore. AI is not just a blanket catch all term, even though it tends to be used that way. AI is everything from AI algorithms that are analyzing medical images to assisting doctors in faster and more accurate diagnoses to the AI that we see being used to control and automate robots and manufacturing, logistics and other industries. Major companies like Pfizer, Eli Lilly, Amazon, and others are incorporating AI into their everyday operations. The technology is real. It’s rapidly evolving, and it is here to stay. I think that’s the important point to remember.

Lou Whiteman: I think it’s so interesting because there’s what Altman said and the way the headlines have taken off with it the idea, we’re in a bubble, everything’s trouble. That’s not really what he said. We sometimes think of the word bubble and we think of worthless and think the same thing. We know that isn’t true. Some stocks can be in a bubble, but yet, there’s also something going on that’s creating something profoundly profitable, profoundly society changing over time. I think what Altman was trying to say is that, yes, some valuations are getting frothy, but, hey, investors, workers who might be getting poached by other companies, if things are frothy, if there could be winners and losers here, why don’t you want to just stay with one of the big winners, one of the big guns? I think he was talking to a specific crowd. I don’t think he was predicting gloom and doom.

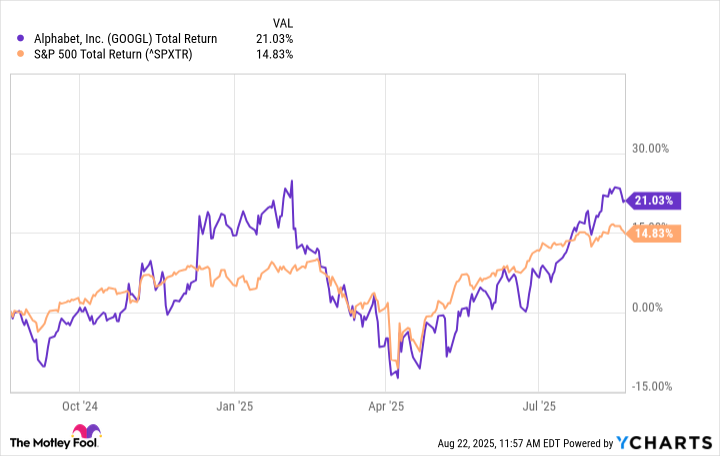

Tyler Crowe: Certainly my take is, and I’ve said this before in other spaces, but the idea that the winner of AI has emerged, I think, is a little early. The best example I can give is Google, which emerged many years after Internet search had been a big thing with Yahoo, Netscape, Ask Jeeves, all these other options that have pretty much gone the way of the dinosaur, and I think we could see something relatively similar with late emerging opportunities, as well. Lou, when we think about opportunities and maybe a little bit from the lens I just mentioned, where are you seeing the opportunities for AI right now?

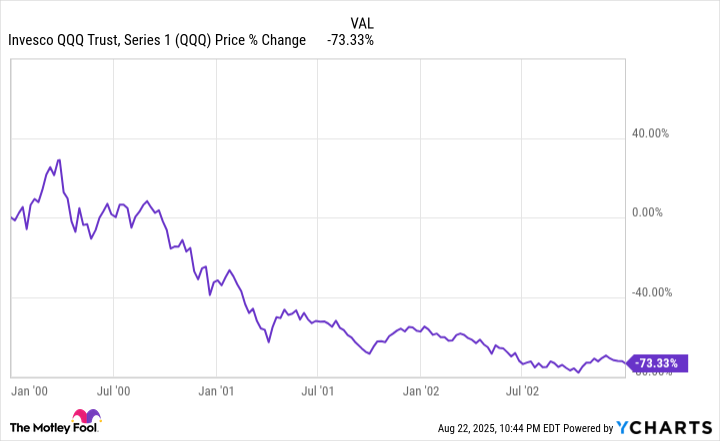

Lou Whiteman: Well, for one, back on the bubble thing, let’s just point out that we both had a dot-com bubble, and companies like Amazon emerged. Even if there is a bubble, valuations may be stretched, but there still will be long-term winners among the companies we’re talking about. For me, right now, it’s all about diversification, whether it’s Amazon or if it’s Apple or Microsoft and Alphabet, these are companies with a lot of ways to win, and AI is part of that. But take that versus a Palantir or CoreWeave where all of your eggs are in the AI basket. I would much rather be with a diversified company. I don’t really like the picks and shovels, though. I think these have gotten just as over valued or maybe even more so than some of the main players. I love the idea that we’re going to need energy, we’re going to need data centers. I think that’s all true, but I also think that that’s very priced in. If there is a bubble, I almost think it’s there and not just the big companies that are using it.

Tyler Crowe: Rachel, for investors who are trying to identify, like things with durable growth stories, durable advantages versus an AI hype play, how do you think investors should look at it as separating between the two?

Rachel Warren: I think, fundamentally, there needs to be a real business that’s underpinning that technology. Looking for companies that are solving tangible real world problems or maybe is being used to optimize existing processes, not just a company using AI for the sake of using AI. Then also when you’re looking at some of these businesses, are these AI applications providing clear value? How does a company plan to generate revenue from its AI business? Is this a sustainable model with potential for growth? Ultimately, I think, especially amid the AI boom where you’re trying to really separate the wheat from the chaff, so to speak, you need to be looking for companies with sustained revenue growth, healthy profit margins, and positive free cash flow, which suggests they’re generating enough cash to fund their operations and invest in their future AI growth. I think that’s why we get back to a lot of these major players like the Amazons and Alphabets, because there is a real business there, and they are incorporating massive revolutionary AI elements into their businesses which have remained the crux of their respective industries for decades.

Tyler Crowe: The AI story, I feel like we could go in so many different angles, but we are still in the midst of earning season. We’re going to move on, and coming up next, we’re going to look at two retailers who are looking to new leadership right now to turn their prospects around.

Target reported earnings earlier today that were well, less than great. Before we recorded this episode, we were planning on discussing Target’s earnings through the lens of tariffs because it’s been such a hot topic of lately. But then the company threw us a little bit of a curveball and announced that current chief operating officer Michael Fiddelke will be taking over the CEO spot from Brian Cornell, starting in February of 2026. Now, Target’s earnings did beat Wall Street’s expectations, but they were pretty low expectations to begin with, and it maintained its guidance for the rest of the year, and its stock was down 7% today as of this taping. What stood out to you in the earnings or the announcement of the CEO change? What can Fiddelke do to actually turn things around here?

Rachel Warren: I do think it’s important to highlight it. Target has a range of issues it’s facing right now, and they do predate the tariff environment. Some of these problems are related to the consumer, but a lot of Targets issues also go back to the waning days of the pandemic. We saw consumers pull back on expenditures as inflation increased, and they focused more on needs-based categories. There has been this real significant shift to value. In many cases, that has led consumers to competitors like Walmart. Targets also faced criticism and boycotts in recent years that have severely impacted sales, and it has yielded ground to competitors in key areas where it used to lead, HomeGoods being one vital category. As you noted, they just reported their Q2 sales and earnings. Net sales in the quarter were down 0.9% from a year ago, comparable sales fell 1.9%, operating income fell by 19.4%. They did see a 14% increase in non-merchandise sales. Their digital sales grew about 4%. Tariffs, of course, are likely to erode some of their profit margins. There’s also a very likely reality that they’re going to need to raise some prices, and that could impact consumer expenditures. Cornell will remain executive chairman, but I do think it’s clear that management is looking to right the ship, and they think that a new leader at the CEO helm is an important step. I do think Target can come back from this, but it’s going to require time and patience. Again, a lot of these issues predate what we’ve seen in its industry the last several months. One thing I’ll note, this is still a major dividend payer for investors, 54 consecutive years of dividend increases and counting. That might be one reason to look at Target on the dip right now.

Lou Whiteman: Can come back from it, but a big emphasis on can for me. I’m not ready to make a call, and I don’t want to be too scared here, but retail is full of seemingly just powerhouse brands that just suddenly disappear or lose their mojo. Again, I don’t know if that’s what’s going to happen to Target, but I think target investors have to be a bit worried here. Ask Cole’s investors, ask Sears investors, ask JCPenney’s investors. Big, well established brands can go from all as well to things go terribly wrong and not recover. I think, as Rachel said, this has been a long time coming. On the back end, you talk to Target suppliers, and they’ll say, we get dealing with two or three people a year. It’s just chaos. I’ll say this, I think Michael Fiddelke has a big task up ahead just to stabilize a business that doesn’t feel stable to me. I’m hopeful, but I don’t think it’s a slam dunk because guys, honestly, what does Target bring to the retail table that you can’t get somewhere else? What is their go to thing? I can’t answer that question, and if I was thinking of investing, that would really scare me.

Tyler Crowe: It is a tough question to ask, and at the same time, I don’t think it’s a coincidence that a lot of the retailers and brands and a lot of the companies we’ve been talking about have been struggling is coming in a pretty volatile post COVID world. I think a lot of companies have been shaken to their core and haven’t quite found their way out of the woods yet. In that same vein of new leadership, Estée Lauder reported its fiscal fourth quarter earnings today, as well. Sales were down 8% for the year. Net income swung to a huge loss, but a lot of that came from significant impairment and restructuring charges because new management came in and is looking to make significant changes. CEO Stéphane de La Faverie came in in January and took over for longtime serving CEO, as well as displacing the Lauder family a little bit, who have been tied to the C-suite, tied to the board. There was a little bit of corporate drama. I know the Wall Street Journal covered it pretty extensively coming up to that. But Rachel, I’m going to toss this to you. Do you think that this corporate shakeup that de La Faverie is proposing is going to really work, and will it allow Estée Lauder to get back on track to being a winning company that it was for as long as it was?

Rachel Warren: You’re right. This does have such an extensive history of being a winning company as one of the legacy players in the beauty space. I think the jury’s still out as to whether this turnaround will be effective. I do think that they still have a place in the industry, but it’s going to be an uphill battle. They are seeing sales declines across pretty much all of their core segments, and there are some very practical reasons for that. One being that Estée Lauder heavily and historically had relied on the Chinese market for growth, especially through tourist spending as well, and in European markets. But China in particular, their luxury market has experienced a significant slowdown, and that’s really impacted Estée Lauder sales, and a lot of their strategies through the years, which had been really successful in the past, have failed to resonate with the latest and youngest generation of beauty consumers, and it has become an increasingly competitive space in the years since Estée Lauder’s heyday. This is also a company that was slow to adapt to the shift toward online beauty sales and online shopping. We saw even competitors like L’Oréal that invested more heavily in online channels. Estée Lauder continues to face really fierce competition from other emerging beauty and skincare brands. One obvious example is e.l.f. which just acquired Haley Bieber’s brand Rhode and also owns many other key brands in the modern beauty space. Of course, now there’s the tariff factor that is compressing margins across the industry. Estée Lauder, they have had significant workforce reductions. They’ve been shifting their marketing strategy. They’ve been reevaluating some of their supplier relationships. But time will tell the environment they’re operating in now is very different than that of 15 or 20 years ago.

Tyler Crowe: In the age of TikTok, airport duty free seems a little outdated in terms of your dedicated sales model. Next up, we’re going to talk about Home Depot’s and Lowe’s who are taking a very different approach to slugged growth in the past couple of years. Does it ever feel like you’re a marketing professional just speaking into the void? Well, with LinkedIn ads, you can know you’re reaching the right decision makers. You can even target them by job title, industry, company, role, seniority, skills, company revenue, and did I say job title yet? Get started today and see how you can avoid the void and reach the right buyers with LinkedIn ads. To get 100 pounds off your first campaign, go to linkedin.com/lead to claim your credit. Terms and conditions apply. We just discussed two retailers looking to new leadership to shake things up, but home improvement retail has also been moving and shaking quite a bit in the past couple of years. But instead of fresh faces in the front of the C-suite, they’re actually looking to acquire their way out of a slump. Just today, when Lowe’s announced their earnings for the quarter, it was also announced it was buying building products distributor foundation building materials from a private equity company for about $8.8 billion. Now, this just comes a few months after Home Depot announced it was acquiring GMS, its second specialty building products distribution company in as many years. Now, Home Improvement retail has been in the dumps for a myriad of reasons of interest rates, COVID. You name your crisis over the past five years. I want to start with Lou this time. What do you make of these moves of moving into professional contracting specialty product distribution?

Lou Whiteman: Tyler, I can’t answer this without bringing up a third company, QXO, which is also trying to consolidate this industry. They, of course, are run by Brad Jacobs, who has consolidated the tool rental industry, has consolidated trucking, has consolidated waste. Whether or not QXO ends up being a success, I do believe Brad Jacobs knows how to identify a market ripe for a roll up. I have no idea if he assumed Home Depot and Lowe’s will goes aggressively in when he started QXO or if this is turning into a problem. But I do think if you look at there’s 75,000 very small little companies here. It’s fragmented the logic of a roll up and a logic for a Home Depot or Lowe’s to go in and try to roll up this industry. It’s there, and I think on paper, at least, it makes sense, whether it works for Lowe’s, whether it works for Home Depot, that we’ll have to see.

Rachel Warren: I think if you take a step back, this makes a lot of sense. First of all, it’s worth pointing out that Home Depot commands a much larger market share and significantly higher revenue than Lowe’s, and it has a more extensive store network. It’s historically really focused on serving professional contractors. Those represent something like half or about 45% of its sales, and Lowe’s needs to gain ground here. Its recent moves make sense. They also recently acquired a company called Artisan Design Group for $1.3 billion as they’re really trying to strengthen their presence in the new home construction market, expand their pro services. They have rolled out their total home strategy, where they’re looking to be a one stop shop for DIY as well as pro customers. But the reality of the environment in which Home Depot and Lowe’s are operating in remains, we know that high interest and mortgage rates have discouraged home buying and selling. Consumers are allocating their spending to other areas. I think that these are both, solid value driven businesses. Focusing on the pro market, I think is a right move for them. But I do think we’re going to continue to see sluggish growth figures unless and until the environment in which they’re operating starts to relax and we start to see growth again.

Tyler Crowe: It feels like the building products industry specifically has been a little bit of a small fish, or bigger fish eat smaller fish until another bigger fish comes along. Lou, I’m going to ask this last question. Is there enough room in this market for basically three giant sharks? I’m including three because you really pitched QXO so well. If Home Depot’s, Lowe’s, and QXO are all simultaneously looking at major roll ups, is there enough room for them to eat?

Lou Whiteman: There is enough in theory. My fear is what this does to pricing. Not all assets are created equal. I think I’d be surprised if Home Depot or Lowe’s wants to put too much more capital work here with these big deals they’ve done. I think that does provide a lane for QXO, but there’s a lot of work to be done. Not all assets are created equal, and it will be curious to see who makes the right decisions as far as capital allocation and who ends up with the right fortress asset at the end of the day when everything’s cobbled together.

Tyler Crowe: As always, people on the program may have interest in the stock they talk about, and the Motley Fool may have formal recommendations for or against, so don’t buy or sell stocks based solely on what you hear. All personal finance content follows Motley Fool editorial standards, and it’s not approved by advertisers. Advertisements are sponsored content and provided for informational purposes only. To see our full advertising disclosure, please check our [inaudible] . For Lou Whiteman and Rachel Warren, our production leader Dan Boyd and the entire Motley Fool Money team, I’m Tyler Crowe. Thanks for listening, and we’ll chat again soon.