Image source: The Motley Fool.

DATE

Tuesday, August 26, 2025 at 8:00 a.m. ET

CALL PARTICIPANTS

Chief Executive Officer — Kristian Sorensen

Chief Financial Officer — Samantha Xu

Need a quote from a Motley Fool analyst? Email [email protected]

TAKEAWAYS

Time Charter Equivalent (TCE) Income— $38,800 per available day and $37,300 per calendar day, both above prior guidance of $35,000 per day.

Profit After Tax (Attributable to Equity Holders)— $35 million profit with earnings per share of $0.23.

Dividend Declared— $0.22 per share dividend declared, representing 75% of shipping NPAT, supplemented by retained dividends from Product Services 2024 results.

Product Services Segment Profit After Tax— $6 million net profit after tax for Product Services, with realized gross profit of $15 million.

Aggregate Realized Product Services Profit YTD— $39 million as of June 30, 2025.

Dry Docking Days— 139 days in Q2 2025; management expects 143 days in Q3 and 135 days in Q4 2025, impacting available earning capacity.

Third Quarter Guidance— Approximately $53,000 per day fixed for 90% of available days, exceeding all-in cash breakeven of $24,800 per day for the year 2025.

Financing Activity— New $380 million term loan and revolving facility secured for advanced gas fleet, plus $215 million term loan facility for BW LPG India; $250 million shareholder loan terminated early.

Fleet Composition and Growth— 409 VLGCs in service globally as of Q2 2025, with only 7 new deliveries expected in 2025 and an order book of 111 vessels.

Time Charter Portfolio Exposure— 44% of shipping exposure, including 32% fixed rate; Q3 2025 fixed at 90% of available days.

Segment Profitability— the balance of fixed time charter out estimated to contribute $74 million in the second half of 2025.

Net Leverage Ratio— 31% in Q2, down from 33% at the end of last year primarily due to lease liability reduction.

Operating Expenses (OpEx)— $9,000 per day OpEx in Q2 2025; own fleet operating cash breakeven expected at $19,100 per day for full year 2025 and total fleet at $21,700 per day for full year 2025; all-in cash breakeven projected at $24,800 per day for the year.

Liquidity Position— $287 million in cash at the end of Q2 and $421 million in undrawn revolving credit lines at quarter end.

Trade Finance Utilization— $303 million trade finance utilization, equating to 38% of total available credit for trading activities.

Kristian Sorensen— “VLGC market is characterized by solid fundamentals with robust growth in export volumes from the U.S. and Middle East; fleet inefficiencies and Panama Canal congestion are absorbing capacity and elevating rates, with spot rates reaching above $70,000 per day for certain routes as reported in Q2 2025.

Product Services Value at Risk— Average bar value at risk was $6 million, reflecting a balanced trading book.

Return Metrics— Shareholders’ equity was $1.9 billion as of Q2 2025; annualized return on equity and capital employed were 98%, respectively.

SUMMARY

Management highlighted a volatile quarter driven by exceptional geopolitical disruptions and shifting trade flows, resulting in elevated freight rates and increased demand for very large gas carriers (VLGCs). The company’s ongoing drydocking program is expected to constrain operational days through Q4, which may affect near-term capacity and reported income. BW LPG Limited’s time charter strategy has provided downside protection but has also limited exposure to recent spot rate surges, influencing guidance for Q3 2025. Liquidity remains robust following recent financings and early loan repayments, with the next major maturity not due until 2029. Management underscored the significant impact of Panama Canal congestion and evolving cargo flow patterns on market fundamentals.

CEO Sorensen stated, “the supply-demand balance in the VLGC market is tight, and the bargaining power is in the shipping market’s favor.”

Samantha Xu said the reported net asset value for Product Services does not include a $10 million unrealized physical shipping position as of Q2 2025, indicating additional latent value not recognized in current financials.

Fleet renewal and newbuild activity remain limited in the near term, with only seven new VLGCs expected for delivery in 2025 and approximately 60 ships in the global fleet over 20 years of age.

Spot rates above $70,000 per day are described as sustainable by management under current conditions, though potential downside risk remains if market dynamics shift.

The CFO cautioned that unrealized gains and losses for Product Services will continue to see fluctuations before the positions are realized, underscoring ongoing earnings variability tied to market volatility.

INDUSTRY GLOSSARY

VLGC (Very Large Gas Carrier): Ocean-going vessel designed for the bulk transport of liquefied petroleum gas (LPG), typically with a capacity exceeding 80,000 cubic meters.

FFA (Forward Freight Agreement): Derivative contract used for hedging freight rate exposure by locking in future shipping rates for a particular route and timeframe.

Tonne Mile: A demand metric calculated as the volume of goods shipped multiplied by the distance transported, reflecting overall transportation demand in shipping markets.

NPAT: Net Profit After Tax; company earnings after all expenses and taxes.

Full Conference Call Transcript

Kristian Sorensen: Thank you, Aline, and hello, everyone, and thank you for taking the time to be with us today as we review our second quarter financial results and recent relevance. So let’s turn to Slide four, please. The second quarter was marked by extraordinary geopolitical and market events, which substantially increased the market volatility both for shipping and trading. For the quarter, we reported a TCE income of $38,800 per available day and $37,300 per calendar day, above our guidance of $35,000 per day. In a quarter with spot rates fluctuating between $10,000 and $70,000 per day, the time charter portfolio played a vital role in protecting our downside.

After minority interests, the Q2 profit was $35 million, equivalent to an EPS of $0.23. And the Board of Directors has declared dividends of $0.22 per share, consisting of 75% of our shipping NPAT, topped up with retained dividends from Product Services 2024 results. Moving on to our trading operations. Product Services achieved a gross profit of $15 million and a profit after tax of $6 million. Samantha will take you through the details later in the presentation. And it’s important to keep in mind that it is the realized result, which generates Product Services dividend capacity. As of June 30th, the aggregated realized result for 2025 is $39 million.

Further on our shipping activities, 2025 is a busy drydocking year for us. In the second quarter, we had 139 days related to vessels drydocking. In the second half of the year, we expect 143 and 135 days, respectively, for Q3 and Q4. These numbers should be noted since they impact our revenue-generating potential on top of the drydocking cost itself. For the third quarter, we are guiding on about $53,000 per day fixed for 90% of our available days. These are solid levels above our all-in cash breakeven of $24,800 per day. On the asset side, BWG was added to our own fleet in June after we declared a very lucrative purchase option earlier this year.

On financing, we finalized a $380 million term loan and revolving credit facility to finance the advanced gas fleet and secured a $215 million term loan facility for BW LPG India fleets. Our $250 million shareholder loan from BW Group was terminated earlier due to ample liquidity. But now that Q2 is over, the focus is on 2025, which has started off on a strong note. So let’s turn to the next slide, please. The current VLGC market is characterized by solid fundamentals with robust growth in export volumes from the U.S., supported by high domestic LPG production and ongoing terminal expansions. The Middle East volumes are also slightly up, backed by a reversal of the OPEC cuts.

The extraordinary factor is how inefficiencies in the LPG trade pattern have absorbed substantial shipping capacity in recent months. The first such inefficiency emerged after China imposed retaliatory tariffs on U.S.-sourced LPG, which led to a significant reshuffling of U.S. export volumes away from China and into other parts of Asia. The sudden shift of U.S. volumes toward India and Southeast Asia, combined with the redirection of Middle East volumes to China rather than India, absorbed considerable capacity from the VLGC fleet and pushed rates up. The short but intense Israel-Iran conflict also fueled spot rates for ships loading around that period in the Middle East.

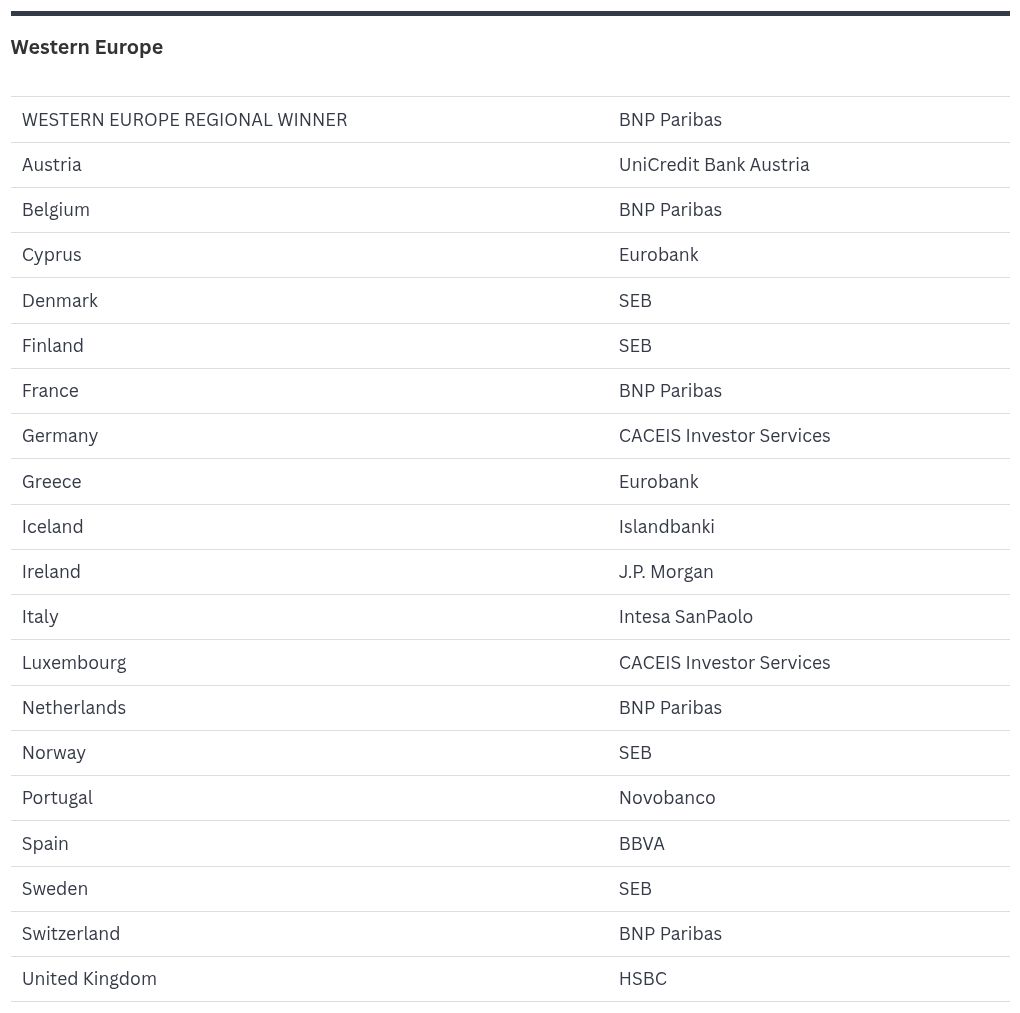

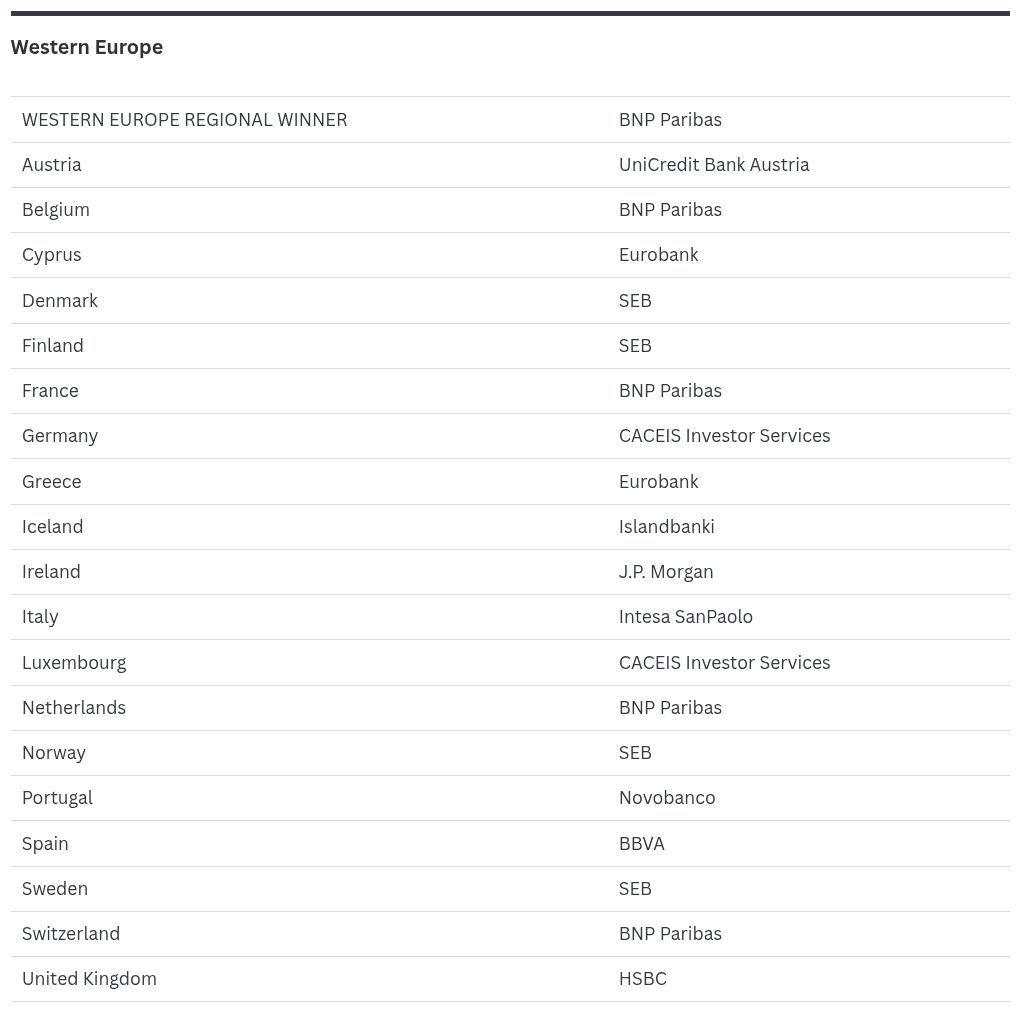

Now trade patterns are slowly returning to pre-trade workflows, but the Panama Canal has once again become a bottleneck as growing traffic from container ships, ethane carriers, and other prioritized or high-paying segments strains capacity. The consequence has been more VLGCs routing around South Africa, which significantly impacts the tonne mile for the global VLGC fleets, making fewer ships available, which, in turn, is pushing rates up. In addition, the global fleet growth is at a low level, with 409 ships currently in service and only seven more to be delivered in 2025.

We keep an eye on the LPG FFA market, which is currently pricing the balance of 2025 at an equivalent of low $60,000 per day for the Middle East Japan benchmark leg. Next slide, please. This slide shows how the LPG market dynamics played out after the Chinese retaliatory tariffs were implemented. The U.S. LPG export volumes shifted from Chinese destinations to India, but also Japan took a big chunk of the rerouted cargoes. U.S. LPG exports to India were above 1 million tonnes in 2025 compared to less than 100,000 tonnes for the entire 2024.

Middle Eastern volumes also played a key role by replacing U.S. cargoes to China, thereby redirecting traditional cargo flows for India to longer haul destinations in China and absorbing more shipping capacity. Furthermore, China substituted U.S. LPG with cargoes from Canada and Australia, a trend that we see continues. All in all, the massive reshuffling of cargoes that took place was creating substantial inefficiencies in the LPG supply chain, which required more shipping capacity and moved rates up. The trade pattern is now pivoting towards the pre-liberation day structure in anticipation for a trade deal between the U.S. and China. But the Panama Canal has created new inefficiencies for the fleets. Next slide, please.

In 2023, 2024, we all spent significant time analyzing the Panama Canal dynamics. Now with the canal regaining relevance, it’s worth revisiting its key aspects driving our markets. The new Panama Canal locks have a daily capacity of around 10 ships in total combined for both directions. VLGCs have over the last years taken up between two to three of these 10 transit slots. As previously explained, VLGCs are not prioritized through the canal during periods of increased traffic. So when waiting times become excessive or auction fees for available slots are prohibitively high, the alternative is to route vessels around the Cape Of Good Hope.

And this rerouting increases sailing distances by up to 50% compared with the Panama Canal route to Northeast Asia and has an immediate and material impact on the VLGC market by raising demand for tonnage to offset the longer voyages. Monitoring developments in the Panama Canal will therefore be important in assessing the direction of the VLGC freight rates going forward. The increased demand for shipping capacity has pushed spot rates up to a level above $70,000 per day for loading in the U.S. Gulf. As you can see from the graphs on this page, shipping is currently capturing almost all the profit in moving cargoes from the U.S.

Gulf to the Far East, and there is very little room left for profit on the cargo price itself. Demand for vessels, driven by increased export volumes and the aforementioned inefficiencies, is growing faster than the capacity of the VLGC fleets. And the upcoming export terminal expansions will likely lend support to shipping share of the U.S. Far East arbitrage. In the LPG value chain, there is a daily arm wrestling going on between terminals, cargo owners, and the shipping market on capturing as much as possible of the price difference between the U.S. and the landed price in Asia.

For the time being, the supply-demand balance in the VLGC market is tight, and the bargaining power is in the shipping market’s favor. On that note, I’d like to remind you how this may impact the Q3 accounting result for Product Services since the change in the mark to market valuation of their shipping portfolio is not captured in the P&L, while forward cargo and paper positions are included. Looking ahead on this slide, the U.S. export volumes are forecasted to continue growing on the back of increased production of LPG.

The crude oil wells in the Permian Basin are more gaseous than we expected some years ago, and the gas production is forecasted to grow at least twice as much annually as the crude oil production, where lower growth figures are expected in the next five years’ periods. The growth in U.S. LPG exports is supported by several terminal expansions from now into 2028. And Energy Transfer has already started their LPG exports from their Nederland terminal expansion. Moving over to the Middle East. The export growth is forecasted to accelerate next year with Qatar leading the way as well as Abu Dhabi. In neighboring Saudi Arabia, the Jafura project is worth keeping an eye on.

Although it’s further out in time, the size of the LPG volumes made available for exports are potentially adding another 5 to 10 million tons of LPG to the growing volumes from the Middle East. On the fleet and newbuilding front, there is little new to report and the order book counts 111 additional vessels to the current fleet of 409 vessels where about 15% equal to 60 ships and thereabouts are older than 20 years. And then it’s over to you, Samantha.

Samantha Xu: Thank you, Kristian, and hello, everyone. Let’s dive into our shipping performance. The 2025 completed with the TCE of $37,300 per calendar day or $38,800 per available day, over 94% fleet utilization after deducting technical off hire and waiting time. The healthy result achieved in a volatile market was a strong testament to our commercial strategy, consistently taking on time charter and FFA for coverage in a strong market to provide support when spot markets are under pressure. In Q2, the time charter portfolio was 44% of the total shipping exposure, amount of which 32% is fixed rate time charter.

Looking ahead for Q3 2025, we have fixed 90% of the available fleet days at an average rate of about $53,000 per day. For the second half of 2025, we have secured 34% of our portfolio with fixed rate time charter and FFA hedge respectively at $45,200 and $51,700 per day. Our time charter out fleet is estimated to generate a profit of around $9 million over our time charter in fleet. On top of that, the balance of our fixed time charter out of portfolio is estimated to generate $74 million. On the product services side, the business posted a realized gain of $6 million for Q2.

The positive result reflected a disciplined approach and effective risk management in a volatile quarter. On the unrealized open positions, we reported a $12 million increase in mark to market on our cargo position, which was offset by a negative movement in paper position of $3 million. After accounting for other expenses, which mainly comprise general and administrative expenses, product services reported a net profit after tax of $6 million for Q2 and net asset value of $58 million as at the quarter end. As we mentioned in the previous quarters, the large mark to market valuation movement is due to the gradual phase in of our multiple year term contract, which reflects value adjustments in time of volatile market.

While the value is significant, it reflects the delta between the balance sheet dates, and we’ll continue to see fluctuations before the positions are realized. We also want to highlight that due to the nature of trading, its gain and loss are realized in different financial periods and cannot be extrapolated and predicted using its historical performance. Its unrealized position will fluctuate depending on the valuation at the end of the financial period, driving the accounting results up and down drastically. It’s important to remember that our trading model looks at creating value combining positions of cargoes, paper, and shipping positions.

As such, we would like to remind you that the reported net asset value does not include the unrealized physical shipping position of $10 million, which was based on our internal valuation. In light of the strong shipping market outlook, the open cargo contracts and hedging position may in turn experience negative mark to market valuation changes, and we’ll continue to see fluctuations before the positions are realized. In Q2, our average bar value at risk was $6 million, reflecting a well-balanced trading book of cargoes, shipping, and derivatives after including the increased term contract volume as mentioned. Going on to our financial highlights.

We reported a net profit after tax of $43 million, including a profit of $16 million from BW LPG India, a $6 million profit from product services. Profit attributable to equity holders of the company was $35 million for this quarter, which translates into an earnings per share of 23¢ and an annualized earning yield of 8% when compared against our share price at the June. We reported a net leverage ratio of 31% in Q2, a slight decrease from 33% reported end of last year. The decrease was due to lease liability reduction of $123 million from the purchase option exercised for BW Kisuku and BW Yushi, partly offset by the net drawdown of some banking facilities.

For Q2, the board declared a dividend of 22¢ per share, which translates to a 110% payout of our quarterly shipping profit. These are also supported by some of the retained dividends from product services in 2024. For the period end, our balance sheet reported a shareholders’ equity of $1.9 billion. The annualized return on equity and capital employed for Q2 were 98%, respectively. Our Q2 OpEx was $9,000 per day. For full year 2025, we estimate our own fleet’s operating cash breakeven per day to be $19,100 per day and total fleet’s operating cash breakeven, including time charter in vessels, to be $21,700 per day.

Please note, this is a reduction compared with the cash breakeven of 2024 of $22,800 per day, primarily due to meticulously managed financing, reduced time charter in vessels, and lower G&A per day. And this is also offset by increased OpEx. All in cash breakeven, including dry dock program, for the year is estimated to be $24,800. Next slide, please. On the liquidity side, at the end of Q2, we maintained a strong position of $7.8 billion, including $287 million in cash and $421 million in undrawn revolving credit facilities. Due to our meticulously managed financing plan, we are able to support our fleet growth and remain a robust and resilient financial position to weather the future.

Our repayment profile continues to be sustainable and healthy with major repayment only kicks in after February 19, 2029. On the product services side, trade finance utilization stood at a moderate level of $303 million or 38% of our available credit line, providing sufficient room for future trading needs. Okay. With that, I would like to conclude my update. Thank you for listening, and back to you, Aline.

Operator: Thank you, Samantha, and thank you, Kristian. We would now like to open the call for Q&A for questions. So please type your questions in the Q&A channel. You can also click the raise hand button to ask your questions verbally. Please note though that participants have been automatically muted, so please press unmute before speaking. We will start with the verbal questions first before then moving on to the chat. So please, if you want to ask a question, please raise your hand. I see first up Thomas Christiansen. Please unmute yourself.

Thomas Christiansen: Thank you. Can you hear me?

Operator: Yes.

Thomas Christiansen: That is really good. I have a question regarding the fleet growth. First of all, if you could that’s a factual question. Put some figures regarding the capacity of the VLGC fleet today and with the expected 111 vessels going forward. And then my next question is if that is a concern, this fleet growth to you? And if it is, how you will mitigate the impact? And if not, why it’s not a concern?

Kristian Sorensen: Thank you, Thomas. I can say I mean, it’s to go into detail of every vessel size. It’s probably going to take too long, but these ships are quite standardized, except that you have about is it 60 ships now of this fleet, which are Panamaxes, which can go both the old and the new canal lane with a capacity of 88,000 cubic meters. Otherwise, the VLGCs are relatively standard in their design. Some are 91,000, some are 93 and some are 88,000. Like I said, if you go back to the years before 2010, these ships are typically 82,000, maybe 84,000 cubes. So that’s kind of the way that the design has developed over the last ten years.

When it comes to the fleet growth in 2027, 2028, it’s something we’re absolutely not naive about. It should be viewed in the context of also more LPG volumes coming on stream, like mentioned, from the U.S. as well as the Middle East. I think the fleet growth is kind of the same picture we had going from 2022 into 2023, where the fleet growth was actually absorbed very well in the market because the inefficiencies and the volume expansion from the U.S. in particular absorbed the fleet capacity, which came on the water. But we are absolutely not naive about this.

And as previously mentioned, we also have a time charter portfolio, which is currently just above 30% of our capacity, which we are given provided the rates are found attractive, probably going to grow into towards 40%. So that’s the way we are protecting the downside as also mentioned in the beginning of our presentation.

Operator: Thomas, you had a follow-up question?

Thomas Christiansen: Oh, yes, I did. I mean, little bit in the same context. I mean, recently, Panama announced that it wouldn’t register the ships above fifteen years. I mean, you say on a global level, how does that impact the fleet of big gas carriers? And also, does would that impact the BW LPG’s business?

Kristian Sorensen: Sorry. I didn’t get that. That the Panama Canal has?

Thomas Christiansen: No. The Panama register, the flag register Panama, announced that it will not register ships above fifteen years going forward. How that how does that impact the global market and your market?

Kristian Sorensen: Well, then there will be fewer ships going through the Panama Canal, and I guess more ships have to sail around South Africa if to and from Asia and the U.S., if that is the case.

Thomas Christiansen: I think it’s more I think it’s more about, to register, to be to be to flag the Panama flag going forward that the

Samantha Xu: Hello?

Kristian Sorensen: Thomas, you disappeared.

Operator: Yeah. It looks like we lost him.

Kristian Sorensen: Thomas, are you with us?

Thomas Christiansen: Can you hear me now? Yes.

Kristian Sorensen: Yeah. We can.

Thomas Christiansen: Okay. Sorry. Yeah. It’s no. I think it’s more about it’s the register, the flag register, Panama’s flag register that one doesn’t want to allow, vessels above fifteen years to be registered, with Panama Flak going forward. So I guess that somehow will exclude some vessels from the global fleet of big gas carriers. So if you have a view on how that will impact the global fleet and your business too.

Kristian Sorensen: I think the I’m not sure about the restrictions on flagging ships in Panama. But if that is the case, I presume that there are all the registers where you can flag your ships. So it’s nothing which will have a commercial impact on our markets as far as I can see.

Thomas Christiansen: Alright. Thank you.

Operator: Thank Next up was Climent Molins. Please go ahead.

Climent Molins: Hi, good afternoon, and thank you for taking my questions. Over the years, you’ve generated significant shareholder value by exercising the purchase options at well below market prices on time charter team vessels with the Yuchi as the most recent example. Could you remind us whether you have purchase options on any of your remaining time charter in vessels?

Kristian Sorensen: We do have on one ship later in the decade, but there are no purchase options in the immediate future to say to phrase it that way. But we do have some towards the end of the decade.

Climent Molins: Okay, makes sense. Q3 guidance was a bit, let’s say, disappointing maybe relative to recent market trends, especially on the spot market. A portion of that is attributable to your time charter book. But could you please delve a bit into the numbers? Where a significant portion of days fixed before rates went up?

Kristian Sorensen: That’s something we will have to get back to you on for the next quarter because that’s that requires a bit of meticulous working to get that number correct. But you’re absolutely right that the time charter portfolio, which protected our downside in the second quarter is also affecting the number we’re guiding on for the third quarter. And also keep in mind that we do have dry dockings taking place throughout this year. And there is also a position and timing effect here, which is important to keep in mind because these voyages are usually three months voyages.

And to have ships in position for the uptick in the rates takes time to before you see ships are load ready and can actually benefit from the strength in the market. So I think we have to get back to you on the details on the split between spots and time charter like we typically do in our earnings presentation.

Climent Molins: Makes sense. Thank you for the color anyway. And final question from me. You had 139 dry docking days in Q2 followed by 143 and 135 in Q3 and Q4 respectively. How many vessels are expected to go through drydocking each quarter? And secondly, have you seen any congestion going into drydocks?

Kristian Sorensen: No congestions, but it’s another six, seven ships for the remainder of this year.

Climent Molins: Thank you. That’s all from me. I’ll turn it over.

Kristian Sorensen: Thank you.

Operator: Thank you, Climent. We have, John Dixon next.

John Dixon: Good morning, Kristian. Good morning, Samantha. I just have a real quick question for you related to the Panama Canal. We saw earlier this year like, just you can hear me. Right?

Samantha Xu: Yeah. I can hear you well, John.

John Dixon: Oh, okay. Earlier this year, President Trump here in the United States has really spent a lot of time with Panama trying to get the freight rates down for US flag vessels. Is that and US naval vessels, of course. Is that something that you see that’s impacting the congestion in the Panama Canal? And do you kind of expect to see that going forward?

Kristian Sorensen: Not really. The capacity is mainly being absorbed by container ships. We see more ethane carriers on the back of the increased exports of ethane from the U.S. And this is going to accelerate in coming years as well as other ship types. But we don’t so far see any impact from the, let’s say, naval ships or the U.S. flagships as you mentioned.

John Dixon: Okay. Thank you very much. That was my only question.

Operator: Thank you, John. Do we have any more questions that you would like to ask verbally before we move on to the chat? If not right now, we might just turn to the chat, maybe starting with Andreas first. SGA has come down from Q4 and also Q1. What is driving this? And is the current level a more realistic level going forward?

Kristian Sorensen: Samantha, I guess this one is for you. On the G and A side, what typically drives this up? I presume this is the G and A we are referring to. Right?

Samantha Xu: I assume the SGA refers to the G and A. Yeah. From this and the current level is more or less. Yeah. I think, Andreas, so GNA is not something that we can how to say how to say we can give you a good base for you to estimate because partly of that is the shipping’s journey and the other part is product services journey, which is a reflection of the realized profit as part of the incentive scheme. So that’s why it would you will see fluctuations of a G and A as a true up reflecting that the product services are realized profit as well.

Operator: Alright. Anders had another question related to spot rates being lower. So the question was, with the current market dynamics being favorably and comparing relative to peers reporting recently, what is the reason for the achieved spot rates for Q3 being relatively lower for BW LPG Limited?

Kristian Sorensen: Yeah, I think well, it’s not I guess, our peers have to answer for their numbers themselves. But at least for us, when we guide on the Q3 numbers, it’s including both spot and the time charter portfolio. So it’s not pure spot. And as mentioned also to Climent earlier is that the time charter portfolio is affecting this number compared to the pure spot rate that you see in the markets. And of course, have the positioning, the timing effects and the fact that we also have a relatively busy drydocking agenda and scheme this year, which will impact guiding and the results going forward.

Operator: Thank you. We move on to a question from Peter on VLACs. To what extent are the VLACs affecting the VLGC market? And when do you expect to start seeing some scrapping?

Kristian Sorensen: The VLACs are currently, you know, as they are being phased in, you know, these are basically going to trade as far as we can see as regular VLGCs because the ammonia trade for these kind of vessels hasn’t materialized yet and has probably not gone materialize before we are well into the 2030s as it looks now. So we regard them as part of the, let’s say, conventional VLGC fleet in our market outlooks. And then there was another question, which was whether we start seeing some scrapping. Scrapping is typically taking place when the markets are really, really low.

These ships, when they go out, let’s say, the conventional trade, they’re typically when they reach, at least 25 years, they end up in captive trade, floating storage operations. And technically, these ships can last, you know, until they are 40 years of age basically, because there is very little wear and tear compared to a dry cargo ship, for instance. So we I don’t anticipate to see any scrapping activity picking up before the markets are at a very different level than what we see today.

Operator: Thank you, Kristian. We have another question in the chat from Olaf on contract extension. Do you have any plans to extend the contracts for the vessels you’re currently chartering in?

Kristian Sorensen: This is something we will decide on as we get closer to the expiry of these various contracts. So we will inform the market more on how we extend or choose not to extend these contracts as we move into the third and the fourth quarter.

Operator: Thank you. Another question from Greg on ton mile upside. Regarding ton mile upside from U.S.-China trade tensions, you mentioned that voyage patterns are reverting. Can you quantify in general terms how much of the tonne mile upside is still here still there today? Is it mostly still there or mostly gone?

Kristian Sorensen: This is a very good question, Greg. What we do see is that U.S. cargo flows into China have kind of returned to a certain extent. But the surge in U.S. cargoes heading into India has come off. So I think it’s it’s a bit too early to see whether there is actually a new trade pattern established between the U.S. and India, for instance, or if this was just a one off. So it’s hard to kind of quantify this. But as mentioned, we saw more than 1 million tons heading from the U.S. into India in the second quarter against less than 100,000 tonnes for the entire 2024.

But the and also a side effect of this, which is quite interesting, which we probably underestimated was that India, which over the last years has absorbed basically 50% of all the LPG exports from the Middle East was suddenly receiving less cargoes from the Middle East because the Middle East sent more cargoes all the way to China. So we need a bit more time, I think, to quantify these ton mile effects and how it really impacted the market.

Operator: Thank you. We have a question from Axel Styrman on Ethene. Do you have any comments to the optionality on Ethene LPG exports from the U.S. Gulf in 2025 and in 2026. Which share of Ethene LPG do you expect to be shipped from the expansions where there is such optionality?

Kristian Sorensen: Thanks, Axel. So we understand that from the Netherlands terminal, for instance, they will start up with LPG and then phase in the ethane as we get into 2026. We assess kind of we have a fifty-fifty split on that one. Enterprise, they have two expansions where one of them will eventually be ethane only. So I think there is good reasons to believe that, you know, a substantial part of the terminal expansion for energy transfer as well as enterprise will be designated for ethane capacity.

Operator: We have another question in the chat from Chandan on Panama Canal congestion. So he would like to know what is driving the containership congestion increase in Panama Canal. What do you think?

Kristian Sorensen: I’m not sitting close enough to the container market to give a kind of a qualified reply on this, but I suspect that it has something to do with the ongoing trade war, negotiations between China and the U.S. But the container traffic in and around the canal is steadily growing simply because also there are more ships in general on the water fighting for this very limited capacity, which the Panama Canal has to offer.

Operator: And final question for now in the chat before we can open up again, verbally as well is from John on the spot rates level. How do you look at the current freight market for VLGCs? Are spot rates of $70,000 a day a sustainable level, or do you feel there are some downside risk in the near to medium term? And how do you look at the traffic in Panama Canal, especially for containers into the second half of 2025?

Kristian Sorensen: Good questions. I think there is always a downside risk when you are at $70,000 per day in the market. But we do see also today, for instance, that ships are being booked around that level. So it seems like the market is able to absorb it and that the rates are sustainable. But I wouldn’t say that there is not any downside risk to this rate level. But we believe that the Panama Canal is definitely playing a vital role in driving these rates further up or down. The fundamentals are solid. So it’s not like we have changed any views on the fundamentals of the market. But the wildcard is the Panama Canal.

And as mentioned, we see the containers are taking up substantial and increasing part of that capacity over the last couple of weeks. So it seems like the situation, even though it’s it’s rapidly changing from one week to the other, it seems like the Panama Canal congestion is going to be playing a role in the market in our market going forward. I think that seems to be the case.

Operator: Thank you, Kristian. There’s no more questions in the chat right now, but we have John Dixon who raised his hand again. So please, if you wanna go ahead, John.

John Dixon: Kristian, just real quick. Looking to the fourth quarter, Samantha said and you all showed that you’ve you’ve booked about 30% of your available days into the fourth quarter. Obviously, the way I’m looking at that is that if those freight rates stay higher leading into the fourth quarter, I’m assuming that is gonna be reflected. I mean, obviously, you still have a lot of available days left to book. Is that kind of the way you guys are looking at it? Or what’s your perspective leading into that fourth quarter?

Kristian Sorensen: I think, John, the way to look at this is that regardless of how the market is performing the spot market is performing, we have this 30 odd percent of all the fleet capacity locked in at $45,000 per day thereabout. And this will obviously have an impact on our time charter equivalent for an income for that quarter. But the remaining 70%, are exposed to the spot market. So that’s something we are happy to keep for time being at least, if that kind of answered your question.

John Dixon: It does, Kristian. Thank you. I and I appreciate it.

Operator: Thank you, John. Do we have any more questions? Either you wanna type it into the chat or raise your hand. We still have a couple of minutes left. Alright. If not, Kristian, you wanna provide a few closing remarks?

Kristian Sorensen: Then I think it’s time to round it off and say thanks to everyone listening in and for asking good questions. And we look forward to seeing you again in November. And in the meantime, we look forward to an exciting market development in the months to come. Thank you, everyone.

Operator: Thank you, Kristian. Thank you, Samantha. This will conclude our call. The call transcript and recording will be available on our website shortly. So thanks a lot for dialing in, and we wish you a very good rest of your day.