South Korean game makers split on IP strength, new releases

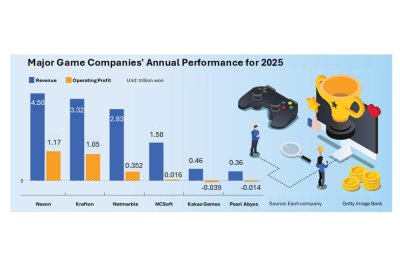

A chart shows 2025 annual revenue and operating profit for major South Korean game companies, highlighting strong performances by Nexon and Krafton and losses at Kakao Games and Pearl Abyss. Graphic by Asia Today and translated by UPI

Feb. 12 (Asia Today) — South Korea’s major game developers reported sharply mixed 2025 results, with companies backed by strong intellectual property and hit new titles posting record earnings while others struggled amid delays in releases.

Nexon said annual revenue rose 6% to 475.1 billion yen (about 4.51 trillion won, or roughly $3.13 billion), marking a record high. Operating profit reached 124 billion yen (about 1.18 trillion won, or $819 million).

The company attributed growth to the success of new title “Arc Raiders,” which has sold more than 14 million copies, and global expansion of the MapleStory franchise. Franchise revenue for MapleStory rose 43%, while Dungeon & Fighter posted double-digit growth in South Korea and China.

Krafton joined the so-called “3 trillion won club,” reporting annual revenue of 3.33 trillion won (about $2.31 billion) and operating profit of 1.05 trillion won (about $729 million), both record highs. Revenue from the PUBG: Battlegrounds IP increased 16% from a year earlier, supported by global collaborations and new game modes.

Netmarble posted revenue of 2.84 trillion won (about $1.97 billion) and operating profit of 352.5 billion won (about $244 million), helped by new titles based on in-house IP such as Seven Knights Reverse and RF Online Next.

NCSoft saw revenue fall 5% to 1.51 trillion won (about $1.05 billion) but returned to profitability with operating profit of 16.1 billion won (about $11 million), aided by cost-cutting and the November launch of Aion 2.

In contrast, Kakao Games reported a 26% drop in revenue to 465 billion won (about $322 million) and an operating loss of 39.6 billion won (about $27 million), citing a gap in new releases and restructuring costs.

Pearl Abyss posted revenue of 365.6 billion won (about $253 million) and an operating loss of 14.8 billion won (about $10 million), extending losses for a third consecutive year. The company said its upcoming title Red Desert, scheduled for release in March, will be key to a turnaround.

Industry analysts said the results underscore the importance of long-running hit franchises and well-timed new launches.

“Companies that steadily operated successful IP while expanding revenue through updates and collaborations were able to limit volatility,” one industry official said. “Those with prolonged gaps in new releases inevitably faced short-term revenue declines.”

— Reported by Asia Today; translated by UPI

© Asia Today. Unauthorized reproduction or redistribution prohibited.

Original Korean report: https://www.asiatoday.co.kr/kn/view.php?key=20260213010004838