Trans athletes face intense efforts to sideline them. These California teens are resisting

At a recent meeting of California’s high school sports governing board, two seniors from Arroyo Grande High School spoke out against a transgender peer competing on their track and field team and allegedly “watching” them in the girls’ locker room.

One of the Central Coast students said she is “more comfortable” changing in her car now. The other cited a Bible verse about God creating men and women separately, and accused the California Interscholastic Federation of subjecting girls to “exploitative and intrusive behavior that is disguised through transgender ideology.”

“Our privacy is being compromised and our sports are being taken over,” she said.

During the same meeting, Trevor Norcross, the father of 17-year-old transgender junior Lily Norcross, offered a starkly different perspective.

“Bathrooms and locker rooms are the most dangerous place for trans students, and when they are at their most vulnerable,” he said. “Our daughter goes to extreme lengths to avoid them. Unfortunately, sometimes you can’t.”

Lily Norcross with her parents, Trevor and Hilary Norcross.

(Owen Main / For The Times)

Norcross said Lily’s teammates had for months been misrepresenting a single moment from the year prior, when Lily had to use the restroom after a full day of avoiding it, chose to use the one in the locker room because it is monitored by an adult and safer for her than others, and briefly stopped to chat with a friend on her way out.

“There’s always more to the story,” he said.

The conflicting testimony reflected an increasingly charged debate over transgender athletes participating in youth sports nationwide. Churches, anti-LGBTQ+ advocacy groups, cisgender athletes and their conservative families are organizing to topple trans-inclusive policies, while liberal state officials, queer advocacy groups, transgender kids and their families are trying to preserve policies that allow transgender kids to compete.

The battle has been particularly pitched in California, which has some of the nation’s most progressive statewide athletic policies and liberal leaders willing to defend them — including from the Trump administration, which has attacked transgender rights and is suing the California Department of Education and the CIF, alleging their trans-inclusive sports policies violate the civil rights of cisgender athletes.

Along with a pending U.S. Supreme Court decision on the legality of policies banning transgender athletes from competing in states such as Idaho and West Virginia, the Trump administration’s lawsuit against California could have sweeping implications for transgender athletes — with a state loss potentially contributing to their being sidelined not just in conservative states, but nationwide.

For the handful of transgender California teens caught in the middle of the fight, it has all been deeply unnerving — if strangely motivating.

“I have to keep doing it, because if I stop doing sports, they won,” Lily Norcross said. “They got what they wanted.”

A coordinated effort

The movement to overturn California’s trans-inclusive policies is being coordinated at the local, state and national levels, and has gained serious momentum since several of its leaders joined the Trump administration.

At the local level, cisgender athletes, their families and other conservative and religious allies have expressed anger over transgender athletes using girls’ facilities and resentment over their allegedly stealing victories and the spotlight from cisgender girls.

In 2024, two girls at Martin Luther King High School in Riverside filed a lawsuit challenging the participation of their transgender track and field teammate Abigail Jones, arguing her participation limited their own in violation of Title IX protections for female athletes. A judge found insufficient evidence of that, and recently dismissed the case.

Last year, Jurupa Valley High School track star AB Hernandez won several medals at the CIF State Track and Field Championships despite President Trump personally demanding she be barred from competing. Critics argued Hernandez’s wins were unfair, despite CIF having changed its rules so that her cisgender competitors received the medals they would have received had she not competed.

AB Hernandez competed for Jurupa Valley High School in the long jump at the 2025 CIF State Track and Field Championships.

(Tomas Ovalle / For The Times)

The challenges to Abigail, AB and Lily competing have all been driven in part by a network of conservative organizations working across California and beyond to oust transgender girls from sports, including by coordinating with evangelical churches, pushing social media campaigns, lining up speakers for school board meetings and working with cisgender athletes to hone their messages of opposition.

Shannon Kessler, a former PTA president and church leader who is now running for state Assembly, has worked within the wider network. In March 2025, Kessler founded the group Save Girls’ Sports Central Coast, and the next month distributed fliers at Harvest Church in Arroyo Grande that called on parishioners to challenge Lily’s participation on the track and field team.

Kessler said the two seniors on Lily’s team, who did not respond to a request for comment, had initially asked if she would “speak on their behalf,” so she did, but she has since let the girls “take the lead.”

“They took the initiative to speak and wrote their own speeches,” Kessler said, of their remarks at the recent CIF meeting.

Norcross said the effort to sideline his daughter has clearly been coordinated by outsiders from the start. He blames Kessler, Harvest Church and the state’s wider network of conservative activists for stirring up baseless fears about transgender athletes, exposing his family to danger and leaving them no choice but to defend themselves publicly.

“It’s not a fair position to be in,” he said.

Tied up in court

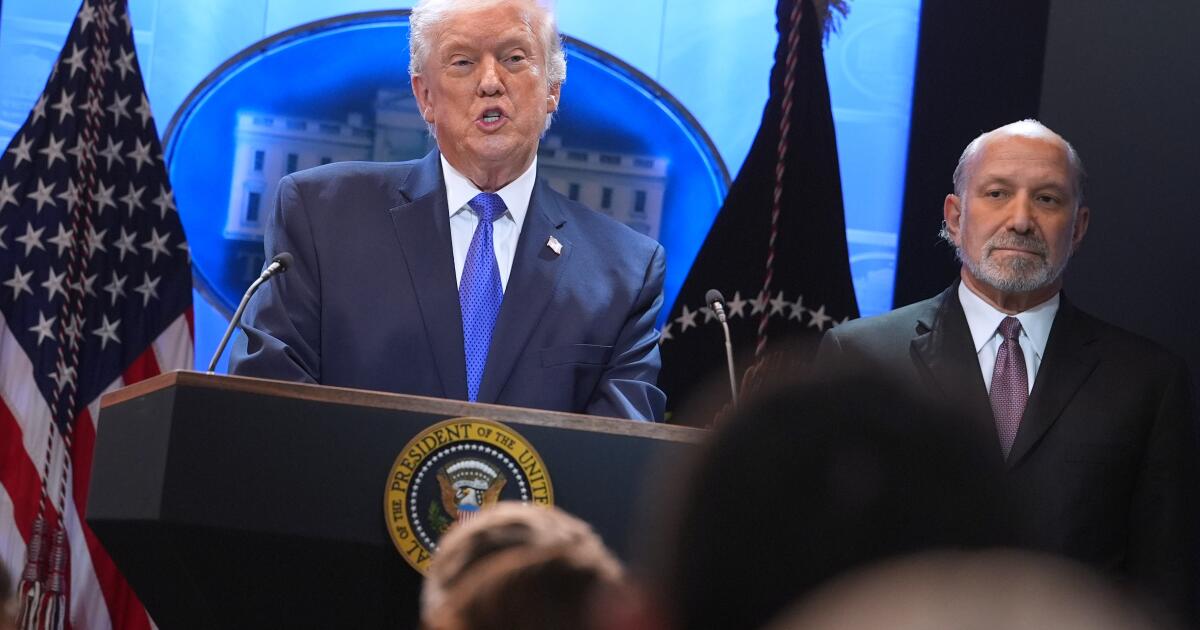

Within months of Trump issuing his February 2025 executive order calling for transgender athletes to be barred from competition nationwide, two leaders within the California conservative network turned Trump administration officials — Harmeet Dhillon, who is now assistant attorney general for civil rights, and former state Assemblyman Bill Essayli, who is now in charge of the U.S. attorney’s office in Los Angeles — quickly moved to bring the state to heel.

They launched an investigation into California’s trans-inclusive sports policies, ordered its school districts to comply with Trump’s order in defiance of state law, and then sued the Department of Education and the CIF when they refused — alleging the state’s policies illegally discriminate against cisgender girls under Title IX by ignoring “undeniable biological differences between boys and girls, in favor of an amorphous ‘gender identity.’”

Neither Dhillon nor the Justice Department responded to a request for comment. Essayli’s office declined to comment.

Assistant Atty. Gen. for Civil Rights Harmeet Dhillon arrives for a news conference at the Justice Department in September.

(Andrew Harnik / Getty Images)

The Department of Education and the CIF have called for the lawsuit to be dismissed, arguing that Title IX regulations “do not require the exclusion of transgender girls” and that the Justice Department had provided no evidence that the state’s policies left cisgender girls unable to compete.

The CIF said in a statement that it “provides students with the opportunity to belong, connect, and compete in education-based experiences in compliance with California law,” but it and the Department of Education said they do not comment on pending litigation. California Atty. Gen. Rob Bonta’s office has slammed the Trump administration’s efforts, and filed its own lawsuit to block them.

Separate from the California litigation, there is a major case on transgender youth athletes before the U.S. Supreme Court.

After athletes successfully challenged West Virginia and Idaho bans on transgender competition in lower federal courts, the states appealed. During arguments last month, the high court’s conservative majority sounded ready to uphold the state bans — but not necessarily in a way that would topple liberal state laws allowing such athletes to compete.

Pressure and resolve

Lily, AB and Abigail — all of whom are referenced anonymously in the federal lawsuit against California — agreed, with their parents, to be identified by The Times in order to share how it has felt to be targeted.

Abigail, 17, graduated early and is preparing to start college but hasn’t stopped being an advocate for transgender high school athletes, continuing to show up to CIF and school board meetings to support their right to compete.

“This is a part of my life now, whether I like it or not,” she said.

Speaking can be intimidating, Abigail said, but it has also become familiar — as has the cast of anti-transgender activists who routinely show up to speak as well. “It’s always the same people,” she said.

Abigail Jones participates in a protest against President Trump and his attacks on transgender people in April in Riverside.

(Gina Ferazzi / Los Angeles Times)

AB, also 17, said last year — when everyone, including Trump, seemed to be talking about her — was “just so much — too much.”

She felt she had to constantly “maintain an image,” including among her peers, that she was “not bothered by anything and just confident,” which was exhausting, she said. “There were a lot of times I just didn’t go to school, because I felt like I couldn’t keep up that image and I didn’t want them to see me down.”

It still can be overwhelming if she looks at all the vitriol aimed her way online, she said, but “off the internet, it’s a completely different story.”

AB was nervous headed into last year’s championships, but a couple of other competitors reached out with their support and the meet ended up being “a blast,” she said. At track practice this year, she’s surrounded by friends — one of her favorite things about being on the team.

For Lily, the last year has been “different and interesting, in not really a good way.”

She has had slurs lobbed at her and been physically threatened. She sometimes waits all day to use the toilet, nearly bursting by the time she gets home. When she has to use a school restroom, she times herself to be in and out in under three minutes. She took P.E. courses over the summer in part because she felt there would be fewer students around, but faced harassment anyway. Like AB, she feels as though she’s under a constant spotlight.

And yet, Lily said she is also “a lot happier with who I am” than she ever was before transitioning a couple of years ago. She said she’s enjoying her classes and her school’s Gender and Sexuality Alliance, where LGBTQ+ kids gather at lunch to swap stories, and is optimistic about the future — even if things aren’t great right now.

Her dad said watching her come out and transition has been gratifying, because “the smile came back, the light in her eyes came back.” Watching her navigate the current campaign against her, he said, has been “really hard,” because “she has been forced to grow up too quickly — she has been forced to defend herself in a way that most kids don’t.”

Mostly, though, he’s just proud of his kid.

“We had our fears as parents, as any parent would, that, OK, this is a different path than we thought our kid was going to be on, and we are worried about her safety and her future in this world,” he said. “But she is amazingly strong — amazingly courageous.”