Japan’s Digital Infrastructure and the Growing Demand for Unlimited Mobile Data Among International Visitors

Japan is one of those spots on the map of the planet Earth where infrastructure and digital innovation are closely connected.

The country considers technology as an instrument of national competitiveness. For the last few years, this approach has extended, bringing revolution to Japan digital infrastructure, and exceeding expectations not only of citizens but also of international travellers.

5G Expansion and Digital Urban Infrastructure

5G Japan tourism connectivity has accelerated, reflecting broader structural changes in the Japan telecom market. The nationwide 5G coverage of the major carriers has rapidly expanded.

Not so long time ago 5G in Japan was closely connected with industrial policy goals, special highlights among which are automation, smart manufacturing, and AI deployment. As for the sphere of tourism, the impact is no less significant.

Concerning major urban centers such as Tokyo, Osaka, and Fukuoka, high-speed connectivity for them became a significant part of the smart traffic systems, services for real-time navigation tracking and a platform for digital payment. As a result, foreign visitors get into an environment where stable data access is guaranteed.

Japan’s digital infrastructure is reliable, fast, and efficient. These qualities maintain the broad economic model of the country. However, this situation brings high expectations from visitors who are upset with limited data packages because they create a big contrast to the high-tech urban ecosystem.

Smart Tourism and Data Consumption Trends

Digital tourism Japan can be smooth and easy with AI-driven translation services, booking services, and transportation networks.

As a result, in your Japan data usage, you can easily carry out your daily tasks such as streaming, making video conferences, and having cloud-based document access. Even if you’re a short-term visitor, you will need a lot of data and a stable connection for simultaneous operation of your devices.

Such providers as Mobal have become part of the broader ecosystem within this environment. It guarantees international mobility for the maximum comfort of users. Japan supports the strategy of revitalizing inbound tourism, which is linked to regional economic development, especially when talking about areas outside Tokyo. High-speed connectivity is vitally needed.

Remote Work, International Mobility and Data Demands

The latest trend towards Japan is not only the attraction of tourists, but also the creation of comfortable conditions for those who choose remote work Asia opportunities. A lot of people nowadays are choosing hybrid or fully remote jobs, so they can do their daily work and travel at the same time. As a result, these people need good connections not only for their travel needs, but also for joining conferences, working with large files and secure company systems. Public Wi-Fi is not enough, and the need for fast, reliable, and high-speed internet only increases.

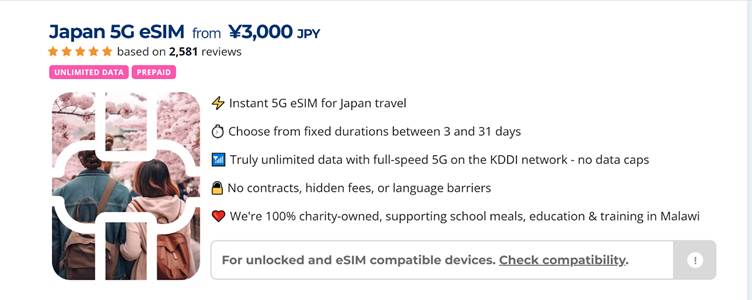

In this context, as demand grows, many international visitors search for Japan eSIM unlimited data solutions that match their usage patterns. One example is available at Mobal Japan eSIM unlimited data, which provides an unlimited eSIM designed specifically for short-term stays, typically ranging from 3 to about 31 days, with unrestricted data usage suited to tourists and business travelers.

eSIM technology supports Japan’s tendency for digital transformation. eSIMs are the easiest way for travelers to stay connected, which can be arranged beforehand.

Policy, Regulation and Mobile Accessibility for Foreign Visitors

Japan’s telecom system is a perfect balance of competition and strict oversight. The market is tightly controlled by the rules around SIM registration, protection of consumers, and network licensing. As a result, foreign visitors may face a problem while getting a local SIM card.

At the same time, it’s clear that easy mobile access is needed for the positive experience of Japan for both business and travel spheres. Mobal provides a stable connection within the regulated system. All the services are perfectly adapted to correspond to legal requirements and the needs of travellers. The focus is not on promotion but on smooth service and security compliance.

Japan expands 5G networks, developing smart city technologies. As a result, regulations are constantly changing, covering such aspects as cybersecurity and digital identity. Such updates are needed for easily foreign visitors access and reliable mobile networks.

The Future of Digital Access in Japan

To sum up all of the said above, the focus of Japan’s digital strategy is on the deep use of AI technology and faster network standards. Any city needs data and smart systems. Mobile internet became a need because it provides people with an opportunity to access transport, arrange shopping, and carry out their daily tasks.

Most of the international visitors Japan data usage visitors have expectations, quite similar to the expectations of local residents. Fast data is a must. The demand for Japan eSIM unlimited data plans is constantly growing, and it’s not about trends, but about the fact that travel and digital infrastructure have become closely connected. Companies which provide data for travelers work between regulation, technology, and global travel. Their role can’t be underestimated because connectivity is needed for the support of tourism, business, and the workforce. For Japan as a country, known for technological leadership in smart cities Japan, the accessibility of reliable digital systems for all categories of visitors is highly important to support its reputation.

Talking about the latest trends, the line between physical and digital infrastructure will slowly disappear due to the expansion of 5G networks. The main challenge at the current stage of development is to make sure that networks match changing travel patterns. As a result, seamless mobile access for short-term visitors is not a temporary trend, but the best reflection of long-term changes in the digital economy of Japan.