Prediction: 2 Stocks That Will Be Worth More Than IonQ 5 Years From Now

There is a lot of hype with this quantum computing company. But it has a lot of bark and little bite.

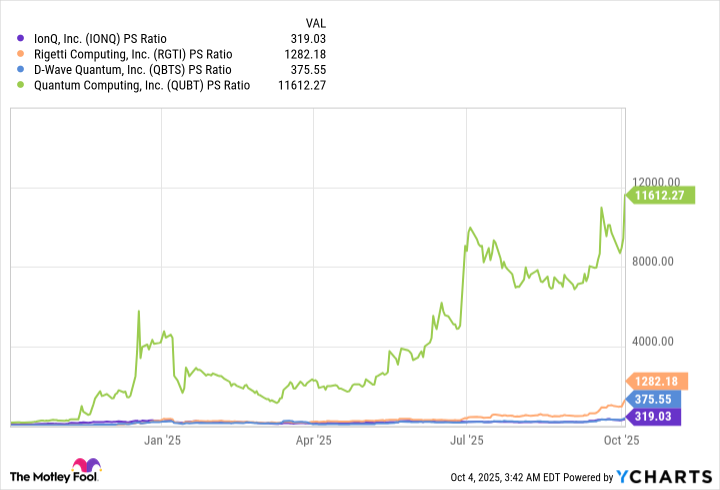

Everyone wants to own quantum computing stocks. Companies like IonQ (NYSE: IONQ) are up hundreds of percent in the last year, with the aforementioned stock now at a market cap of $25 billion while generating less than $100 million in revenue. Quantum computing could drive huge gains in productivity if the technology is ever commercialized, but today, IonQ is a highly speculative company with little to no business model. This makes it an incredibly risky stock to own.

Here are two stocks not betting on a speculative science fiction future, but creating value in the present. Both Remitly Global (RELY -3.13%) and Portillo’s (PTLO -2.76%) will be larger than IonQ in five years’ time. Here’s why you should add them to your portfolio over any quantum computing stock.

Remitly’s disruptive opportunity

Remitly Global has moved in the opposite direction from IonQ in 2025. Shares of the remittance provider are off 42% from highs set earlier in 2025, while IonQ is up 78% year to date (YTD) and just reached a new all-time high.

Investors are nervous about Remitly because of the immigration crackdown in the United States, which may reduce cross-border payments from the United States to Mexico and other Latin American countries. This is Remitly’s core business as a mobile disruptor to the legacy players, such as Western Union. Fears are also rising due to a new tax on remittance payments, although it is just a 1% tax and likely not to greatly impact payment flows.

Despite these worries, Remitly has posted strong growth throughout 2025. Revenue was up 34% year over year last quarter, with 40% growth in send volume. Not only is Remitly completely disregarding immigration fears for remittance demand, but it is also taking a ton of market share from legacy players due to its low fees and easy-to-use mobile application.

What’s more, Remitly is starting to get profitable. On $1.46 billion in trailing revenue, the business generated an earnings before interest and taxes (EBIT) of $27 million, with plenty of room to increase its operating leverage over time. Compare that to IonQ with minimal revenue and huge operating losses, and Remitly looks like a company that should have a larger market cap than any quantum computing stock.

Image source: Getty Images.

Portillo’s expansion plans

Portillo’s is a restaurant chain that sells Chicago-style street food, such as hot dogs and Italian beef sandwiches. It has begun to expand to other markets such as Texas and Florida with average success, as some of its restaurant volumes have been hit by a broad slowdown in consumer spending at restaurants in 2024 and 2025.

Despite this, Portillo’s is poised to grow substantially in the years ahead. It is planning to slowly grow its presence in new states around the country, bringing this beloved Chicago brand to a national stage. Last quarter, Portillo’s posted just 3.6% annual revenue growth, but that is due to the fact that its new store openings are going to be weighted to the back half of 2025. With the company planning to have just around 100 restaurant locations at the end of this year, there is still a huge runway for the concept to expand to new metropolitan areas in the United States.

Portillo’s has a market cap of just $464 million today. Investors may look at this market capitalization compared to IonQ and think it is impossible for the restaurant operator to surpass the $25 billion stock within five years. But let’s truly compare the underlying financials to show why IonQ is grossly overvalued at its current price.

Over the last 12 months, Portillo’s generated $65 million in EBIT on $728 million in revenue. IonQ generated just $53 million in revenue and lost $351 million (it has never been profitable). Portillo’s may not surpass a $25 billion market cap in five years, but it will be larger than IonQ because IonQ does not deserve anything close to a $25 billion valuation.

Buy Remitly and Portillo’s. Avoid IonQ and other quantum computing stocks. Your portfolio will thank you five years from now.

Brett Schafer has positions in Remitly Global. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.