Europe becoming arms powerhouse despite increased imports, says SIPRI | Military News

The Ukraine war has increased Europe’s dependence on arms imports in the past five years, but it may also have helped to turn Europe into a rising arms manufacturer and exporter, new research suggests.

Imports of major arms by European states more than tripled during 2021-25, when the Ukraine war has raged, compared with the previous five-year period of 2016-20, the Stockholm International Peace Research Institute (SIPRI) said in its annual Arms Transfers report released on Monday.

Recommended Stories

list of 4 itemsend of list

Almost half of those weapons – 48 percent – came from the United States, suggesting that Europe is failing in a commonly shared ambition of becoming more weapons-autonomous.

Poland and the United Kingdom are Europe’s biggest importers of weapons, said SIPRI.

Europe’s growing market

However, there are caveats to that picture.

“Ukrainian arms imports over the last five years made 43 percent of the overall increase in European imports,” said Katarina Djokic, a leading SIPRI researcher.

That figure measures only direct imports from the US to Ukraine, she said. It does not include imports made on Ukraine’s behalf by other European states. So in reality, Ukraine’s needs made up an even bigger proportion of Europe’s imports.

Beneath that headline figure of growing European imports lies another picture of Europe.

“Taken together, the arms exports of the 27 current EU member states went up by 36 percent,” said SIPRI’s report.

That is a faster growth rate than the US’s 27 percent over the same period, and China’s 11 percent.

The European Union’s combined arms exports accounted for 28 percent of total global arms exports in the past five years, nearly replacing its imports, which account for a third of the world’s total.

That 28 percent of the global market is “four times higher than Russia’s export volume and five times higher than China’s”, said SIPRI.

Russia’s market crumbling

At the same time, Russia, seen as Europe’s main security threat, has seen its share of arms exports collapse by 64 percent in the past five years compared with the previous five years.

“Their exports have dropped off partly because they desperately need what they make themselves,” said General Ben Hodges, a former commander of US forces in Europe.

“But nobody wants to buy Russian kit because it’s been proven to be not that good … their technology has been defeated by Ukrainian technology,” he told Al Jazeera.

Russia’s top clients are abandoning it, Djokic said.

“China has promoted its own defence industry and has become independent in arms production. For a while, they were importing at least, for instance, Russian-produced engines for Chinese-produced aircraft. Now they have their own design, they don’t really need it,” she said.

Will the US continue to dominate Europe?

Europe depends on the US for a number of reasons, said Djokic.

Some items, such as multiple-launch rocket systems, are not manufactured in Europe, she noted.

Then there is the desire to go for the best-in-class.

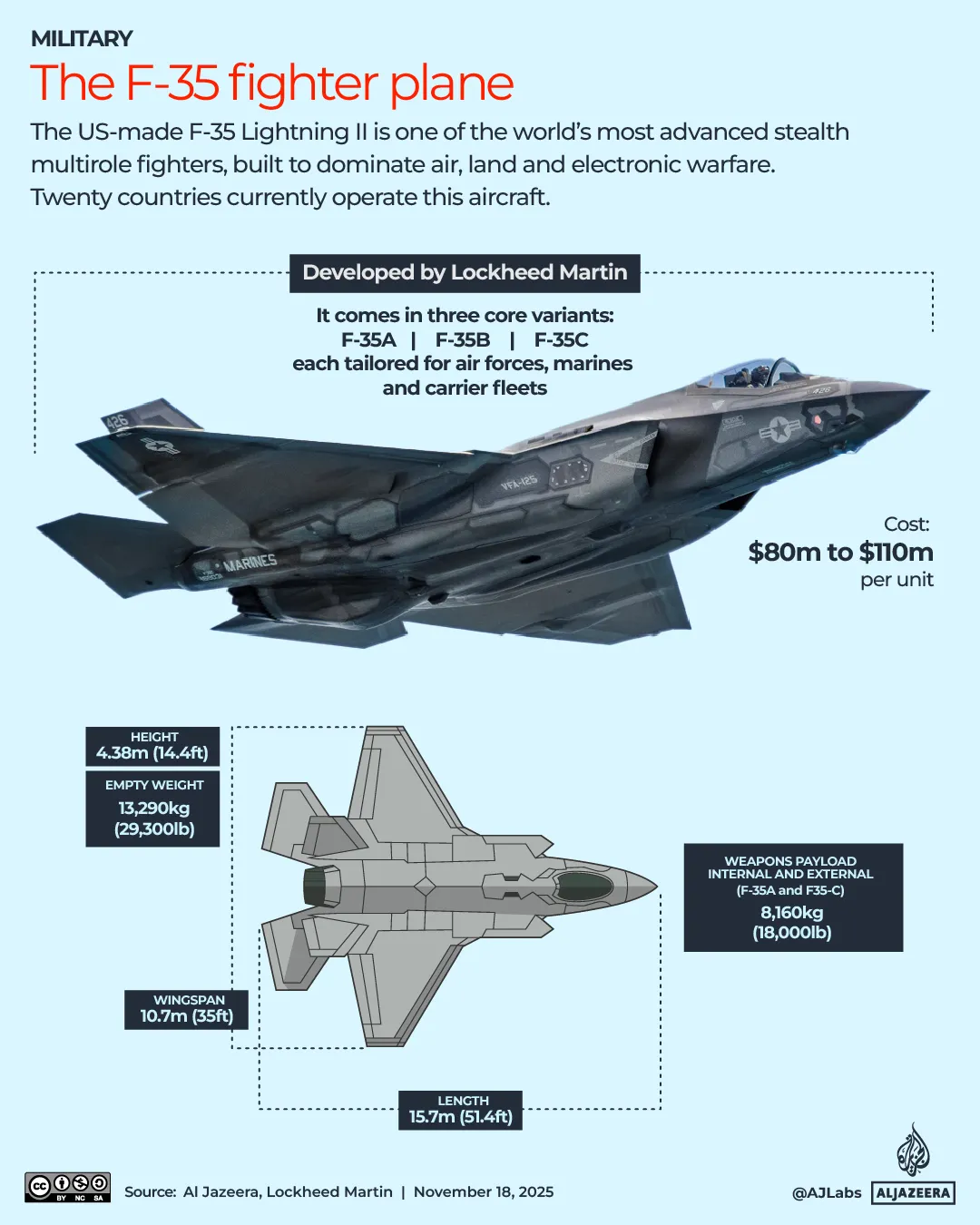

“[States] go for something they perceive as superior technology, so you have many air forces wanting to have the F-35 [jets] even though some of them can’t use all the capabilities they gain with that,” said Djokic.

Another example is the battle-proven Patriot antiballistic missile defence system.

But perhaps the biggest reason is the desire to strengthen the security partnership with the US, which has been perceived as the biggest security partner, “especially in the eastern part of the EU”, Djokic said.

For example, Poland, which says it is building Europe’s largest land army, is equipping its armed forces almost exclusively with US weapons.

That may be changing.

Unlike in previous support packages from the EU, Brussels is now insisting that Ukraine give preferential treatment to weapons it can buy in Europe.

That is because after the US moved away from providing aid to Ukraine under President Donald Trump, the EU has become Ukraine’s biggest donor and supporter, sending 195 billion euros ($230bn) to date and voting to lend Ukraine another 90 billion euros ($106bn) over the next two years. Much of that money will now flow back into the EU.

The perception of the US as a security partner is also likely to suffer, said Hodges.

“The transatlantic relationship is still there, but it’s not the same and probably will never be the same,” he said. “Europeans are realising that they have to become less and less dependent on the US if an American president can say, ‘S**** you guys’.”

‘Dangers are not going to go away’

Hodges was referring to Trump’s abandonment of Ukraine in the midst of Russia’s invasion, his questionable commitment to NATO and his threat this year to invade Greenland, a territory belonging to a NATO ally.

“Given Russia’s war in Ukraine, the fighting in the Middle East, the dangers are not going to go away. So most European countries have a more sober, realistic view of the threats and the need for stronger capabilities for deterrence, especially if they sense that the US is not as present or capable or reliable as it has been,” Hodges said.

“You’ll continue to see growth, and investors are more willing to invest in defence now – pension funds, insurance companies – who have traditionally shied away from defence.”

Europe has ploughed 150 billion euros ($175bn) into Security Action for Europe (SAFE), a low-cost loan programme given to member states that buy weapons from other member states. More than 113 billion euros ($113bn) of that have been allocated to member states.

None of these changes in spending and perception is yet reflected in SIPRI’s numbers.

“What we are witnessing now are new orders being placed for European weapons systems, prominently Aristide air defence systems from Germany, or Cesar howitzers from France, where you can tell that this kind of support through the European Union does play a role in promoting within-EU procurement,” said Djokic.