The Dreaded Lose-Lose Scenario Is a Near-Certainty With Social Security’s 2026 Cost-of-Living Adjustment (COLA)

Retired-worker beneficiaries can’t seem to catch a break.

The big day for Social Security’s more than 70 million traditional beneficiaries is right around the corner. Assuming the government shutdown doesn’t delay a key data release, on Oct. 15, the Social Security Administration will unveil a multitude of changes for the upcoming year, with the highlight being the 2026 cost-of-living adjustment (COLA).

For retired-worker beneficiaries, who accounted for more than 76% of all traditional Social Security recipients in August, the income they receive from this all-important program is often vital to their financial well-being. Almost a quarter-century of annual surveys from Gallup shows that 80% to 90% of retirees lean on their monthly Social Security check to cover some aspect of their expenses.

Though retired-worker beneficiaries are less than two weeks away from knowing precisely how much they’ll receive each month in 2026, the dreaded lose-lose scenario looks to be very much on the table.

Image source: The Motley Fool

Social Security’s cost-of-living adjustment plays an important role for beneficiaries

Before digging into the nitty-gritty of what’s to come for program recipients, it’s imperative to understand why Social Security’s COLA exists.

The best way to view Social Security’s cost-of-living adjustment is as a near-annual “raise” that accounts for the effects of inflation that beneficiaries are contending with. Hypothetically, if a large basket of goods and services regularly purchased by Social Security beneficiaries increased in cost by 3% from one year to the next, Social Security payouts would also need to climb by the same percentage to avoid a loss of buying power. Social Security’s COLA is the raise that attempts to mirror the effects of rising prices (inflation).

Prior to 1975, there was no formula for calculating COLAs on an annual basis. From the very first payout in January 1940 through the end of 1974, only 11 cost-of-living adjustments were enacted by special sessions of Congress.

The near-annual COLAs we’re used to today began in 1975, which is when the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) was adopted as Social Security’s inflationary measure. The CPI-W is reported as a single figure on a monthly basis, which allows for quick year-over-year comparisons to determine if prices are, collectively, rising (inflation) or declining (deflation).

The quirk with Social Security’s COLA is that only three months of readings factor into the calculation: July, August, and September (i.e., the third quarter). If the average third-quarter CPI-W reading in the current year is higher than the comparable period of the previous year, inflation has taken place and beneficiaries are set for a higher payout. Payouts can stay the same year to year; they are not decreased, even if prices in the measured period drop.

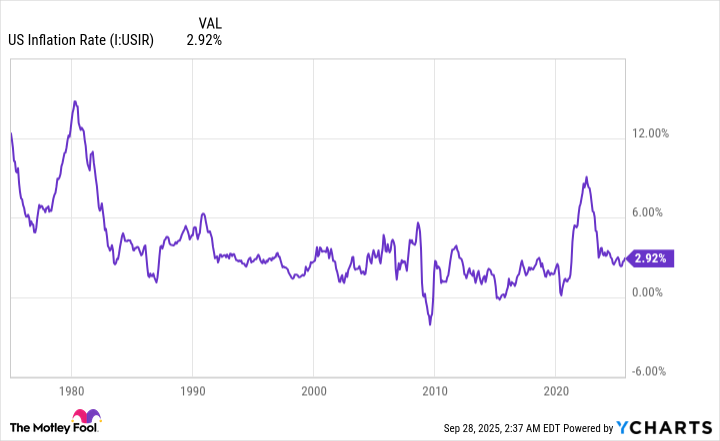

A historic expansion of U.S. money supply sent the prevailing inflation rate and Social Security COLAs soaring. US Inflation Rate data by YCharts.

Independent Social Security COLA estimates for 2026 have been narrowed

Based on independent estimates, retired workers, workers with disabilities, and survivors of deceased workers are all in line for a boost to their monthly benefit in the new year.

Following a decade of anemic cost-of-living adjustments during the 2010s, the last four years have featured above-average COLAs. A historic expansion of U.S. money supply during the earlier days of the COVID-19 pandemic led to the highest prevailing rate of inflation in the U.S. in four decades. The result was a 5.9% COLA in 2022, followed by 8.7% in 2023, 3.2% in 2024, and 2.5% in 2025. To add some context to these payout increases, the average COLA over the previous 16 years is 2.3%.

The encouraging news (at least on paper) for Social Security recipients is that the 2026 COLA is on track to do something that hasn’t been witnessed in 29 years. For the first time since 1988 through 1997, the program’s raise is forecast to reach at least 2.5% for a fifth consecutive year. On a nominal-dollar basis, Social Security beneficiaries have seen their payouts notably increase over the last half-decade.

According to nonpartisan senior advocacy group The Senior Citizens League (TSCL), next year’s COLA is projected to come in at 2.7%. Independent Social Security and Medicare policy analyst Mary Johnson, who retired from TSCL early last year, foresees a slightly more robust payout boost of 2.8% in 2026.

If the assumption is made that one of these two forecasts proves accurate, the average monthly benefit for retired workers would climb by approximately $54 to $56 in 2026. Meanwhile, the average worker with disabilities and average survivor beneficiary would both see their monthly Social Security income rise by $43 to $44, respectively.

Image source: Getty Images.

The dreaded lose-lose scenario is looking likely for most retirees in 2026

But even though independent estimates point to a fifth straight year where Social Security’s raise will top its 16-year average, aged beneficiaries are almost certain to discover the 2026 COLA comes up short in two ways.

The first issue relates to the inherent shortcomings of the CPI-W. While near-annual COLAs are a vast improvement compared to Congress passing along raises without rhyme or reason, the CPI-W is itself far from perfect.

As its full name makes clear, the CPI-W tracks the costs “urban wage earners and clerical workers” are facing. These are typically working-age Americans not currently receiving a Social Security benefit. More importantly, urban wage earners and clerical workers spend their money differently than seniors — and adults aged 62 and over make up 87% of Social Security’s traditional beneficiaries.

Older, retired Americans spend a larger percentage of their monthly budget on shelter and medical care services than working-age folks. Not only does the CPI-W not adequately account for the higher weighting retirees place on these two spending categories, but the trailing-12-month inflation rate for shelter and medical care services has been consistently higher than the COLA passed along to program recipients.

Based on two separate studies by TSCL, the purchasing power of a Social Security dollar dropped by 36% from 2000 to 2023, and by 20% between 2010 and 2024. This loss of buying power is likely to continue in 2026.

Retirees who are dually enrolled in Social Security and traditional Medicare are also set to lose in the upcoming year.

People who are enrolled in traditional Medicare and Social Security almost always have their Medicare Part B premium automatically deducted from their monthly Social Security payout. Part B is the portion of Medicare responsible for outpatient services.

In 2023 and 2024, the Part B premium rose by 5.9% each year. But based on estimates from the June-published Medicare Trustees Report, the Part B premium is forecast to climb 11.5% to $206.20 per month in the upcoming year. There’s little doubt that this is going to partially or fully offset the impact of next year’s Social Security COLA for most dual enrollees.

Even if the cost-of-living adjustment for 2026 surpasses TSCL’s and Johnson’s respective forecasts, it won’t be enough to pull retirees out of this lose-lose scenario in 2026.