ADVERTISEMENT

ADVERTISEMENT

The price of Bitcoin (BTC) is expected to reach a high of $162,353 this year (€139,148), before it settles at around $145,167 (€124,418).

That’s according to UK fintech firm Finder’s latest survey, collecting price predictions from 24 crypto industry specialists.

Within responses, high and low estimates range widely, and the most optimistic predictions expect a peak price of $250,000 this year. The average lowest price prediction sits at $87,618, with some predicting that Bitcoin will fall as low as $70,000.

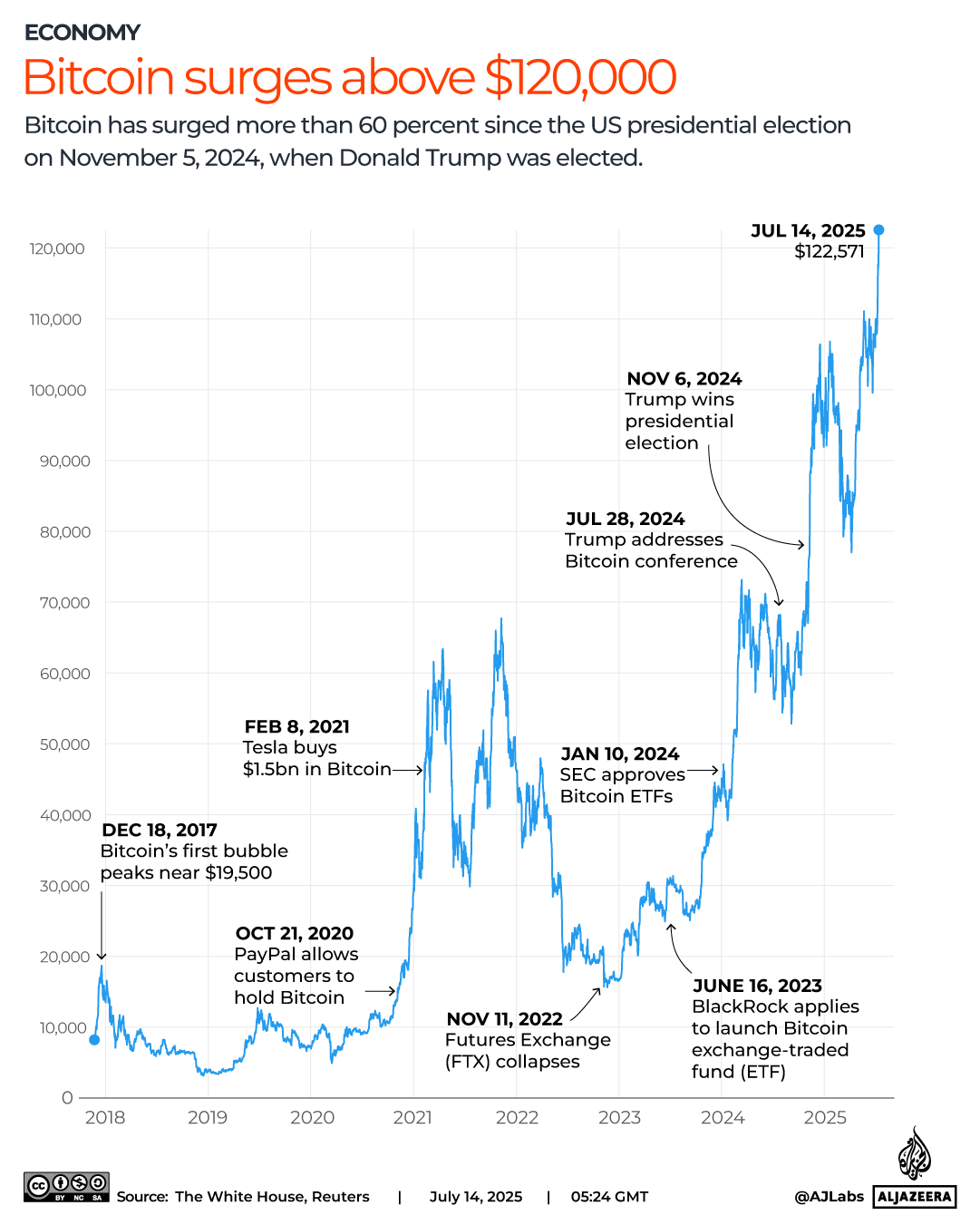

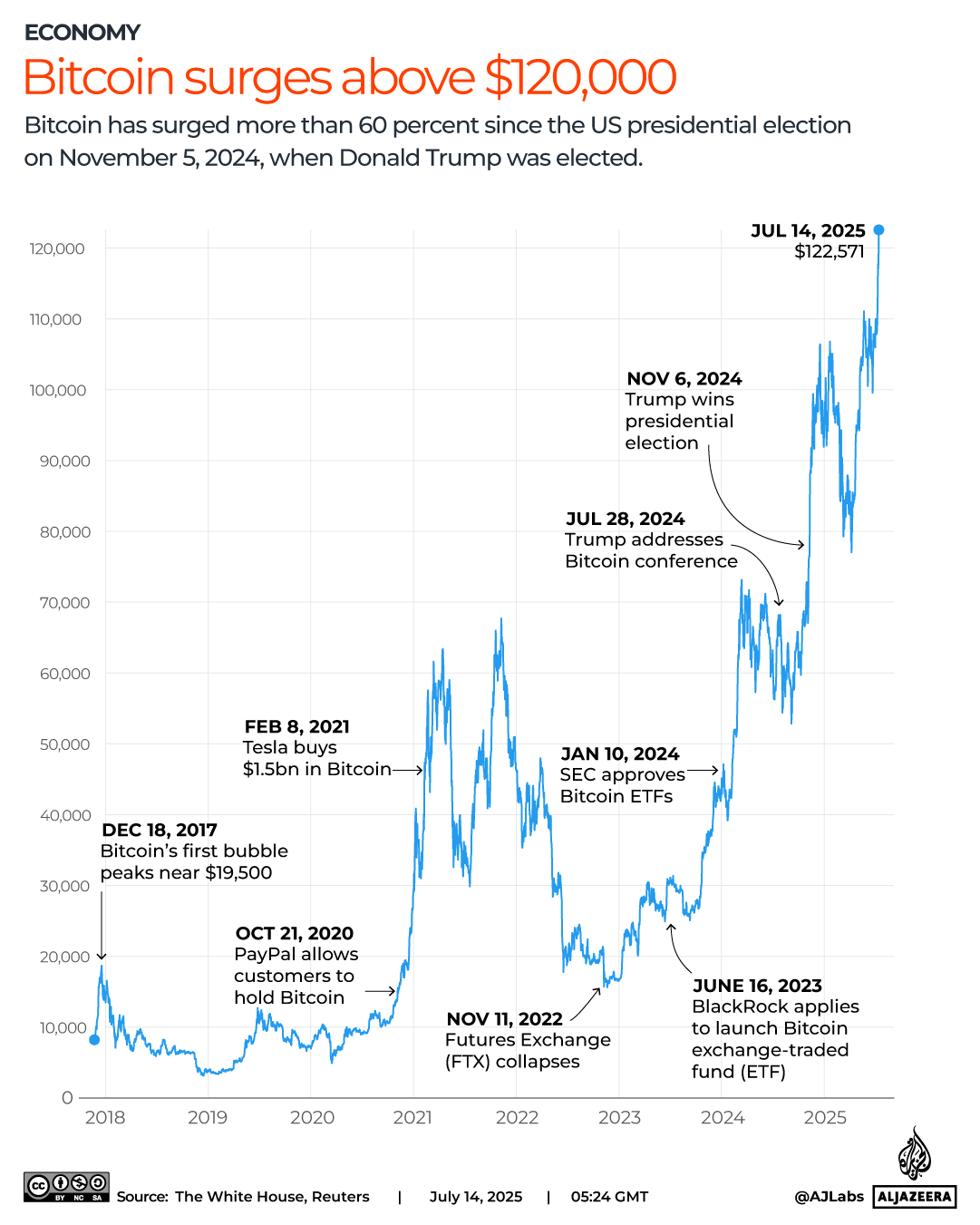

The cryptocurrency has recently reached $120,000 from just below $100,000 at the end of last year.

“There are a number of factors increasing demand for Bitcoin, including clearer and more favourable regulations, increased utility such as payments, and changing economic conditions,” crypto exchange Zondacrypto’s CEO, Przemysław Kral, told Euronews.

He added that regulations such as the EU’s MiCA contributed significantly to the recent rally. The Markets in Crypto-Assets Regulation (MiCA) sets uniform EU market rules for crypto-assets. This, coupled with an increased interest from institutional players, largely in the form of exchange-traded funds (ETFs), made crypto more accessible for many.

Cryptocurrency-based ETFs make it easier for investors to gain exposure to cryptocurrencies without having to buy them directly. These funds have exploded in popularity since Bitcoin ETFs began trading in US markets last year.

Is there a bubble around Bitcoin?

While the integration of crypto into mainstream finance has genuinely boosted interest towards Bitcoin, there is a possibility that a so-called bubble is forming. In other words, the price is being ‘blown up’ by investor interest without fundamentals supporting it.

According to Northeastern University’s crypto expert and professor of international business and strategy Ravi Sarathy, big institutional investors, including MicroStrategy, have been accumulating large pools of this asset, and it is possible that they are propping up the price of the cryptocurrency. MicroStrategy holds a Bitcoin stash worth approximately $65bn.

After the previous reluctant approach from institutional investors, “new US measures authorising Bitcoin ETF funds have made it easier and more convenient for both institutions and retail investors to invest some of their resources in these higher risk/higher return Bitcoin vehicles”, Sarathy told Euronews Business.

Bitcoin issuance has a ceiling of 21 million, driving rising demand in the face of a limited supply. “This has also led to the rise of Digital Asset Treasuries (a corporate strategy, ed.) which seek investor funds to invest in a variety of cryptocurrencies and tokens, including Bitcoin, a further fillip to demand, and fuelling rapid Bitcoin price appreciation,” Sarathy said, adding that after a short reaction to further US legislation, longer-term price appreciation could still continue.

How Washington is fuelling Bitcoin’s rally

Interest in Bitcoin has increased dramatically since US President Donald Trump widely campaigned to make the US the world capital for crypto. The US administration’s support for crypto assets reached new highs recently as the government dubbed this week ‘Crypto Week’. Lawmakers in the House are debating a series of bills that could define the regulatory framework for the industry in the United States.

“Bitcoin and crypto in general, is being propped up by the Trump administration, ironically given its initial promotion as an alternative to government-backed currencies and support from libertarians,” said John Hawkins, senior lecturer at the University of Canberra.

He believes that the token “lacks any fundamental value, and after 16 years, it has still failed to meet its initial aspiration to be a common means of payment. It remains a speculative bubble.”

Others see Trump’s support as a reason to buy.

Rouge International & Rouge Ventures’ managing director, Desmond Marshall, said that “Together with Trump’s embrace of digital crypto assets, his sons dealing with huge amounts of crypto projects and the strong US dollar, the US government is already buying large reserves of BTC. This is supported by many businesses venturing into this realm with enterprise crypto strategies.”

The most bullish crypto specialists, expecting a large price increase, bet that Bitcoin could reach $250,000, buoyed by institutional demand.

“Corporate and institutional demand is not slowing down while retail is still absent and nation state adoption is just getting started,” said Martin Froehler, CEO of Morpher trading platform.

Bitcoin’s price has increased nearly 25% since the beginning of the year, despite ongoing uncertainties related to tariff tensions, the conflict in the Middle East, and the lack of monetary policy easing in the US.

Is it the right time to buy Bitcoin?

Around 61% of the experts surveyed believe that it is the right time to buy.

However, caution is always important, according to crypto exchange Zondacrypto’s CEO, Przemysław Kral.

He told Euronews: “With such hype comes the need for caution. No one knows whether the price will go up or down. We always recommend doing your research and getting educated on Bitcoin before investing in it.”

Kadan Stadelmann, the CTO at Komodo Platform, believes that Bitcoin is going to steadily grow in value over the next six months before it returns to a bear market (when investors mainly sell instead of buy).

“Considering Bitcoin touched $110,000 already, and there’s still at least six months left in this bull run…I expect the peak around Q1 of 2026 and a bear market to follow,” said Stadelmann.

When asked what their expectations were for the very long term, the crypto experts surveyed by Finer said Bitcoin could reach values of $458,647 by 2030 and surpass $1 million by 2035.

How quantum computing might impact Bitcoin’s cryptographic security

The vast majority of the crypto specialists surveyed (79%) see quantum computing as a threat to Bitcoin’s cryptographic security, as quantum computers could potentially break the encryption standards that secure cryptocurrencies.

A quarter of the experts (25%) think that quantum computers will be able to crack Bitcoin within the next five years, and another 25% find that it’s a realistic possibility within the next five to ten years. The remainder (29%) say it’ll take longer than ten years.

Just 8% say that quantum computers pose no threat, and only a third of the experts are confident that the Bitcoin community is somewhat prepared for this threat.

Disclaimer: This information does not constitute financial advice; always do your own research to ensure it’s right for your specific circumstances. We are a journalistic website and aim to provide the best guides, tips and advice from experts. If you rely on the information on this page, then you do so entirely at your own risk.