Is the Brat credit card from Charli XCX’s The Moment real?

Need to know

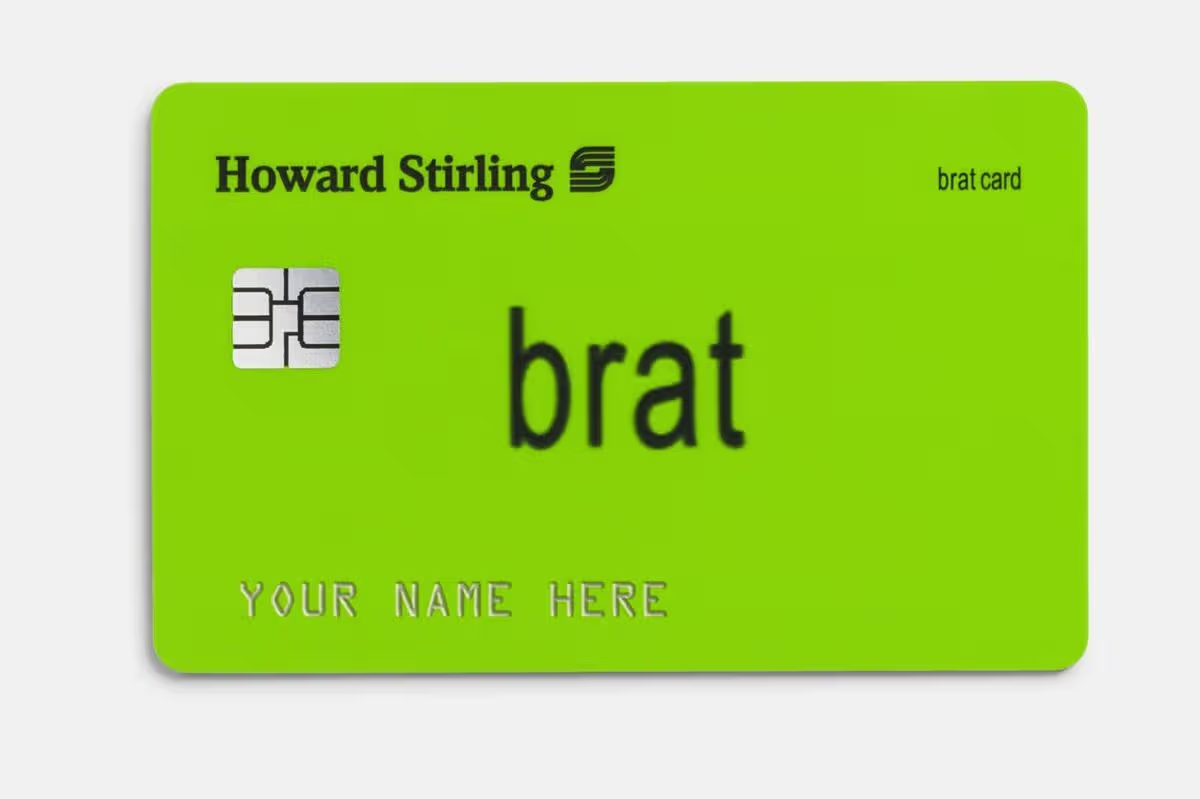

The bright green credit card is a main character all on its own in The Moment

Everything to know about the Brat credit card from The Moment including whether you can get one

- Charli XCX’s feature-length pop mockumentary The Moment hit UK cinemas today (February 20). The Von Dutch hitmaker stars as an exaggerated version of herself in the film, which follows what happens as she prepares for her first-ever arena tour.

- One of the key moments in the film is the Brat credit card Charli is forced to promote, issued by fictional bank Howard Stirling. Card holders are promised free tickets to the Brat tour with disastrous consequences.

- Given the film blurs the line between Charli’s real experiences in the pop world and total fiction, just how real is the bank card? Can you really get one? And was it ever used a promotional tool?

- The card is a total work of fiction – that is, until now. Film studio A24 has actually made the card available to buy for $10 in order to promote The Moment and it has already sold out. However, the card is merely a gimmick and doesn’t function as a working bank card nor does it hold any monetary value.

- A blurb accompanying the product reads: “Howard Stirling Bank is brat. Introducing the new brat card in collaboration with Charli XCX. You’re different. Your credit card should be too. Get your custom embossed brat card today.”

- Fans who missed out on getting their own physical copy can still download a picture of one customised with their own name on the fictional Howard Stirling website.

READ THE FULL STORY: Charli XCX’s The Moment plot explained